NVDA is blocked at the Daily and Weekly upper channelsI am guessing over $1k for NVDA. A few down days for SMCI might make it tradeable for me.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

...until it isn't. From a fundamentals perspective, once earnings come out I doubt the weekly channel will hold.NVDA is blocked at the Daily and Weekly upper channels

tivoboy

Active Member

I know a lady.IWANTTHISPUPPYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYPLSPLSPLSPLSPLSPLS

View attachment 1047870

I have no objections at all to Elon having his payday. I just want him bound by a reasonable sales strategy. The amount isn't an issue for me even, although someone should be paying for the original fiasco other than the overall shareholder pool. The board (and Elon) did screw up which is why they lost the case.Yeah I hate the Twitter buy and his antics over the past couple of years but people had plenty of opportunity to unload their shares at above the target goal for Elon's compensation plan over the past 1-2 years. He delivered on his end and should get his pay. I find it to be in the poorest taste for any shareholder to deny Elon's his pay package after he more than 10X the company.

tivoboy

Active Member

could my 3x July -cc @1000 ($61.5) have caused this.. ;-)

tivoboy

Active Member

Friends don’t let friends buy a BOATLOAD of nearly anything..OK Guys. I just bought a boatload of Calls. Since everyone and their mom were Bearish, I went ahead and test my luck this times going the opposite way.

Got to admit should have waited for the green light from the big guy(s) but it is what it is.

Been a fun journey and made some nice friends along the ways. If the SP drop from here and you don't hear from me after 5/31 just know I'm back safe and sound working at Wendy. I'm too gassy for Taco Bell. My boatload of Calls can also rest in peace knowing it has sacrificed itself for my Call Seller Pals out there.

Adios Amigos and Yoona please call me if you are in need to adopt a cute little dog

Loves,

the Dog

thenewguy1979

"The" Dog

JK.........No worry. Just got 4 x 185C exp 5/31. Going cut loose if going below 172.Friends don’t let friends buy a BOATLOAD of nearly anything..

I cannot just quit. I have too many good friends here to listen to my BS everyday

thenewguy1979

"The" Dog

Feeling Hurt....I get it...... I wasn't born to be pretty.....IWANTTHISPUPPYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYYPLSPLSPLSPLSPLSPLS

View attachment 1047870

Do you mind sharing the date and strikes you are using to sell the calls? I also own NVDA, AVGO, and other Semis and MAG7.That’s pretty darn cheap… I’d like to move up a tad to 505/510 IF I could get close to same premium… too busy selling AVGO, AMAT and NVDA calls at the moment though.

Arul

Member

Right now say Jan 25 270s are at ~ $6, say 6.

I could roll to Jan 260 400 for same $6 ... or say like $350 for $9. 1st choice more neutral. 2nd choice is more bearish, take money upfront. And after SP drops after vote, can move back to Jan25 250s and keep the difference in spreads ... just a thought. Also rolling before the vote means will get better price for Jan 26 (at least short term - assuming SP goes down)

Also Jan 26 not that bad, Jan 27 will be available by Sept

The current Jan 25 270s are from prior rolls down from 500, 400 and 350 ...

Main thing is you have "options with options"

+ On Solar . it's 12kW system. Costs like 22K after tax rebates. The previous house I sold, I had 8kW and my summer needs were not met slightly, so 12kW should do it for me. Rest details don't have in front of me. Pls check Tesla website. VA has net metering as well, and Powewalls were not in my budget. Plan was always to use the CC monies to fund the panel

Thanks and highly appreciated. MIne is an 8 kw system and only produces 6KW only.Right now say Jan 25 270s are at ~ $6, say 6.

I could roll to Jan 260 400 for same $6 ... or say like $350 for $9. 1st choice more neutral. 2nd choice is more bearish, take money upfront. And after SP drops after vote, can move back to Jan25 250s and keep the difference in spreads ... just a thought. Also rolling before the vote means will get better price for Jan 26 (at least short term - assuming SP goes down)

Also Jan 26 not that bad, Jan 27 will be available by Sept

The current Jan 25 270s are from prior rolls down from 500, 400 and 350 ...

