$50/mo is not enough. You get to sleep/work an extra hour every day. You get to send your car to your spouse/kids/parents to take them places when you are at work. You get to start a trip at the end of the day and wake up somewhere 500 miles away. If you are old you get mobility, if you are a drunk you get to keep your car. That is even before you get to RT.Has anyone tried to figure out what it could mean financially for Tesla if they went from selling FSD to not selling it and instead using a subscription model?

Almost every software company in the world has or is trying to switch to a subscription service. Adobe probably being the most prominent (financial) success. Those that still haven't almost all make you pay again every time there is a version with significant upgrades which I think Tesla want to avoid. But they also don't want to give free upgrades for maybe 20 years.

Even when robotaxi fleets exist I believe Tesla would sell/subscribe you FSD for private use for something similar to the current price. If you want to have it join the fleet the price will be much higher.

I can see a number of cases where owners might actually prefer to subscribe while it would also be more profitable for Tesla. $7k is a lot of money to pay at once even if you can afford a $40k car. Even if you take out a loan it will increase your downpayment and might get you a higher rate or even being denied a loan if the total is deemed to high for you income/credit score.

If you are selling to get a new car you'll have to worry about being able to find a buyer that will get you a significant part of those $7k back. If you are buying a used car without FSD you would probably not want to pay $7k if your car is already say 10 years old. For Tesla I think it means they won't sell FSD to hardly any car that is over 5 years old or so. Assuming a 20 year lifespan you would only get 15 years of value compared to 20 when bought new. Older cars even less.

There is also the insurance issue. I've already seen articles about insurance companies not wanting to reimburse FSD in certain situations.

Here's my take on the numbers.

If you let owners subscribe to FSD when it's fully available so that you can sit and read or watch video while in the driver seat I think almost everyone would subscribe if the cost was $50 a month. Even those that will eventually drive a 20 year old Tesla worth maybe $5k then would pay that in most cases.

So for a 20 year lifespan Tesla would get 240 months x $50 = 12k

They could obviously also have different levels with some higher levels getting extra perks and if Elon is looking to expand the life of Teslas, for environmental reasons for example, they could have a slightly higher price for new cars and a little lower for old ones. Also a little less per month the longer you signed op for.

With the correct price point, which I think would be around $50/month, they might get a 90% take. So 10.8k average per car.

I don't think we really know what percentage has paid and obviously have even less idea about how many will pay once it's available but I'm thinking something like 50% at best at a one time $7k fee.

With those numbers Tesla would make something like 3.5k per car on average compared to 10.8k

Lets say Tesla gets to 3 million cars sold per year in the not to distance future. That's only 6 gigafactories. That would mean a difference of 8.5k x 3 million = $21.9 BILLION extra in almost pure profit every year compared to selling it outright. Even if the $7k price got the same 90% take which I think is impossible a $50 dollar/month model would still pull in an extra $11.4 billion.

Granted, it's better to get payment today than spread out over 20 years average but that's a big difference. And just like leasing contracts Tesla could sell those off if they needed the money sooner. Plenty of pension funds that would buy those against just a few interest points.

Either my 3 am math is way off or Tesla will obviously already have figured this out. In that case FSD could be much more valuable than I think almost anyone have figured.

Anyone have any factual numbers or ideas that would change my estimates?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

theschnell

Member

I have discussed valuation allowance and recognizing differed tax losses with someone who has been at the center of such determinations. Much of what has been previously discussed here is true. I am not an expert on the area but what I gleaned from my conversation is as follows

‘The decision to do so has to be backed by the auditor. This person believes with enough pressure that the PCW partner managing the account could be influenced enough to support it. It’s not an issue the IRS cares about and would not review. However, the SEC could issue a letter to ask about it. Now we all know the short sellers would not stoop so low as to try to influence the Short sellers Enrichment Commission to investigate the decision. The SEC could with an adverse decision force tesla to restate the earnings report. But we all know that the SEC has been so supportive of Elon that this would not be an issue. Is it worth the risk? We will find out. If it’s not done with q4 then it probably not be done till q3 or q4 the qtr where these decisions are usually made

I’ve been thinking on this, and unless they are extremely confident that Q1 is either profitable or only a small loss and the rest of the quarters profitable, then I hope they wait to pull this into the P&L. It would just look really bad to pull this in and then have a really bad Q1 make it look like they were trying to juice the stock further without justification.

Now that said, I was pretty confident that Q1 would be close to profitable but two recent things have made me far less certain.

1) The Coronavirus effecting G3 output.

2) If Model Y starts ramping in Q1 and ramps slowly like Model 3 in 2017 with negative margin.

