My employer is blaming HMRC for PAYE codes being changed incorrectly for electric car owners for 2020/2021 (was 0%). The problem appears to be that the online tax form p11d(b) incorrectly has no dropdown menu for electric vehicle. Selecting what was correct last year "other vehicle" leads to hmrc assuming it is some old heap fossil car with no recorded CO2 and defaults to about 25% bik. The message clearly places the blame at hmrc's feet. Salary Sacrificers - check your pay slips!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

P11d(b) error

- Thread starter Cnixon

- Start date

spooksman

Member

The P11D(b) is the Class 1A report for the whole business, it is the P11D that covers your own tax. You should have been sent a copy of the data in this form by your employer by now (by the 6th of July actually).

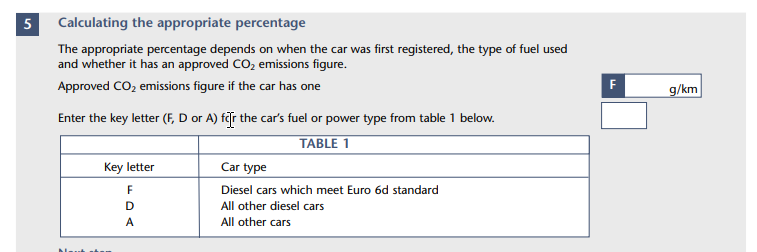

However there is no specific setting for an electric vehicle on a P11D, HMRC class a car's fuel type as "A", "D" or "F", and electric cars fall into "A", along with just about every car. "D" is for old diesel (Euro 4) cars, and "F" is for RDE2 (Euro 6D) diesel cars, everything else is an "A".

Your employer should have reported your car as an "A" with an approved CO2 of zero (0g/km). However you may find that they incorrectly marked the 'no approved CO2' box for your car, meaning you'd be taxed at a higher percentage instead of 0%. Easy mistake, as many people think that an electric car has no approved CO2 - it does, it's just zero!

Your employer could probably resolve this for you by submitting an amended P11D, but you can also make a 'personal representation' via your personal tax page I believe.

Hope that helps...

PS - Also, remember it goes from 0% on your tax for 20-21 to 1% for 21-22, that should be in your tax code now as well!

However there is no specific setting for an electric vehicle on a P11D, HMRC class a car's fuel type as "A", "D" or "F", and electric cars fall into "A", along with just about every car. "D" is for old diesel (Euro 4) cars, and "F" is for RDE2 (Euro 6D) diesel cars, everything else is an "A".

Your employer should have reported your car as an "A" with an approved CO2 of zero (0g/km). However you may find that they incorrectly marked the 'no approved CO2' box for your car, meaning you'd be taxed at a higher percentage instead of 0%. Easy mistake, as many people think that an electric car has no approved CO2 - it does, it's just zero!

Your employer could probably resolve this for you by submitting an amended P11D, but you can also make a 'personal representation' via your personal tax page I believe.

Hope that helps...

PS - Also, remember it goes from 0% on your tax for 20-21 to 1% for 21-22, that should be in your tax code now as well!

Last edited:

Thats no longer the case..... apparently. HMRC have a new setting for BEV ..they just havn't told anybody completing the online form.......

However there is no specific setting for an electric vehicle on a P11D, HMRC class a car's fuel type as "A", "D" or "F", and electric cars fall into "A",

Personally I wonder if my company is talking the proverbial.

spooksman

Member

If you have a look at HMRC's WS2 (P11D Working Sheet 2 Car and car fuel benefit 2020 to 2021) there are only three letters for car fuel type.

That is current legislation - if HMRC's website allows you to choose other options (such as BEV - Battery Electric Vehicle) from a drop down, it then translates them into one of three letters above for the calculation of the cash equivalent - maybe that translation has an issue?

As I said, it can be resolved for your 20/21 P11D via an amendment. HMRC will likely also have used those data points for your 21/22 'estimate' which they use for your new tax code, so you will probably need to address that as well to be sure - a P46(car) from your employer would likely sort 21/22, or by you via your personal tax account on the web.

Feel free to PM me if you think I can assist.

That is current legislation - if HMRC's website allows you to choose other options (such as BEV - Battery Electric Vehicle) from a drop down, it then translates them into one of three letters above for the calculation of the cash equivalent - maybe that translation has an issue?

As I said, it can be resolved for your 20/21 P11D via an amendment. HMRC will likely also have used those data points for your 21/22 'estimate' which they use for your new tax code, so you will probably need to address that as well to be sure - a P46(car) from your employer would likely sort 21/22, or by you via your personal tax account on the web.

Feel free to PM me if you think I can assist.

Your employer should have reported your car as an "A" with an approved CO2 of zero (0g/km). However you may find that they incorrectly marked the 'no approved CO2' box for your car, meaning you'd be taxed at a higher percentage instead of 0%. Easy mistake, as many people think that an electric car has no approved CO2 - it does, it's just zero!

Your employer could probably resolve this for you by submitting an amended P11D, but you can also make a 'personal representation' via your personal tax page I believe.

I had this problem, received a new tax code notice from HMRC today. I called them and they can correct the current year immediately over the phone, and notify your employer in 5-10 working days. So you can make sure it doesn’t affect your pay.

However, they also told me that once a P11D has been issued for last year, it can only be corrected by a P11D reissue. So get your employer to do that.

In our case the payroll system apparently didn’t accept 0 as a valid input into the CO2 box, so as a workaround they left it blank and checked the box. I suspect other systems have similar input validation which needs updating!

intactradio

Member

OK, this suddenly clears things up for me. My employer issued a new P11D in the middle of this month (not entirely sure why) and updated my company car details to a Class A car. HMRC immediately pounced on this and calculated that I'd underpaid tax this year, and adjusted my tax code to accommodate this. This resulted in me paying just short of an extra £1k in PAYE this month. This all happened before HMRC could even issue me a letter telling me that my tax code had been changed so the first I learned of it was when I received my pay slip!

I'm now bouncing between my payroll department and HMRC to figure out how to correct this. I have a new, corrected tax code reflecting Tesla's tax bracket, but nobody seems to be able to figure out how to reimburse tax overpayment short of HMRC making small adjustments over the rest of the tax year to address the overpayment. Not ideal.

Moral of the story: anyone with a Tesla company car, log on here to check that HMRC have the right company car information for you:

www.gov.uk

www.gov.uk

I'm now bouncing between my payroll department and HMRC to figure out how to correct this. I have a new, corrected tax code reflecting Tesla's tax bracket, but nobody seems to be able to figure out how to reimburse tax overpayment short of HMRC making small adjustments over the rest of the tax year to address the overpayment. Not ideal.

Moral of the story: anyone with a Tesla company car, log on here to check that HMRC have the right company car information for you:

Check or update your company car tax

Tell HMRC about changes to your PAYE company car or fuel benefit details

I'm ok for some reason. Others including Monky & Intactradio above seem to have hit the problem. It sounds like payroll not HMRC.If you have a look at HMRC's WS2 (P11D Working Sheet 2 Car and car fuel benefit 2020 to 2021) there are only three letters for car fuel type.

View attachment 689556

That is current legislation - if HMRC's website allows you to choose other options (such as BEV - Battery Electric Vehicle) from a drop down, it then translates them into one of three letters above for the calculation of the cash equivalent - maybe that translation has an issue?

As I said, it can be resolved for your 20/21 P11D via an amendment. HMRC will likely also have used those data points for your 21/22 'estimate' which they use for your new tax code, so you will probably need to address that as well to be sure - a P46(car) from your employer would likely sort 21/22, or by you via your personal tax account on the web.

Feel free to PM me if you think I can assist.

Similar threads

- Replies

- 0

- Views

- 314

- Replies

- 2

- Views

- 743

- Replies

- 79

- Views

- 54K

- Replies

- 13

- Views

- 4K

- Replies

- 28

- Views

- 14K