Jack6591

Active Member

A Tesla investment thread that prohibits political discussion, is like sex with a condom. It’s safer...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

The difference between a good driver and an average one is that a good driver sense the danger of a road cluster configuration and can avoid them and stay away.

The ex wife of my brother had about 1 or 2 accidents yearly from situations she said she was not at fault. Like a drunk driver making a Uturn at a green light she had, people not stopping on the red light, people not making their stop.

in 20 years of driving I had no accident over 200 000 miles of driving and I had about 15 situations I saved my car from near misses. A guy in North Carolina overtaking the left lane when I was there, I expected it and just moved over on the left half of the wheels off road.

3 days ago I was taking a call for work and I was about to go on my green light but saw the car in the cross section jerking his car before I started accelerating, I waited before accelerating and he ended up passing on his red light and crashed in the car in the lane besides mine.

I wonder how the AI will be trained for these unfrequent unusual situations that the driver just see that there is a clusterf&$% about to happen.

Not saying that I am a good driver and could drift in a rally and win LeMans, but I try to avoid at all cost people driving like boneheads either passing them as far as possible to be 1 mile away of them or moving completely out of the way when a Mustang is speedin at 180mph when I’m getting out of my rental car out of Miami airport. These moves might prevent some near misses that can happen 1 or twice a year when you drive over 30 000 miles yearly. I wonder how much FSD can actively place you in a position safer away from these situations. It’s a life saver against crashing your car from getting asleep behind the wheel but I am eager to see how it can be a life saver from other human drivers driving recklessly. Once all car will be FDS, the accident rate will be near 0. It’s the transition period I am interested into.

It is a word with many meanings.You hit the nail on the head. There are too few sane humans left in the USA!

What's a cabinet?

If after you go full margin, your brokerage announces less margin credit on stocks like TSLA (since stocks are obviously in a freefall), you get an instant margin call. I've never been there but it can't be a fun way to live (dependent on others for your solvency).

Life is too short to mess with using other peoples money. It's a cocky and/or desperate thing to do. It might work out but it might not. Plus, you're letting the lender skim sure profits while you're taking all the risk.

Indeed, when I drive, or even walk along the street, I'm not just assessing what’s happening, but extrapolating what may happen, and what I can do to minimise risks of different scenarios. A really easy application of my thinking is that when I’m waiting for a metro (subway) to arrive, I don’t stand on the edge of the platform, but with my back against the wall and close to the station exit.

Yeah, but nowhere near as much fun!

