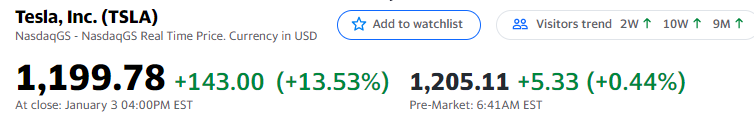

There seems to be a bit more chatter about this being a gamma squeeze. Gawd NO! Too much volatility, I want this to be a fundamental move, based upon long term valuation, not some short term gamblers payday.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

petit_bateau

Active Member

Let's see, @Gigapress seems to be at $40k income, which implies (using 5%) an $800k portfolio.Option 1: Since you're an engineer, you have the raw tools to start your own startup. That is a hoot, hard work, and the rewards could easily be 10x to 100x what you've made from your investments (ever wanted your own jet?).

Option 2: Start a family. Also rewarding! You can be retired while you enjoy life playing tennis, golf or whatever while you raise your kids at home.

Option 3: Since you're only 27, my recommendation is to do 1 then 2.

Good luck!

One good outcome (well done) does not mean aquisition of a cloak of invincibility.

If you go do your own start up in the engineering sector (outside of software) aimed at any non-trivial serious problem it is soooo easy to burn through $800k it is unreal. Bear in mind the general adage that 8/10 startups fail utterly. 1/10 makes breakeven, and 1/10 does well and the odds of success are pretty poor. My own opinion is that the general adage averages are heavily skewed in a positive manner by the relatively low-impact low-cost plays you see (new drinks, foods, S&M plays, etc) and that the real numbers for science/engineering-hard problems are much worse, i.e, greater probability of failure. And doing it in a field like renewables will be even harder for a range of reasons we can discuss. (Getting hard data on these outcomes is tricksy).

And ... going through a business failure like that tends to make the probability of divorce quite high (edit: actually even if successful the pathway is so hard relationships suffer). Especially if kids in the mix. Which would tend to make the divorce even more expensive. (So, whatever else one does, always get a pre-nup with the he/she of your dreams if/when you meet them).

And ... getting rehired after (say) 10-20 years of hippiedom and/or failed new-venturedom at the (then) age of (say) 40-50 is quite difficult. It doesn't really matter whether it should be that way, and I do hear that USA is better in this respect to an extent, but one should not dismiss this point out of hand. That in turn means the ability to refill the pot if/after the rather depressing above series of bad outcomes were to come to pass becomes a fairly difficult exercise.

So if you go down those pathways good luck ! Alternatively most folk I've known in that position (e.g. trusties, Microsoft millionaires, dotcommers, etc) who have had fulfilling lives seem to have done it either by staying involved in work in academic contexts, or staying in work in life-style business contexts, or by inflicting themselves on the charitable sector.

And then there are those I have known who have not had fulfilling lives. Some complete trainwrecks in fact. Wasn't it the famous footballer George Best who explained how he blew his fortune as, "I spent about half on booze, women, and drugs, the other half I just wasted".

Last edited:

HG Wells

Martian Embassy

Put some in the bank and get sniped.So...I followed through on this comment from October.

I retire in 10 days.

It feels surreal to be doing this after only 6 years of engineering work, and before even buying my first house or car. All my material possessions can be packed up to move in one day. I am very glad I decided to use most of my income to buy peace of mind and freedom. It feels like I found a loophole in society.

@farzyness has shared in some recent YouTube videos his desire to use the TSLA abundance to take time off to explore and find out what being a human is really about before attacking the next phase of his life. I feel the same way, except for me that adventure may end with a new beginning at Tesla or Boring Co. On the other hand, maybe I'll want to start my own business finally, or step away from the Musk world for a while and get a job somewhere else. Honestly, I don't know right now and I would appreciate any advice from those older and wiser than I, especially those like @Artful Dodger who have given a middle finger to the rat race early in life, or those like @Discoducky who have worked at Tesla.

I wanted to share this here today for a several reasons:

1) Contributing to our community's current camaraderie and euphoria.

2) Inspiring others here to go hardcore with shoveling as much of their capital as possible into investments to build a brighter future for themselves and all of humankind, especially those who are still young enough to do this before the encumbrances of marriage or kids.