Main thing is you have "options with options"

+ On Solar . it's 12kW system. Costs like 22K after tax rebates. The previous house I sold, I had 8kW and my summer needs were not met slightly, so 12kW should do it for me. Rest details don't have in front of me. Pls check Tesla website. VA has net metering as well, and Powewalls were not in my budget. Plan was always to use the CC monies to fund the panels

tivoboy

Active Member

Well I sold the NVDA July $1000 @61,5 and I'm working on the AVGO $1560 July for $48.50 but it did t clear. I'm fine with either going they are in TAA and up 1000% at this point.Do you mind sharing the date and strikes you are using to sell the calls? I also own NVDA, AVGO, and other Semis and MAG7.

Trying to sell july MU @140 FOR $7.5

Willing to sell AMD for July @190 for $5 or 185 for 8. That's another 10+ bagger at this point.

Haven't figured out TSM or ASML yet

At this point I need to reduce position size but I've been selling calls hard for 2 years now

Last edited:

Well I sold the NVDA July $1000 @61,5 and I'm working on the AVGO $1560 July for $48.50 but it did t clear. I'm fine with either going they are in TAA and up 1000% at this point.

Trying to sell july MU @140 FOR $7.5

Willing to sell AMD for July @190 for $5 or 185 for 8. That's another 10+ bagger at this point.

Haven't figured out TSM or ASML yet

At this point I need to reduce position size but I've been selling calls hard for 2 years now

I’m enjoying tremendous vicarious pleasure reading this and happy for you and happy seeing you and others doing well diversified. I’m still a one-trick pony trading solely TSLA, at least until I can escape my longs ($260-$320)—maybe my head needs an adjustment. Meanwhile watching and hopefully learning.

I remember NVDA <$110; SPY <$350, Meta <$90, etc. not so long ago. But with TSLA down near $100 the same time it was hard to imagine changing horses then.

So back to my daily mediation: Keep calm and trade on!

intelligator

Active Member

Travelled this week, little time on the wire ... what's next week event? I still have 5x +p180 long put for Jan '25 , getting the gut feel it may be time to cash in.I have a feeling a lot of people will get bagged next week. Seems like not enough people take the "last refueling station" seriously enough. Downside risk is $7.5, upside is $25+. Still many are hedging with short calls.

thenewguy1979

"The" Dog

Travelled this week, little time on the wire ... what's next week event? I still have 5x +p180 long put for Jan '25 , getting the gut feel it may be time to cash in.

SP moon to 200 plus…….

Thanks, and congrats on so many 10 baggers!Well I sold the NVDA July $1000 @61,5 and I'm working on the AVGO $1560 July for $48.50 but it did t clear. I'm fine with either going they are in TAA and up 1000% at this point.

Trying to sell july MU @140 FOR $7.5

Willing to sell AMD for July @190 for $5 or 185 for 8. That's another 10+ bagger at this point.

Haven't figured out TSM or ASML yet

At this point I need to reduce position size but I've been selling calls hard for 2 years now

tivoboy

Active Member

It’s the 1000+ bagger that got away that makes me always ask - should I just HOLD this one a bit longer. Really.Thanks, and congrats on so many 10 baggers!

I had that with TSLA in 2019 - 2021, but was with options, $1000 went to $1.3mIt’s the 1000+ bagger that got away that makes me always ask - should I just HOLD this one a bit longer. Really.

