Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

BMW removing touchscreen from a bunch of models due to chip shortage

Certain BMW models are going to lose their touchscreen functionality to save silicon and allow BMW to maintain its current production levels

HG Wells

Martian Embassy

Since its the weekend.

How many servants are optimum for a two person household?

A live in maid goes without saying.

But what about a gardner ?

We only have 1/2 acre at our main house and he wouldn't have much to do.

I prefer to drive myself so he couldn't do double duty.

Does a chef need an assistant ?

When going to our mountain retreat, do we have a second set or just fly them out ?

Truly, first world problems.

How many servants are optimum for a two person household?

A live in maid goes without saying.

But what about a gardner ?

We only have 1/2 acre at our main house and he wouldn't have much to do.

I prefer to drive myself so he couldn't do double duty.

Does a chef need an assistant ?

When going to our mountain retreat, do we have a second set or just fly them out ?

Truly, first world problems.

All the people I would hire if it wasn’t my kids around I have to show them how to function in a normal life. Just for the sake of not spoiling my kids, I am doing the laundry, washing the dish and mopping the floor when my 18 months old spill all her milk while his older Brother try to serve her some milk. If I wasn’t to show my kids to live a normal regular life, I would have at least 5 person on the payroll to do everything I hate doing.Since its the weekend.

How many servants are optimum for a two person household?

A live in maid goes without saying.

But what about a gardner ?

We only have 1/2 acre at our main house and he wouldn't have much to do.

I prefer to drive myself so he couldn't do double duty.

Does a chef need an assistant ?

When going to our mountain retreat, do we have a second set or just fly them out ?

Truly, first world problems.

Artful Dodger

"Neko no me"

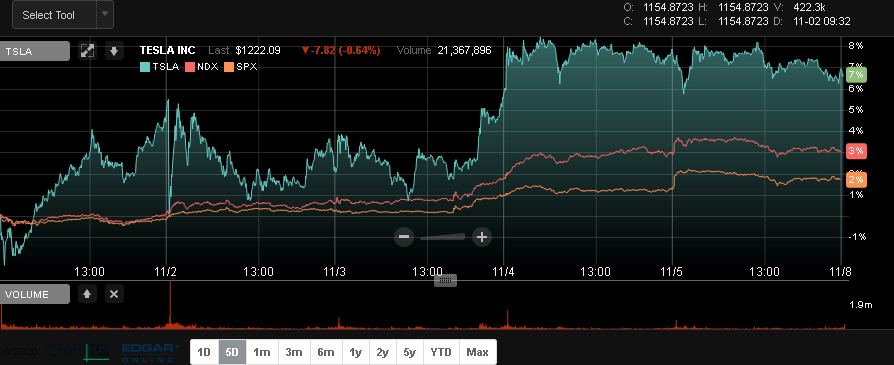

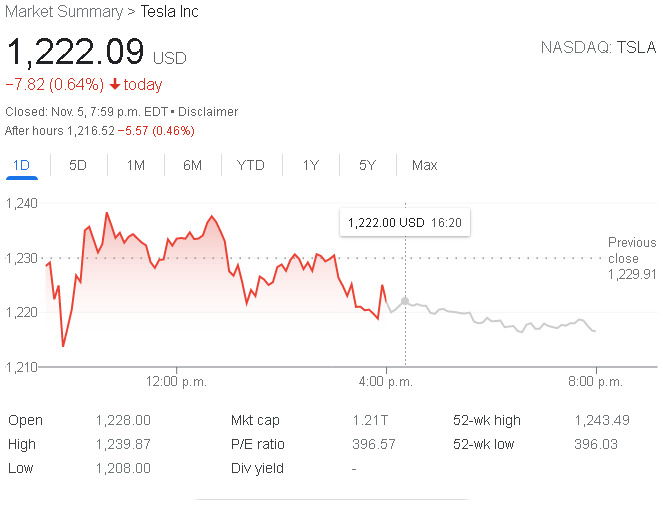

TSLA: a Rock Opera in 3 Parts:

The Week that was: (multiple ATHs set in all 4 SP categories Nov 1-5, 2021)

The Day that was: (MMs+hedgies won't give up the Close)

The After-hrs session: (woeful volume; shortzes have no home life)

This page will resume updating on Nov 08, 2021 04:00 PM ET.

Cheers!

The Week that was: (multiple ATHs set in all 4 SP categories Nov 1-5, 2021)

The Day that was: (MMs+hedgies won't give up the Close)

The After-hrs session: (woeful volume; shortzes have no home life)

TSLA After-Hours Quotes

Data last updated Nov 05, 2021 08:00 PM ET.This page will resume updating on Nov 08, 2021 04:00 PM ET.

| Consolidated Last Sale | $1,216.7 -5.39 (-0.44%) asdf |

|---|---|

| After-Hours Volume | 287,718 |

| After-Hours High | $1,227.75 (05:00:37 PM) |

| After-Hours Low | $1,216.00 (06:27:49 PM) |

Cheers!

