Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

OK guys, my buddy Jenson is talking at 1PM pacific. That dude know how to pump the stock.

Supposed to announce next gen of AI chipset.

Hold onto your underwear or diaper......as this can affect the whole Market.

Supposed to announce next gen of AI chipset.

Hold onto your underwear or diaper......as this can affect the whole Market.

StarFoxisDown!

Well-Known Member

To be a contrarian....if Nvidia were to announce anything too ground breaking, it would actually be long term bad for Nvidia. Who knows what the threshold is for compute power for the majority of Nvidia's customers to have before their need for additional computer power is gone.OK guys, my buddy Jenson is talking at 1PM pacific. That dude know how to pump the stock.

Supposed to announce next gen of AI chipset.

Hold onto your underwear or diaper......as this can affect the whole Market.

For example, take FSD. Elon's commented a couple times now in the past few days that their computing needs are being addressed rapidly. Tesla will obviously still need a lot of computer before FSD still has a ways to go but how about once they get all functionality in and are just on the later part of the March of 9'.

You could argue Nvidia only wants to announce incremental advancements (enough to stay ahead of competition) but to where there will be a many year tailwind of demand

You will get filled. I think TSLA is looking set to go on a end of day run. We will see what it actually does but so far so good.

Ding ding.

I juste sold 6 x 175 CCs for 28/3 on shares I have been assigned on puts and that I have been trying to sell for weeks but failed. If the SP rises then I am happy to let them go

I’m looking to sell calls at ~$185/190 level out 2 months. With a target ~ $197-$200 all in close out return.

You can get -C190 5/17 [email protected] now (=$199)

tivoboy

Active Member

that would be good.. but frankly I’d rather the extra $3 in premium even for the $5 in lower price. I’ll have to re-assess tomorrow.You can get -C190 5/17 [email protected] now (=$199)

that would be good.. but frankly I’d rather the extra $3 in premium even for the $5 in lower price. I’ll have to re-assess tomorrow.

Let us know what you decide. The bullish chatter (such as TSLA may pull a rabbit out of the hat; they're going to let TSLA run now; this time the Earning Call will be more upbeat/surprises; etc.) can be distracting to set up bearish positions.

juanmedina

Active Member

Good video from Sasha:

I am trying to stick to my plan to buy shares after Q1. Tesla raising prices on the Model Y seems like a good direction for margins and I also plan on subscribing to FSD when I come back from vacation and see what all the noise is about. Maybe that will give some guidance to make a decision and pull the trigger on some shares.

I am trying to stick to my plan to buy shares after Q1. Tesla raising prices on the Model Y seems like a good direction for margins and I also plan on subscribing to FSD when I come back from vacation and see what all the noise is about. Maybe that will give some guidance to make a decision and pull the trigger on some shares.

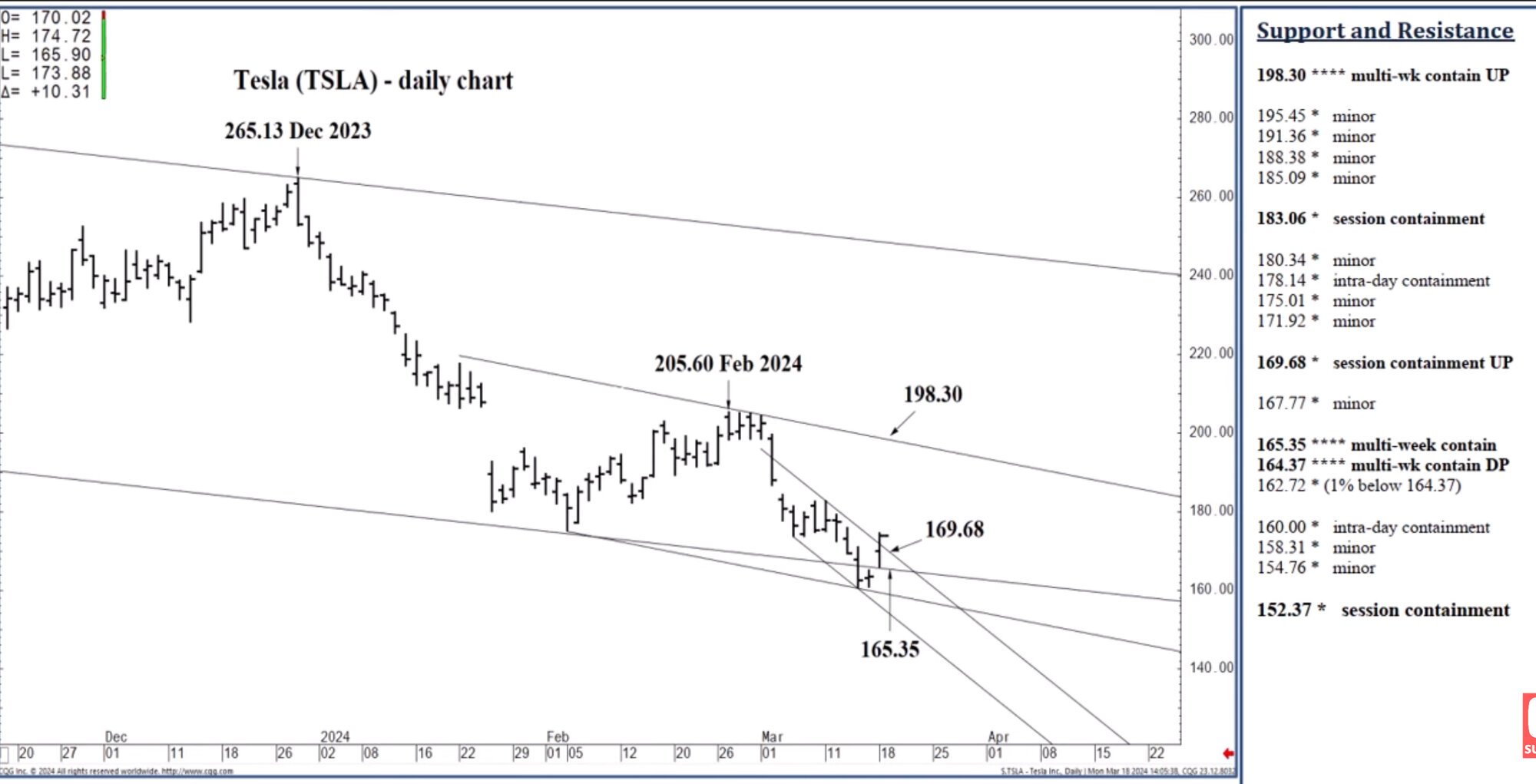

Cary gone bullish on TSLA

Having closed earlier over $171 neutralized the Friday sell signal. One can go long anticipating $198.30 in 1-2 weeks, but keep in mind that TSLA will need to get past $178 and $183 resistances first. A close over $183 any day this week can result in $198.30 by this Friday

Meantime $169.68 can act as decent support and bottom-picking territory.

Watch the short video for the rest:

Meantime $169.68 can act as decent support and bottom-picking territory.

Watch the short video for the rest:

What's your thought on this Jim?Having closed earlier over $171 neutralized the Friday sell signal. One can go long anticipating $198.30 in 1-2 weeks, but keep in mind that TSLA will need to get past $178 and $183 resistances first. A close over $183 any day this week can result in $198.30 by this Friday

Meantime $169.68 can act as decent support and bottom-picking territory.

Watch the short video for the rest:

View attachment 1029413

View attachment 1029412

What's your thought on this Jim?

I'm a big fan of Cary's analysis, he's been on point since I've followed his updates (very long time). Had I acted on his analysis and not been paralyzed with indecision/fear, I would have sold at $265 channel top and bought back at $160 channel bottom (a $630k win...

So to answer your question, macro permitting I do see bullish continuation from here into P&D, prolly a rocky zig-zag, and it may also be wise to consider selling into $190-$195 if we get up there, expecting rotation back down to $160's. NFA.

To add to the intrigue, I have 10x -C175 3/22 I sold for $1.00 that's red ($3.65 now). May be the first roll I'll need to do in months if we keep running. But I think we could test $166-167 tomorrow (Tuesday special!) and maybe I'll BTC then.

I also bought earlier in the morning 12x +P150 4/26 @$4.60 (now red at $3.50). Going decide tomorrow if to STC for a loss based on PA and revisit adding any +P's back later in the week.

Last edited:

Yoona, can you pls explain a bit what he means?

tivoboy

Active Member

Will do.. frankly, i don’t think anything about the overall narrative or industry/secular narrative has changed and to some extent it’s a bit worse. So I’m fine trying for these levels and payouts overall. Is there a risk of a $25 run up from here for SOME reason, sure but $200 is a concrete ceiling at this point and will be very difficult resistance for a while. It would take something truly substantive to get us up and OVER and open up much upside. I’m happy to see that happen, but also happy to pick up the play at that point with more conclusive info and not just optimism. I put the over under here for a $20 move to UNDER and not over in the next 45 days. Stay frosty.Let us know what you decide. The bullish chatter (such as TSLA may pull a rabbit out of the hat; they're going to let TSLA run now; this time the Earning Call will be more upbeat/surprises; etc.) can be distracting to set up bearish positions.

he suspects this is a bull trapYoona, can you pls explain a bit what he means?

i like his posts... somehow he has access to data that no one else has and customized his TV for it

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K