3) Asking for advice, as mentioned above.

4) Offering advice for anyone who wants tactics, frameworks and mindsets to save this much this quickly while maintaining a better-than-average standard of living.

5) Inviting American TMC members who might like to meet up to consider sending me a DM, because in a few months, I'll be slowly travelling all around the USA. I've already penciled in a plan with one member in New Orleans. I also intend to spend the summer of 2023 in France if the pandemic has completed by then, and I would enjoy organizing a Euro TMC party.

I love you all.

(Technically I'm not retiring yet; my manager and I set up an unpaid leave of absence for 6 months so I can come back in July if I want to. Something to consider for anyone else considering quitting early but feeling nervous about the finality of terminating employment at their company.)

Finding out you had a kid you had NO knowledge about can be a significant financial drain.

The wife (even though it happened YEARS before you met her) will always scream and yell when you write that medical school tuition check.

Nolimits

Member

OT:

That's a big question: What would you do with your life, if you could do anything you wanted? A friend asked me that in May 1997, as I was setting up a Linux mail server for our nascent Internet co-op, using the 2nd DSL line installed in our city (he lives in Vancouver now, VP of a large Telecom Co.).

[My answer may not surprise you (I suspect you have already realized it too), but I'll share it with the group because there may be a few folks that don't know it yet, or don't really believe its true, or that it applies to them.]

Back in '97 I paused, blinked, looked at my friend, and said simply: "You know, you're right! I can do anything I want". Mid-thirties, healthy, strong, well-educated, it was like I was suddenly awake to the possibilities before me in life. I think THAT's the day I truly became an adult. It all comes down to choosing your own path, doing it well (so you can be proud of yourself), and making the work matter.

I've walked many roads in my life. I've been a home owner since I was 12 (thanks Dad, miss you). I was a honor student and track athlete in High School (ran 4:13 mile when I was 16). I have undergraduate studies in 7 specalties in business and science, and my 1st job after graduating was teaching a 400-level Statistics Lab titled "Test Theory". I am a retired Army Officer (thanks Col Mike, miss you), have owned my own IT business, and worked as a Computer Instructor.

I have never failed at anything I tried to do for a technical reason. It inevitably involves human factors, generally resolving down to greed, jealousy, or hidden motives. Solution for that sounds simple, right? Jetison. But thats not so simple when interpersonal relationships are involved. People want/need things from you, and they don't want to consider the effects of their request on you. Eventually, you just find a balance.

These past 12 years, I've focused most of my effort on learning Climate Science (hint: we're in deep doo-doo), and now working on the ONLY tenable solution, which is accelerating the World's transition to sustainable energy. Tks, Elon.

And my journey's not done. I have many more roads I plan to walk, beginning with my new Tesla Model Y LR AWD and my National Parks passport. When I see something interesting, and important, I plan to stop and do it. "Adventure is out there."

How's that?

Oh, if you're still reading this, YOU CAN DO IT TOO. You really can. If you free you mind, your feet will take you where you need to go.

This is NOT the end, this is the beginning.

Cheers!

4:13 mile is no joke. I thought I was quick once with a 4:31 mile. You were at another level!

Hmm. Every doctor I know spent 8 years in college, and 15 years paying off their medical school.

I suspect that affects their perspective A bunch.

4years college 4 years medical school, 4-5years residency, 1-3 years of fellowship can lead to madness from delayed gratification. People are too busy studying their respective field with no idea on how to manage real income. It’s easy to see how we get led astray by “financial advisors” or buy too big of a home etc. then they are stuck having to pay off their stupid decisions. (Possibly hating their job too bc they feel trapped, etc). Also during the grueling hours, it can ruin relationships or marriage which can add to another burden. Live like a resident/ FIRE movement has been very good last decade and I am seeing many colleagues pay off debts quicker, not making senseless decisions.

It is amazing how relatively « easy » it is to become rich by investing in companies where the CEO is working 20/7 and making our investment grow like never seen before.That’s a good idea. But from my own experience starting a business, I found myself and lot others unable to grow the capital as fast as Elon musk. For most ppl, it’s better to invest it in musk/bezos types. Let them do the dirty job and we cheer from sidelines

I’m always shocked to see how easier it is to make money from leveraging others people work than to work ourselves. You just have to be stress resistant to go through the roller coaster ride and be able to accumulate wealth to invest in the first place which is by sustaining a frugal lifestyle, having high income or wise use of leveraging at the right moment. But the most important factor is to have the good judgement to pick up one of Elon Musk’s companies.

