Not sure about high, but low would be -1 car.So … what actual number would be high or low enough to move stock price?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Agreed, i think even a small beat would be the same FUD 'rhetoric' like always.Not sure about high, but low would be -1 car.

Artful Dodger

"Neko no me"

Lol, that's literally true, as in 2020 when Tesla delivered 499,550 cars and CNBC Television reported a 'miss' because Tesla guided for 500K cars... guidance provided 5 years earlier!Not sure about high, but low would be -1 car.

... that's when CNBC trots out the 'whisper' number to beat.Agreed, i think even a small beat would be the same FUD 'rhetoric' like always.

Cheers to the Longs!

B

betstarship

Guest

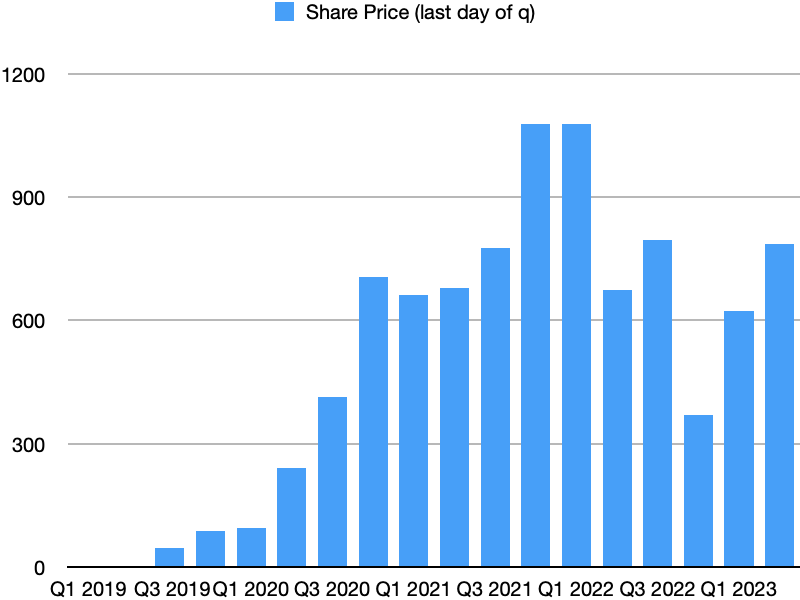

Just a heads up - we're back to about same the last-day-of-the-quarter share price back in Q3/2021, Q3/2022...and, now, Q2/2023.

Q3/2021 - was about the beginnings of production for Giga Texas heading into Q4/2021. October was when GigaTexas was named HQ.

Q3/2022 - AI Day (TeslaBot Reveal), Tesla Shareholder Day Future News [1], Giga Texas reaches 10k (total) production, Cybertruck tooling in GigaTexas started in October

Q2/2023 - Tesla NACS partnerships, Tesla Gigafactory bids (France, Spain, China, etc.), start of GigaTexas Cybertruck Production leading in to Q3/2023, Deutsche Bank is "All-in" after visiting GigaTexas [2]

[1] Musk: Tesla To Build 10-12 Gigafactories, 20M EVs Per Year By 2030

[2] Deutsche Bank "All In" On Tesla Following Giga Texas Meeting - CleanTechnica

Edit: Open question, anyone happen to know how much total production has come out of GigaTexas since inception?

Q3/2021 - was about the beginnings of production for Giga Texas heading into Q4/2021. October was when GigaTexas was named HQ.

Q3/2022 - AI Day (TeslaBot Reveal), Tesla Shareholder Day Future News [1], Giga Texas reaches 10k (total) production, Cybertruck tooling in GigaTexas started in October

Q2/2023 - Tesla NACS partnerships, Tesla Gigafactory bids (France, Spain, China, etc.), start of GigaTexas Cybertruck Production leading in to Q3/2023, Deutsche Bank is "All-in" after visiting GigaTexas [2]

[1] Musk: Tesla To Build 10-12 Gigafactories, 20M EVs Per Year By 2030

[2] Deutsche Bank "All In" On Tesla Following Giga Texas Meeting - CleanTechnica

Edit: Open question, anyone happen to know how much total production has come out of GigaTexas since inception?

