This seems very unlikely. Anyone have any hard evidence of this? Could different MMs handle it differently?

Knowing that Elon has discussed burning the shorts, people's imagination is working overtime most likely.

Knowing that Elon has discussed burning the shorts, people's imagination is working overtime most likely.

Because that's how dividends work.

It's explained in exactly the paragraph you quoted in your post.

That's not correct.

The guy who is now the owner of record (which is neither the lender of the share, nor the short of the share-it's the guy who BOUGHT the shorted shares from the shorter) gets the 4 extra shares from Tesla as a dividend.

The short OWES the original lender 4 extra shares that he WOULD HAVE gotten from Tesla as a dividend- and he owes them on the same date the dividend would've been paid.

You don't get to just owe those 4 extra shares "whenever"

You can still repay the 1 original share whenever. But the 4 dividend shares you own ON dividend day.

If it's a dividend.

If it's a normal split, then yeah, you just now owe 5 whenever instead of 1 whenever.

THAT is why split vs dividend matters for shorts.

So @ihors3 says 10.53M shares short (on Aug 7th), so at current volumes that would take a couple of days for the shorts to cover, if that was the only trading happening. In reality they have a few weeks in which to cover, so it will probably only add about 1M shares/day to the trading. But then there's the snowball effect of pushing the price higher, so they need to cover as soon as they can, so...

Edit: another way to look at it. Tesla will issue 4*186M new shares. But the broker's books will show an extra 4*10.53M shares owned either by the owner of record or the lender. 10.53/186 ~= 5.6% of the new shares that are unaccounted for, and that will come straight from the shorts, one way or another. So, because TSLA is so heavily shorted, there actually is a value increase of about 5% per share. I think.

Not if it's a dividend, no. That's the key difference from a regular split.

Yes. For the cash amount of the dividend.

In this case, the dividend is 4 shares of stock

Thus, on August 28th specifically, they must pay the lender of the 1 share, 4 shares of stock.

They can't pay them with anything else. And they can't wait later to pay them either.

In short (pardon the pun)-

They don't magically "owe" them 5 shares anytime instead of 1 share anytime.

They owe them 1 share anytime just as they did before, and they own them a 4 share dividend ON the date the dividend is paid- August 28th.

All of this assumes 2 things:

it IS a dividend and not a regular split.

And-

They are still short T-2 days from the registered date (Aug 21).

So there's gonna be shorts rushing to cover in the next ~5 trading days to avoid all this.

And then more of them rushing to come up with 4 post-split shares per borrowed share by August 28th.

No, they absolutely can not.

The dividend isn't cash. In any amount. It's 4 shares of stock.

They don't get to pick how they provide the dividend to the lender- it must be exactly what a holder of record would've gotten if they'd not lent the share.

Likewise they can't give a lender a share of stock worth what a CASH dividend would've been worth that day going the other direction.

The difference is they owe them 4 shares on August 28th specifically.

Not "anytime they decide to close their short"

That's a huge, huge difference.

Of course it does.

They are required to pay the lender the full dividend ON the dividend payment date.

That's a forced payment on a specific date.

Post SPLIT they would.

Post dividend is not the same thing

Post dividend they still owe 1 share anytime they wish to close their short.

But they owe 4 shares on august 28th specifically

If it's a dividend it means exactly that.

They owe 4 shares (per borrowed share) on August 28th to the lender of the shares.

Split and dividend are treated differently for shorts from each other.

@Knightshade Why are you speaking so certain?

A short's obligation is between them and their broker. You are saying the broker will force the short to immediately cover 4 post-split shares on the effective date. This does not make sense from the broker's perspective.

Why would they do that when:

1. Those 4 post split shares are immediately available to borrow again, meaning the short can just cover and then short again immediately.

2. The short is their customer, and doing this will upset their customer.

3. The broker themselves can benefit from the shorts continuing their original position because the broker keeps a portion of the interest.

The share lender has to be given 4 real voteable shares, they can't be "fake" non-voteable shares like the one they are holding in place of what they lent out.

But, after thinking about it some more I think the broker will just handle this for the shorts in the background. There are plenty of shares available to borrow, so the broker will just borrow 4x more shares and deliver them to the lenders, and then update the shorts account to reflect that they lent those out as well. And once they have delivered those shares to the lender they can then borrow and lend them out just like the original shares.

mayhem

@Knightshade et all

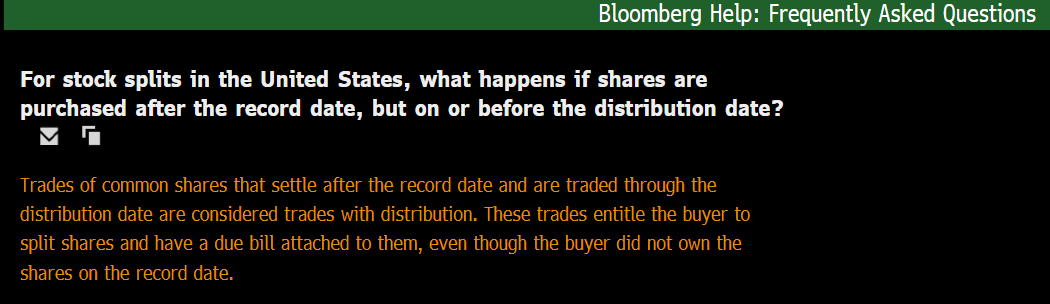

a forward stock split is categorized as a dividend event. stop getting hung up on the language. its a split.

the dividends category in the world of corporate actions include stock divs, cash dividends, and forward splits. and no, forward split isn’t taxable in US.

a spin-off can be. a cash div is, even a regular stock div (income)

not a split.

reverse splits are reorganizations.

next,

if you have have 100 shares you’ll now have 500, if you hold until ex date monday 8/31

just like if you’re short 100 you’ll be short 500

the borrow of 100 shares to cover your short becomes a borrow of 500 shares at 1/5 the price

and yes, the stock loan contracts are marked to market.

and no, you don’t owe 500 shares back if short on record date, or pay date. you’d just stay short, but now 5x, until you chose to close out. the loan contract stays open as long as you’re short.

..unless you are on the end of a fail to deliver to nscc in which case you’d be bought in. but tesla is liquid right now, and not hard to borrow.

if you were short a stock when a cash div went ex-date, you’d be debited the cash div amount on pay date.

friday 8/28 is the last day to open or adjust a position to be affected by the split

if you close or adjust your position on friday 8/28 those positions traded will not be affected by the split.

if you have 1 november20 1500 call

for example

it will now be 5 november20 300 call

at least if the oOCC handles it like they’re handling appl

https://infomemo.theocc.com/infomemos?number=47369