I don’t envy them: In both cases their joining the buying (from below) and the selling (from above) works against them by increasing/decreasing the price as they buy or sell, they then have to turn around and do the opposite once the wall is breached which their buying/selling helped happen in the first placeFor tall +gammas, dealers will buy TSLA as price approaches it from below and sell TSLA as price passes it to cap the upside.

For tall -gammas, dealers will sell TSLA as price approaches it from above and buy TSLA as price passes it to cap the downside.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

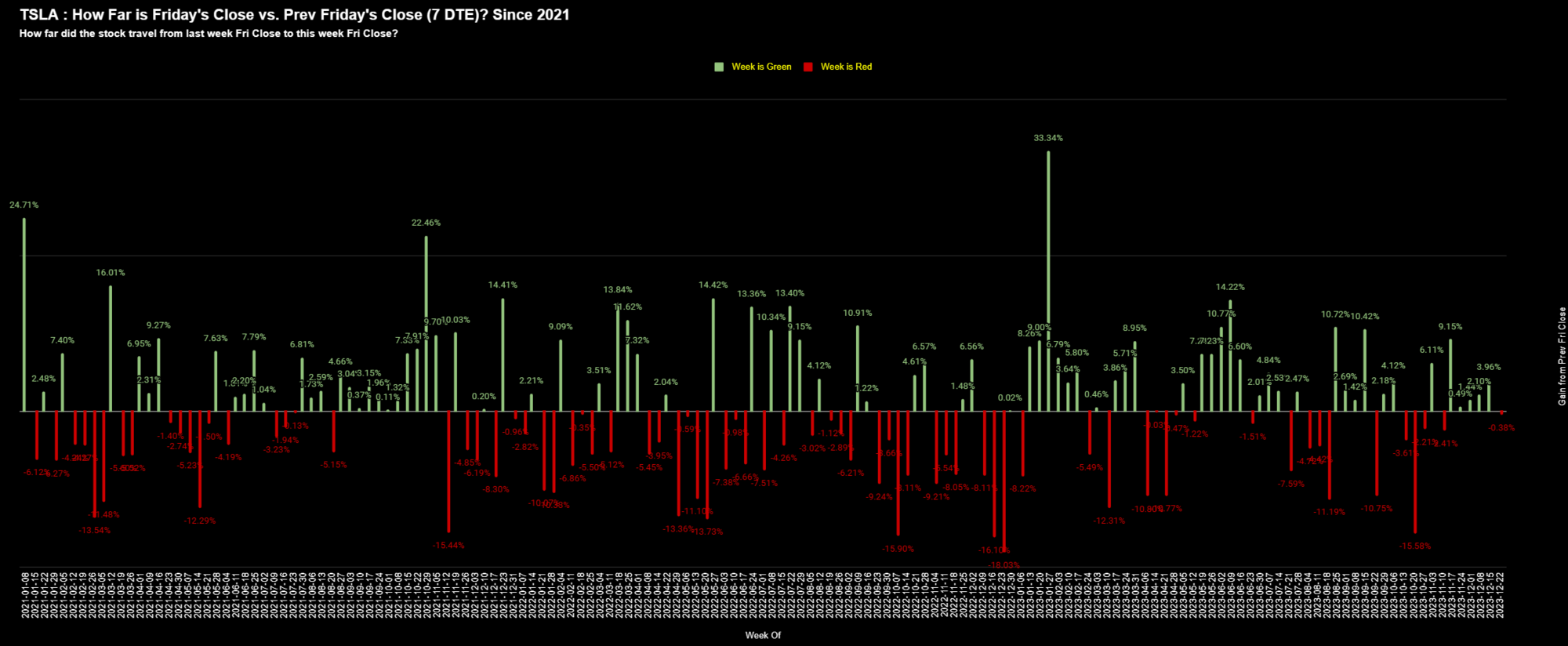

Guess this aligned with stocks ( sound stocks) eventually only goes up and the study from Yoona that Selling Puts is safer then selling Call. Also noticed the chart show profit taken at 50%. That one of the strategy that Jim and many other used which increase % of winning.3 more tools for success:

1) backtesting - this provides visual solid evidence that your strategy works and allows you to assess your risk and make data-driven improvements. The main purpose is so that you can limit your risks. More importantly, it allows you to control emotions because of rules you set out beforehand. Past performance is no guarantee of future results, but 703 weeks are compelling data.

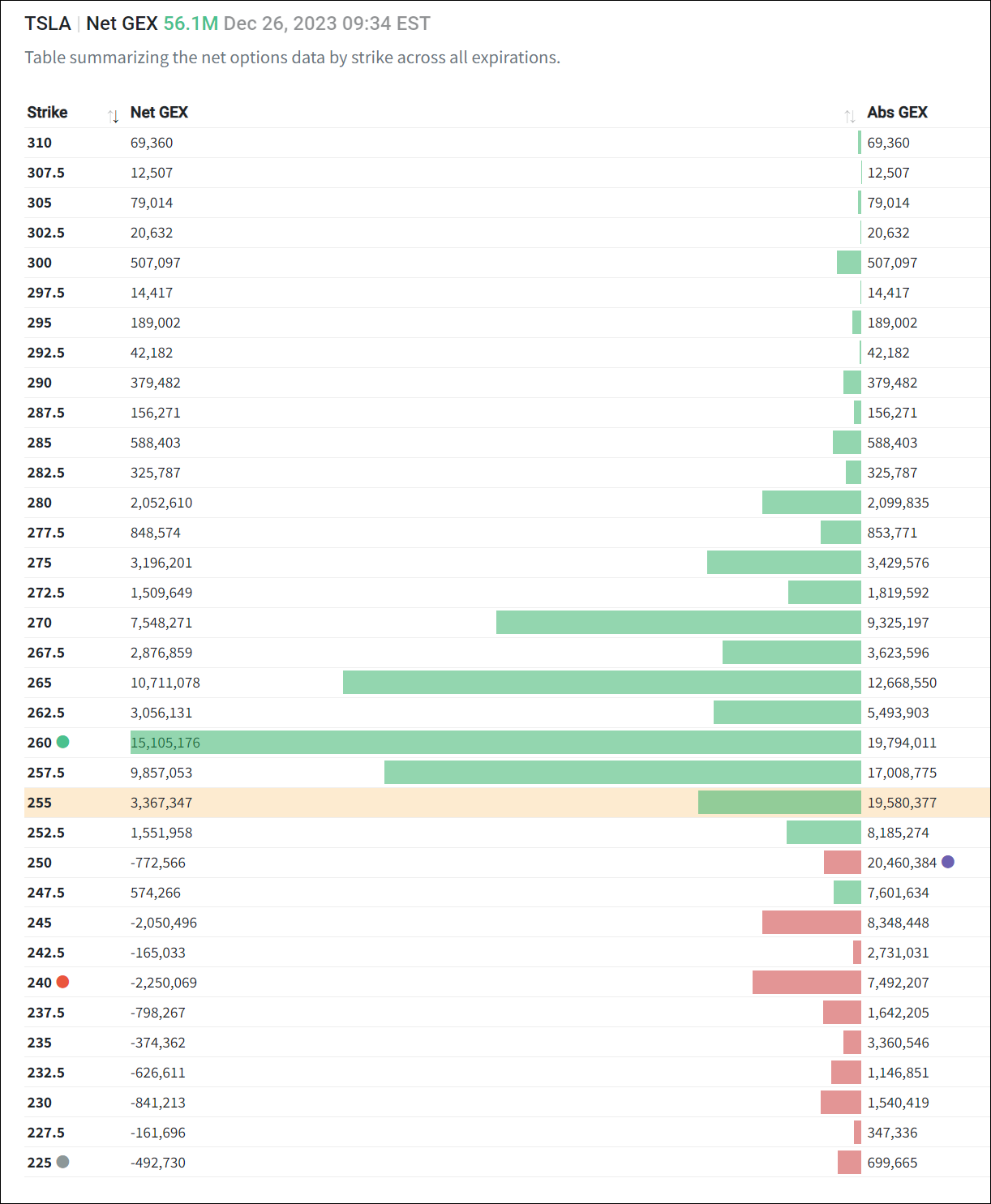

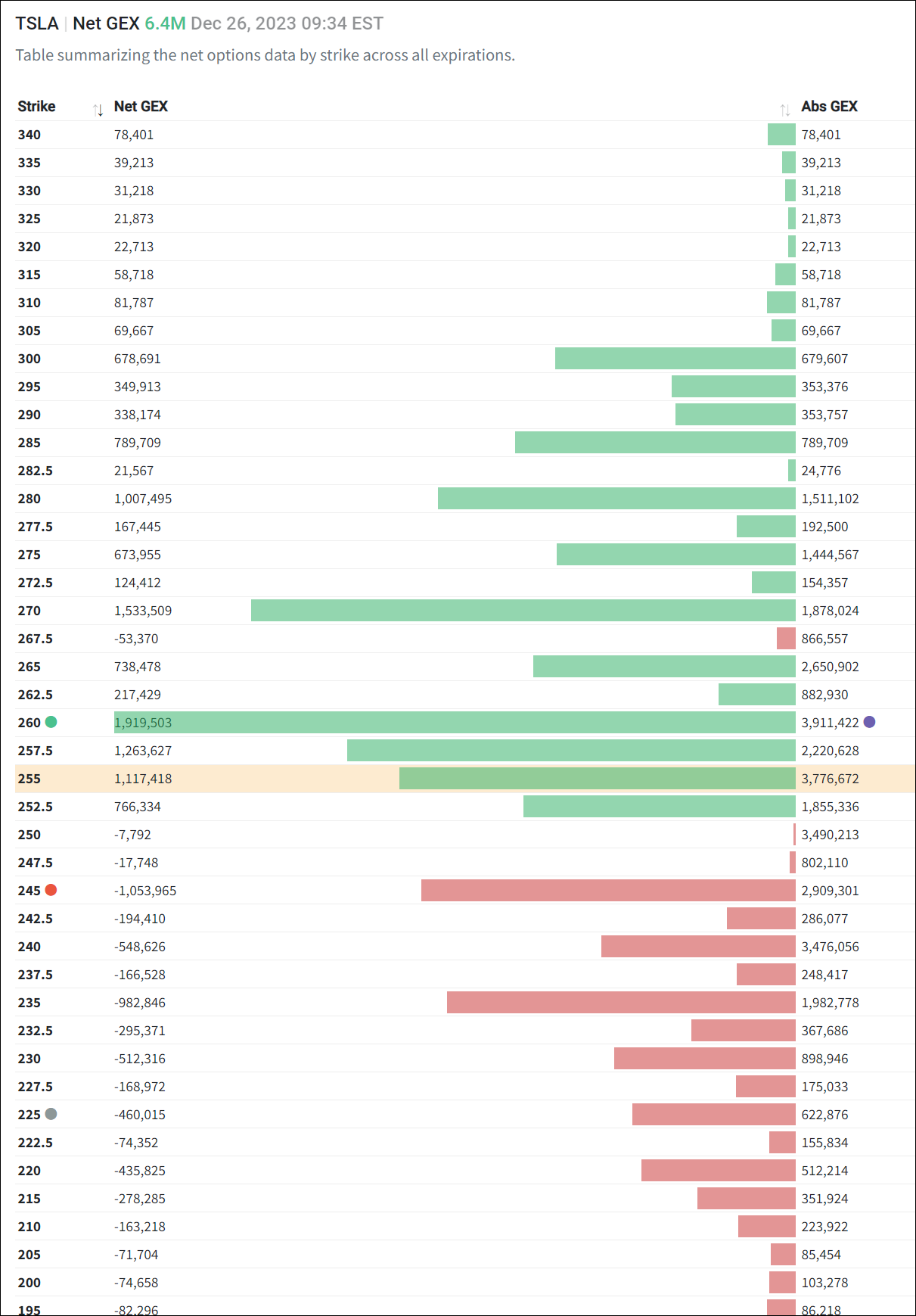

2) gamma exposure - know where market participants are in on the action. Tallest +/- gammas are magnets (but dealers don't have to hedge until price reaches those gammas).

For tall +gammas, dealers will buy TSLA as price approaches it from below and sell TSLA as price passes it to cap the upside.

For tall -gammas, dealers will sell TSLA as price approaches it from above and buy TSLA as price passes it to cap the downside.

3) delta - the picture tells the whole story; the lower the delta (5 to 10), the higher the win rate (97.92%). Yeah, yeah, i know, little income. But risk management is important, you should want the win more than the income.

The eye-opener is that in the last 3 yrs, 22 stocks are better than TSLA for BPS. I am going to map them out to see R/R...

View attachment 1003007

Good stuff. Thanks Yoona and team for the continual data sharing.

Arul

Member

Good information. Thanks. Also i read your explantion about rolling and i learnt a lot out of it. I do roll my CC but sometimes i let it get assigned, but now think i could have given a chance to Roll it especially for Tesla which is very volatile. Thanks.3 more tools for success:

1) backtesting - this provides visual solid evidence that your strategy works and allows you to assess your risk and make data-driven improvements. The main purpose is so that you can limit your risks. More importantly, it allows you to control emotions because of rules you set out beforehand. Past performance is no guarantee of future results, but 703 weeks are compelling data.

2) gamma exposure - know where market participants are in on the action. Tallest +/- gammas are magnets (but dealers don't have to hedge until price reaches those gammas).

For tall +gammas, dealers will buy TSLA as price approaches it from below and sell TSLA as price passes it to cap the upside.

For tall -gammas, dealers will sell TSLA as price approaches it from above and buy TSLA as price passes it to cap the downside.

3) delta - the picture tells the whole story; the lower the delta (5 to 10), the higher the win rate (97.92%). Yeah, yeah, i know, little income. But risk management is important, you should want the win more than the income.

The eye-opener is that in the last 3 yrs, 22 stocks are better than TSLA for BPS. I am going to map them out to see R/R...

View attachment 1003007

chillerjt

Member

18.5k weekly China numbers. Merry Christmas, too late for a Santa rally?

Well we are +6.5% since Dec 1218.5k weekly China numbers. Merry Christmas, too late for a Santa rally?

Might be the little Christmas rally

Years goes by and does not look the same

Last year I had ski season pass was on the ski slopes with the kids on December 28th getting called by my broker for repeated 150k+ margin calls after my account got wiped out from too many puts sold on margin.

