50-50How many -2% QQQ days were there last year? What happened the day or two after?

(paging Yoona....)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I have a hard time believing we will net up this week in TSLA. It just seems like enough people want to be out of the market in 2024 until the dust settles, so I expect selling to dominate. If my -250 Jan 19 puts get assigned at an effective price of $214 I am not stressed at all. Same goes for the -262.5 calls (effective $297).

But, I am curious how trading will go overall this year and coming up with a strategy for me that covers my cashflow needs. Not sure if the '23 patterns will be representative.

But, I am curious how trading will go overall this year and coming up with a strategy for me that covers my cashflow needs. Not sure if the '23 patterns will be representative.

3 more today, also ~260

6 rate cuts expected, lot of money on side lines ... why will selling dominate?I have a hard time believing we will net up this week in TSLA. It just seems like enough people want to be out of the market in 2024 until the dust settles, so I expect selling to dominate. If my -250 Jan 19 puts get assigned at an effective price of $214 I am not stressed at all. Same goes for the -262.5 calls (effective $297).

But, I am curious how trading will go overall this year and coming up with a strategy for me that covers my cashflow needs. Not sure if the '23 patterns will be representative.

2023 not many expected so many rate increases I think ...

StarFoxisDown!

Well-Known Member

I would very much have to disagree on that assessment. Everyone and their mom is waiting for a correction to pile money into the market as I think we're about to enter a roaring 20's economy with a corresponding strong bull market. And it's not just my opinion, the data is supporting it.I have a hard time believing we will net up this week in TSLA. It just seems like enough people want to be out of the market in 2024 until the dust settles, so I expect selling to dominate. If my -250 Jan 19 puts get assigned at an effective price of $214 I am not stressed at all. Same goes for the -262.5 calls (effective $297).

But, I am curious how trading will go overall this year and coming up with a strategy for me that covers my cashflow needs. Not sure if the '23 patterns will be representative.

Not saying a recession is impossible but as data has continually kept coming in both on economic and inflation, it supports a goldilocks' soft landing. That's simply the case with the data that's been coming in for the past 12 months but especially the past 6 months. As with most healthy sustaining bull markets, you need corrections. The market hasn't corrected yet. Everyone's waiting on it. A ton of money is sitting on the sidelines waiting on it.

I'm one of those hoping there's a decent correction here over the next 1-2 months. I want to close the CC's I sold on 2,000 shares with a Dec 2025 370-420 strike price back in July, roll my Dec 2025 LEAPS (in the low to mid 100's) to June 2026 on the cheap, and pick up a handful more June 2026 LEAPS. Then wait and be patient of the new bull market to spark with TSLA I think being a strong breakout stock in 2nd half 2024 and sell CC's at about 200 points higher than the share price as we go from 300 to 350 to 400 and beyond

Last edited:

I hope I am wrong. The rate decreases could be a buffer, but between the election, regulatory pressure on the big tech companies, potentially rebounding real-estate market, ongoing global instability, and today's look of a sector rotation I am just suspicious.6 rate cuts expected, lot of money on side lines ... why will selling dominate?

2023 not many expected so many rate increases I think ...

For me, it is a question of what I do with 5-10% of my portfolio, not about holing up in a bunker with gold bars.

intelligator

Active Member

I'd set these before I left for the day but they didn't hit ... I was asking too much. Checking gamma against the end of day chain, seems we are neutral, negative and positive gamma sitting at p240 and c262.5 ... same in terms of OI. I know we can't wholly trust gamma or OI. Thinking to do the same Wednesday but in real time, -p230 and -c270 , $30 wide , sell each side into strength. Will adjust $5 out if things get hot. The intent is to day-trade on the reversal of what I sell into. Anyone see it different?

Jim, thanks for sharing your scalping trades. I understand opening the short calls and selling them as the stock price drops. I can't quite picture your GTC second position. Can you walk us through an example?An example of scalping CC's throughout a day's volatility, even smallish amounts add up: Today's tally=$4,490

No need to chase and risk, small and steady still wins decently!

View attachment 1005131

PS Before I BTC a scalping CC I open a new GTC order for the same position with the original STO price (or better if trend is going back up) and let it sit in the hopper. 70% of the times it hits at some point and I ride it again.

Sure, here’s what I do:Jim, thanks for sharing your scalping trades. I understand opening the short calls and selling them as the stock price drops. I can't quite picture your GTC second position. Can you walk us through an example?

1) I often STO a set of CC’s at day high, lately in the opening 10-15 min madness where IV is high as well for TSLA. I choose a relatively safe strike/DTE (0.10-0.12 delta) so I’m not under pressure. And I only open on about 10-15% of my longs (sometimes I’ll ladder in at staggered levels above the original position if SP keeps going up and I feel we’re in an overextended spot and a fade is highly likely).

2) When/if share price fades (I find it happens for TSLA often around 11:15-11:45am but can be later in the day) I choose “add to positions” in the brokerage app, select same qty, set GTC, same position, and same or better price than original STO price. It won’t hit until the SP recovers back up so there’s no problem setting this up, can always cancel the order or move price up if there’s a spike or some good news comes out. (There's no hidden genius here, I do it because I’m lazy and it’s easier than hunting the position again on the chain after I close it.)

3) I BTC the original at or near what I think is lows of the day (often when I see green numbers light up my positions screen and keep getting greener, always a nice treat! Over $300-$500 gets my attention, though I certainly let it ride for more if it’s clearly tanking). Once I decide to close I’ll often set the BTC order to $0.10 or more below where it’s currently trading and let it sit. It hits most of the time and squeezes out a bit more $$ from the pirates. If I see it’s not going to hit then I raise it to what the market is giving (I’ll sometime look at the 1-min and 3-min Stoch and RSI for hints of direction/force). BTW if I don’t end up closing the position for whatever reason, it’s important not to forget to cancel the pending new order. (Edit: funny story, I once set a GTC CC order at 0.10 delta and set a $15.00 price (figuring it would never hit) just have it in the hopper until the right time to adjust the price down to open the position. Well, TSLA went on a huge tear and it ended up triggering…I had to get right out! Lol. Since then I use $25.00 as a placeholder price if I’m just monitoring a position that I may or may not want to open (again since I’m lazy and don’t want to hunt it in the chain every time.))

4) I monitor SP (via alerts) and I adjust the new STO price I’m looking for based on what’s going on with any TA/GEX/ etc.

5) If SP keeps falling and breaks crucial support downwards and it’s clear I won’t get a chance to STO the position again at the original price again, but I still want that position, I just STO at the current price and ride it down further. But need to be careful of a quick recovery (TSLA is know for fake breaks) and of not “shorting in the hole.”

NFA, just something I found works for me when I’m in scalping mood.

PS Since this is mainly scalping I often leave $$ on the table and I’m okay with that. Small and consistent gains are very underrated IMO. Also I haven’t needed to roll a position in a long time.

Last edited:

