I was on the same path until I was too deep into the first spread, the second I managed to get out with little pain. Add 2 zeros and a negative, that's my loss this week. But I sleep good now.

I'll setup a conservative trade Thursday for 4/26.

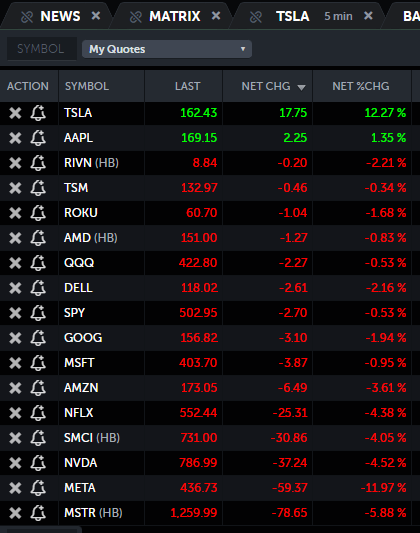

I have 5x TSLA Jan '25 +p180 that I should have sold at SP 140. Can't believe the street flipped given poor ER. I was looking for a few more percent return to help close the outlay. Oh well, live to fight another day.

Do we see a retrace to 140s anytime soon ? I don't want to write puts against these, may as well cash in , no ?

EDIT: just read

@tivoboy posts, 150 might be floor. Okay, that's a few more percent, willing to hang in for that to cash in these puts. 4/26 -p130/+p140 insurance and option to but are not worth anything, but that's what it was.