Since its the weekend.

How many servants are optimum for a two person household?

A live in maid goes without saying.

But what about a gardner ?

We only have 1/2 acre at our main house and he wouldn't have much to do.

I prefer to drive myself so he couldn't do double duty.

Does a chef need an assistant ?

When going to our mountain retreat, do we have a second set or just fly them out ?

Truly, first world problems.

You need a butler who can make these trivial decisions for you.

ZeApelido

Active Member

OT

When thinking about all those emission reduction promises many years away:

www.theshovel.com.au

www.theshovel.com.au

When thinking about all those emission reduction promises many years away:

Man Announces He Will Quit Drinking by 2050 — The Shovel

He has assured friends it will not affect his drinking plans in the short or medium term.

Taylor said it was important not to rush the switch to non-alcoholic beverages. “It’s not realistic to transition to zero alcohol overnight. This requires a steady, phased approach where nothing changes for at least two decades,” he said, adding that he may need to make additional investments in beer consumption in the short term, to make sure no night out is worse off.

StealthP3D

Well-Known Member

If I knew know what I knew in 2011…not about Tsla price but just about investing I would likely be 10x from where I am. But thanks to this board…when the next Tsla comes along I will be ready.

Newsflash:

The Next Tesla Is Tesla

Check back with me in 2030.

Last edited:

StealthP3D

Well-Known Member

Eh, to which I’d reply, what’s the purpose of wealth if you spend all your time pursuing it instead of enjoying it? I’d rather live in the now than cut my living expenses and discretionary purchases to the bone in order to support the nebulous future or to leave vast sums to my descendants. For me, part of that is keeping my shares but also using the margin they provide as the backing needed to sell options for income and wealth creation. It is true that a crash can hurt me, and I was not a happy camper a couple times this year (Feb/May, IIRC)… but it’s still been a great year overall for me on both sides (shares & options).

Not that anything is wrong with other people going other ways… to each their own… let’s not prescribe a single solution for all. I‘d be happy if we left “should”s out of the conversation.

I retired 21 years ago at age 37 with the freedom to go where I wanted when I wanted and how I wanted. I no longer needed to ask for time off, budget money and could buy whatever I wanted. Before I retired, I DID live in the here and now, I just didn't blow money on stupid things like new cars, fancy clothes, big houses and expensive accommodations. Now, for the rest of my life, I can have whatever I want without worrying about the cost. Debt holds most people back from realizing this.

It seems that the concept of saving and working towards a goal is lost on many people.

StealthP3D

Well-Known Member

Also the amount I add to my wealth selling margin backed bull put spreads weekly is vastly greater than any savings I'd get buying crappy wine instead of good or eating ramen instead of steak.

Doubtless one can get into a lot of trouble if they don't know what they're doing. But that's true of most endeavors in life. You can get into a lot of trouble with power tools, firearms, cars, having kids, alcohol, hell physics itself if you don't know what you're doing.

Or you can get great things out of all of those if you learn to deal with them responsibly. Margins no different.

I'll just point out that people who have found themselves in margin hell are not limited to those who don't know what they are doing. Markets are capable of becoming very unpredictable, sometimes more quickly than it's possible to do anything about it and the road is littered with people who thought they were using margin responsibly and knowledgeably. The key is that people naturally become accustomed to the way things are (and have been in the recent past) and thus under-estimate how volatile things can become. It's the trap that wise investors avoid, especially when markets are high.

2

22522

Guest

Totally agree but when covid started, I had invested all my money in January in S&P500 ETFs according to the recommendations of the great John Bogle book on investing. When TSLA collapsed, I had no free money and I saw this as an opportunity of a life time. I could not let the wave pass and miss if because my surf board was left on the shore.

really interesting point of view or Tom Nash about the advantage of Tesla during high inflation.

Commentary on videos and Elon musings.

Because of Tesla buying power on batteries they can waltz into any market with a high battery cost fraction and win on price. All others need a sticky niche besides price. Mary knows that and has designed her company to shelter in a niche until her cost position improves. [Aside: I don't know if Mary has watched Young Frankenstein, where someone accidentally drops something and then tries to cover it up. If this happens with a pouch cell, do you get a fire?]

Elon indicated future direction in appearances with much more clarity than we see today.

Specifically, he talked about immediate payment terms from customers and 60 day payment terms from suppliers. Explaining that if you can deliver to customers within 30 days of receiving the parts, you have 30 days of cash before you pay your supplier. Zero cash is needed to grow. Like you have 1/12th of annual revenue looking for a purpose. Note: this is a first order calculation where labor is not the largest component of vehicle cost. We are trying to define one boundary and can back off the ideal case once we know the limit as labor approaches zero.

