tdroesch

Member

Looking for advice from anyone using Tesla insurance.

I have a new 24' MSP and my current company (Mercury) has me at $2,576 for six months, which is a 132% increase in premium with the same coverage from my previous vehicle, a 21' X5M Comp. I am in CA with 37 years driving, 15+ years with Mercury, good driver, no tickets or accidents, never late on payments. Coverages for that policy are shown in the attached pic and I am just sick about the pricing.

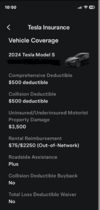

Because of this, I have been shopping around and the pricing (sadly) seems to be similar elsewhere, except for Tesla, which is offering a substantially lower premium for higher coverage. Coverages for that estimate are shown in the attached two screenshots and the total premium for six months is $1,173. Having read some negative posts regarding Tesla insurance here on this forum, I was hoping anyone with experience as a current or previous Tesla insurance customer can lend me some advice or guidance as to whether or not they recommend the service.

Thanks in advance for any feedback.

One additional strange side-note that I experienced with Mercury: the original quote they gave me on my 24' MSP included a ridiculous 31,500 miles annually (their estimate) and I had to get an underwriter review just to request a reduction in their estimated mileage. My 24' MSP lease is for 12,000 miles annually, the last three cars I leased & insured with Mercury have verifiable mileage of less than 11,000 miles annually, and still the lowest they would offer me was 13,501 miles when calculating the premium.

I have a new 24' MSP and my current company (Mercury) has me at $2,576 for six months, which is a 132% increase in premium with the same coverage from my previous vehicle, a 21' X5M Comp. I am in CA with 37 years driving, 15+ years with Mercury, good driver, no tickets or accidents, never late on payments. Coverages for that policy are shown in the attached pic and I am just sick about the pricing.

Because of this, I have been shopping around and the pricing (sadly) seems to be similar elsewhere, except for Tesla, which is offering a substantially lower premium for higher coverage. Coverages for that estimate are shown in the attached two screenshots and the total premium for six months is $1,173. Having read some negative posts regarding Tesla insurance here on this forum, I was hoping anyone with experience as a current or previous Tesla insurance customer can lend me some advice or guidance as to whether or not they recommend the service.

Thanks in advance for any feedback.

One additional strange side-note that I experienced with Mercury: the original quote they gave me on my 24' MSP included a ridiculous 31,500 miles annually (their estimate) and I had to get an underwriter review just to request a reduction in their estimated mileage. My 24' MSP lease is for 12,000 miles annually, the last three cars I leased & insured with Mercury have verifiable mileage of less than 11,000 miles annually, and still the lowest they would offer me was 13,501 miles when calculating the premium.