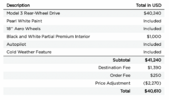

I want to get the Colorado EV Tax credit as I live here. Oregon has a discounted New tesla I want.

To get the Colorado Credit I need to register and title for the first time in Colorado, and not another state. Ive heard in California that they register the car when you buy it.

Is it the Same in Oregon? This page confuses me.

www.tesla.com

www.tesla.com

To get the Colorado Credit I need to register and title for the first time in Colorado, and not another state. Ive heard in California that they register the car when you buy it.

Is it the Same in Oregon? This page confuses me.

Registering Your Tesla | Tesla Support

Depending on your state, Tesla will either handle titling and registration for you, or process and mail you the documents you’ll need to complete registration at your state’s motor vehicle department.