Today was day three of the stalemate between longs and shorts where shorts try to push the SP down and cap it there and longs buy under 300, break the caps, and bring the SP close to 300. The net result is that the SP has hardly budged the past three trading days. Thursday and Friday included the impact of many 300-strike calls expiring that week and an additional incentive for shorts and sellers to keep the SP under 300, but today was clear of that factor and yet the dynamics remained much the same. Today was another low volume day for TSLA with mostly negative macros (see NASDAQ chart below).

The day began with a dip that quickly turned into a climb as the normal Monday morning buying exuberance kicked in. The shorts saw the morning buying show weakness, and so they began the selling and managed a steep dip to a little above 294 around 11:40ish. Note that at 11:09am we saw 57,000 shares sold in a minute to enable that steep dip. Note, too, the NASDAQ shows no similar dip at that time. Nonetheless, buyers quickly returned the price to 298ish. Then came an attempt at a small push-down and capping at about 297, but it did not hold and the day ended in a game of whack-the-mole. To get an idea of the quantity of short-shares likely covered at end of day, I see 264,000 shares trading hands in the final minute of market trading.

The NASDAQ began low but managed to climb into the green after 3pm

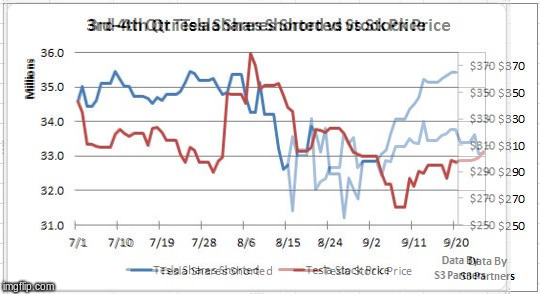

Shorts sold 58.16% of TSLA today, a noticeable decline from the previous three days but still at a very high level.

To shine light on the stalemate, consider the views that are common in the short-seller community:

* Elon Musk is either going to jail or will tweet the pedo guy again and be removed by the board

(longs typically see this is a very remote possibility, and so perceived likelihood is extremely different between longs and shorts)

* Tesla already has problems finding buyers for RWD Teslas and will exhaust the backlog of Performance orders soon

(longs recognize that a great number of Model 3 buyers changed orders from RWD to AWD when the dual motor vehicles became available and although there's work ahead to match buyers with RWD 3s, there's adequate demand in North America to absorb the surplus plus when Tesla starts shipping to Europe in Q1, a whole continent of P3D buyers begins to be addressed)

* Tesla is going bankwupt in early 2019 when the convertible bonds come due

(longs suspect price recovery of TSLA will reduce the necessary cash payments vs. stock payments to bondholders, but longs also feel confident that Tesla will be generating hundreds of millions of dollars cash every quarter from Q3 onward, which will allow Tesla to pay cash to all bondholders, if needed).

* Tesla's Model 3 output is not even 4,000 M3/wk and production is FUBAR. Tesla won't be profitable at these production rates.

(longs are concerned about production rates but know that there was enough of a carry-in of M3s from Q2 that Tesla has the ability to be profitable if it can substantially reduce the carry-over into Q4. Longs know that quarterly positive cash flow will be hundreds of millions greater than profits. Burst at the factory (such as 2300 vehicles in 2 days which works out to be 8,050/wk for S,3,and X, which can be looked at as 6K/wk M3 and 2k/wk for S&X, which is excellent. If you transfer 1k/wk of that production to S & X, the revenue only gets better. Rather than production being FUBAR, there is some bottleneck or a few bottlenecks that will be cleared up and then numbers accelerate quickly).

Because of these views by shorts, they are likely to continue unusually high levels of effort between now and Q3 production and delivery date, and so I'm less optimistic today about hitting 310 by then than I was last week. I also suggest that shorts will be looking at Q3 and Q4 as one or two quarter exceptions before Tesla goes back to losing money. Longs disagree, but if profits are too skinny or non-existent in Q3, shorts could make some headway in convincing the market of their beliefs. For this reason, I am personally taking an investment position of maintaining my substantial presence in TSLA through the Q3 production and delivery numbers but avoiding a bet on anything in 2018 or too early in 2019, just in case the market sides with the shorts. In that case, Tesla would need to get production well above 6K/wk and demonstrate profitable gross margins before the market could come around, and I prefer being an investor to a gambler. OTOH, if Tesla flies upward in October, my holdings will be substantial enough that my bases are covered for the upside. I will become more aggressive with some medium-term calls when I see the production numbers of Model 3 above 6K/wk and some improvement in the delivery situation.

Conditions:

* Dow down 181 (0.68%)

* NASDAQ up 6 (0.08%)

* TSLA 299.68, up 0.58 (0.19%)

* TSLA volume 4.8M shares

* Oil 72.08, up 1.30 (1.84%)

* Percent of TSLA selling by shorts: 58.16%