Dated 2022...on paper

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Bought-to-close a variety of overnight + morning-pop short calls at $161 area for decent gains, helped make up 40% of the losses on the dying +C205 4/19.

Watching PA now. It's trading surprisingly tame for Quad-Witching, unless the fun-and-violence crew are coming later.

If $160 is defended I'll wait on selling new CC's until we see if we get any bounce, and sell into it.

I also closed the +160/-150 3/28 spread for nice gains (thanks @dl003!). Will reopen if we lose $160.

Watching PA now. It's trading surprisingly tame for Quad-Witching, unless the fun-and-violence crew are coming later.

If $160 is defended I'll wait on selling new CC's until we see if we get any bounce, and sell into it.

I also closed the +160/-150 3/28 spread for nice gains (thanks @dl003!). Will reopen if we lose $160.

Probably a pop because of the India tariffs newsOK I closed by Jan 25 240 calls for like 2100 scalp.

+ sold 2 Apr 26 160 PUTS for $10

and bought 894 shares with CC monies ... (sold 8 Apr 200 CCs against)

Let the rebound begin ...

that happened long before ... but could be why 160/161 acted as supportProbably a pop because of the India tariffs news

likely MM heading to Max Pain (atleast that's what I am hoping for ... )

I drove FSD 11 from/to Dr today morning (compared to last 1-2 years, it's so good) ... and though I must hedge against my CC's before V12 comes out ...

thenewguy1979

"The" Dog

@Max Plaid @MikeC I'm preparing a plan for my 10X -P250 9/20 (extrinsic is $0.80 currently) in case extrinsic drains out in the low $150's and at risk of assignment.

Looking at the chain I can debit roll it down and out to 10x -P240 for 3/2025 (6 months further out; more time for SP to recover or just bounce; gain $5.15 in extrinsic). It will have a debit of about $6,000 which I assume is better than booking a $37,210 loss (the delta between $192.21 CB and ~$155) if I was assigned and immediately sold the shares. I can easily earn the $6k back through my regular scalping.

As an aside, if assigned I can also sell ATM calls for about $10k the week of assignment to help recover some of the loss.

Am I missing something?

Is there a better roll that's not too far out?

Ty

Looking at the chain I can debit roll it down and out to 10x -P240 for 3/2025 (6 months further out; more time for SP to recover or just bounce; gain $5.15 in extrinsic). It will have a debit of about $6,000 which I assume is better than booking a $37,210 loss (the delta between $192.21 CB and ~$155) if I was assigned and immediately sold the shares. I can easily earn the $6k back through my regular scalping.

As an aside, if assigned I can also sell ATM calls for about $10k the week of assignment to help recover some of the loss.

Am I missing something?

Is there a better roll that's not too far out?

Ty

Last edited:

Jim have u looked at flip roll options (if u have shares to cover) for some?

Thanks. Do you mean flipping the -P250 to -C250? I have plenty of shares but they have a CB of $328 (don't ask...

TexasGator

Member

You could sell call for whatever strike/date gives u credit u ok with. Since covered by shares can roll up and out indefinitely.

In the case I consider above it's about even and have plenty of shares to cover and still write others against

In the case I consider above it's about even and have plenty of shares to cover and still write others against

Yes, I sell calls anyway all the time.You could sell call for whatever strike/date gives u credit u ok with. Since covered by shares can roll up and out indefinitely.

In the case I consider above it's about even and have plenty of shares to cover and still write others against