This subject generates strong views. However, your opinion and that of @AudubonB are nit in conflict IMO.….

My opinion is the outsized focus on quarterly reports is silly.

You can take the A LOT position....I'll take the not so much opinion.

You emphasize what should be, while our esteemed creator of the sub-forum, chooses to be snarky in emphasizing what IS.

So, I agree with you both about what ‘should be’ and what ‘is’.

I beseech @AudubonB to be less snarky.

After all as a frequent reader of @Unpilot posts I observe clear distinction between facts and opinion. In fact one might say multi-dimensional at times.

Right, whatever Tesla reports, the whisper number will magically be slightly above the actual number.Lol, that's literally true, as in 2020 when Tesla delivered 499,550 cars and CNBC Television reported a 'miss' because Tesla guided for 500K cars... guidance provided 5 years earlier!

... that's when CNBC trots out the 'whisper' number to beat.

Cheers to the Longs!

Reactions to quarterly reports etc can be worthy of focus if you're looking for instances where the short-term market response deviates from your understanding of long-term value creation and thus presents a buying opportunityThat's the thing about opinions...we all have them.

Your opinion is I have one dimensional thinking and a lack of understanding.

Since I don't know you, I will refrain from such a characterization.

My opinion is the outsized focus on quarterly reports is silly.

You can take the A LOT position....I'll take the not so much opinion.

petit_bateau

Active Member

Approx 123,000 model YEdit: Open question, anyone happen to know how much total production has come out of GigaTexas since inception?

Analyst Consensus varies:

448,000 Bloomberg

446,823 Tesla IR Compiled

445,000 Factset

My guess is that the media will use the 448k as the estimate (the highest of course).

Perhaps +5k (453k or higher) or -5k (443k or lower) will move the stock.

Factset on the low side? Then I’m expecting them to trot out Refinitiv numbers that are magically 10k higher.

B

betstarship

Guest

Approx 123,000 model Y

So, they will >10x production in a year in GigaTexas...

snellenr

Member

There's an engineering principle called "Eating your own dog food" (aka "dogfooding") wherein a company uses its own products in daily operations. It shows confidence in and commitment to the product as well as gaining real-world operational experience that can feed into customer support and product improvement.It seems unlikely that even these Megapacks would keep continuous plant operation through another Feb 2021 style Snowpocalypse like we experienced here. But most of our grid outages occur on smaller timescales than days, and Megapacks would cover many of those.

Buckminster

Well-Known Member

Farzad is doing one starting in 5 mins:I was hoping Tesla Daily would do a live show.

i don’t see it yet.

Artful Dodger

"Neko no me"

Just a heads up - we're back to about same the last-day-of-the-quarter share price back in Q3/2021, Q3/2022...and, now, Q2/2023.

3 years ago (on July 10, 2020) I wrote this here on TMC: #178,767 talking about the magic of compounding (you know, 'Time-in-the-Market' vs. 'Timing-the-Market').

So let's see how

TSLA 3-Yr CAGR: 21.9% | ARKK 3-Yr CAGR: -17.7%

SPY 3-Yr CAGR: 13.6% | QQQ 3-Yr CAGR 12.8%

Cheers to the HODL'ers!

Last edited:

Moon Buggy

Member

466000/479600

Deliveries/Production

Monday up like a balloon.

*Edit to add:

What: Date of Tesla Q2 2023 Financial Results and Q&A Webcast

When: Wednesday, July 19, 2023

Time: 4:30 p.m. Central Time / 5:30 p.m. Eastern Time

Q2 2023 Update: https://ir.tesla.com

Webcast: https://ir.tesla.com (live and replay)

Deliveries/Production

Monday up like a balloon.

*Edit to add:

What: Date of Tesla Q2 2023 Financial Results and Q&A Webcast

When: Wednesday, July 19, 2023

Time: 4:30 p.m. Central Time / 5:30 p.m. Eastern Time

Q2 2023 Update: https://ir.tesla.com

Webcast: https://ir.tesla.com (live and replay)

B

betstarship

Guest

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K