"Always look on the bright side of life (followed by whistling...)"A nice idea, but sadly, negative news sells. Positive news, not so much.

Also, if you post something positive you are "sticking your neck out" -- warranted or not, if something bad happens (or is merely widely reported as having happened) then you are accused of drinking kool-aid or being subject to a reality distortion field.

Negative wins. It isn't just $TSLA, its also politics, weather, religion, etc.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Fact Checking

Well-Known Member

New article with some anecdotal data about an impressive end of Q3 Tesla delivery push:

"Tesla Model 3 Delivery Push In Full Ramp Mode"

"It seems that people are going to be floored when they learn how many Tesla Model 3 sedans are being delivered currently."

"Vancouver #Tesla $tsla is delivering Model 3s until 10pm everyday. Demand is insane."

"It seems that people are going to be floored when they learn how many Tesla Model 3 sedans are being delivered currently."

"Vancouver #Tesla $tsla is delivering Model 3s until 10pm everyday. Demand is insane."

TradingInvest

Active Member

There's a couple of news sites with no Tesla FUD and quality reporting, such as:

Cleantech News — #1 In EV, Solar, Wind, Tesla News | CleanTechnica

Electrek

Teslarati.com - Tesla News, Tips, Rumors, and Reviews

EV Obsession

I do think 'mainstream' news sites are going to change their Tesla reporting over the next year or so as well, like they did it when SpaceX started delivering success after success.

Right now both Tesla and Elon is making it somewhat easy to create negative false narratives about Tesla, and shorts are all too happy to help them out when it comes to citing "industry experts" - but robust execution and success is going to wipe away most of those false narratives.

Patience ...

Agree with the good news sites.

Those 'mainstream' news sites will continue to attack Elon and Tesla until the shorts stop paying them. These days the news sites can't make money from ads, because most of the ads money goes to Google and Facebook. They can't get money from subscription either. Most people read from free sites.

Tesla shorts will not quit so easily. They think Q3 Q4 profit is an one time fluke, Tesla will run out of orders next year. They think even if Tesla becomes profitable, the P/E will be in the hundreds, which will prove their point that Tesla doesn't worth much. They think Tesla can't generate enough profit to service debt, let alone getting billions for growth. They think competition is coming, so Tesla will bankrupt with ballooning debt. They think Tesla as a car company, the upside is limited, so shorting is safe. So they are likely to stay short. Only after Tesla Network is active with autonomous cars, shorts will wake up from the worst nightmare. It will be too late for them.

This gives me numerous opportunities to keep adding shares whenever they attack the stock. Knowing why some 'news sites' attack Tesla non stop, I just ignore them completely.

Fact Checking

Well-Known Member

BTW., $TSLA just broke through to $294, which was Monday's closing price and close to the Tuesday opening price - before the Tuesday drop caused by the weird Bloomberg hit piece.

Very robust, bullish price action today, on higher than usual volume: $TSLA shrugged off a big drop on NASDAQ in the early day as if nothing happened.

Very robust, bullish price action today, on higher than usual volume: $TSLA shrugged off a big drop on NASDAQ in the early day as if nothing happened.

Navin

Active Member

One thing both bulls and bears can agree on is that tesla’s Stock movement is bipolar.

Xpert

Member

I’m expecting $302.50 by friday, and $322 next friday. After that depending on deliveries and tsla statement. Barring FUD attacks which is a wild card...I could be wrong of course.What's peoples' expectations for price action? I'm expecting a moderate jump from deliveries, followed by FUDding back down to relatively low levels, followed by a big jump after the Q3 report, followed by even more aggressive FUDding. I plan to schedule sells and buys accordingly.

I’m expecting $302.50 by friday, and $322 next friday. After that depending on deliveries and tsla statement. Barring FUD attacks which is a wild card...I could be wrong of course.

If this keeps up I’d expect pushback tomorrow and a hard top at 300 for Friday.