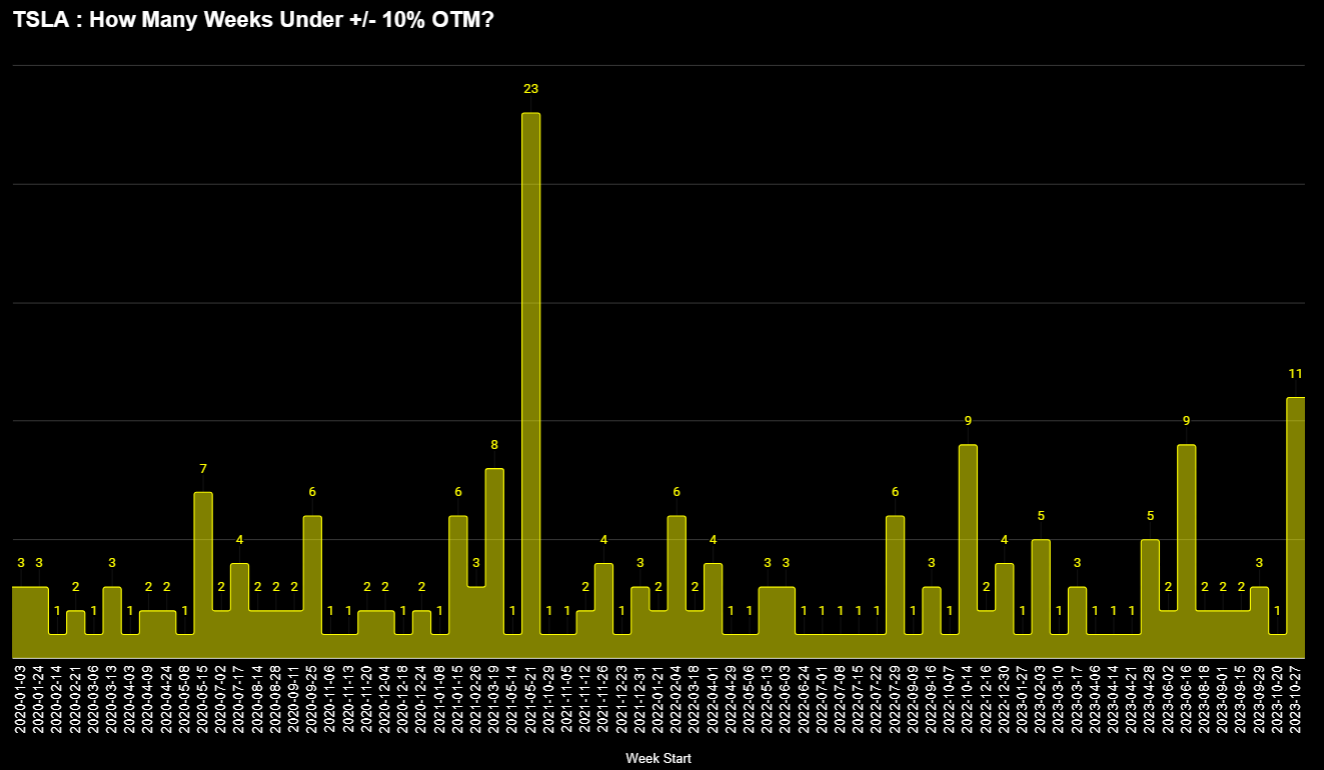

we are on the 14th consecutive week of squeeze:

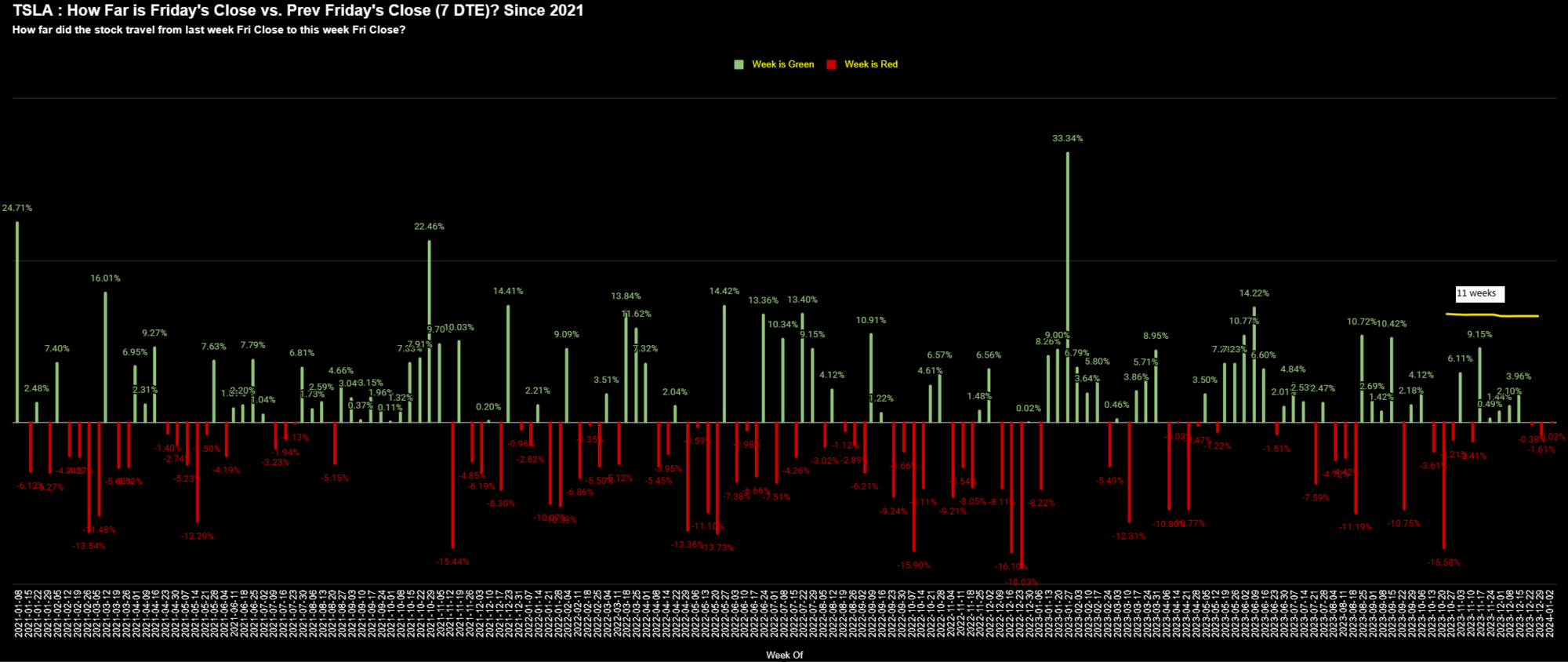

we've been under 10% OTM (7DTE Prev Fri Close to Fri Close) for 11 weeks, since Oct 27:

translation: we're overdue for an explosive move?

we've been under 10% OTM (7DTE Prev Fri Close to Fri Close) for 11 weeks, since Oct 27:

translation: we're overdue for an explosive move?

