Hock1

Member

Doesn’t matter. There’s no way I would trust the numbers, considering who actually reported them.The SEC reports of FTDs say that they provide only cumulative totals; you have to take differences to see the daily changes.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Doesn’t matter. There’s no way I would trust the numbers, considering who actually reported them.The SEC reports of FTDs say that they provide only cumulative totals; you have to take differences to see the daily changes.

Model 3 registrations in Europe will likely not surpass 2000 in February.

So you think that nearly half of the registrations in Europe were in Norway alone (a location that required a second shipping stage to get vehicles there)? 906 registrations there in February. Norway is probably <30%, I'd guess around 25%.

Weird that you think that they're behind schedule in Europe, when they started delivering in mid February when customers were told that deliveries wouldn't begin until late February.

Good point. Still. Does the price changes and then the chaotic allocations of compensations sounds like a plan that they had carefully planned?

Karen, how do you reconcile that as of now the avail date for the SR M3 (35k) is still 2-4 weeks? How is that possible with the backlog of reservations and floodgates of others who can now afford to buy a M3??You think that they spontaneously started generating new models of vehicles with no prior planning? That you can spontaneously whip new packs, new interiors, a new order site, and new federal approval for the new models into existence?

Karen, how do you reconcile that as of now the avail date for the SR M3 (35k) is still 2-4 weeks? How is that possible with the backlog of reservations and floodgates of others who can now afford to buy a M3??

Karen, how do you reconcile that as of now the avail date for the SR M3 (35k) is still 2-4 weeks? How is that possible with the backlog of reservations and floodgates of others who can now afford to buy a M3??

Thanks. Are you still short term bearish?High production rate and their strategy from late last year of maintaining inventory of common configs.

No, I don't think there's some inexhaustible waiting list in the US (and hasn't been for some time, most of the orders they've been taking are new, and a lot of people who initially wanted SRs either upgraded to MR or got some other vehicle). I think people here often overestimate "waiting lists". At the same time, I also think people tend to underestimate new orders. They've been driving Tesla in the US for the latter quarter, possibly even the latter half, of last year.

Thanks. Are you still short term bearish?

According to my calculations (see elsewhere on this forum), unrestricted cash for Tesla stood at $1.1B right after the bond payment with several hunderds of millions of possible downsides. That would explain the fire sale and severe cost slashing we're witnessing. It's also lower than management possibly anticipated : the delivery ramp in Europe is going relatively slowly. Despite 4 vehicle carriers unloaded already, Model 3 registrations in Europe will likely not surpass 2000 in February. March will see a large inflow of cash as cars gets delivered. Still, I could see Elon describing this moment in time in a few years as 'Tesla passed within weeks of bankruptcy'. I have trimmed my holdings accordingly. Not an advice.

I really don’t understand the huge price drop on european Model S and X prices.Not sure about $70k but French prices look $10k lower to me (Model S). Can anyone confirm.

M3 - LR AWD and above only available in France - not sure about prices.

Anyway, it's not so important. The question is, does the company behave as it is low on cash or not?

I really don’t understand the huge price drop on european Model S and X prices.

I bought 85D 2015, comparable model now costs almost 20% less.

This!! EM is a bit crazy sometimes, but I trust him doing the right things, and makes adjustments if necessary.In Elon we trust. So say we all!

As a customer, I'm not complaining. As an investor, I don't understand.

The answer is the same for both, progress.As a customer, I'm not complaining. As an investor, I don't understand.

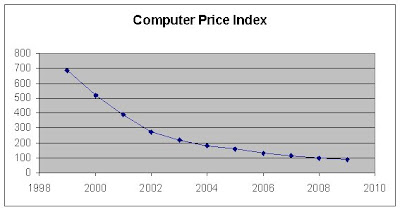

Wow, these are really cool!Right-hand side. All dollars are on the same scale.

BTW: AP now appears to be detecting stop lines at intersections in shadow mode:

And it's no-fun days over in Ford:

Anxiety builds among Ford employees. Hackett says that's fair, but he's confident