I think next week it breaks 300 again then it’s free willy to 320

Fact Checking

Well-Known Member

Tesla shorts will not quit so easily. They think Q3 Q4 profit is an one time fluke, Tesla will run out of orders next year. They think even if Tesla becomes profitable, the P/E will be in the hundreds, which will prove their point that Tesla doesn't worth much.

And if earnings are exactly zero it's a division by zero fault?

So my view is that what shorts think or say won't matter after Q3/Q4. What matters is the "slow money" who will be activated by robust financials. (The "smart money" is already on board.)

All the decade long whinging of shorts didn't keep AAPL or AMZN from becoming trillion dollar companies, and it won't keep TSLA from becoming one either.

What shorts do or don't do is immaterial once Tesla starts executing as promised, then Shortsville is going to look like this.

Last edited:

Artful Dodger

"Neko no me"

Fact Checking

Well-Known Member

What's peoples' expectations for price action? I'm expecting a moderate jump from deliveries, followed by FUDding back down to relatively low levels, followed by a big jump after the Q3 report, followed by even more aggressive FUDding. I plan to schedule sells and buys accordingly.

- Downside risks for longs:

- If production guidance of 50-55k Model 3 units is missed, or Model S/X production of at least 25k units is missed, and/or deliveries are below the level of production, then price is probably going to suffer.

- If Tesla issues some new guidance that lowers expectations for Q3 or Q4 results then price is probably going to suffer.

- Expectations of longs are very high at the moment - in cases unrealistically high: more than 100k production or deliveries are very likely not going to happen, more than 75k is already nice.

- Upside risks for shorts:

- If production guidance is beaten, or deliveries are significantly higher than production, then price is probably going to jump up.

- Expectations of shorts are very low at the moment. Even if Tesla 'meets guidance' that's something many shorts did not expect - and might close as a result. The question is the balance of disappointed longs vs. disappointed shorts in the 'meets guidance' situation - I have no idea.

- There's risks of further positive guidance from Tesla in the delivery letter. In Q1 and Q2 they added/reiterated guidance about demand and future performance. We don't know whether Tesla does any of that, and what topics they are going to cover.

- There's risks of a blow-out quarter. Either deliveries (more likely) or production (less likely) could be super high.

I think the least likely outcome is that the price will stay put, as there's big expectations both on the short and on the long side and there's going to be disappointment even in the 'meets delivery/production guidance' case.

Personally I think there's an at least 50% chance that they are going to at least meet guidance, and a 20% chance for a special upside, either in the numbers, or in the guidance, but that there's a 20% chance for a special downside as well.

Just sold calls to rearm at next drop. Noon is just not my favorite time for whatever reason.

YOU get 100% returns.

And YOU get 100% returns.

EVERYBODY GETS 2 BAGGERS!

I’ll be rearming more 9/21s at 240cst

YOU get 100% returns.

And YOU get 100% returns.

EVERYBODY GETS 2 BAGGERS!

I’ll be rearming more 9/21s at 240cst

Last edited:

So it's a mixed bag - it can go either way.

- Downside risks for longs:

- If production guidance of 50-55k Model 3 units is missed, or Model S/X production of at least 25k units is missed, and/or deliveries are below the level of production, then price is probably going to suffer.

- If Tesla issues some new guidance that lowers expectations for Q3 or Q4 results then price is probably going to suffer.

- Expectations of longs are very high at the moment - in cases unrealistically high: more than 100k production or deliveries are very likely not going to happen, more than 75k is already nice.

- Upside risks for shorts:

- If production guidance is beaten, or deliveries are significantly higher than production, then price is probably going to jump up.

- Expectations of shorts are very low at the moment. Even if Tesla 'meets guidance' that's something many shorts did not expect - and might close as a result. The question is the balance of disappointed longs vs. disappointed shorts in the 'meets guidance' situation - I have no idea.

- There's risks of further positive guidance from Tesla in the delivery letter. In Q1 and Q2 they added/reiterated guidance about demand and future performance. We don't know whether Tesla does any of that, and what topics they are going to cover.

