Today was much like yesterday in that the NASDAQ was trading negatively and efforts were extended by shorts to keep TSLA from running into the green. On opening, buying enthusiasm led to a short rally but when the NASDAQ did a dive starting at about 10:20am, TSLA followed and with help from you-know-who TSLA bottomed out about 11am with slightly more loss than than NASDAQ. Once the NAS started to recover, though, TSLA headed higher and the shorts needed to play "whack-the-mole" for about an hour before they lost the ability to hold TSLA in the red.

Notice the bumps higher in after hours trading. AAPL released good news in their ER about 4:30pm and you can see some small spikes. Then Tesla unveiled a new pricing structure for Models S and X, and between the two TSLA climbed higher.

The NASDAQ dipped about 1% in the first hour and a half and then moved little

If you'd like to see details of the new S & X pricing, please see the

Model S configurator . The bottom line is that the 100kwh battery has likely become the default battery right now for both the S & X. The new S & Xs are priced higher than the 75kwh variations but less than the 100s. Although Tesla likely has more in store for the S & X later this year, this move rationalizes the Tesla lineup. The extra cells needed to give the S 310 miles of range probably don't cost much more than $2,500, and so Tesla can make more money selling the basic S (or X) rather than the 75. It's a vehicle that offers more value than what it replaces (near 100kwh range and performance at a lower price), and so the change gives buyers an incentive to pull the trigger. Simultaneously, Tesla has simplified the product lineup. Both these changes should be positives for the company as it likely has some type of reworking at the factory that involves the S and/or X production lines. Perhaps we'll hear more Wednesday afternoon.

You may want to look at

KarenRei's post about Bloomberg Model 3 tracker. Basically, the tracker is giving a 13 week backward view number of Model 3 production. The number has been rising but the tracker doesn't give us much info on what's currently happening. Behold, though changing some code you can view the weekly numbers, which extend too high otherwise and need to be cut off. Some TMC followers were suggesting the new weekly numbers would be pushing 10,000/wk when you compare the heights of those weekly lines to the heights of the 6,000/wk line. My best guess is that we're nowhere that high, but that Bloomberg realized the current numbers were way too low, due to some very nice increases in production during the past month, and so they have put in some overly high weekly numbers to bring the running total to a more reasonable number. In any event, the takeaway is that Bloomberg is realizing that Tesla has indeed been increasing Model 3 production this month, and that's a good thing.

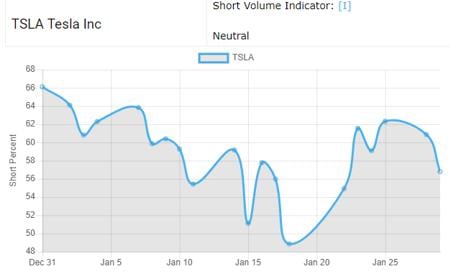

Finally we're seeing a decrease in the serious short manipulations with a somewhat less absurd 57% today. That number still suggests plenty of manipulations, but it's nice to see the decrease. One possible reason? We've been seeing short covering between a little below 400,000 shares/day in recent sessions to as high as 800,000 shares/day. Shorts are obviously getting out prior to the 4Q ER. If the manipulators also happen to be the shorts getting out, then once they have extracted themselves, in my dreams I hope we would see less in the way of manipulations. We'll see, but don't hold your breath.

Looking at the tech chart, I included a wider view to put everything into better perspective. The upper bb is at 363, and so we have lots of room to run higher if the ER surprises to the up side. On the other hand, the lower bb is at 277, which would help limit any dip if the news is disappointing. Overall I am hopeful that Elon and Depak's explanations of what is transpiring at Tesla will calm the investors and help us recover ground lost after the announcement about 4Q and 1Q earnings being lower. The market doesn't like uncertainty and this ER could be critical for the two to lay out the plan for a nicely profitably 2019.

As always, it is best to keep your trading horizons fairly long with this stock. We were all surprised how gaming of the Q4 Production and Delivery analyst numbers allowed a miss to be declared when in reality we were thrilled with the numbers. With the high manipulations we've seen since the beginning of the year, I wouldn't relax and make too many short-term assumptions until we have more information from Tesla and they demonstrate that they can indeed hit the numbers they forecast.

Although TSLA has been outperforming the NASDAQ recently, it was good to see investors get the mojo to actually push us into the green today. We're going into the ER with a desire to push this SP higher and weakening abilities of the shorts to prevent it, both of which are good things.

Conditions:

* Dow up 52 (0.21%)

* NASDAQ down 57 (0.81%)

* TSLA 297.46, up 1.08 (0.36%)

* TSLA volume 4.6M shares

* Oil $53.20