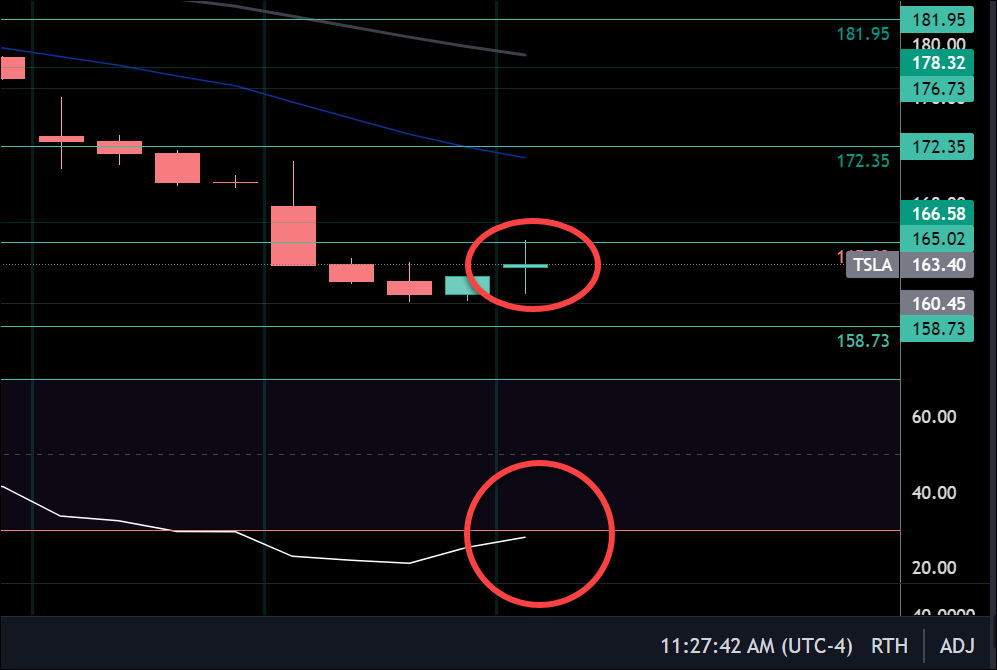

A ray in the darkness?

Potential positive divergence developing on the 2h time frame. Price will now need to confirm.

Potential positive divergence developing on the 2h time frame. Price will now need to confirm.

intelligator

Active Member

Slow and steady , selling .04 and .05 delta and forming 100 wide IC legs is working well, thanks for the suggest ! To get on with the weekend, I closed the put side of NVDA and SMCI, left the +c positions that were 0.00 bid to expire. Now I just have TSLA +P180 that I hope to see increase value, if the blip we are seeing now is short lived before a probable slide down for a few weeks. Getting out of the Jan 2025 -P240 (using 2022 gains) has removed so much stress contemplating what to do when extrinsic approached $1 and below. I've reduce my cash by quite a bit, but it feels so good to sleep at night. I also decided to keep my shares for the long haul... cost basis is so low. GLTA!View attachment 1028263

secret sauce (not rocket science!):

- max 6Δ (TastyTrade recommends less than 16Δ)

- ladder in daily (roll to 6Δ again when your Δ moves, or STO new daily 6Δ)

⚡️ELECTROMAN⚡️

Village Idiot

I'm pretty sure the bottom is at 158, so I put a sell stop order in for 158.

I was referring to Yoona's 1% ROIC, but agree with what you say and am well aware of it - I lecture my kids regularly how Lucy, privileged and entitled they are...Many of us belong to the richest 1%, but don't realise it.

ChiefRollo

Member

I think it’s probably just you and RSF in that club. We’re simply peeking through the windows with aspirations.I was referring to Yoona's 1% ROIC, but agree with what you say and am well aware of it - I lecture my kids regularly how Lucy, privileged and entitled they are...

Why not write 10x -c240's at the same 3/2025 strike? Do we think the SP will be there by then? I personally don't think so and there'd be plenty of time to roll up if the SP did rally@Max Plaid @MikeC I'm preparing a plan for my 10X -P250 9/20 (extrinsic is $0.80 currently) in case extrinsic drains out in the low $150's and at risk of assignment.

Looking at the chain I can debit roll it down and out to 10x -P240 for 3/2025 (6 months further out; more time for SP to recover or just bounce; gain $5.15 in extrinsic). It will have a debit of about $6,000 which I assume is better than booking a $37,210 loss (the delta between $192.21 CB and ~$155) if I was assigned and immediately sold the shares. I can easily earn the $6k back through my regular scalping.

As an aside, if assigned I can also sell ATM calls for about $10k the week of assignment to help recover some of the loss.

Am I missing something?

Is there a better roll that's not too far out?

Ty

The good news with your current 9/20 -p250's is that there's a lot of OI >12k, but almost zero volume, so no-one is trading them and unless they all get exercised at once, you'd be unlucky

There's quite a few here with a hell of a lot more $portfolio than me, that's for sure, and mine is around 40% of where it was in November 2021, although to be fair with the cash I took out in the interim, probably more like 55%I think it’s probably just you and RSF in that club. We’re simply peeking through the windows with aspirations.

For sure if I had just kept my original shares, never traded anything, my account would be 25% lower than it is right now

Right, I'm off down the pub...

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K