- There's risks of a blow-out quarter. Either deliveries (more likely) or production (less likely) could be super high.

I think the least likely outcome is that the price will stay put, as there's big expectations both on the short and on the long side and there's going to be disappointment even in the 'meets delivery/production guidance' case.

Personally I think there's an at least 50% chance that they are going to at least meet guidance, and a 20% chance for a special upside, either in the numbers, or in the guidance, but that there's a 20% chance for a special downside as well.

I disagree. I think that the market has - like before Q2 - strongly baked in pessimism. I feel they're expecting a miss. Consequently, I think that a hit at 50-55k will be a solid gain, a near-miss (~49k) will be a slight gain, and exceeding the goals would be a very strong gain. I'd expect a moderate miss (~47k) to be break even, and a strong miss to be a loss.

Remember that a stock moves not based on how well it performs relative to guidance, but rather how well it performs relative to market expectations.

My personal expectations on M3 deliveries is ~55k, with ~6k hit for at least one week in September.

Loving this giant middle finger to Bloomberg.

HELL YEAH BROTHER. Gene Wilder telling Bloomberg how it is.

Tslynk67

Well-Known Member

No sensible Long would close their position with a massive dump of shares. This was probably a signal to the AI of the news to come within minutes. Over 800K shares total traded during the 11:43 min according to NASDAQ.

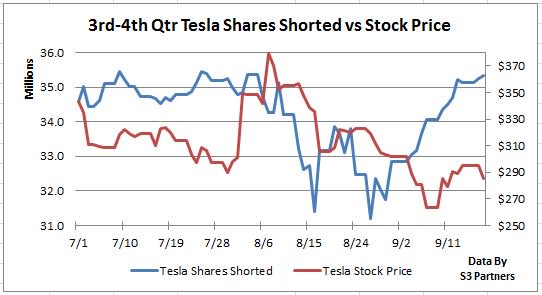

Ihor D. reports that net Shares Short barely increased on Tuesday, so the big 1 M share dump from 11:43-11:44 was either a co-ordinated move by some large institutions or shorts that covered almost immediately. 6 M shares traded within 30 min, so it could well have been the latter.

View attachment 336228

Ihor unusually did a mid-day update, which shows more shorting this morning:

$TSLA short interest $10.07, 35.33 million shares short, 27.71% of float. Shares shorted are up 824k over the past week & am seeing/hearing of more short activity this morning.

brian45011

Active Member

BTW., fully agreed, just a minor correction to that figure, here's the fine print of the 2019 notes prospectus:

According to that the maximum conversion rate corresponds to a $252.54 per share conversion rate.

Here's the relevant language where they are spelling out the conversion limits:

In addition, if the price of our common stock in the transaction is greater than $900.00 per share or less than $252.54 per share, in the case of the 2019 notes, or greater than $900.00 per share or less than $252.54 per share, in the case of the 2021 notes (in each case, subject to adjustment), no adjustment will be made to the applicable conversion rate. Moreover, in no event will the conversion rate per $1,000 principal amount of 2019 notes as a result of this adjustment exceed 3.9597 or the conversion rate per $1,000 principal amount of 2021 notes as a result of this adjustment exceed 3.9597, in each case subject to adjustments in the same manner as the conversion rate as set forth under “Description of Notes—Conversion Rights—Conversion Rate Adjustments”.

$1,000/3.9597 = $252.54.

Also note that in the Q2 conference call Elon clearly indicated that they want to pay all convertibles in internally generated cash:

Elon Reeve Musk - Tesla, Inc.The '$900m converts' Elon was referring to are the $920m face value convertible notes due in March 2019.

"Yeah, our default plan is we pay – we start paying off our debts. I don't mean refi-ing them, I mean paying them off. For example, there's a convert that's coming due soon, a couple hundred million, $900 million, something like that. We expect to pay that off with internally generated cash flow."

i.e. he is certain that Tesla is cash flow positive to such an extent that they can easily pay off the convertible notes without any dilution.

