Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

My guess is that Elon is probably optimizing the thrusters for cornering rather than straight-line acceleration. He's probably aiming to make a car that can beat the all-time Nordschleife lap time by maybe 30 seconds or so. With a production car. When you can take the sharpest turn on the 'ring at 140 MPH the hardest part will be keeping the driver from passing out.

Elon actually said Tesla could aim for a 7 second Nurburgring lap with a mass produced, unmodified from the production line model S, guess Plaid is going to be an alien spaceship.

Pretty sure he meant 7 minutes and accidentally said seconds but that’s an impressive level of engineering for any vehicle. There are modified one offs that can go quicker and those are impressive in their own right.

JRP3

Hyperactive Member

Surprised to hear Elon support the simplistic idea that more CO2 is better for plants. Yes plants may grow faster and larger with extra CO2 but they can also end up weaker, less able to survive taxing conditions, and have lower nutrient values. I'd think he'd have a better handle on all effects of rapidly increasing CO2 levels.

pitabun

Member

So many peeps here are so critical of this interview. I thought it went great, although a bit questionable talking about AI and the clean up on aisle 6.

Interview really shows Elon's love for Model S & X. X in particular seemed to be their pride & joy of the - this really doesn't align with our mission, but let's do it just 'cause - mentality.

Man I wish I wouldn't have to sell shares to own PLAID or X, but it just means I can't afford it!

Interview really shows Elon's love for Model S & X. X in particular seemed to be their pride & joy of the - this really doesn't align with our mission, but let's do it just 'cause - mentality.

Man I wish I wouldn't have to sell shares to own PLAID or X, but it just means I can't afford it!

Does it (significant reverse gamma-hedge) happen when the puts strike so far OTM (like the $20 in this case)?

@FrankSG @generalenthu, and of course others, comments please?

Those $20 strikes will be a piss in the wind even if Tesla falls to 200. I don't have a phrase to describe how inconsequential they are from the delta or gamma they add.

That said, I can think of one weird reason they could be useful. If you're looking to exit out of deep out of the money puts, juicing the option vols would not hurt, especially after a sharp pullback. And throwing a little money on catastrophe puts can help keep the vols elevated for a bit. The phrase for that would be painting-the-tape I believe.

My company’s duffel bags are of the highest quality with a water proof liner. The closures are a special patented design which makes the bag both water and air tight. The bags themselves can withstand a drop from 30,000’ and are guaranteed not to explode on impact keeping your cash safe. The bag can be buried in any kind of soil and will not biodegrade for 100 years. It also flame retardant and stands up well to acid baths. No scenario has been overlooked. Your cash will be safe.

Sorry mods for O/T, but we're AH so...

Back in the day, I used to fight Forest Fires in Northern Ontario as a summer job. We would routinely be punted from the midsection of some variety of Bell or Eurocopter into a water source* along with our gear, mostly away from the flamey end of the fire. Our personal gear bags were canvas, zippered units that contained an impermeable liner that made them air and water tight. Fire, not so much. Never had the opportunity to test with acid or bury them for any significant period of time. I think we'd sometimes throw the non-breakable stuff from a couple hundred feet if the trees were tall, not quite 30,000'.

The liner worked great, but as I discovered on my first fire, nobody tells you need the bag AND the liner, and so you end up watching in horror as the next 3 weeks worth of socks and underwear (not cash) is thrown out of the helicopter and thoroughly soaked in that water source before you've even had the chance to set your boots on the ground.

That job will make you thankful for the little things in life, like dry feet.

*I read once that northern Ontario has something like 500,000 lakes, and I believe it, but the fires unfortunately don't value waterfront property the way people do, and so we often were dumped wherever was wet/close enough to the fire for the pump to pull water and jumping 30' of out a helicopter was unlikely to cause serious injury. Great times.

According to CICC, Tesla Shanghai factory produced 24.8k vehicles in Jan 2021 (Source: CCA), up 9.9% [MoM] from Dec 2020; Tesla's domestic sales in Jan 2021 were 15.5k units, mainly due to the large export volume and the slow ramp-up of Model Y production capacity.

