sundaymorning

Active Member

I have invested as much money as I am willing to lose without endangering my future -- but I may add more as finances permit. Yes, it is risky, especially with the powers gunning for Tesla, but the upside is also large, and I want to be apart of that potential success.

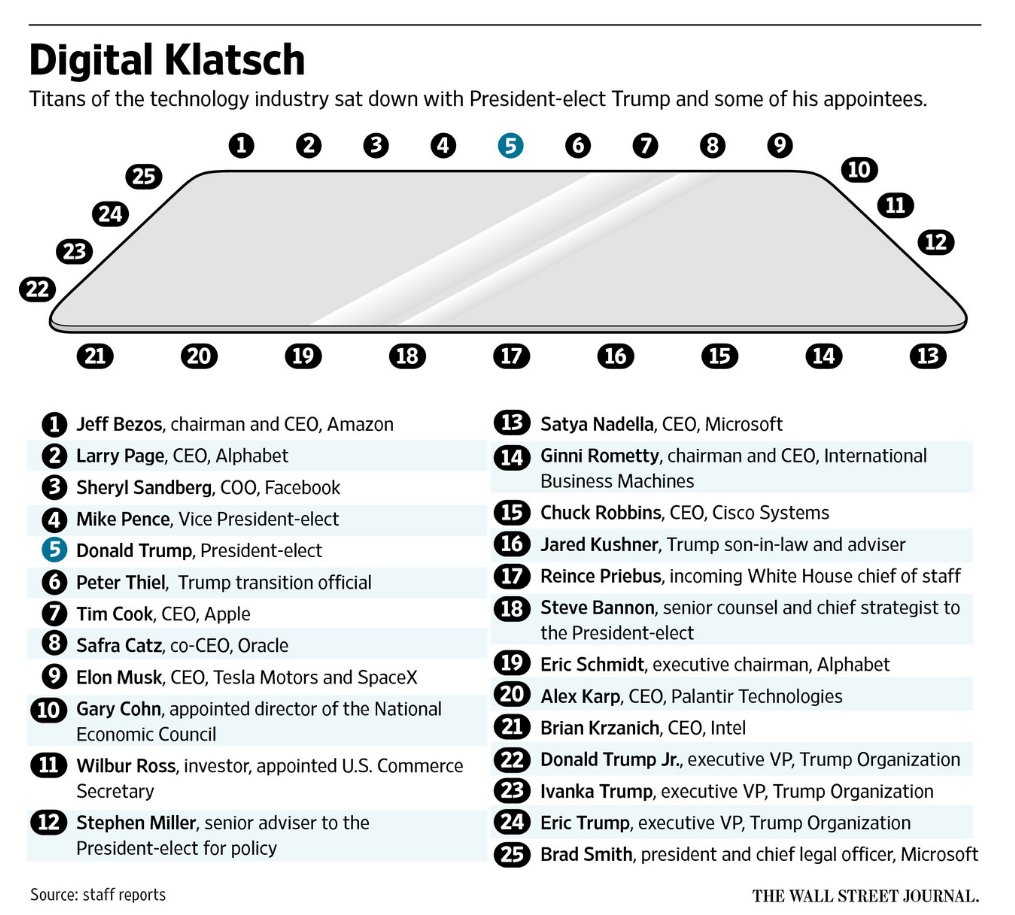

As an aside, I must say that the meeting with Trump has certainly galvanized the players here. I prefer to bet with EM and optimism, than bet failure and pessimism. Playing short means that when you win, someones dream has failed, how sad.

Longs here are very honest people. But shorts are a different story. They won't mind lying through their teeth to make a quick buck. They spread FUD and misinformation because they have no alternative. If I were short, I would resort to spreading FUD too, out of my own fear of losing.

Tesla isn't as risky as some may think it is. You've seen M3, you've seen the lines.... it's execution from here on out.

Last edited: