Model S didn’t have a price cut. I’m waiting for that one.About the same for Belgium.

So I wouldn't worry too much about margins.

Why do a price cut in Europe when there is certainly not a demand issue here?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Nice timing. The Brussels auto show starts tomorrow, and that is typically a big sales booster for the car sales in Belgium. I think the traditional car manufacturers are now frantically reworking their discount spreadsheets. Inflation reduction!About the same for Belgium.

So I wouldn't worry too much about margins.

Why do a price cut in Europe when there is certainly not a demand issue here?

Thekiwi

Active Member

Germany with a 21% price drop on the model Y SR apparently.

Down in the mid $117 range pre-market, almost 5% down. There should be some relief around $110-115 due to past resistance and MM's protecting the big Put walls for options expiry.

We've actually had a statement released from Tesla in Germany about the price cuts. Reuters are quoting Tesla Germany as saying:

"At the end of a turbulent year with interuptions to the supply chain, we have achieved a partial normalisation of cost inflation, which gives us the confidence to pass this relief onto our customers"

We've actually had a statement released from Tesla in Germany about the price cuts. Reuters are quoting Tesla Germany as saying:

"At the end of a turbulent year with interuptions to the supply chain, we have achieved a partial normalisation of cost inflation, which gives us the confidence to pass this relief onto our customers"

MartinAustin

Active Member

TSLA pre-market opened at $117 or so. About the same low as during trading on Thursday.

Dikkie Dik

If gets hard, use hammer

Watch the „Coup de Grace“ Elon layed out and predicted to unfold.

The 800 pound Gorilla is rising.

Today the rules in the auto industry changed.

We will witness damage.

View attachment 895185

‘All your sales are belong to us’

samn

Member

This is amazing. Super bullish. Can't wait to watch this unfold.

According to my records the following price changes have occured in the UK, standard options:

Model 3 | £48,490 -- > £42,990 (-11.34%)

Model 3 LR | £57,490 -- > £50,990 (-11.31%)

Model 3 Performance | £61,490 --> £57,990 (-5.69%)

Model Y | £51,990 --> £44,990 (-14.43%)

Model Y LR | £57,990 --> £52,990 (-8.62%)

Model Y Performance | £67,990 --> £59,990 (-11.77%)

Model 3 | £48,490 -- > £42,990 (-11.34%)

Model 3 LR | £57,490 -- > £50,990 (-11.31%)

Model 3 Performance | £61,490 --> £57,990 (-5.69%)

Model Y | £51,990 --> £44,990 (-14.43%)

Model Y LR | £57,990 --> £52,990 (-8.62%)

Model Y Performance | £67,990 --> £59,990 (-11.77%)

MartinAustin

Active Member

OK the CNBC hit piece is out, loaded with inaccurate claims and a headline that is straight from fantasy-land. Apparently Q4 deliveries were "lackluster"

samn

Member

OK the CNBC hit piece is out, loaded with inaccurate claims and a headline that is straight from fantasy-land. Apparently Q4 deliveries were "lackluster"

Not surprised... At this point I don't know what could surprise. Tesla will be lackluster, dangerous, unsafe, and have demand and production problems according to the media right up until they are the biggest auto producer in revenue and profits, and then in volume as well potentially. We are seeing the commitment of Tesla to move forward and adapt while driving towards the mission. The media fight and the commitment to achievement of the mission are the opposing forces that help create the intense volatility around Tesla and TSLA.

This is a moment might really show this. Short term this move might be interpreted as weakness, uncertainty, or otherwise as a negative by the market, but long term I believe this will be a moment that shows the power of Tesla's commitment to the future.

Excludes software and accessories, so FSD, wheels and even paint may not change eligibility. Everyone seems to ignoring that part. Margins may actually rise, with all those plus battery and charging credits included.Teslas gross margin was 30+% q4 2021 when a model Y was 53k. We are now back to 53k.

So with this price cut, model Y owners cannot finance FSD and must buy after the fact. I probably see a down tick in fsd purchase and uptick in subscription

NOTE: corrected after multiple people pointed out my 'mental typo'. The overall point is that the legal definition of 'accessory' may end out not being the logical one. Several OEM interests may well help change the logic, just as they already did with hybrids.

Last edited:

I don't think you can order MYP with 7 seats...? Could be a good moment to add the option...The waiting list for LRs is going to get very long, very fast. Tesla will surely want to prioritize Performance Ys. 7 Seat performance Y will dominate for a while.