The hardest part for doctors is to not jump on the rock superstar lifestyle when they are finishing their residency while hearing our staff talking about their 1.5M house renovations with 20k coffee machine in their 200k kitchens. How amazing is their Porsche Targa. You have to delay gratification for another 5 years to invest that money before « live large. A big house. Five cars, You're in charge. » My wife is always shocked to see how much the nurses are asking for contribution to all doctors for the Christmas party, around $500. Then the hospital foundation inviting doctors for a fundraising supper which has $2500 suggested minimal contribution. When I was driving in the hospital parking with my Toyota Corolla purchased to a colleague of mine when he bought his BMW after 1 year of work, I was judged by everyone. I was joking around half the time I had to get towed to the hospital parking lot and that made me feel good being chauffeured this way but in the end, all doctors I know all buy luxury vehicles because that’s what is expected from people around them. People stopped commenting about my Corolla, Mazda 6 and Dodge caravan when I purchased my first Model 3 and Model Y from passive income made with TSLA investment. Just then I was driving a doctor’s car and fitted the mold. When you deviate from society expectations, be ready to justify it everyday or laugh about it.4:13 mile is no joke. I thought I was quick once with a 4:31 mile. You were at another level!

4years college 4 years medical school, 4-5years residency, 1-3 years of fellowship can lead to madness from delayed gratification. People are too busy studying their respective field with no idea on how to manage real income. It’s easy to see how we get led astray by “financial advisors” or buy too big of a home etc. then they are stuck having to pay off their stupid decisions. (Possibly hating their job too bc they feel trapped, etc). Also during the grueling hours, it can ruin relationships or marriage which can add to another burden. Live like a resident/ FIRE movement has been very good last decade and I am seeing many colleagues pay off debts quicker, not making senseless decisions.

Last edited:

HG Wells

Martian Embassy

In case nobody's noticed. We finally turned a nice shade of GREEN.

CitizenKane

Member

It’s gotta be the right kind of business. It can’t be a me too business. The product/service has to be unique and innovative with a large addressable market. So, yes, that means doing a lot of hard work identifying a good product and then r&d to see if it is viable. Think big. It is easy to fool yourself that some small little add on feature can support a company, but it can’t.

Actually, in my experience, a successful business can very well be a "me too" business. People who do not run businesses often think the business idea is very important, but I would say that is only 5% of success. Execution is the key, not the idea. There are so many lazy and poor competitors out there so by just delivering better than those, you will earn a good reputation and attract business. I would also warn anyone thinking about becoming an entrepreneur to spend too much time on planning, things will never turn out as planned anyway. Think more about the first sale of a product or a service. Before you have sold anything, you do not have a business, in my opinion. Then again, I have never run any Silicon Valley type startup or biotech venture, where the first couple of years seem to be all about raising capital.

Sorry for the off topic advice nobody asked for but entrepreneurship discussions trigger me

Causalien

Prime 8 ball Oracle

ya it takes a qhile to turn sudden wealth into passive income. First you have to deal with taxes and if you want tax efficient withdrawal, it takes longer. Then finding a good place to park the money and safe investment at that.It is amazing how relatively « easy » it is to become rich by investing in companies where the CEO is working 20/7 and making our investment grow like never seen before.

I’m always shocked to see how easier it is to make money from leveraging others people work than to work ourselves. You just have to be stress resistant to go through the roller coaster ride and be able to accumulate wealth to invest in the first place which is by sustaining a frugal lifestyle, having high income or wise use of leveraging at the right moment. But the most important factor is to have the good judgement to pick up one of Elon Musk’s companies.

