Found an interesting TSLA stock anticipated moves analysis channel that seems to be less hype and clickbait and more solid info. Sharing in case it can be useful for others here:

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

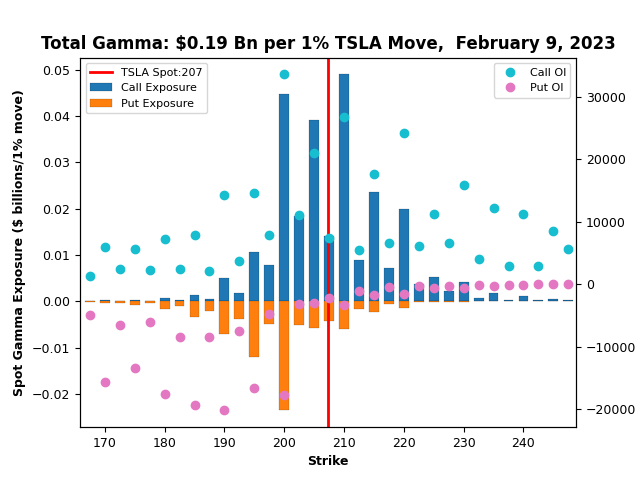

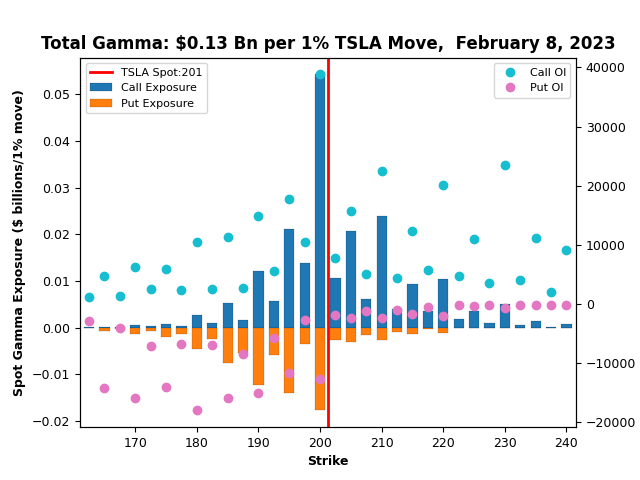

Using the simple straight line stike throug from begining of February, the closing price was close to where I thought we'd land, aftermarket was a beat! Yeah, got lucky. Call OI increased at c210, c220, c230, put stronghold gained at p185, p190, p195. I followed @Max Plaid with a 2/17 -c240 CC for 2.50 during the second peak this morning, got busy and missed the sale of a -p185/+p165 BPS for 1.75 ... from the looks of it, we'll do better Friday morning. It almost feels like we can tag 200? If we dip down further, will take profit on the CC and reposition the rolled positions to a better spot.

dropgems

Member

I’m in 200p weeklies bought when spot price was $211 today. Tesla hit a lod 202.88 after hours which was strange (nvidia, which I’m also in puts, did the same thing after hours). I think the stock dumps big though tomm or next week. First target $185. We’ll see.

I have the same thought. 180-185 is my first target pull back level after CPI, just the 0.382 Fibonacci retracement and the RSI cool down that could happen from my amateur TA wise. Just ignore if you guys find it non sense. If TSLA get there before CPI, it could be worse, the ER gap next maybe.I’m in 200p weeklies bought when spot price was $211 today. Tesla hit a lod 202.88 after hours which was strange (nvidia, which I’m also in puts, did the same thing after hours). I think the stock dumps big though tomm or next week. First target $185. We’ll see.

On the upside, I am quite comfortable rolling if needed at >200 price range. IMO, Investor day could be the sell the news event. Just my 2cent in short term. Long term, I believe that we'll be >$500 latest 2025.