CICC remains optimistic about Tesla Shanghai factory's capacity ramp-up and maintains its judgment that the annual production of Shanghai factory will be above 450k units.

https://twitter.com/realteslar/status/1360082204466941956?s=21

CICC remains optimistic about Tesla Shanghai factory's capacity ramp-up and maintains its judgment that the annual production of Shanghai factory will be above 450k units.

https://twitter.com/realteslar/status/1360082204466941956?s=21

Webeevdrivers

Active Member

Guess we'll be waiting a little longer to drink to 1000 bucks with the wifes hand painted wine glasses.

Maybe next week.

Maybe next week.

Stone_Watcher

Member

Why does expiry feb 19th look so strange and feb 26th look fairly normal?

View attachment 635986 View attachment 635987

I've never seen anything like that. I showed a buddy who's been trading derivatives for twenty years and he's puzzled.

Possibly a way for someone to generate cash to avoid a margin call? Why am I not selling these? I'll sell 150k!

2daMoon

Mostly Harmless

Surprised to hear Elon support the simplistic idea that more CO2 is better for plants. Yes plants may grow faster and larger with extra CO2 but they can also end up weaker, less able to survive taxing conditions, and have lower nutrient values. I'd think he'd have a better handle on all effects of rapidly increasing CO2 levels.

Besides, ... everyone knows it's Brawndo that has what plants crave.

asburgers

Sell order in at $8008.5

Criscmt

Member

The $500 reduction does apply to all who cross the 200,000.So, that $500 reduction doesn't apply to other makers as they cross the 200,000 threshold? I had assumed it would be applied equally to every manufacturer.

I am sorry, what in my wording made it appear otherwise?

Criscmt

Member

Those $20 strikes will be a piss in the wind even if Tesla falls to 200. I don't have a phrase to describe how inconsequential they are from the delta or gamma they add.

That said, I can think of one weird reason they could be useful. If you're looking to exit out of deep out of the money puts, juicing the option vols would not hurt, especially after a sharp pullback. And throwing a little money on catastrophe puts can help keep the vols elevated for a bit. The phrase for that would be painting-the-tape I believe.

Would you be able to take a look at this thread, about reverse gamma squeeze, and share your comments?

My limited knowledge seems to say the points mentioned don’t actually point to any such dangerous setup for the stock.

I am not clear about this

@FrankSG ?

Ability to do a 180 turn at the end of my driveway so I don't have to back out or do multi-point turn.

Parallel park instantly by moving sideways into a spot.

and I could start a sandblasting business without having to buy additional equipment.

Tesla would win the Nurburgring ring even if there are faster cars. Just let those pass on the outside and blast them into the guard rail with the thruster.

Artful Dodger

"Neko no me"

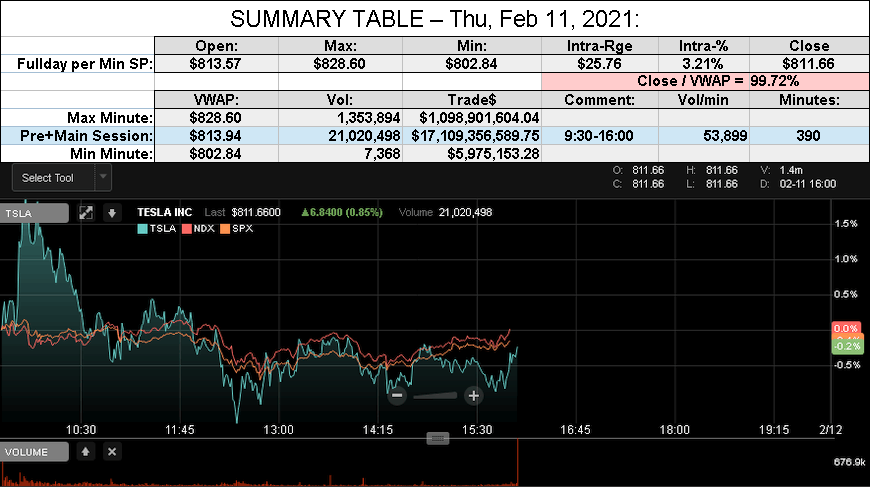

After-action Report: Thu, Feb 11, 2021: (Pre+Main Session Trading)

Headline: "TSLA Capped to Macros"

Pre-Market:

Main Session:

TSLA S&P 500 Weight: TSLA/FB = 1.849464% (Feb 09)

Mkt Cap: TSLA / FB $779.075B / $769.982B = 101.18%

NB: Yahoo & Google have updated Mkt Cap re 10-K shares (Feb 10, 2021)

CEO Comp. Status: (est'd Mkt Cap including 10-K (Feb 01) shares)

Comment: "Serfing the Wave"

QOTD: @Curt Renz "However, I suspect what you wrote includes a typo"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Capped to Macros"

Pre-Market:

Volume: 481,711

SP High $820.00

SP Low $804.82

SP High $820.00

SP Low $804.82

Main Session:

Traded: $17,109,356,589.75 ($17.11B)

Volume: 21,020,498

VWAP: $813.94

Close: $811.66 / VWAP: 99.72%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $837.50 (-$12.50 from Wed)

Volume: 21,020,498

VWAP: $813.94

Close: $811.66 / VWAP: 99.72%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $837.50 (-$12.50 from Wed)

TSLA S&P 500 Weight: TSLA/FB = 1.849464% (Feb 09)

Mkt Cap: TSLA / FB $779.075B / $769.982B = 101.18%

NB: Yahoo & Google have updated Mkt Cap re 10-K shares (Feb 10, 2021)

CEO Comp. Status: (est'd Mkt Cap including 10-K (Feb 01) shares)

TSLA 30-day Closing Avg Market Cap: $810.25B

TSLA 6-mth Closing Avg Market Cap: $526.18B

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Mkt Cap req'd for 9th tranche ($500B) likely achieved Wed, Feb 03, 2021

Nota Bene: Operational milestones req'd (chart at link).

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $526.18B

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Mkt Cap req'd for 9th tranche ($500B) likely achieved Wed, Feb 03, 2021

Nota Bene: Operational milestones req'd (chart at link).

FINRA Volume / Total NASDAQ Vol = 40.9% (40th Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 43.2% (47th Percentile rank Shorting)

FINRA Short Exempt ratio was 0.84% of Short Volume (49th Percentile Rank Exempt)

FINRA Short / Total Volume = 43.2% (47th Percentile rank Shorting)

FINRA Short Exempt ratio was 0.84% of Short Volume (49th Percentile Rank Exempt)

Comment: "Serfing the Wave"

QOTD: @Curt Renz "However, I suspect what you wrote includes a typo"

View all Lodger's After-Action Reports

Cheers!

To be honest, I'm ok with somebody already doing everything they can to fight something, not keeping up with ALL it's negative impacts in detail.Surprised to hear Elon support the simplistic idea that more CO2 is better for plants. Yes plants may grow faster and larger with extra CO2 but they can also end up weaker, less able to survive taxing conditions, and have lower nutrient values. I'd think he'd have a better handle on all effects of rapidly increasing CO2 levels.

Criscmt

Member

The Feb-19 graph looks the way it is because it’s skewed by the interesting and crazy high volume very low strike ($20-$50) puts someone bought.Why does expiry feb 19th look so strange and feb 26th look fairly normal?

View attachment 635986 View attachment 635987

Those puts are making volume of options at other strikes abnormally low, but if you look at the volume of those strikes, their y-axis numbers are in the normal range.

I read about such low strike puts ($20 strike) bought for Mar-19 expiry, but not these ones expiring Feb-19, interesting...

Tslynk67

Well-Known Member

That's a whole lotta worthless puts at a $20 strike price. I assume they were bought pre-split at $100 strike price, betting on bankwuptcy

I think they were bought this week, was discussed quite a lot here, some theorising that they might have been a cause for the SP's big drop on Tuesday

Edit: disregard the above, I have been put-straight by AD...

Last edited:

Artful Dodger

"Neko no me"

No, Puts at the $20 Strike price have been high for a long time (I've been tracking this since Jan 29, 2021). Put OI is only up by 15% since then, and highest Put has been at $20 throughout:I think they were bought this week, was discussed quite a lot here, some theorising that they might have been a cause for the SP's big drop on Tuesday

So, the alternate explanation is more likely (margin protection).

Cheers!

Criscmt

Member

I thought about margin protection as a factor, but the bulk purchase of $20 strike puts wouldn’t be margin protection I suppose, right?No, Puts at the $20 Strike price have been high for a long time (I've been tracking this since Jan 29, 2021). Put OI is only up by 15% since then, and highest Put has been at $20 throughout:

View attachment 636063

So, the alternate explanation is more likely (margin protection).

Cheers!

Of course, unless theoretically someone super rich or large fund is using a lot of margin.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K