This may well be the theme for most of 2024And we'll be right there alongside them milking theta by selling options and scalping the ranges

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

need a pic to goes with that.This may well be the theme for most of 2024

This may well be the theme for most of 2024

One year is a long time in Tesla world. I know it's all gloomy right now but I would take it week by week. You never know with TSLA.

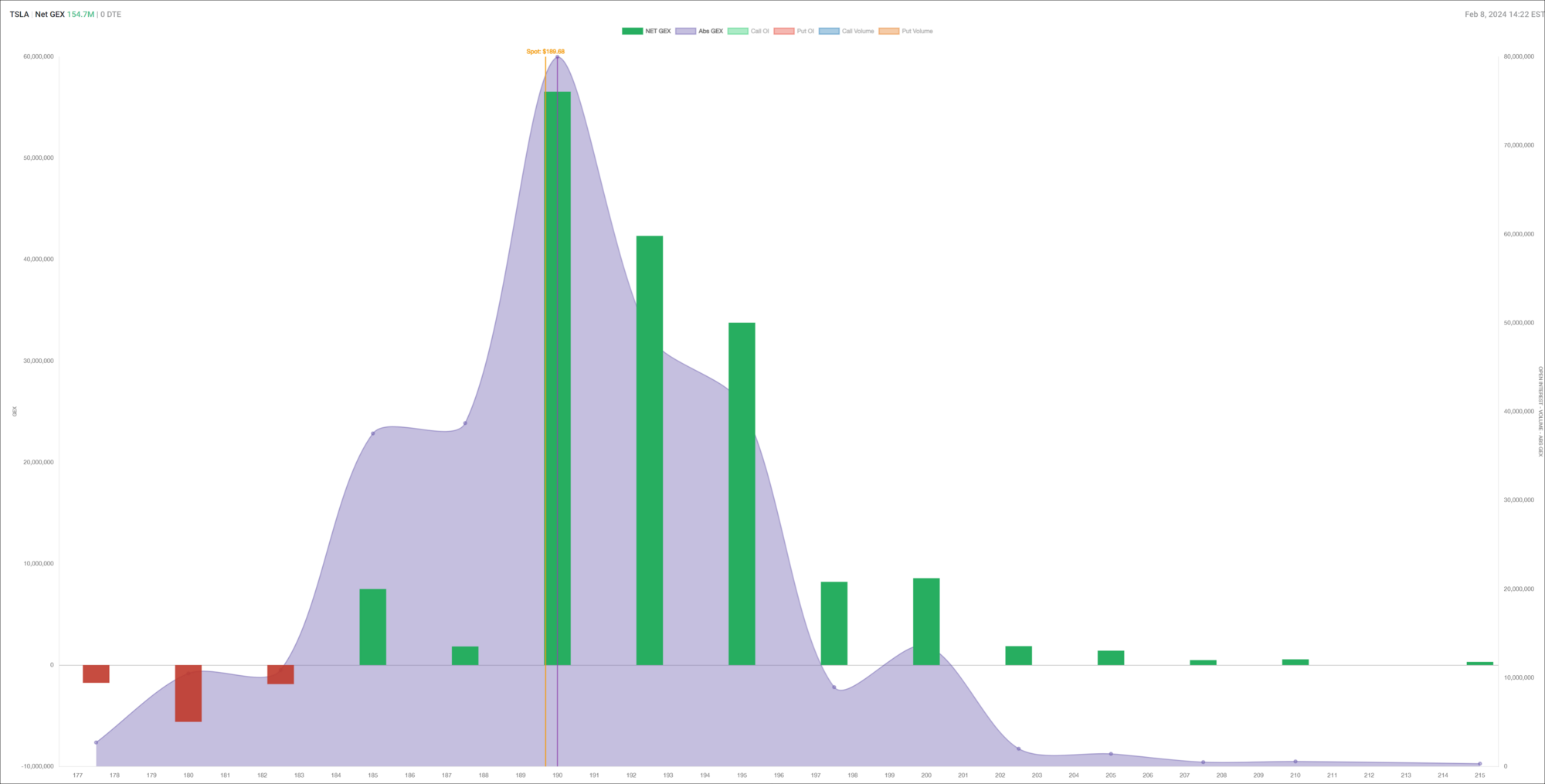

Mostly green bars left for this week, with $190 being center of gravity and some bias from GEX to the right @$196:

CC - Cash Cow

Milk them cows without getting slaughtered - been my mantra for past couple fo years

I reset my CC's from this week to next week - now at 202.5 strikes. We have CPI next week ... so we know how market will freeze

agree, TSLA is the party's last girl on the chair nobody wants to dance with, the girl who might as well be the wallpaperIt just feels like all the traders want this to go higher but there seems to be zero interest in the stock from institutions.

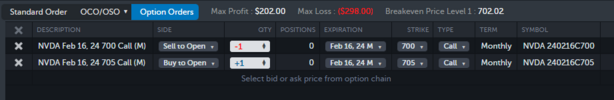

comparing today's NVDA chain to last friday's TSLA chain, one can get more income selling options on NVDA 1DTE vs TSLA 7DTE for the same 7Δ risk.

today's 1DTE nvda 7Δ +p645/-p675/-c730/+c760 gives 89 cents

last friday's 7DTE tsla 7Δ +p140/-p170/-c205/+c235 gives 51 cents

LET.THAT.SINK.IN.

read that again, it wasn't a typo

EVEN IF income is the same, imagine de-risking for 6 days AND no key-man risk, no weekend black swan risk, no distracted CEO risk, no bad tweet BS risk, no daily struggle with FUDs, no MMD, etc.

that's my last nvda post... sorry, mods!

But then where do we go for our daily pain that we’ve been conditioned to seekagree, TSLA is the party's last girl on the chair nobody wants to dance with, the girl who might as well be the wallpaper

comparing today's NVDA chain to last friday's TSLA chain, one can get more income selling options on NVDA 1DTE vs TSLA 7DTE for the same 7σ risk.

today's 1DTE nvda 7σ +p645/-p675/-c730/+c760 gives 89 cents

last friday's 7DTE tsla 7σ +p140/-p170/-c205/+c235 gives 51 cents

LET.THAT.SINK.IN.

read that again, it wasn't a typo

EVEN IF income is the same, imagine de-risking for 6 days AND no key-man risk, no weekend black swan risk, no distracted CEO risk, no bad tweet BS risk, no daily struggle with FUDs, no MMD, etc.

that's my last nvda post... sorry, mods!

2/16 is probably 180-195, with a chance of 200@Yoona what do you see for next week? Seems a bit all over the place with old legacy positions along for the ride:

Thank you. It’s hard to get a read on the GEX chart when it’s so lumpy like that.

csmith1521

Member

agree, TSLA is the party's last girl on the chair nobody wants to dance with, the girl who might as well be the wallpaper

comparing today's NVDA chain to last friday's TSLA chain, one can get more income selling options on NVDA 1DTE vs TSLA 7DTE for the same 7Δ risk.

today's 1DTE nvda 7Δ +p645/-p675/-c730/+c760 gives 89 cents

last friday's 7DTE tsla 7Δ +p140/-p170/-c205/+c235 gives 51 cents

LET.THAT.SINK.IN.

read that again, it wasn't a typo

EVEN IF income is the same, imagine de-risking for 6 days AND no key-man risk, no weekend black swan risk, no distracted CEO risk, no bad tweet BS risk, no daily struggle with FUDs, no MMD, etc.

that's my last nvda post... sorry, mods!

This is what I did today. Closed my TSLA ICs and opened NVDA BCS. Made significantly more income for less additional baggage and 1DTE.

Well the way NVDA has been going, I wouldn't be that confident writing a -c730 for tomorrow!agree, TSLA is the party's last girl on the chair nobody wants to dance with, the girl who might as well be the wallpaper

comparing today's NVDA chain to last friday's TSLA chain, one can get more income selling options on NVDA 1DTE vs TSLA 7DTE for the same 7Δ risk.

today's 1DTE nvda 7Δ +p645/-p675/-c730/+c760 gives 89 cents

last friday's 7DTE tsla 7Δ +p140/-p170/-c205/+c235 gives 51 cents

LET.THAT.SINK.IN.

read that again, it wasn't a typo

EVEN IF income is the same, imagine de-risking for 6 days AND no key-man risk, no weekend black swan risk, no distracted CEO risk, no bad tweet BS risk, no daily struggle with FUDs, no MMD, etc.

that's my last nvda post... sorry, mods!

Plus is has gone up so far for so long now, it's surely due a correction at some point...?

csmith1521

Member

It seems as tho MMs are going to defend the 700 call wall this week.Well the way NVDA has been going, I wouldn't be that confident writing a -c730 for tomorrow!

Plus is has gone up so far for so long now, it's surely due a correction at some point...?

csmith1521

Member

Question for those who don't use IBKR. Can you roll both sides of an IC in one transaction? If so, what platform are you using? I found out IBKR does not have the functionality to do this.

Also worth noting we're at "Extreme Greed" right now: https://edition.cnn.com/markets/fear-and-greed

chiller

Member

IBKR absolutely supports this. You might have to use the strategy builder, but it will basically let you construct any roll you want.Question for those who don't use IBKR. Can you roll both sides of an IC in one transaction? If so, what platform are you using? I found out IBKR does not have the functionality to do this.

thenewguy1979

"The" Dog

Maybe the higher premium is due to ER coming up? TSLA has similar premium before the ER dump.Well the way NVDA has been going, I wouldn't be that confident writing a -c730 for tomorrow!

Plus is has gone up so far for so long now, it's surely due a correction at some point...?

Previously I have sold ATM Puts riding the pump wagon, but stop since the stock was swinging 30+ a day. A gain 30 points out of the money can easily be a loss just by holding the contract overnight.

Attachments

csmith1521

Member

Good to know! I spoke with customer support and they were unable to help me. I'll play around with it a bit more. Thanks!IBKR absolutely supports this. You might have to use the strategy builder, but it will basically let you construct any roll you want.

tivoboy

Active Member

It’s really just a technical overboughtedness scale.. what I like to follow is the extreme FOMO, and MOMO ETF, and the build in retail investor money flows.. that’s when you know the rug is going to be pulled out, or the music stops, or there’s a missing chair, etc.Also worth noting we're at "Extreme Greed" right now: https://edition.cnn.com/markets/fear-and-greed

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K