R

ReddyLeaf

Guest

From my rudimentary learnings from @dl003, this might be the pullback that we’ve been expecting. Here’s an hourly graph showing the divergence of several momentum signals (lower highs) and the SP (higher highs). If I understand @dl003 correctly, that’s a sign that momentum is slowing and a reversal is imminent. Maybe that AH trading is the big boys pulling out.I’m in 200p weeklies bought when spot price was $211 today. Tesla hit a lod 202.88 after hours which was strange (nvidia, which I’m also in puts, did the same thing after hours). I think the stock dumps big though tomm or next week. First target $185. We’ll see.

I’m hopeful that there will be at least a small pullback because my existing CCs are in real trouble now; various near dates and strikes at 145,149,155,170,185,205. I need a significant pullback to salvage any type of roll. Unfortunately, I also opened a bunch of 180/190-250/260 ICs for next week just to try and generate enough premiums to buyback some calls. Now the BPS side is in trouble and I will need to roll down and out. Damn, I didn’t learn from you guys last year. Spreads are highly directionally dependent. I did great this week with similar ICs, but got greedy and made the mistake of opening too early for next week. Must hold back and only sell spreads on Wednesday!

Looks like there was a note from Jonas that caused the late AH drop. Stock was actually climbing up until 7 PM EST.From my rudimentary learnings from @dl003, this might be the pullback that we’ve been expecting. Here’s an hourly graph showing the divergence of several momentum signals (lower highs) and the SP (higher highs). If I understand @dl003 correctly, that’s a sign that momentum is slowing and a reversal is imminent. Maybe that AH trading is the big boys pulling out.

View attachment 905340

I’m hopeful that there will be at least a small pullback because my existing CCs are in real trouble now; various near dates and strikes at 145,149,155,170,185,205. I need a significant pullback to salvage any type of roll. Unfortunately, I also opened a bunch of 180/190-250/260 ICs for next week just to try and generate enough premiums to buyback some calls. Now the BPS side is in trouble and I will need to roll down and out. Damn, I didn’t learn from you guys last year. Spreads are highly directionally dependent. I did great this week with similar ICs, but got greedy and made the mistake of opening too early for next week. Must hold back and only sell spreads on Wednesday!

For the near term look for the 5 day SMA as support which currently stands at 198. If that support is taken out we could start sliding down with the macros. I have a feeling(based on the strength yesterday and today despite bad macros) that TSLA will continue to show resilience. Take it one level at a time. Bears will try their hardest to close below the 5 day SMA.

Also remember this weekend is Super Bowl and could generate a lot of buzz for EVs and Tesla in particular.

We are close, but I think not quite there yet. After a breathtaking 110% rise, I think the exhausted buying pressure has to show up on the daily timeframe and its not there yet. Today TSLA made a fresh high on daily RSI. In the past, whenever this happened, that was not the top. The subsequent higher high could be the top so I’m looking forward to another high after a few days of consolidating. More importantly, option flow still shows heavy call activity despite the pullback. This is very weird as IV has dropped twice in the last two weeks, only to pick back up the next day and then some. With no Tesla specific events on schedule, me think somebody knows sonething. Feel very similar to last March rally on the leaked split news. The number Im watching tomorrow is 191. If it closes above, that will confirm TSLA as bullish for the next 2 months. If below, while looking unlikely now, I have to say be cautious as we just got rejected by this level twice in 2 weeks. Rejected once is normal. Twice in a row is trouble.From my rudimentary learnings from @dl003, this might be the pullback that we’ve been expecting. Here’s an hourly graph showing the divergence of several momentum signals (lower highs) and the SP (higher highs). If I understand @dl003 correctly, that’s a sign that momentum is slowing and a reversal is imminent. Maybe that AH trading is the big boys pulling out.