This years the kids play hockey, no ski season pass since my oldest is the captain of his team and need to be there for all the tournament games, there is no snow whatsoever, I was on call from December 20th and will be till Dec 28th, worked 16h per day everybody fractured at the same time it seems. At least it’s getting easier and easier to work with my 5th metatarsal fracture.

Debating what to do with this unexpected money. My wife is telling me to just buy plain TSLA stock with that money. I feel more like selling far out CSP ITM puts to let Theta decay do it’s thing if SP is the same in 1-2 years. I bought enough LEAPS to feel happy. Donc have the time to do weeklies at the moment.

Merry Christmas everyone. This year was 100x less painful than last year, even with a fractured foot.

Don't forget that Market Makers aren't looking to make money on trading the shares, they just want to keep the order book neutral. They make their money on the gap between Bid and Ask, at least that's my understandingI don’t envy them: In both cases their joining the buying (from below) and the selling (from above) works against them by increasing/decreasing the price as they buy or sell, they then have to turn around and do the opposite once the wall is breached which their buying/selling helped happen in the first place

Yeah, I'm looking to transition away from LEAPS into common stock & cash, not time-limit on those and a Delta of 1, but will take me some time to get thereWell we are +6.5% since Dec 12

Might be the little Christmas rally

Years goes by and does not look the same

Last year I had ski season pass was on the ski slopes with the kids on December 28th getting called by my broker for repeated 150k+ margin calls after my account got wiped out from too many puts sold on margin.

This years the kids play hockey, no ski season pass since my oldest is the captain of his team and need to be there for all the tournament games, there is no snow whatsoever, I was on call from December 20th and will be till Dec 28th, worked 16h per day everybody fractured at the same time it seems. At least it’s getting easier and easier to work with my 5th metatarsal fracture.

Debating what to do with this unexpected money. My wife is telling me to just buy plain TSLA stock with that money. I feel more like selling far out CSP ITM puts to let Theta decay do it’s thing if SP is the same in 1-2 years. I bought enough LEAPS to feel happy. Donc have the time to do weeklies at the moment.

Merry Christmas everyone. This year was 100x less painful than last year, even with a fractured foot.

Well it's as easy to get screwed-over in a run from 100 to 300 as it is 300 to 100, but we survived to tell the tale