Last edited:

Arul

Member

pardon my ignorance. how do you calculate the 10% OTM ?we are on the 14th consecutive week of squeeze:

View attachment 1005186

we've been under 10% OTM (7DTE Prev Fri Close to Fri Close) for 11 weeks, since Oct 27:

View attachment 1005189View attachment 1005191

translation: we're overdue for an explosive move

we are on the 14th consecutive week of squeeze:

View attachment 1005186

we've been under 10% OTM (7DTE Prev Fri Close to Fri Close) for 11 weeks, since Oct 27:

View attachment 1005189View attachment 1005191

translation: we're overdue for an explosive move?

Agreed. Question is where will the trigger come from? It’s been MIA just as long.

Arul

Member

What is BTW?Sure, here’s what I do:

1) I often STO a set of CC’s at day high, lately in the opening 10-15 min madness where IV is high as well for TSLA. I choose a relatively safe strike/DTE (0.10-0.12 delta) so I’m not under pressure. And I only open on about 10-15% of my longs (sometimes I’ll ladder in at staggered levels above the original position if SP keeps going up and I feel we’re in an overextended spot and a fade is highly likely).

2) When/if share price fades (I find it happens for TSLA often around 11:15-11:45am but can be later in the day) I choose “add to positions” in the brokerage app, select same qty, set GTC, same position, and same or better price than original STO price. It won’t hit until the SP recovers back up so there’s no problem setting this up, can always cancel the order or move price up if there’s a spike or some good news comes out. (There's no hidden genius to this move, I do it because I’m lazy and it’s easier than hunting the position again on the chain after I close it.)

3) I BTC the original at or near what I think is lows of the day (often when I see green numbers light up my positions screen and keep getting greener; always a nice treat!). Once I decide to close it I’ll often set the BTC order to $0.10 or more below where it’s currently trading and it hits most of the time. Squeezes out a bit more $$ from the pirates. If I see it’s not going to hit then I raise it to what the market is giving (I’ll sometime look at the 1-min and 3-min Stoch and RSI for hints of direction/force). BTW if I don’t end up closing the position for whatever reason, it’s important not to forget to cancel the pending new order. (Edit: funny story, I once set a GTC CC order at 0.10 delta and set a $15.00 price (figuring it would never hit) just have it in the hopper until the right time to adjust the price down to open the position. Well, TSLA went on a huge tear and it ended up triggering…I had to get right out! Lol. Since then I use $25.00 as a placeholder price if I’m just monitoring a position I may or may not want to open (again since I’m lazy and don’t want to hunt it in the chain every time.))

4) I monitor SP (via alerts) and I adjust the new STO price I’m looking for based on what’s going on with any TA/GEX/ etc.

5) If SP keeps falling and breaks crucial support downwards and it’s clear I won’t get a chance to STO the position again at the original price again, but I still want that position, I just STO at the current price and ride it down further. But need to be careful of a quick recovery (TSLA is know for fake breaks) and of not “shorting in the hole.”

NFA, just something I found works for me when I’m in scalping mood.

PS Since this is mainly scalping I often leave $$ on the table and I’m okay with that. Small and consistent gains are very underrated IMO. Also I haven’t needed to roll a position in a long time.

Last edited:

thenewguy1979

"The" Dog

It stand for “Gotto Take Classes!’What is GTC ?

Kidding!

GTC=Good ‘Till Close. This means the order is kept open until I close it manually, instead of auto-canceling by the end of the day (usual default).

Choosing GTC is riskier than “day” if you’re not able to monitor the share price closely.

Arul

Member

ThanksIt stand for “Gotto Take Classes!’

Kidding!

GTC=Good ‘Till Close. This means the order is kept open until I close it manually, instead of auto-canceling by the end of the day (usual default).

Choosing GTC is riskier than “day” if you’re not able to monitor the share price closely.

juanmedina

Active Member

An example of scalping CC's throughout a day's volatility, even smallish amounts add up: Today's tally=$4,490

No need to chase and risk, small and steady still wins decently!

View attachment 1005131

PS Before I BTC a scalping CC I open a new GTC order for the same position with the original STO price (or better if trend is going back up) and let it sit in the hopper. 70% of the times it hits at some point and I ride it again.

Dang that is impressive. I think I need to stop being lazy and try to trade all day instead of wasting all day looking at Twitter. Is the (10) the quantity of contracts? No puts?

Is the (10) the quantity of contracts? No puts?

Quantity

Only covered calls

Sometimes I’ll make an exception and buy puts or put-spreads when the big boys on here do it and there’s good conviction, but I normally like to stick to selling premium.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K