The hardest part for doctors is to not jump on the rock superstar lifestyle when they are finishing their residency while hearing our staff talking about their 1.5M house renovations with 20k coffee machine in their 200k kitchens. How amazing is their Porsche Targa. You have to delay gratification for another 5 years to invest that money before « live large. A big house. Five cars, You're in charge. » My wife is always shocked to see how much the nurses are asking for contribution to all doctors for the Christmas party, around $500. Then the hospital foundation inviting doctors for a fundraising supper which has $2500 suggested minimal contribution. When I was driving in the hospital parking with my Toyota Corolla purchased to a colleague of mine when he bought his BMW after 1 year of work, I was judged by everyone. I was joking around half the time I had to get towed to the hospital parking lot and that made me feel good being chauffeured this way but in the end, all doctors I know all buy luxury vehicles because that’s what is expected from people around them. People stopped commenting about my Corolla, Mazda 6 and Dodge caravan when I purchased my first Model 3 and Model Y from passive income made with TSLA investment. Just then I was driving a doctor’s car and fitted the mold. When you deviate from society expectations, be ready to justify it everyday or laugh about it.

Then you bump into inefficiencies from large capital and all sorts of problems that takes time to solve, not money.

It's not like an instant change for passive income. Much easier to spend spend spend, which is probably why we see so many broke has beens.

It made me even more jealous of ppl born from old money like Canada's premier. Cause this has all been done already. Their wealth is already throwing out passive income.

That’s something I was looking forward to do, write 10 puts ITM with 1 year expiry to clear my margin balance. I was wondering if waiting to sell into a position of strength when there is a sudden 3-4% drop might give a better premium. Finally the SP kept raising. Maybe will wait another 1-2 weeks if there is a profit taking drop of peaking IV to do so.Hmm. I wrote 30 TSLA Jan '23 1525 puts today for $525/share (TSLA at ~1180). Cleared out my margin balance very nicely.

Mike Smith

Active Member

Here we have Jed Dorsheimer of Cannaccord Genuity revealing that he is currently modelling zero production from Berlin or Austin in 2022.

Just found this snippet in the Stock Market reddit:

"In 2050 society will bifurcate into two classes: $TSLA shareholders and non-shareholders. The former will be known colloquially as "Shareholders" amongst the populace. They will live in walled garden paradises."

CHOAM is coming

"In 2050 society will bifurcate into two classes: $TSLA shareholders and non-shareholders. The former will be known colloquially as "Shareholders" amongst the populace. They will live in walled garden paradises."

CHOAM is coming

J

jbcarioca

Guest

I know several people who 'resemble your comments'. There are not very many occupations that require near-death experiences to begin to make a decent living.It is amazing how relatively « easy » it is to become rich by investing in companies where the CEO is working 20/7 and making our investment grow like never seen before.

I’m always shocked to see how easier it is to make money from leveraging others people work than to work ourselves. You just have to be stress resistant to go through the roller coaster ride and be able to accumulate wealth to invest in the first place which is by sustaining a frugal lifestyle, having high income or wise use of leveraging at the right moment. But the most important factor is to have the good judgement to pick up one of Elon Musk’s companies.

The hardest part for doctors is to not jump on the rock superstar lifestyle .. People stopped commenting about my Corolla, Mazda 6 and Dodge caravan when I purchased my first Model 3 and Model Y from passive income made with TSLA investment. ..Just then I was driving a doctor’s car and fitted the mold. When you deviate from society expectations, be ready to justify it everyday or laugh about it.

My Subaru-driving highly trained oncologist is now debating if he can afford a Tesla. he does not drive much since he spends nearly all of every day either in surgery, doing interminable paperwork (yes, paper, it's only a tiny bit automated), studying (robotic surgery is not easy to learn) or doing pre- and post-op consultations.

Of course such people have almost zero time to do investment research. That seems to be the province of plastic surgeons and cosmetic dentistry.

Now when I visit mine the parking lots are full of Teslas and now, other EV's too. All the shiny new chargers of five years ago are overused and more are being added, including a nice array reserved for 'Doctor's only'.

Endurance can help yield progress, can it not? Assuming, of course, native intelligence and diligence exist in copious supply.

How many TSLA buyers happen because of Tesla experiences.

Note: When in 2014 my soon-to-become oncologist friend just had to see my new P85D together with his PA I did not think it strange at all. Perhaps that is because I bought a Ferrari 308GT4 from a UK surgeon who was twirling the keyring when I was in a coma and doomed to die. He eliminated the 'die' part but soon sold me his Ferrari.