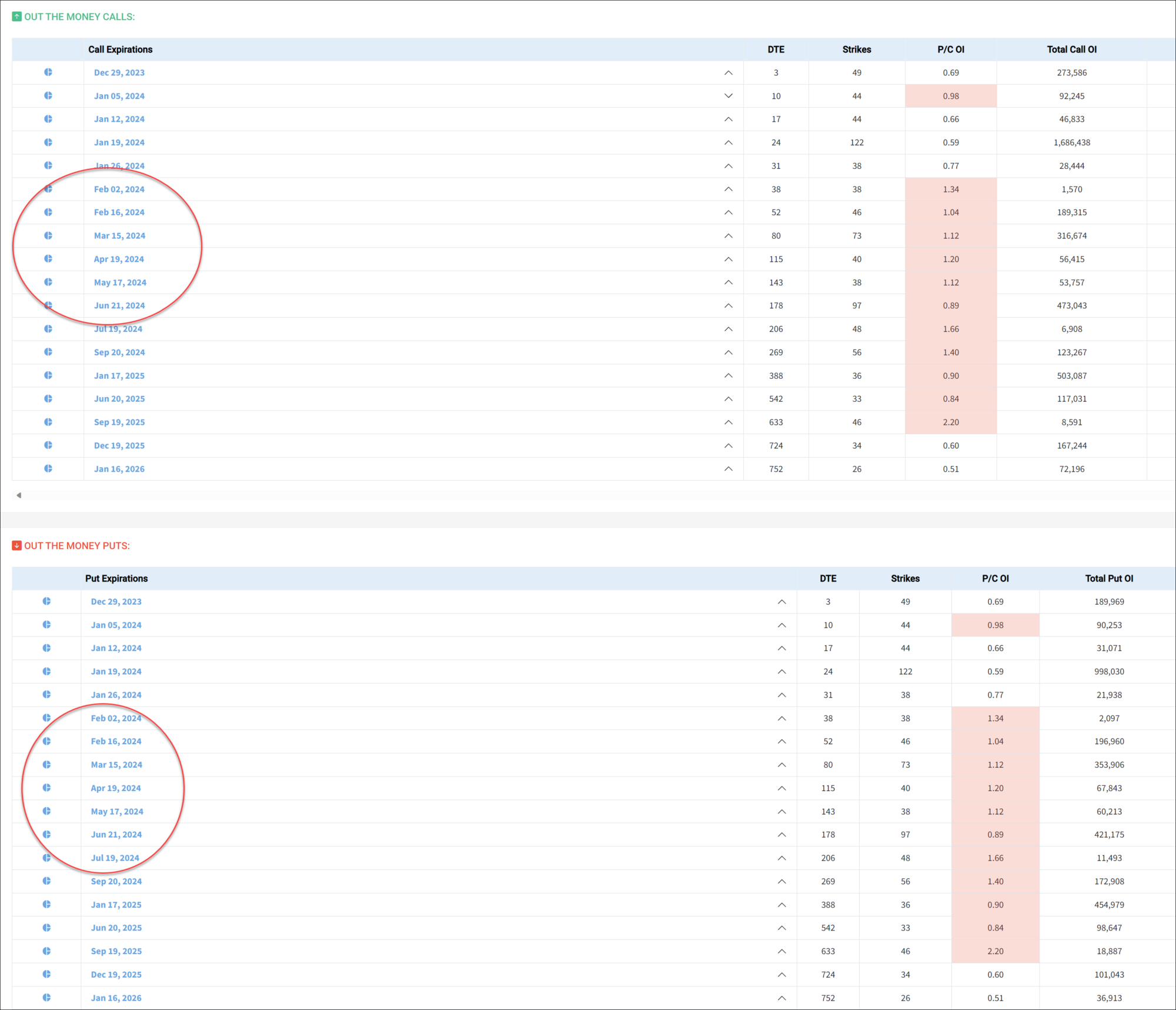

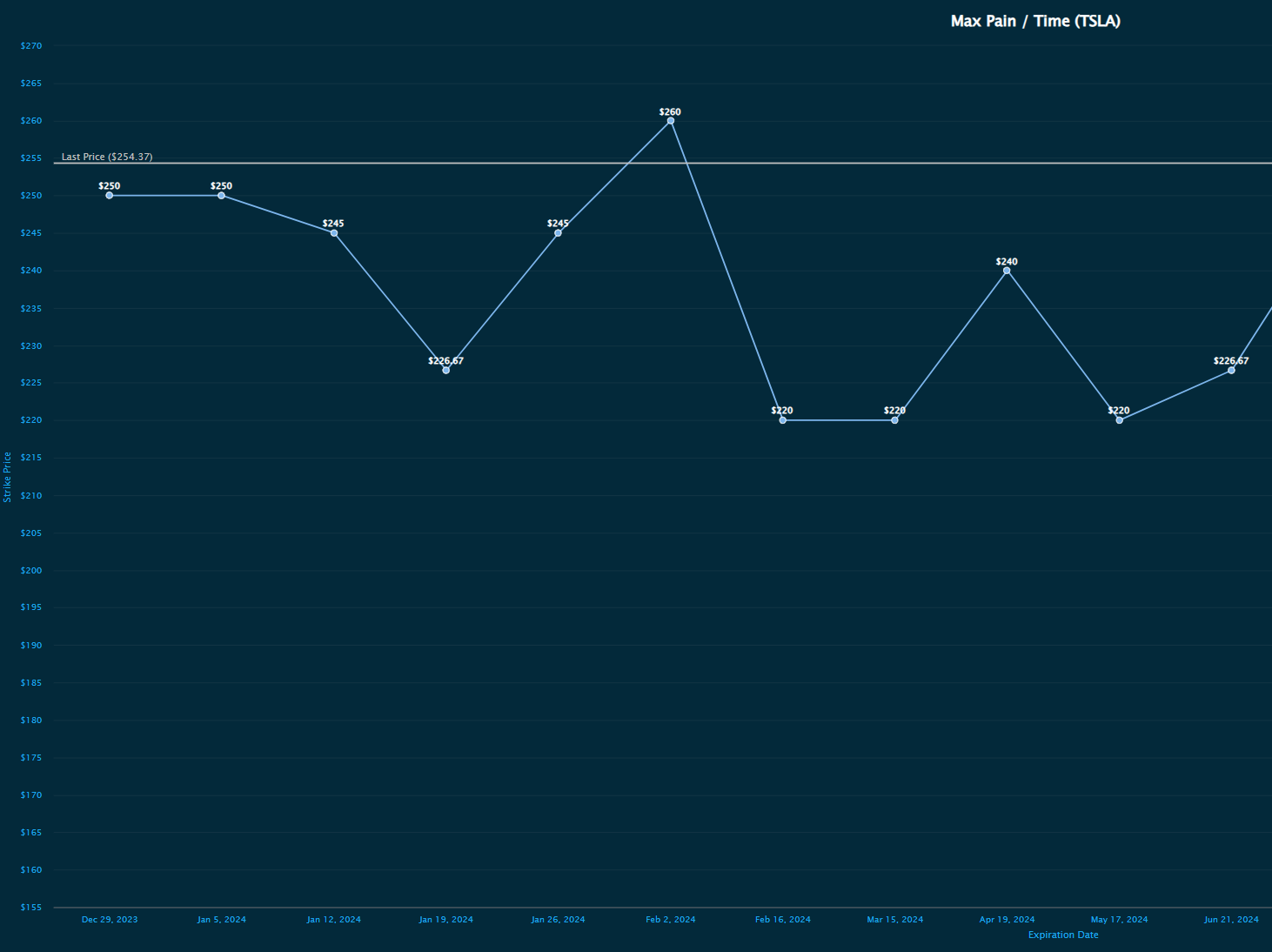

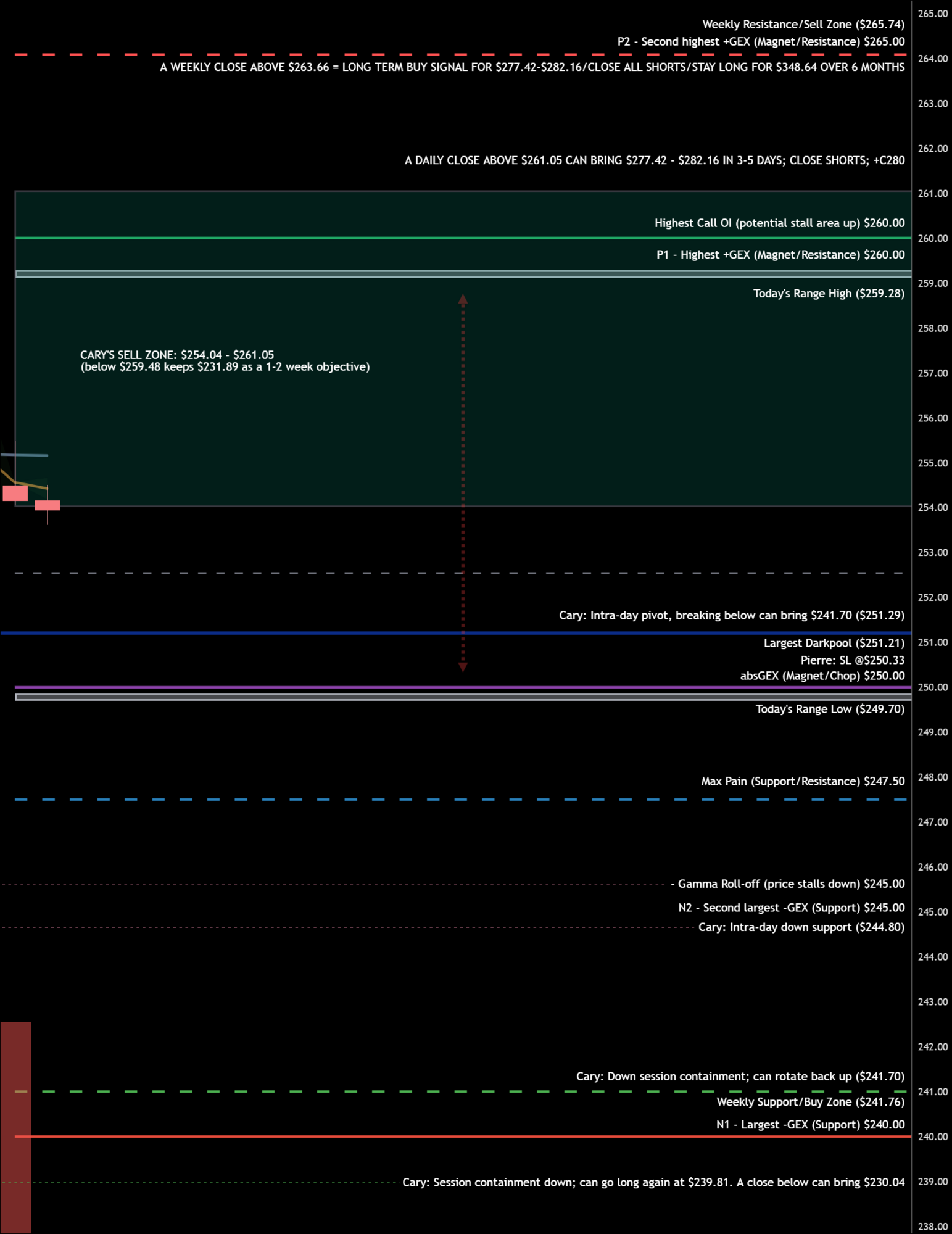

P/C ratio leaning bearish mid-2024, supports what @tivoboy and others here have been saying about tilting short/bearish Feb/Mar:

