mrau

Authorized Driver

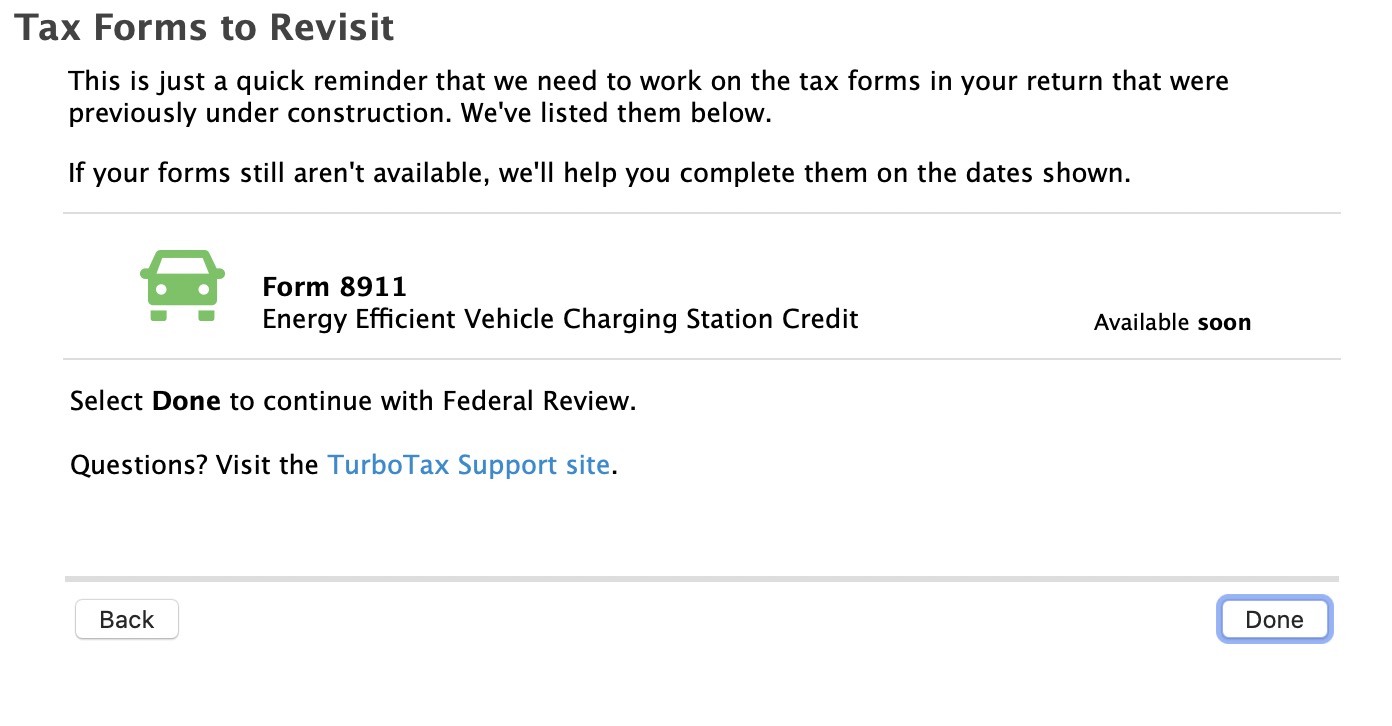

Turbo Tax does have Form 8911 that you can fill out for tax year 2019. However, after you finish with the deductions section a screen comes up that says they are still working on the tax form. Checked for updates today but nothing new. Hopefully soon is real soon.

Here is a screen shot from this morning.

Here is a screen shot from this morning.