Conclusion: After the endless process of med school, residency and specialization, many people become quite interesting and curious people. I still have no idea how many have Teslas, but I'll wager Porsche might have yielded indulgence preference to Tesla in many places.

For all of you suddenly starting to think about retiring early we have some threads you should check out - and take the discussion to:

Early retirement strategies

How much $ to retire and how to fund your lifestyle in retirement

UK pre/post retirement strategies

How to best sell down when retired - and options are not possible

Best of luck!

Early retirement strategies

How much $ to retire and how to fund your lifestyle in retirement

UK pre/post retirement strategies

How to best sell down when retired - and options are not possible

Best of luck!

That's absurd... You left out the Bitcoin maxis /sJust found this snippet in the Stock Market reddit:

"In 2050 society will bifurcate into two classes: $TSLA shareholders and non-shareholders. The former will be known colloquially as "Shareholders" amongst the populace. They will live in walled garden paradises."

CHOAM is coming

nativewolf

Active Member

Well good on you. I have less experience than say a @jbcarioca but I'll throw my two cents out there. Join the Peace Corps. Provides one an opportunity to better appreciate other cultures and share that when you return to the states, share something of the USA, maybe do something useful while a volunteer (mostly 1&2).So...I followed through on this comment from October.

I retire in 10 days.

It feels surreal to be doing this after only 6 years of engineering work, and before even buying my first house or car. All my material possessions can be packed up to move in one day. I am very glad I decided to use most of my income to buy peace of mind and freedom. It feels like I found a loophole in society.

@farzyness has shared in some recent YouTube videos his desire to use the TSLA abundance to take time off to explore and find out what being a human is really about before attacking the next phase of his life. I feel the same way, except for me that adventure may end with a new beginning at Tesla or Boring Co. On the other hand, maybe I'll want to start my own business finally, or step away from the Musk world for a while and get a job somewhere else. Honestly, I don't know right now and I would appreciate any advice from those older and wiser than I, especially those like @Artful Dodger who have given a middle finger to the rat race early in life, or those like @Discoducky who have worked at Tesla.

I wanted to share this here today for a several reasons:

1) Contributing to our community's current camaraderie and euphoria.

2) Inspiring others here to go hardcore with shoveling as much of their capital as possible into investments to build a brighter future for themselves and all of humankind, especially those who are still young enough to do this before the encumbrances of marriage or kids.

3) Asking for advice, as mentioned above.

4) Offering advice for anyone who wants tactics, frameworks and mindsets to save this much this quickly while maintaining a better-than-average standard of living.

5) Inviting American TMC members who might like to meet up to consider sending me a DM, because in a few months, I'll be slowly travelling all around the USA. I've already penciled in a plan with one member in New Orleans. I also intend to spend the summer of 2023 in France if the pandemic has completed by then, and I would enjoy organizing a Euro TMC party.

I love you all.

(Technically I'm not retiring yet; my manager and I set up an unpaid leave of absence for 6 months so I can come back in July if I want to. Something to consider for anyone else considering quitting early but feeling nervous about the finality of terminating employment at their company.)

I have explored being a business school professor, much writing if you are in a good school... too much for me I found work in the largest companies stifling, difficult to observe the impact of my efforts (or others). You don't say why you quit work? I caution against geographic atrophy, as you can pack up and move and that's a strength already. Many of the problems in the USA today are, in my view, caused by people not being willing to move, change in all its forms is usually useful.

I have been involved in 3 start ups and loved them ; 2 failed and 1 sold quickly. I am on my last startup now and we've picked a doozy of a challenge. Feel free to stop by Northern VA (others too) if you want to see what a hands on environmentally oriented startup feels like.

Academia: lots of good to be said for a career studying basic science. Much under appreciated.

Since you invested in Tesla I assume you care something about the environment and our challenges. Some other environmentally oriented areas:

Farming and forestry are completely open to disruption. Most organic farming is just complete bunk, sure arsenic is organic, fish meal is organic. One is not good for you and the other is the least sustainable source of nitrogen out there. The urban farming VC kick is just complete bunk, farmland is cheap, labor is a constraint in the EU, NA, and much of Oceania (japan, korea, australia, etc). So much hoopla but so little done. In ag it ranges from social policy to actual farming. If you find this at all interesting you should spend a couple of years farming.