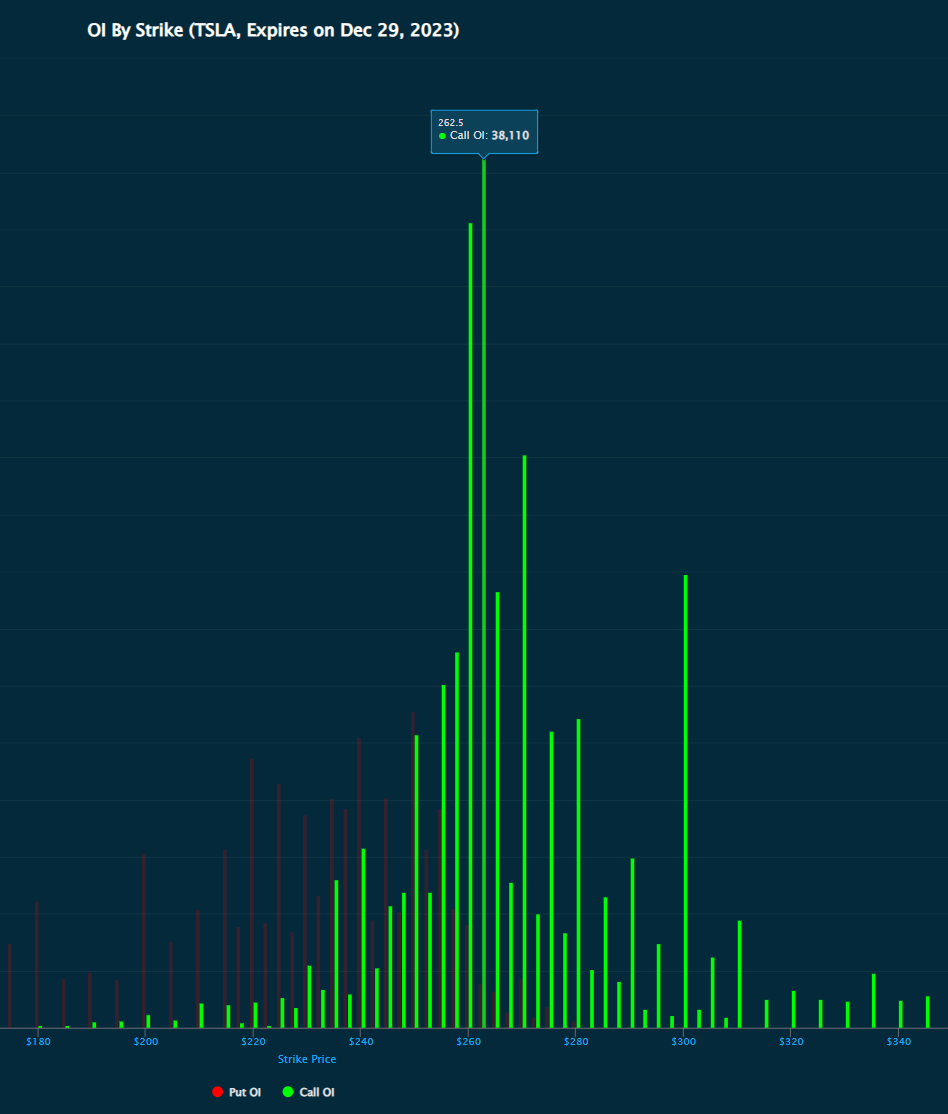

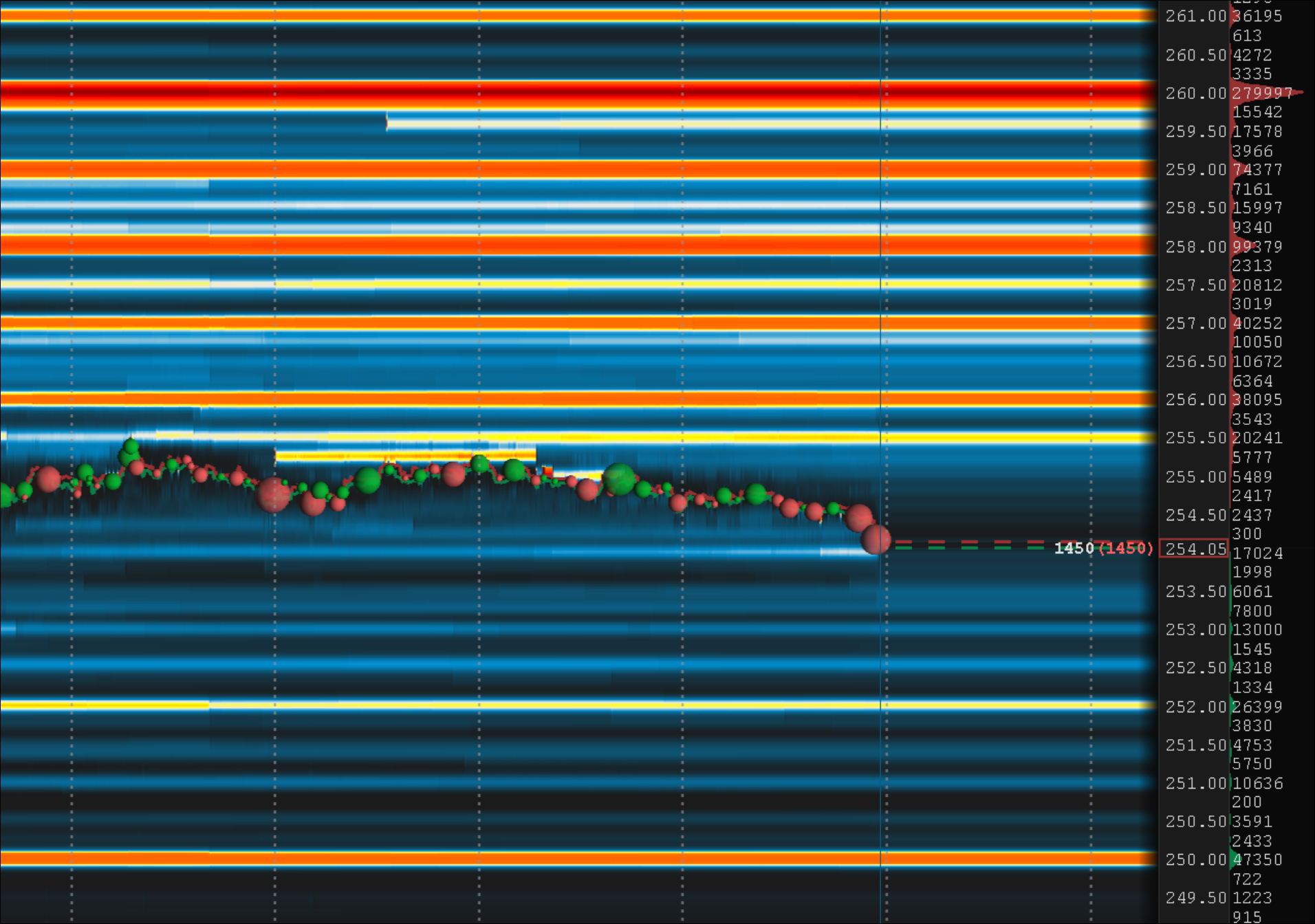

12/29 3DTE 68% Probability of Market Maker Move = 244.17-264.83 based on last night's options premiums @ 53.93% IV.

Super tight guess 253.56-255.44.

Highest gamma 262.5. Highest call wall 260. Highest put wall 250.

235 is possible next week 1/5.

Super tight guess 253.56-255.44.

Highest gamma 262.5. Highest call wall 260. Highest put wall 250.

235 is possible next week 1/5.

Last edited:

QTA levels with commentary

12/29

1/5

12/29

1/5

Sorry for the stupid question, but when you say12/29 3DTE 68% Probability of Market Maker Move = 244.17-264.83 based on last night's options premiums @ 53.93% IV.

Super tight guess 253.56-255.44.

Highest gamma 262.5. Highest call wall 260. Highest put wall 250.

235 is possible next week 1/5.

View attachment 1003080View attachment 1003081View attachment 1003079View attachment 1003082

is that the range for close today, or for Friday?12/29 3DTE 68% Probability of Market Maker Move = 244.17-264.83 based on last night's options premiums @ 53.93% IV.

tivoboy

Active Member

Pure money making GOLD.3 more tools for success:

2) gamma exposure - know where market participants are in on the action. Tallest +/- gammas are magnets (but dealers don't have to hedge until price reaches those gammas).

For tall +gammas, dealers will buy TSLA as price approaches it from below and sell TSLA as price passes it to cap the upside.

For tall -gammas, dealers will sell TSLA as price approaches it from above and buy TSLA as price passes it to cap the downside.

3) delta - the picture tells the whole story; the lower the delta (5 to 10), the higher the win rate (97.92%). Yeah, yeah, i know, little income. But risk management is important, you should want the win more than the income.