View attachment 905340

I’m hopeful that there will be at least a small pullback because my existing CCs are in real trouble now; various near dates and strikes at 145,149,155,170,185,205. I need a significant pullback to salvage any type of roll. Unfortunately, I also opened a bunch of 180/190-250/260 ICs for next week just to try and generate enough premiums to buyback some calls. Now the BPS side is in trouble and I will need to roll down and out. Damn, I didn’t learn from you guys last year. Spreads are highly directionally dependent. I did great this week with similar ICs, but got greedy and made the mistake of opening too early for next week. Must hold back and only sell spreads on Wednesday!

You looking at the open-interest or the trading volume?Hmmm, just checked mine. It says something completely different.

Indeed, on today's open-interest, which is just published once per day 7:00EST, there's a 2:1 put to call ratio at 200, however on the volume chart, which is periodically updated throughout the day, we see puts trading 4x higher than the calls, which a whopping 230k volume. The same at 205, where puts traded 3x more than calls

So I'm inferring/assuming that we'll see much higher put volume at these trikes when the volumes are published Friday morning - of course all that trading might mean LESS puts, but unlikely

For some reason I can't upload images right now - will edit later when functioning

I think @Krugerrand was talking about the litter trayYou looking at the open-interest or the trading volume?

Indeed, on today's open-interest, which is just published once per day 7:00EST, there's a 2:1 put to call ratio at 200, however on the volume chart, which is periodically updated throughout the day, we see puts trading 4x higher than the calls, which a whopping 230k volume. The same at 205, where puts traded 3x more than calls

So I'm inferring/assuming that we'll see much higher put volume at these trikes when the volumes are published Friday morning - of course all that trading might mean LESS puts, but unlikely

For some reason I can't upload images right now - will edit later when functioning

SebastienBonny

Member

Yes, starts to look like rolling 210 CC to next week wasn't needed after all.Down 3% premarket. I think broad market flush today

Well, better safe than sorry.

If we end up below 200 there's always a possibility to roll the 225CC tot 220CC for next week.

And there you go, 200 now pwned with puts and 205 neutral... Still can't upland images: Stock Option Max PainYou looking at the open-interest or the trading volume?

Indeed, on today's open-interest, which is just published once per day 7:00EST, there's a 2:1 put to call ratio at 200, however on the volume chart, which is periodically updated throughout the day, we see puts trading 4x higher than the calls, which a whopping 230k volume. The same at 205, where puts traded 3x more than calls

So I'm inferring/assuming that we'll see much higher put volume at these trikes when the volumes are published Friday morning - of course all that trading might mean LESS puts, but unlikely

For some reason I can't upload images right now - will edit later when functioning

SebastienBonny

Member

Indeed, there seems to be a problem uploading images, but most important thing is 200 PUT wall is really massive.

So seems like we will stay above 200.

So seems like we will stay above 200.

Unless all those puts are sold by the Hedgies in order to acquire cheap shares...Indeed, there seems to be a problem uploading images, but most important thing is 200 PUT wall is really massive.

So seems like we will stay above 200.

Yes, and the 200 call “wall” had a pretty good one-day shift towards $210 and higher, although at the moment there seems to be a good chance today’s open < yesterday’s close, but may not be there long (you traders!).Indeed, there seems to be a problem uploading images, but most important thing is 200 PUT wall is really massive.

So seems like we will stay above 200.

SebastienBonny

Member

Yes, that's something we will never know (in advance)Unless all those puts are sold by the Hedgies in order to acquire cheap shares...

what we looking at is one of the most bearish candlestick patterns there is: gravestone doji yesterday complimented by a gap down today - island reversal. However, given the fresh high on daily RSI I mentioned yesterday as well as option flow not supporting a flush, I'm still leaning toward another high, even if just barely exceeding yesterday high, or maybe a double top. Nothing to be worried about yet. 191 is still the number I'm watching today.

myt-e-s-l-a

Member

Well that didn't last long.Time to fade Tesla

STC 1000 TSLA @ 213

and

STO 10x 20230217P195 @ 3.10

Buy 1000 tsla @ 196.50 and BTC 10x P195 put @ 7.50 and STO 10x 20230217C215 @ 3.50

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K