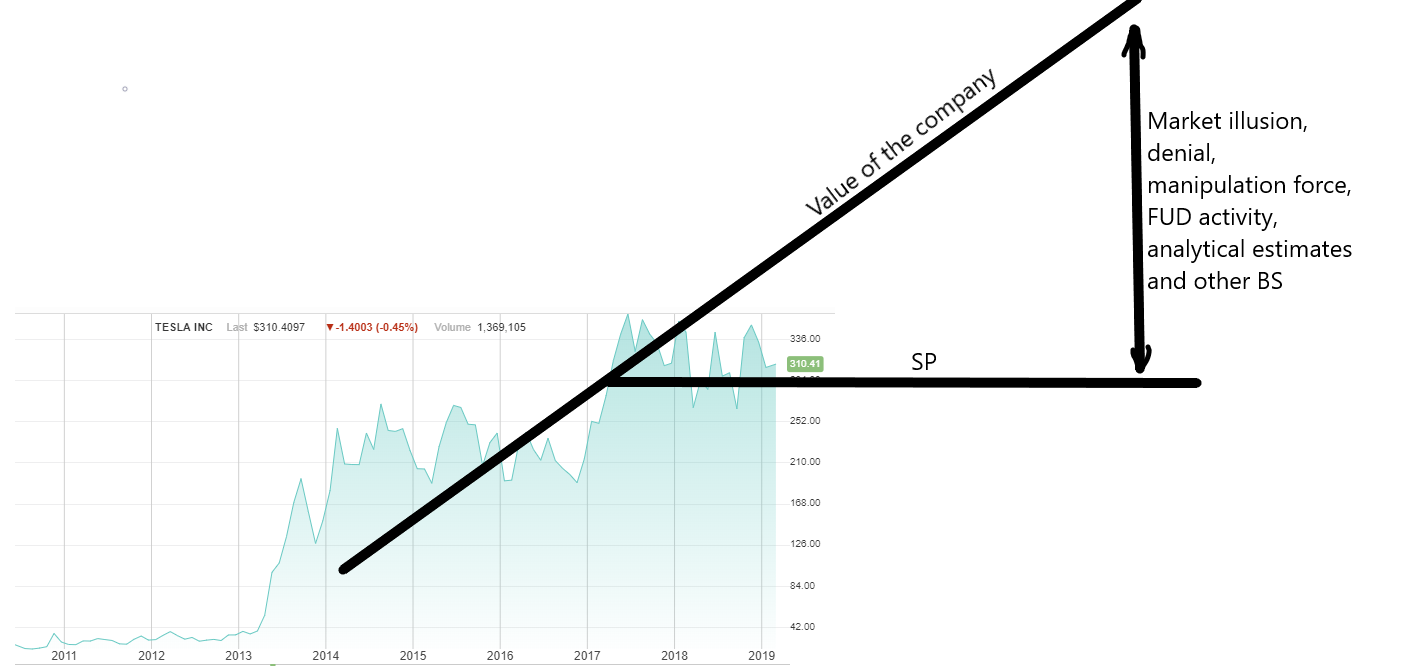

Here is visualisation of my long logic as simple as I could.

We all noticed that SP didn't move much for almost 2 years.

Boy I can't say that for the value of the company.

We all know what progress Tesla made in last 2 years.

So the difference is actual my opportunity.

As long as Market illusion last I can buy shares of awesome company for very low price.

I'm not complaining to much about BS. Maybe I should say thx.

Ideal for me would be if such situation would last for some 10 years.

One day market will wake up and the share price will be launched far above the Value.

Then my logic would be under reconsideration.

Today is another day where I'm having fun on this long term journey with everything around what is happening.

If you are not to much focused on SP movement you will notice a life around. You have to love it! <3

BtW I'm winning each day because Value is increasing and SP do not!

We all noticed that SP didn't move much for almost 2 years.

Boy I can't say that for the value of the company.

We all know what progress Tesla made in last 2 years.

So the difference is actual my opportunity.

As long as Market illusion last I can buy shares of awesome company for very low price.

I'm not complaining to much about BS. Maybe I should say thx.

Ideal for me would be if such situation would last for some 10 years.

One day market will wake up and the share price will be launched far above the Value.

Then my logic would be under reconsideration.

Today is another day where I'm having fun on this long term journey with everything around what is happening.

If you are not to much focused on SP movement you will notice a life around. You have to love it! <3

BtW I'm winning each day because Value is increasing and SP do not!