But, as a contingency, they do have the option, via a simple Tesla board decision, to lower the conversion rate from $360 to $252.

The original explanations were correctly stated months ago:

TSLA Market Action: 2018 Investor Roundtable

TSLA Market Action: 2018 Investor Roundtable

The "simple" Tesla board decision has to be made and filed before 12-1-18 in order to induce conversion during the free conversion period. What level between ~$360/share and $252.54 would you recommend?

Since May 2012, Tesla has stated in ALL filings that it intended to settle the principal amount of all convertible notes using cash. Actions have not always conformed to the stated intention:

On November 15, 2017, we issued 96,634 shares of our common stock to a holder of our 1.50% Convertible Senior Notes due 2018 in exchange for $12.0 million in aggregate principal amount of such notes, pursuant to a privately negotiated agreement. Such issuance was conducted pursuant to an exemption from registration provided by Rule 4(a)(2) of the Securities Act. We relied on this exemption from registration based in part on the representations made by the holder of such notes in the transaction.

In June 2017, $144.8 million in aggregate principal amount of the 2018 Notes were exchanged for 1,163,442 shares of our common stock (see Note 12, Common Stock). As a result, we recognized a loss on debt extinguishment of $1.1 million. In the third quarter of 2017, $42.7 million in aggregate principal amount of the 2018 Notes were exchanged or converted for 250,198 shares of our common stock (see Note 12, Common Stock) and $32.7 million in cash. As a result, we recognized a loss on debt extinguishment of $0.3 million.

What do project for Tesla Cash & Cash Equivalents balance on March 2, 2019 if that $920 million is settled with cash?In June 2017, $144.8 million in aggregate principal amount of the 2018 Notes were exchanged for 1,163,442 shares of our common stock (see Note 12, Common Stock). As a result, we recognized a loss on debt extinguishment of $1.1 million. In the third quarter of 2017, $42.7 million in aggregate principal amount of the 2018 Notes were exchanged or converted for 250,198 shares of our common stock (see Note 12, Common Stock) and $32.7 million in cash. As a result, we recognized a loss on debt extinguishment of $0.3 million.

Tslynk67

Well-Known Member

Likewise. In the past few weeks (I forget just when) Market Watch revived the "burning crashed Tesla" story from June pretending that it had just happened. Oddly, after I made a comment about it here, they lightly edited it to make it less obvious that it was a rehash while maintaining the pretense of it being current news.

Old news passed as new is a common theme. Which is why if Musk quit tweeting and drunk drivers stopped having accidents and the Tesla world was perfect we would *still* have negative news stories to bash $TSLA with.

1. Use current news with a negative spin

2. Publish an "analysis" proving $TSLA is doomed

3. Rehash old news as if it were new

4. Just make it up

I think I got the ordering right, but I wasn't looking at their playbook, I swear.

5. Trundle out Klutz Lutz to talk some absolute bollocks...

I think what is not being adequately covered is that Tesla is gaining market share at other auto's expense.

Network effect is going to keep snowballing. Counter punches are going to be too weak and too slow. (Just like the C63 AMG I destroyed the other day in my 3P+!)

This is a zero-sum game. Every Tesla sold is a tightening noose for all other auto.

Network effect is going to keep snowballing. Counter punches are going to be too weak and too slow. (Just like the C63 AMG I destroyed the other day in my 3P+!)

This is a zero-sum game. Every Tesla sold is a tightening noose for all other auto.

New article with some anecdotal data about an impressive end of Q3 Tesla delivery push:

"Tesla Model 3 Delivery Push In Full Ramp Mode"

"It seems that people are going to be floored when they learn how many Tesla Model 3 sedans are being delivered currently."

"Vancouver #Tesla $tsla is delivering Model 3s until 10pm everyday. Demand is insane."

Vancouver is planning 900 deliveries in September alone..

Tslynk67

Well-Known Member

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 241

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K