Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

Replay hazy, try again.. ;-)I asked ChatGPT but no answer. Figured I ask the one and only TivoBoy.

What % will NDVA hit 1000 next week?

Frankly, I don’t see it and the term structure doesn’t indicate it.

But, with this level of volatility in the SECTOR almost anything CAN happen… but it would be a lot of vol for not a lot of news IMO

If you like your chances, there are very cheap options at 950-965, that would get you a 3x IF we hit 1000 late next week. NFA

I’m short 5x -ccalls at $1060 but they were sold at $16, they are now $4.x, I’m not buying them back b/c IF we get there they can have the stock it’s all in a SEPIRA

tivoboy

Active Member

Just a thought.. why not just start selling the $120 CSP now, bi-weekly or monthly. March is no premium, but if we drift lower Apr could be $1, or do weeklies.. just keep writing and writing. As the price goes lower, obviously premium will shoot up and by that point your adjusted outlay (not basis) could be ~ $110. That’d be a nice place to park and play for the next few years.I have a decent amount of cash set aside that is being set aside to exercise some DITM LEAPS I bought way back in Q1 of 2023 and I've since rolled them into June 2026. I don't want to use a majority of my cash since I like to keep a buffer. I think what I'll likely do if we do go down into the 150's and especially if we fill that gap at 146 intraday, is sell cash secured Puts at a 120 strike price for end of this year and use the proceeds along with a little bit cash set aside to buy some OTM June 2026 LEAPS (but not far OTM, just like $200 strike).

If the stock keeps falling through 146, well I don't mind buying the stock at 120/share and it'll take less cash to buy X number of shares than at 146/share.

Last edited:

It's almost time for me to call a bottom. Short at your own risk.@dl003 I booked decent gains today from the earlier 3/22 put spread down here.

Would a new straight +P175 3/22 @6.00 here be decent r:r in case of <$170 next week, or better wait to see Monday, or not at all?

Thanks in advance.

tivoboy

Active Member

Holy MOG.. I’m sending you a virtual three fingers of single malt.. or Mountain Dew. Heck, you can have a bottle of both.I can't believe I bit the spread bug again and lost.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

Yay! What are you seeing different here than what you saw at $220? Asking to learn.It's almost time for me to call a bottom. Short at your own risk.

Would you like us to help you keep your word? For me, I have a hard time NOT buying calls, but really stay away from spreads due the binds folks have been in.I can't believe I bit the spread bug again and lost.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

I remember the binds that folks were in for the ~$100 Jan 2023 drop and that is forever burned into my brain

ChiefRollo

Member

Just don’t tell her…really for her sake.I can't believe I bit the spread bug again and lost.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

You're asking what I saw at 220 but I don't even remember what I had for dinner last night.Yay! What are you seeing different here than what you saw at $220? Asking to learn.

ChiefRollo

Member

Although the least experienced person here, I’ll share a few words. Buying puts when the market is bearish isn’t contrarian…unless you have clear insights that it will be meaningfully more bearish from here. I’ve thought of doing the same and am waiting for relative peaks over the next couple of weeks…to pull the trigger.@dl003 I booked decent gains today from the earlier 3/22 put spread down here.

Would a new straight +P175 3/22 @6.00 here be decent r:r in case of <$170 next week, or better wait to see Monday, or not at all?

Thanks in advance.

Can’t help but reflect on what Yoona shared yesterday; options trading is addictive and I fear that we’re all here because we have that gambling tendency. You can certainly buy puts here and will be able to timely STC them for some gain; it’s the delicate balance of reward to risk that we want to maintain over time for the odds / gains to lean in our favor.

StarFoxisDown!

Well-Known Member

Thanks for the suggestion/advice. I think I've generally been adverse to doing anything on a bi-weekly or monthly basis and focusing on the shortest plays/strategies being around 6 months or longer. Just keep flexibility and not necessarily have to be on my toes or on point with making real time decisions all the time. My work can be pretty demanding at times combined with I have a child on the way so there periods where I can't make real time trades if something were to happen during market hours.Just a thought.. why not just start selling the $120 CSP now, bi-weekly or monthly. March is no premium, but if we drift lower Apr could be $1, or do weeklies.. just keep writing and writing. As the price goes lower, obviously premium will shoot up and by that point your adjusted outlay (not basis) could be ~ $110. That’d be a nice place to park and play for the next few years.

But perhaps I should be making some more maybe bi-monthly trades/strategies to collect more % than I currently am.

Lol. I meant when you called the bottom a few weeks ago at ~$220 and it dropped another $45 dollars. What are you seeing different now to suggest a bottom is what I’m asking. I’d like to learn what to look for.You're asking what I saw at 220 but I don't even remember what I had for dinner last night.

dc_h

Active Member

I lost bigly when TSLA ran up after the Hertz thing and the bottom dropped out when Elon decided wokeness was the great boogeyman and needed to buy twitter. I had two black swans in a row that wiped out spreads 100%. It was a big loss for me, it is a hot surface I will not touch again.I'm just scared looking at how close they were and the sheered numbers of contracts.

Hope today pullback can alleviates some of those Contracts.

Pissed my pant for loosing couples hundreds this week.

Even Yoona with her FOTM BPS (100 wide) are feeling nervous with today dump.......

Good luck guys and please don't bet the house.

