You need to get a smarter husband. Or one who shuts up and stays out of your way. Or at least maybe your own investing account.Take a deep breath and jump back in - that is the only way to get back in the game.

We made the same mistake on Apple. We owned 2 iPods early 2000s and loved them. When iPhone cane out in 2007, we both purchased around thanksgiving. That was such a superior product to anything out there that we purchased 300 shares of AAPL. Well just over an year later the price had doubled and my husband insisted that there was no further growth and we sold. Then every time I wanted to buy again, he felt it was too expensive- so we never got back in. Think of what 300 shares from 2007 would be worth today.

I decided to start managing my own retirement investments myself in 2013 - the very first stock I purchased was AAPL! It has done very well since then too.

Better late than never I say.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

What engine? I have a Tesla.July 22nd for earnings. Ok ladies and gentlemen, you have 12 calendar days to start your engines.

It's safe but pointless.

MartinAustin

Active Member

Square is also doing it in a similar pattern so I think it's macro-relatedHmm some major climb AH. Wonder if another upgrade or something.

anthonyj

Stonks

I am buying the $2850 strike calls at different expirations. I think there is a decent chance at a VW style squeeze, 5x in one day

Honda invests in China's CATL to jointly develop EV batteries

Honda invests in China's CATL to jointly develop EV batteries

A big 1% investment.

Honda invests in China's CATL to jointly develop EV batteries

A big 1% investment.

LN1_Casey

Draco dormiens nunquam titillandus

I am buying the $2850 strike calls at different expirations. I think there is a decent chance at a VW style squeeze, 5x in one day

Got my $7k/share order ready for that.

ZeApelido

Active Member

Interesting and insightful but unfortunately completely one-sided

My guess is Norwegians are waiting for Model Y.

Not Tesla choosing not to deliver adequate supply of Model 3s to Norway for 6 months.

Families that already have a M3 are likely waiting for MY

Tasha thinks Tesla should start their ride hailing service now.

Been thinking that this is the reason why ARK is not selling shares recently ... (no big news about 10% portfolio rebalancing)

POTS - Plain Old Taxi Service. (Call 1.800.420.POTS)

Returned/Leased cars go back to fleet.

Low maintenance, lower SC rates.

Last edited:

Elon's AI Q&A without the piano background sound.

- My takeaway - biggest challenge for Tesla to grow is to find enough engineers.

Elon Musk talks Autopilot and Level 5 Autonomy at China AI conference (

)

- My takeaway - biggest challenge for Tesla to grow is to find enough engineers.

Elon Musk talks Autopilot and Level 5 Autonomy at China AI conference (

Considering this short money combined with earnings, I was thinking of Merlin engines.What engine? I have a Tesla.

You need to get a smarter husband. Or one who shuts up and stays out of your way. Or at least maybe your own investing account.

TMC's first marriage proposal?

I love Karen...but that really should be a Medium article are at least a twitter unroll(SP)?

Artful Dodger

"Neko no me"

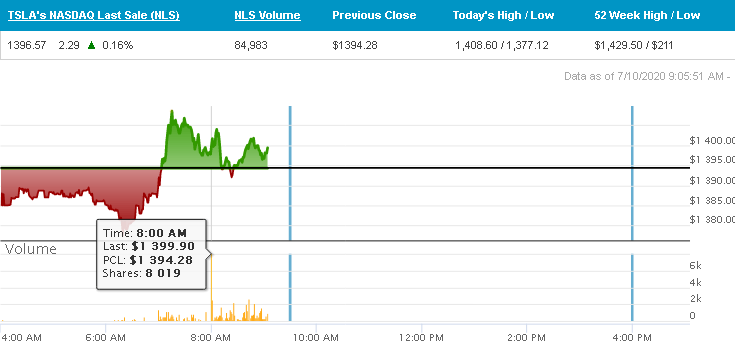

08:00 a.m. Whistle: Fri, 10 Jul 2020

Comment: "Pre-Market High $1,408.50 @ 07:15 ET"

Cheers!

- NASDAQ-100 Futures: +12.50 +0.12% 09:04:34 ET

- TSLA share price: 1399.90 +$5.62 +0.40%

- NASDAQ Pre-market Volume: 80,006 @ 08:00 ET

Comment: "Pre-Market High $1,408.50 @ 07:15 ET"

Cheers!

OT: NKLA update... I just covered my short at $54. Shorted at $70. Not sure if I made any money because of this from ETrade...

The borrow rate for a hard-to-borrow security in your account below is above 25%.

Security:

NKLA

New borrow rate: 767.50%

The rate has gone from 2xx% to 7xx% in the 4 weeks I was short. I'll stick with my TSLA shares and options.

The borrow rate for a hard-to-borrow security in your account below is above 25%.

Security:

NKLA

New borrow rate: 767.50%

The rate has gone from 2xx% to 7xx% in the 4 weeks I was short. I'll stick with my TSLA shares and options.

Jack6591

Active Member

I love Karen...but that really should be a Medium article are at least a twitter unroll(SP)?

I sense that I’m reading the outline for an upcoming book.

StealthP3D

Well-Known Member

But if you bought NIO at $6.8 like ten days ago, you would have doubled your money. Better than Tesla during the same period. I kicked myself for not buying more with my MSFT money.

If your anticipation to TSLA is only 2500-3500 , you probably can find a better stock, if above $5000, then now is the time to buy back.

I think there is a false equivalency happening when the short-term appreciation of NIO and TSLA are compared directly. Ten days? Really? One of the most attractive things about TSLA as an investment to my way of thinking is it's long-term value. Even if you are unlucky and buy in at the all-time high right before the entire market corrects and valuations deflate, TSLA has the bones, the company DNA and the market opportunity and position to "grow itself out of the hole" before you have too much time to regret your decision. It's simply not comparable to most stocks that might have a month (or less) of exceptional market performance under it's belt.

OT: NKLA update... I just covered my short at $54. Shorted at $70. Not sure if I made any money because of this from ETrade...

The borrow rate for a hard-to-borrow security in your account below is above 25%.

Security:

NKLA

New borrow rate: 767.50%

The rate has gone from 2xx% to 7xx% in the 4 weeks I was short. I'll stick with my TSLA shares and options.

NKLA PUTS still intact, but with losses. Thinking it did a Head Fake past 2 days due to MS Stanley note. The warrants are still in play.

cheers!!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K