it worked!

i had SMCI B/W stuck at 901.66 pre-earnings

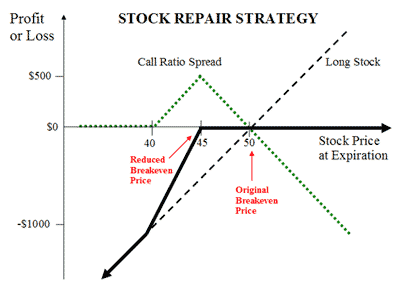

instead of weekly -c905 CC and wait forever for sp to rise, i did a 1:2 Call Ratio Spread aka Stock Repair Strategy aka CC + Bull Call Spread

+c835 x1 and -c870 x2 reduced my breakeven from 901.66 into 865

rinse/repeat and i'm out with no capital loss since there is large initial credit every week

View attachment 1045346

You did your homework, picked a great stock, totally undervalued and ready for a nice price rise. However, after you bought the stock, the damn thing goes and drops 20%. So what do you do now?

optionstradingiq.com