Maybe this was not targeted to anyone in particular but please read the room when posting things like this as someone lost big today. Just sayin' cause I've been there too and the receiver of this message just kicks a man while he's down. No need to reply or defend. All I ask is for exercising discretion for these kinds of posts in the future.ahh, the smell of desperation in a Friday afternoon.

Although the least experienced person here, I’ll share a few words. Buying puts when the market is bearish isn’t contrarian…unless you have clear insights that it will be meaningfully more bearish from here. I’ve thought of doing the same and am waiting for relative peaks over the next couple of weeks…to pull the trigger.

Can’t help but reflect on what Yoona shared yesterday; options trading is addictive and I fear that we’re all here because we have that gambling tendency. You can certainly buy puts here and will be able to timely STC them for some gain; it’s the delicate balance of reward to risk that we want to maintain over time for the odds / gains to lean in our favor.

Well said. Also “don’t short in the hole” is good advice. I think I could answer my own question then: wait for break of key levels and then pull the trigger, maybe $168. Although that’s also the wrong time to do it because puts will skyrocket

ChiefRollo

Member

I’m still trying to crawl my way out of those events.I lost bigly when TSLA ran up after the Hertz thing and the bottom dropped out when Elon decided wokeness was the great boogeyman and needed to buy twitter. I had two black swans in a row that wiped out spreads 100%. It was a big loss for me, it is a hot surface I will not touch again.

I didn't even read what people wrote today. My posts only pertain to TSLA PA most of the time. If that's not your cup of tea, too bad. The **** you think you are? GFY. I will not "please read the room." Why don't you please mind your own ****ing business?Maybe this was not targeted to anyone in particular but please read the room when posting things like this as someone lost big today. Just sayin' cause I've been there too and the receiver of this message just kicks a man while he's down. No need to reply or defend. All I ask is for exercising discretion for these kinds of posts in the future.

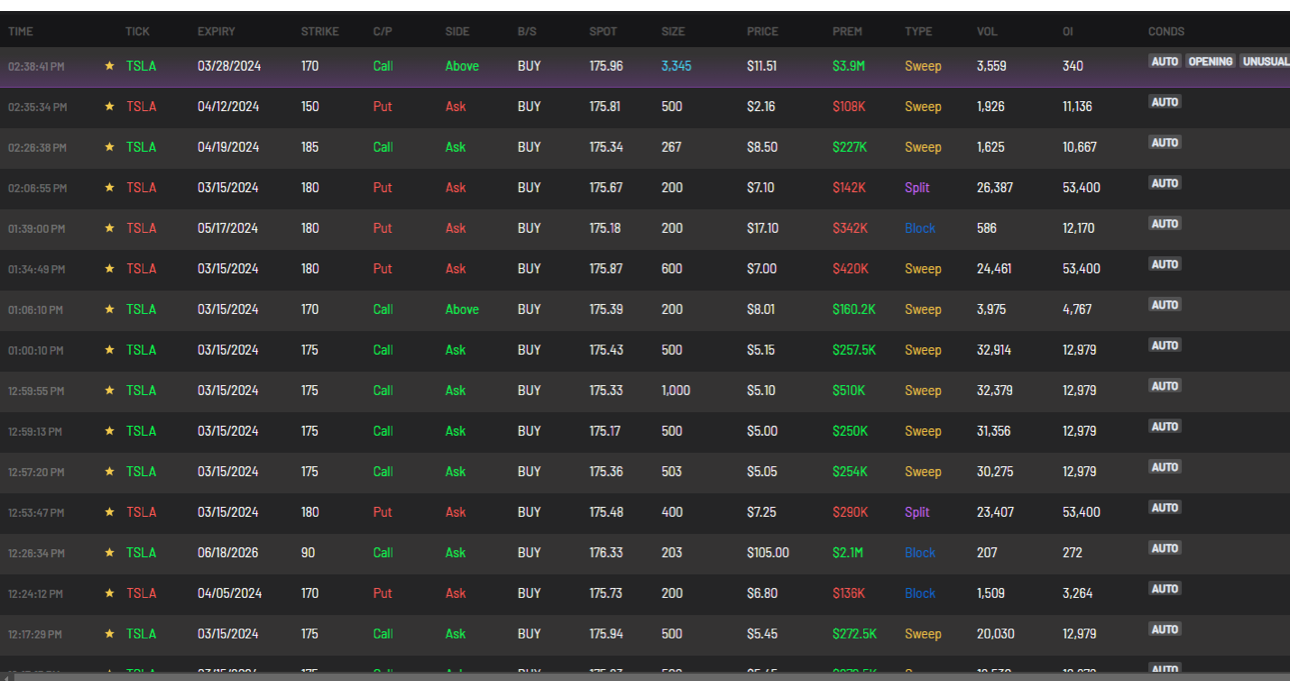

@dl003 Just hit the tape, someone’s been following your posts, can you spot it:

$3.9M order for +C170 3/28

Update:

And another $1.8M for the same strike

$3.9M order for +C170 3/28

Update:

And another $1.8M for the same strike

so sorry to hear thatI can't believe I bit the spread bug again and lost.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

believe it or not, the stock behaved normally today according to the law of averages:

- 1σ is 859-993 and today's Lo/Hi is 865-974 ( it was inside the expected move )

- 0dte is +/-5% OTM and today is -4.35% ( so far ) - it is normal for the stock to move 5% on Fridays

pls take care

but don't listen to me, take Kirk's advice:

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K