If one looks at the design and location of the factories, one sees a manifestation of this obsession with start to finish cycle time, where finish is cash in hand.

30 days of Tesla revenue is 4 billion dollars, today...

[The VW guy said Tesla can get money because of the high valuation. He may be using that as an excuse to act i.e. if we do this metric our valuation will go up. If VW had the same cycle time to cash as Tesla aims for, VW would have 25 Billion laying around. The VW guy thinks his money comes from Wall Street and will try to use his "I am a puppet" narrative to transform VW. He would be much better off focusing on cycle time... He would look like less of a puppet and more of a leader.]

Last edited by a moderator:

StealthP3D

Well-Known Member

It's worse in the UK. I give away a lot of my production to the grid, and I still get charged for the connection 'cost' !

Have you tried billing your electrical provider for the connection between your panels and the meter?

/s

Same here.Strongly disagree.

This reads like someone who thinks "using margin" means "Borrow 100% of max and buy at max prices and hope for the best"

Don't get me wrong- some people do that and get killed. Just as some people use many other forms of credit poorly and get hurt by them- that doesn't mean you shouldn't ever buy a home unless you're paying cash in full though.

There's lots of ways to use margin (and typically only a fraction of what's available to you) that will consistently outperform JUST "buy with cash and act dead"

Last time I ran the math comparing my current gains to what I'd have had if I'd just bought shares with cash and nothing else the difference is comfortably in the 7 figures. And I'm a small fry compared to many.

You can check out the "other thread" to learn more about some of em.

buying with margin at lows made a 7 numbers different today.

but compared to the other thread, it’s a small number

Knightshade

Well-Known Member

I'll just point out that people who have found themselves in margin hell are not limited to those who don't know what they are doing.

And professional drivers sometimes crash. Professional pilots too. Great doctors sometimes make mistakes and kill people. And law enforcement sometimes shoot themselves. Professional cooks sometimes burn themselves. Professional electricians sometimes shock themselves.

Nothing is risk free.

But the folks who know what they're doing are far more likely to not have it happen, and if it does, be a far better position to survive the situation.

Same with trading. Or pretty much anything else.

Markets are capable of becoming very unpredictable, sometimes more quickly than it's possible to do anything about it and the road is littered with people who thought they were using margin responsibly and knowledgeably.

Likewise there's plenty who did use it responsibly and knowledgably, and made far higher returns than just HODLing would have.

One in a post just above as another example (and plenty in the other thread- including lots of stories about ending up in bad positions and the many and varied clever methods by which to turn them around or mitigate them).

The key is that people naturally become accustomed to the way things are (and have been in the recent past) and thus under-estimate how volatile things can become. It's the trap that wise investors avoid, especially when markets are high.

I agree that's a key way to potentially set yourself up for eventual failure- One strategy works every time until it doesn't.

But again there's any number of ways to mitigate risk if you're patient and paying attention.

And if you've taken the time to educate yourself, you'll be able to adjust your strategy when the market changes.

I've changed strategies 4 different times in the last 2 years as market conditions have changed. I've ended up with roughly 3x the number of shares I would've had just HODLing.

And I've been fairly conservative in doing it.

I'm perfectly happy to "only" be making like 3-5% a week ROIC on average (from the margins option work, not counting any gains from the SP itself).

There's folks in the other thread significantly more aggressive than I.

Again this is not something a person should just jump into doing. The very first page in the "other" thread has a link to a options course that's 30-40 hours of time to complete and is a basic education in the topic.

But if you're willing to be patient, open to new ideas, and also important- NOT be greedy- it's a great way to both own more of a great company, but make a nice side income while you're doing it.

It's certainly not for everyone. That's ok, it doesn't need to be.

But it is for some people, and that should be ok too.

Mokuzai

Member

You need a butler who can make these trivial decisions for you.

My butler had better be manning the batcave in my absence and readying the jet.

One Teslabot per location should be able to do everything you need, and will be cheaper and more reliable.Since its the weekend.

How many servants are optimum for a two person household?

A live in maid goes without saying.

But what about a gardner ?

We only have 1/2 acre at our main house and he wouldn't have much to do.

I prefer to drive myself so he couldn't do double duty.

Does a chef need an assistant ?

When going to our mountain retreat, do we have a second set or just fly them out ?

Truly, first world problems.

lafrisbee

Active Member

fixedMy butler had better be manning the batcave in my absence and readying the Batjet.

Now the wait time to take delivery of a LR Model Y is 8 months, delivery estimators in June. Price has increased by $5k on configurator. I have read numerous books about finance suggesting to buy a used car because they lose up to 30% in value in the first years. When you buy a Tesla Model 3, you can sell it the same price 2 years later with 35,000 miles and you can sell your Model Y you just bought for a profit 6 months later. Who would have ever thought buying a car was an investment? All these book were wrong :X

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K