Last edited:

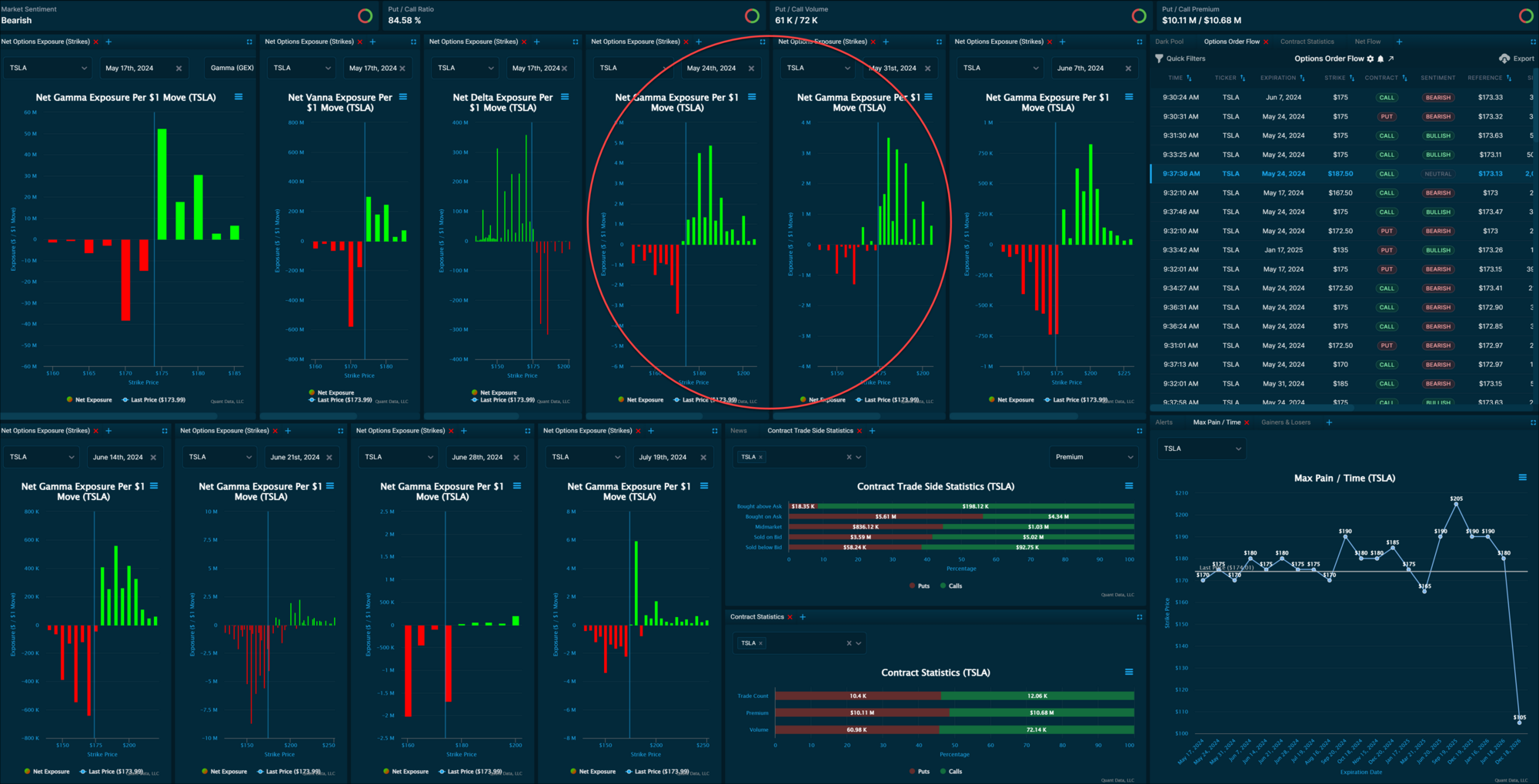

Nice green +GEX walls next two weeks...

Don't get too excited since they've failed us before. But good to keep in mind.

June 7-21 don't look so bullish as of now (plenty -GEX (red).

Don't get too excited since they've failed us before. But good to keep in mind.

June 7-21 don't look so bullish as of now (plenty -GEX (red).

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K