Fact Checking

Well-Known Member

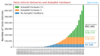

BTW, thanks for doing the math on that. I hadn't done it recently. When I make a 2025 or 2030 valuation for TSLA, I have to assume 3.5% dilution per year. If you think about it, this makes for a significant hurdle to valuation; it impairs the per-share value quite substantially in the bull case. (In order to keep earnings per share steady, they have to grow total earnings by 3.5% every year.)

To be fair, I expected Tesla to stop equity financing after Q3-Q4 last year - boy was I wrong about that.

Nevertheless I do think this might have been the final equity financing round. Once Tesla is self-financing they might start the Amazon/Apple route that might within 5 years even store excess profits tax-free by buying back stock - i.e. I'm quite sure the 3.5% won't be sustained over 10 years - it might even be negative.

Growth companies dilute and then highly successful companies buy back stock. The net dilutive or anti-dilutive effect on a single TSLA share bought today is not possible to measure or estimate in any reliable fashion.

Last edited: