me also, 58% daytrade in less than an hr, closing itgot a quick 1K on the 4 NVDA puts so sold 4 850 Puts for next week -- $14+ premium each

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

AAPL has been a good scalping play lately. Seem to bottom out at 168 then do this dance to 172plus then repeat it self for weeks now.

Wicked stock provided some good strategy.

The plays are cheap since IV are low but volatility in PA lately amplified the returns.

Wicked stock provided some good strategy.

The plays are cheap since IV are low but volatility in PA lately amplified the returns.

Earlier in the day, TSLA:

STC 100x 4/26 -c165 net +$11.35

BTC 100x 4/26 -p165 net -$7.9

STO 100x 4/26 -c150 @$11.6

Now, 100x 4/26 -p140, to sell or not to sell, that is the question... had an order open most of the day at $3.1 and it missed buy 5c (as often seems to be the case...)

Lower the limit now, or wait and see tomorrow...?

STC 100x 4/26 -c165 net +$11.35

BTC 100x 4/26 -p165 net -$7.9

STO 100x 4/26 -c150 @$11.6

Now, 100x 4/26 -p140, to sell or not to sell, that is the question... had an order open most of the day at $3.1 and it missed buy 5c (as often seems to be the case...)

Lower the limit now, or wait and see tomorrow...?

Feels like Elon’s more engaged in Tesla the last couple weeks than in the past few months (or more). Whether for good or for bad, it’s good to see him back.

@Jim Holder r u done setting up the page? i am thinking you can send the updates from now on, TYVM!@Yoona I started a trial of Quant. Below is one of your screenshots from Quant. Is there a way to set the screen to look like this or is it just an assembly of screenshots?

View attachment 1038556

Let's hope he's not doom & gloom on Earnings call............ but there again selfishly I won't mind a >10% dip as I am sitting in 80% cashFeels like Elon’s more engaged in Tesla the last couple weeks than in the past few months (or more). Whether for good or for bad, it’s good to see him back.

juanmedina

Active Member

Are they prioritizing margin instead of volume now? How will the market will react about no growth but higher margins?

aerocristobal

Member

it might hit the ceiling on daily, weekly, monthlySMCI is rocketing today. I got assigned a couple of puts for 965 two weeks ago and thought it might be another week or two before the price recovered, but not any more

View attachment 1039079

This is true, and we were complaining that Elon was distracted by his other companies.Feels like Elon’s more engaged in Tesla the last couple weeks than in the past few months (or more). Whether for good or for bad, it’s good to see him back.

The problem is that this feels like he just now realized the issues and is scrambling to fix everything at once.

I reopened +p150-155 for the next few weeks and -c155-160 for this week. Also trimmed a small percentage of shares.

I still expect to see 145 gap fill at some point this month. Around there I’ll look to start buying back the shares or maybe 12/26 +100c.

SpeedyEddy

Active Member

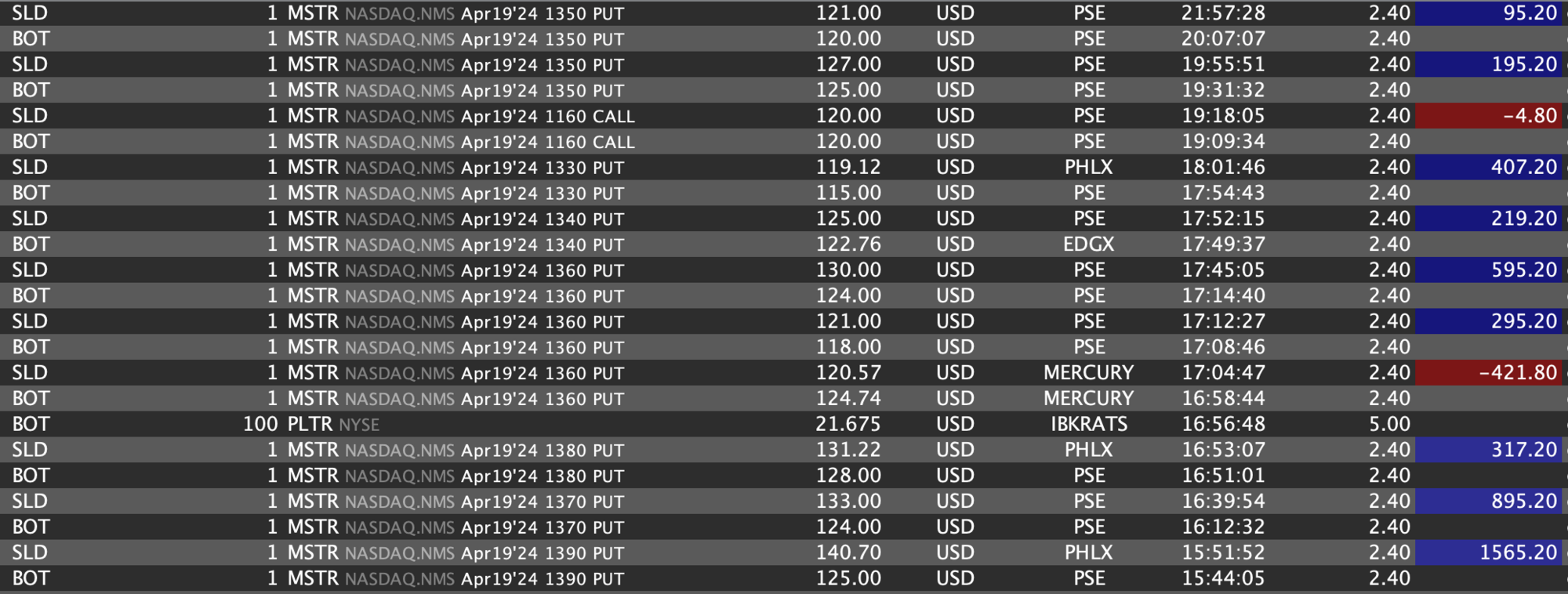

Some nice MSTR trades brought me, amongst money, another 100 PLTR. I had to keep the buttocks tight for long on the last trade, that went green just before the close.

times are CET

PS still holding 1140 Put for Friday.

PS 2 BTC halving will possibly already occur on Friday depending on when block 840.000 will be mined ready

times are CET

PS still holding 1140 Put for Friday.

PS 2 BTC halving will possibly already occur on Friday depending on when block 840.000 will be mined ready

Last edited:

thenewguy1979

"The" Dog

He have too much on the line and he know it. More on the side of what else can he do to pump the stock before and during ER...Let's hope he's not doom & gloom on Earnings call............ but there again selfishly I won't mind a >10% dip as I am sitting in 80% cash

thenewguy1979

"The" Dog

Got to be careful on the tight buttock comment. This aint no jailhouse you knowSome nice MSTR trades brought me, amongst money, another 100 PLTR. I had to keep the buttocks tight for long on the last trade, that went green just before the close.

times are CET

View attachment 1039082

@Jim Holder r u done setting up the page? i am thinking you can send the updates from now on, TYVM!

View attachment 1039077

Haha...sure...here's what I got. BUT I'm not good yet with interpreting the data like you can. I'm happy to post screenshots intraday but would appreciate if you could chime in what we're looking at ;- )

Last edited:

@Jim Holder r u done setting up the page? i am thinking you can send the updates from now on, TYVM!

View attachment 1039077

@Yoona as a test for myself, let me know if my read on the data from left to right on the below is correct:

TSLA is likely boxed $155-160 rest of the week, Vanna saying cap/resistance $160 up, delta is saying lots of downward pressure from puts. Heatmap showing more puts than calls=bearish. Next row below: Next week still bearish, maybe $150 magnet/floor. May 3rd opens possibility of even lower, but some green up top can help hold it up. May 10 $150-$160 again. Net Premium flow shows some call buying but weak.

SpeedyEddy

Active Member

In either case everything below 146 is IMO always a good entry point (to go in long, so no short-term trades, no margin). This bottoming coincides with a spring-flaw that occurs in every election-year. I will switch some PLTR and hopefully MSTR P1140 money to buy in (and sell -P dec '26) especially when it would be getting more violent in the middle-East the coming days. (Which I surely do not hope for, human lives matter more to me than earning a bit but signs tell me hoping that will not be of any help)This is saying that we're bottoming out, UNLESS we crash.

And what if they sell less cars as a result and the P&D drops further...?Are they prioritizing margin instead of volume now? How will the market will react about no growth but higher margins?

It would be nice to see him in cheerleader mode again after these last few terrible calls. I could definitely see a scenario where we bounce hard coming out of it because “the bad news is out of the way” or “sell the rumor, buy the news” after everyone loads up on long puts and short calls for the ER.He have too much on the line and he know it. More on the side of what else can he do to pump the stock before and during ER...

Whilst I agree with your thought there are certain things he is unable to control. Prolonged elevated interest rates & overall macro fears. Possible banking meltdown & wars. He of course knows all these things & has not been shy to warn us about them in the past. Speaks the truth & many on WS don't necessarily like to hear it. (The negatives)He have too much on the line and he know it. More on the side of what else can he do to pump the stock before and during ER...

A++++@Yoona as a test for myself, let me know if my read on the data from left to right on the below is correct:

TSLA is likely boxed $155-160 rest of the week, Vanna saying cap/resistance $160 up, delta is saying lots of downward pressure from puts. Heatmap showing more puts than calls=bearish. Next row below: Next week still bearish, maybe $150 magnet/floor. May 3rd opens possibility of even lower, but some green up top can help hold it up. May 10 $150-$160 again. Net Premium flow shows some call buying but weak.

View attachment 1039089

gamma (market participants) expecting 150-160, judging from tall gammas

cluster of gammas likely to be magnet, especially the tallest

it doesn't necessarily mean tall gammas are supp/res since sp might slide through them, but they are magnets so it's approx below or above the wall

as we approach 0dte, tallest gammas may be the same as tallest OI walls, so that's double confirmation

greeks are just another TA tool, you still need other TA (lines, fibs, MA, EW, etc) to confirm your analysis

dealers (vanna) prefer 150-170, if they can push it

all that on a normal day... if there is a black swan then greeks mean nothing until sp stabilizes back and IV dies down

greeks 'per $1 move' is more accurate than 'per 1% move' as the screen refreshes faster

lowest/highest premium probably magnets, but not necessarily

maxpain is useless, but nice to know

contract stats (premium) is very important to indicate bullish/bearishness for the day, especially if lopsided

aggressive moves (buyer or seller can't wait):

puts bought above ask = bearish

calls bought above ask = bullish

puts sold below bid = bullish

calls sold below bid = bearish

thank you!

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K