Heavy equipment electrification could be a vast opportunity. In charts shared a day or so ago it showed that the impacts of industrial activity are every bit as damaging as light vehicles. Things like excavators and bulldozers and dump trucks are a difficult challenge.

EM and others have long looked at tunnels as a solution to lots of urban transport challenges. He applied a bit of new thinking to the problem but ...it's failing to really resonate. Why? Address that.

Solar roofing- GAF has a new product, Tesla solar roof has been swimming in challenges (from trying to break contracts because they screwed up- over and over you see that one, to an inability to manufacture a roof). I feel that if someone spent a year on a roofing crew, was young, and innovative that there is a lot of room in this space.

LiFe patents expire. Lots of startups looking at that, the energy business could use every watt. Does an explosion of LiFe capacity create a raft of additional constraints and opportunities; ie power electronics, power trading, grid balancing. This accepts that LiFe investments are already there.

China pushed tik tok out there proving there is room for a social media play, might take Chinese military type money but it is out now. Personally I find this sort of thing boring in the extreme but it was lucrative for someone.

Globalization has destroyed many many species. Lots only exist in zoos or museum collections. Address this... heaven help me i have no idea how but that would be nobel prize worthy.

Carbon capture- so I would suggest that on your way south that you stop and visit with Casey Handmer. Now that's an interesting cat.

Casey Handmer's blog

Space, Travel, Technology, 3D Printing, Energy, Writing

caseyhandmer.wordpress.com

caseyhandmer.wordpress.com

On and on. This is just spitballing over coffee as I look out at snowy landscape and it is frigid. No hurry to get to work this AM

Zhelko Dimic

Careful bull

For those that don't know, this will raise cash and clear margin balance, but not the margin itself, i.e. need to have assets or cash securing short put position.Hmm. I wrote 30 TSLA Jan '23 1525 puts today for $525/share (TSLA at ~1180). Cleared out my margin balance very nicely.

I use similar strategy, except I take quite a bit longer positions. For example, I have number of 1100 puts that will expire Jan, sold last year for around $400-$500, and I closed similar ones that were at $1000, in order to sell July's at $1400... Having said that, with newly available very low interest rates, I'm reconsidering if buying shares, leveraging (ligthly!) and paying interest may be a better idea tax-wise

news like we have takes days (potentially weeks) to absorb. what does everyone think short term (about 45 days, enough time to let earnings sink in too)?.

1300, 1400?

1000, 1100?

to me, all seem possible in that timeframe!

but new highs may help establish a new ‘range’. to me that’s the one of the interesting parts.

1300, 1400?

1000, 1100?

to me, all seem possible in that timeframe!

but new highs may help establish a new ‘range’. to me that’s the one of the interesting parts.

Hock1

Member

TSLA is now the largest manufacturing company, by market cap. Certainly would make sense to be included in the 30 Industrials. As mentioned, since it is a share-price based index, TSLA would need to split somewhere between 7 to 10 for 1, in order to conform with others in the indexThanks for sharing this potential reality. What leads you to believe this will happen in the near future?

@MABMAB - if indeed we do squeeze up, I think the difference between this time and that of the leo/hertz pop is that we have tangible numbers. there's those that get it, and when you split the rest (the clueless portion of market) into 2 groups (those who will adjust their numbers accordingly, and those who continue to blatantly ignore Tesla progress), overall this should help build more support than what seemed like an empty bubble (leo/hertz).

consider:

- if anyone has a line on TSLA option open interest or analysis of such, please share (i.e. 50% vol was TSLA options during the leo/hertz gamma)

-----and I assume a decent %age on the put side on the way down

- how much shorting (especially those taking advantage during Elons selling period and holidays low-vol) has already been covered from 890-1200?

-----we'll find out a backwards looking view in about 10 days

- assume macro/geopol disrupting your outlook at any time

consider:

- if anyone has a line on TSLA option open interest or analysis of such, please share (i.e. 50% vol was TSLA options during the leo/hertz gamma)

-----and I assume a decent %age on the put side on the way down

- how much shorting (especially those taking advantage during Elons selling period and holidays low-vol) has already been covered from 890-1200?

-----we'll find out a backwards looking view in about 10 days

- assume macro/geopol disrupting your outlook at any time

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K