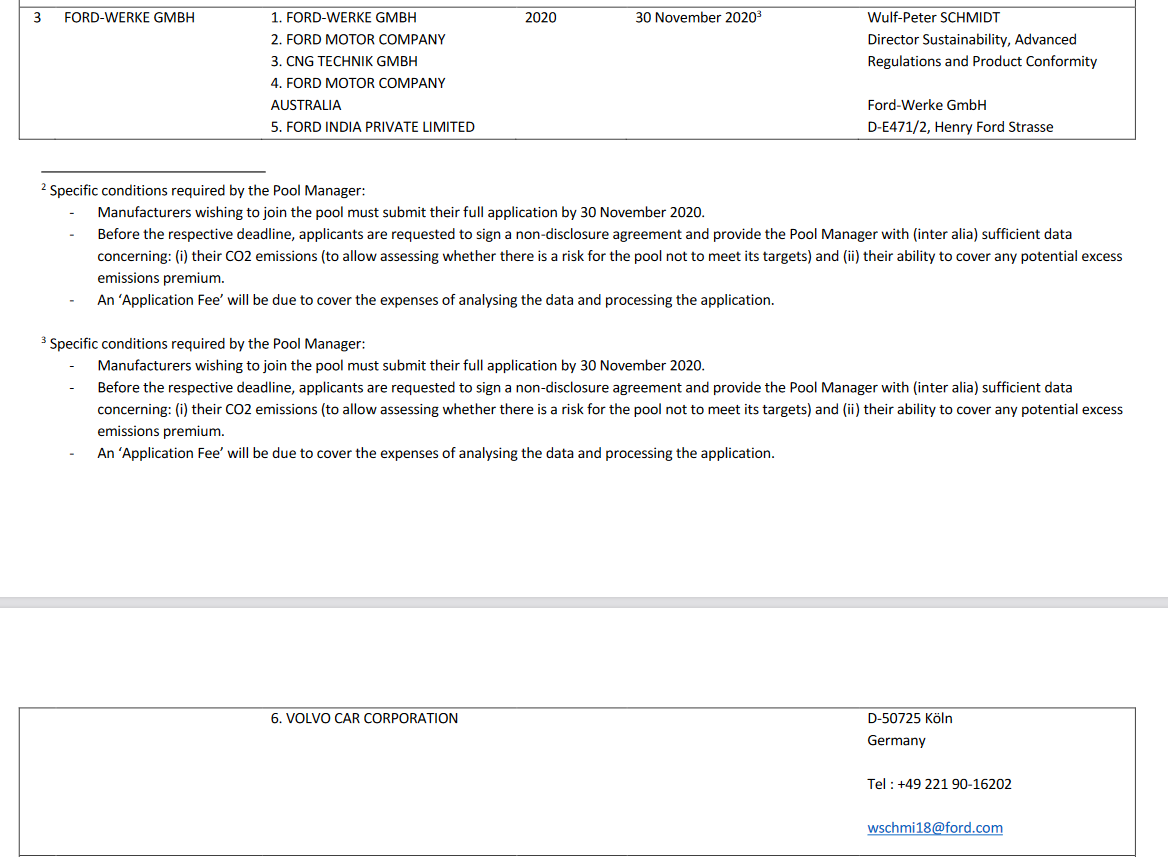

Makes sense. Volvo looks to be nearly at the top of EU emissions compliance.

Ford joined with Volvo

The accountant is estimating up to $1.245 Bn profits in Q4 without Deferred Tax Valuation Allowance or FSD recognition...

Near-future quarterly financial projections

These are pretty explosive numbers. In January when the number comes out, we would be hopefully out of the woods from Corona, as well as the election drama. Exciting times ahead

Ha, you talk as if sp gives a crap. Only two things now move the sp, another stock split or S&P inclusion. Two record knockout earnings now just to see tsla bleed. We bleed 3x macro and recover 1x macro if we are lucky.

It's still very exciting, amazing that it took a stock split to find it's valuation. In pre market today futures losing steam and Tesla looking weak you just get the feeling MMs want to take this down to the 380 support level again today and see if they can shake out a few more shares from the weak longs, seen the story play out so many times.

It should be an interesting week, hold on to your seat beats!

But the final measuring stick will be the number or accidents/deaths per 100 million miles and, on this metric, they will take home the gold.

In time they will continue to improve capabilities to the point where there is hardly ever an accident of any consequence. It will be considered a freak event and make national news (err...wait, if it's a Tesla on Autopilot, it already does).

In ancient times (i.e. mid-1990's) Solar/wind systems had 'charge controllers' and 'inverters' that were both functionally and logically distinct. Charge controllers were fairly crude, while inverters had become quite sophisticated and the best produced '"pure" sine wave' current that was even then far cleaner than any public power was.An electrek article about Tesla's Powerhub (I've not heard about it before, but maybe others here have, thought I'd share it anyway).

Tesla Powerhub: a lesser-known Tesla energy product to control assets - Electrek

Tesla describes Powerhub (not to be confused with Autobidder):

"Powerhub is an advanced monitoring and control platform for managing distributed energy resources, renewable power plants and microgrids. Powerhub is deployed and in use across Tesla’s fleet of over one gigawatt-hour of operating commercial sites. Customers ranging from facility managers to power plant operators use Powerhub to maximize operational efficiency, uptime and asset value. Powerhub covers all common elements of Supervisory Control and Data Acquisition (SCADA) systems and offers standard customizations to meet the operational needs of small, large and virtual power plants.”

The accountant is estimating up to $1.245 Bn profits in Q4 without Deferred Tax Valuation Allowance or FSD recognition...

Near-future quarterly financial projections

Biden Aims to Restore Tax Credit for Tesla, GM

“Restore the full electric vehicle tax credit, target it to middle-income consumers, and prioritize the purchase of American-made vehicles. We assume the proposal makes the electric vehicle tax credit permanent, repeals the per manufacturer cap, and phases out the credit for taxpayers with income above $250,000.”

Link: Joseph Biden Aims To Improve US EV Tax Credit, Restore It For Tesla & GM