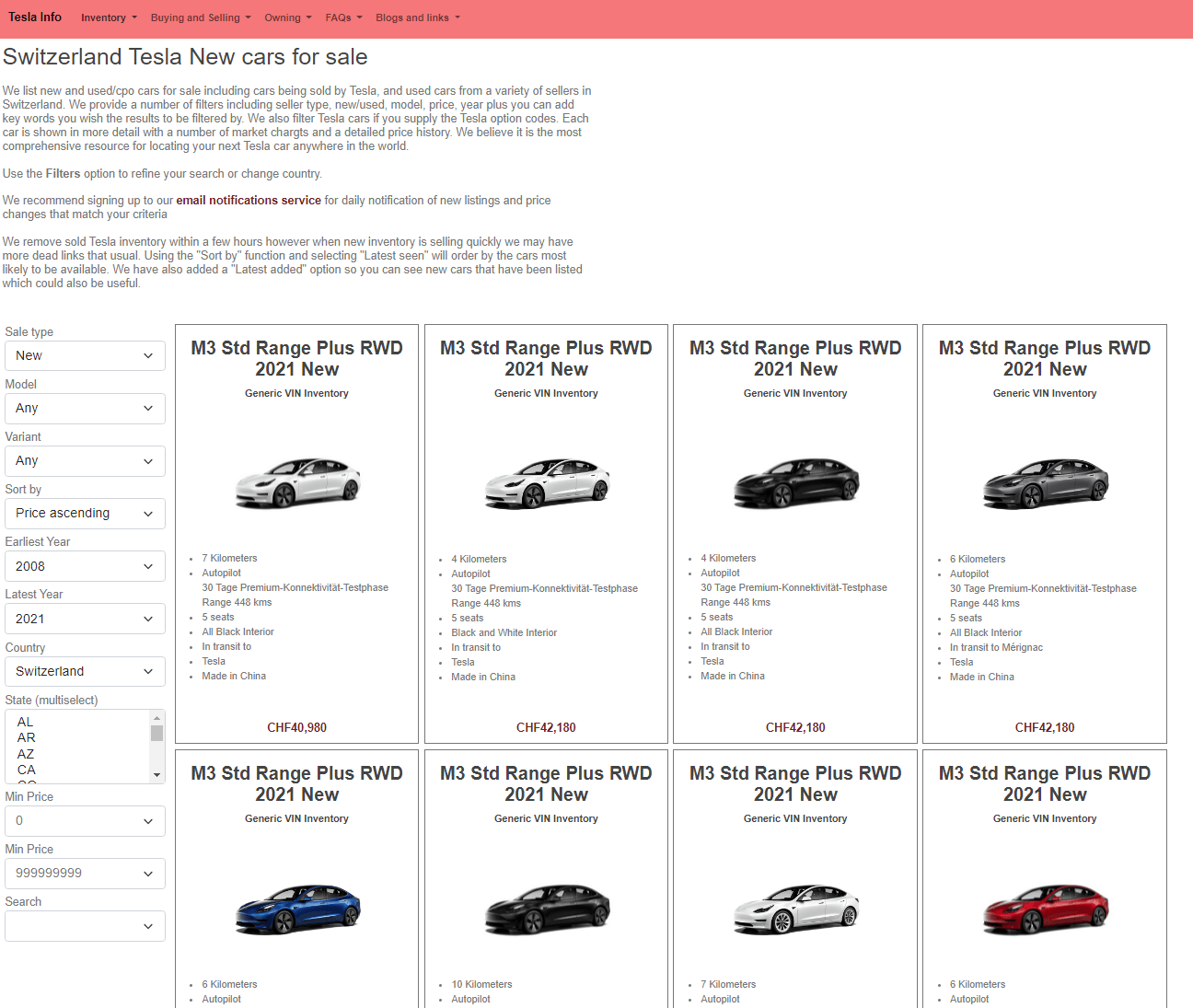

1813 in inventory currently. I wonder how fast that drops tomorrow. Will be fun to watch. I know 2 people personally who are now considering jumping on it.

United States Tesla All inventory

This is the All inventory for cars in United States. The inventory is taken from Tesla directly and refreshed every few minutes, we also explicitly differentiate between New and Demo cars both of which Tesla list as New. In many countries we also gather used cars from various sources. We allow...tesla-info.com

trayloader

Member

I mean-‘All your sales are belong to us’

The architect seemed to have layed this all out.

He now must sit in the ivory birdie tower and has the joy of his lifetime.

Freddie Krueger (rand) on Friday 13th.

The day the Auto industry changed.

cusetownusa

2022 LR5 MSM/Bl | 19"

Where are you getting the $19.5k and $6.5k profit numbers from? When I bought my Model Y LR (May 2022) for $54k it was said that profit margins were close to 30% on that.From 19.5k profit to 6.5k profit. Tesla would need to produce and sell 3 times as many cars to make the same amount of profit. This is the Toyota argument but in reverse now.

Astonishing price cuts all at once. I will definitely need to revise my 2023 earning model. Still looking good but not as bullish on automotive. On the other hand this might indicate that cost deflation is happening faster than I modeled for. COGS per vehicle in Q3 was $39.2k, which was 10% higher than the 2021 average of $35.6k, and even that average had extremely high shipping costs, expedite fees, and chip costs compared to a normal year. Also the new factories are coming into volume production and Tesla likely has a clearer understanding of cost at Berlin and Austin now. Hard to distinguish how much is due to a decline in demand vs an increase in supply.

@Todd Burch is right that some people will take advantage of the lower prices to buy extras, or to upgrade to more expensive variants, so a simple subtraction of the price drops from margins is likely too pessimistic.

Remember that $45/kWh battery credits are going to add an easy $3-4k back into margin this year for North American sales.

The biggest cuts were for Y, S and X which were earning well over 40% margin at the previous prices. Y matters most and it was basically earning about $29k per car if $68k average price and $39k average cost, and that was not even counting cost improvements in Texas and the battery subsidy. If 2023 Y ASP in the US is now going to be ~$55k and cost is going to $36k with deflation and Texas efficiency, profit per car is still going to be 55-36+3 = $22k for 40% gross margin. Both of these numbers are substantially better than Tesla’s global average vehicle profitability has ever been. This matters because Y will comprise the majority of sales volume for Tesla next year. Growth of Y production at the new factories plus hopefully a full year of smooth sailing at Shanghai remains the big story for 2023. Another equivalently huge price cut would be needed to reduce average automotive margin below 20%.

What a power move though. I don’t see how anyone can compete with this.

I doubt GM sells more cars than Tesla in 2025…Remember, GM is going to sell more EVs than Tesla in 2025.

I received the same mail in Belgium.

For legacy auto, yesI'm afraid this will cause a downward spiral

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K