Saint-Laurent-sur-Manoire, France

Seems to be correct, although there's a lot under construction. Tesla finally seems to be switching to V3 for Europe. Right before they build the Icelandic network, yeay!

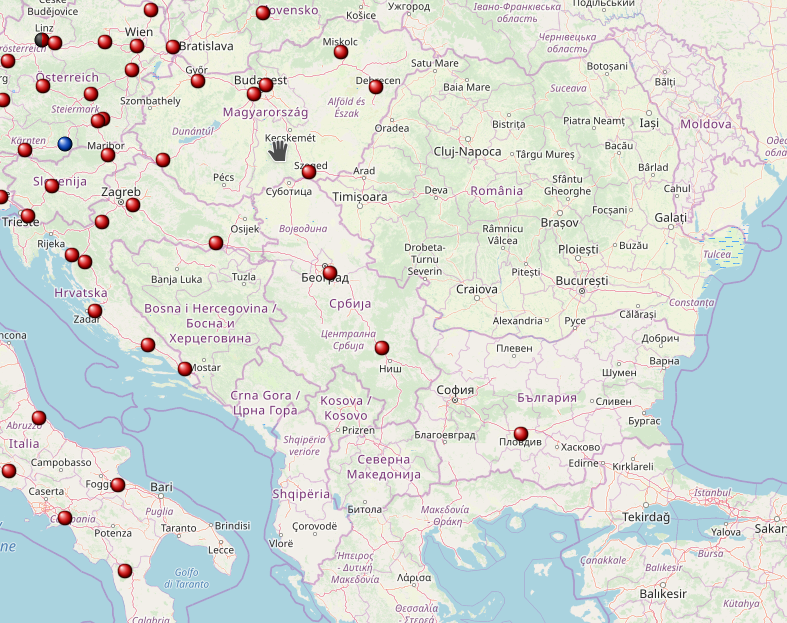

BTW, Bulgaria is now part of the European network

It is not yet posted on supercharge.info, but according to the very reliable Norwegian tu.no (technical, weekly magazine), the first 250 kW supercharger stalls are now online in Norway. I believe these are the first v3 stalls on the European mainland (while still none in the EU),

Teknisk Ukeblad on Twitter

Seems to be correct, although there's a lot under construction. Tesla finally seems to be switching to V3 for Europe. Right before they build the Icelandic network, yeay!

BTW, Bulgaria is now part of the European network