The eye-opener is that in the last 3 yrs, 22 stocks are better than TSLA for BPS. I am going to map them out to see R/R...

Last edited:

I would not trust any call/Put walls for 1/5. If the P&D numbers come in over 1.8m, it could spark a rally, and a miss could easily give us 10% down.

guess for 12/29 friday based on options chain, 68% chanceSorry for the stupid question, but when you say

is that the range for close today, or for Friday?

I got lucky on the -275CC I BTC on Friday hoping for a better entry today. I sold them again for essentially what I bought them for on Friday at the open, and they have quickly lost value since. I really thought the strong China numbers were going to spark more of a rally as it is looking more and more like Tesla is going to hit their guidance for the year.

tivoboy

Active Member

“Give me a stopwatch and a map, and I'll fly the Alps in a plane with no windows”12/29 3DTE 68% Probability of Market Maker Move = 244.17-264.83 based on last night's options premiums @ 53.93% IV.

Super tight guess 253.56-255.44.

Highest gamma 262.5. Highest call wall 260. Highest put wall 250.

235 is possible next week 1/5.

Maybe market is waiting for and is more concerned about margin than qty. cars sold.I really thought the strong China numbers were going to spark more of a rally as it is looking more and more like Tesla is going to hit their guidance for the year.

As someone who suffered terribly in 2022 with BPSs when the market dropped, nobody seemed to bring up that rolling an ITM BPS costs money. So rolling for 35 weeks will cost a fortune, which is why I had rolled them out a year instead of weekly when they went ITM. This is why CSP are safer than BPSs, even if using the same amount of margin.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K