But if they are confident Q1 will be a small loss or better, and all other quarters profitable, then they would have to pull it in at some point fairly soon.

Overall, I still think later this year is the more conservative and better answer but I’d love for them to pull it in this quarter if they could justify it moderately conservatively.

Remus

Active Member

50 per month?! Is Tesla a charity?Has anyone tried to figure out what it could mean financially for Tesla if they went from selling FSD to not selling it and instead using a subscription model?

Almost every software company in the world has or is trying to switch to a subscription service. Adobe probably being the most prominent (financial) success. Those that still haven't almost all make you pay again every time there is a version with significant upgrades which I think Tesla want to avoid. But they also don't want to give free upgrades for maybe 20 years.

Even when robotaxi fleets exist I believe Tesla would sell/subscribe you FSD for private use for something similar to the current price. If you want to have it join the fleet the price will be much higher.

I can see a number of cases where owners might actually prefer to subscribe while it would also be more profitable for Tesla. $7k is a lot of money to pay at once even if you can afford a $40k car. Even if you take out a loan it will increase your downpayment and might get you a higher rate or even being denied a loan if the total is deemed to high for you income/credit score.

If you are selling to get a new car you'll have to worry about being able to find a buyer that will get you a significant part of those $7k back. If you are buying a used car without FSD you would probably not want to pay $7k if your car is already say 10 years old. For Tesla I think it means they won't sell FSD to hardly any car that is over 5 years old or so. Assuming a 20 year lifespan you would only get 15 years of value compared to 20 when bought new. Older cars even less.

There is also the insurance issue. I've already seen articles about insurance companies not wanting to reimburse FSD in certain situations.

Here's my take on the numbers.

If you let owners subscribe to FSD when it's fully available so that you can sit and read or watch video while in the driver seat I think almost everyone would subscribe if the cost was $50 a month. Even those that will eventually drive a 20 year old Tesla worth maybe $5k then would pay that in most cases.

So for a 20 year lifespan Tesla would get 240 months x $50 = 12k

They could obviously also have different levels with some higher levels getting extra perks and if Elon is looking to expand the life of Teslas, for environmental reasons for example, they could have a slightly higher price for new cars and a little lower for old ones. Also a little less per month the longer you signed op for.

With the correct price point, which I think would be around $50/month, they might get a 90% take. So 10.8k average per car.

I don't think we really know what percentage has paid and obviously have even less idea about how many will pay once it's available but I'm thinking something like 50% at best at a one time $7k fee.

With those numbers Tesla would make something like 3.5k per car on average compared to 10.8k

Lets say Tesla gets to 3 million cars sold per year in the not to distance future. That's only 6 gigafactories. That would mean a difference of 8.5k x 3 million = $21.9 BILLION extra in almost pure profit every year compared to selling it outright. Even if the $7k price got the same 90% take which I think is impossible a $50 dollar/month model would still pull in an extra $11.4 billion.

Granted, it's better to get payment today than spread out over 20 years average but that's a big difference. And just like leasing contracts Tesla could sell those off if they needed the money sooner. Plenty of pension funds that would buy those against just a few interest points.

Either my 3 am math is way off or Tesla will obviously already have figured this out. In that case FSD could be much more valuable than I think almost anyone have figured.

Anyone have any factual numbers or ideas that would change my estimates?

Just picking up teenagers from water polo practice worth at least 500 per month. Heck 500 is a absolute steal for that purpose only.

Elrctrek - this afternoon: https://ww.electrek.co/2020/01/27/tesla-solarglass-roof-installation-ramp/

Excerpt:

CEO Elon Musk wants an acceleration of production and installations for the new version of the solar roof.

Excerpt:

CEO Elon Musk wants an acceleration of production and installations for the new version of the solar roof.

50 per month?! Is Tesla a charity?

Just picking up teenagers from water polo practice worth at least 500 per month. Heck 500 is a absolute steal for that purpose only.

Tesla is leaving money on the table today. Prior to FSD becomes a thing, I do think Tesla should start a subscription for EAP for maybe 25/month or something. Increase to 50 when fsd feature complete is out. FSD is not worth 500/mont until supervision is no longer needed.

Fact Checking

Well-Known Member

1) The Coronavirus effecting G3 output.

If we ignore the noise then the coronavirus news over the last 24-48 hours has been positive:

- Still all international coronavirus patients are listed as well and stable, several were released as healed, none died. The large majority of international patients showed mild symptoms.

- No trace of pre-incubation infections with international patients. It's up to around 100 people whose travel companions have been extensively examined, who sat on planes and in busy places and the infections so far were all in 'close contact', not through casual contact.

- China has not doubled down on their earlier thesis that the Wuhan virus is infectious during incubation (when patients don't have symptoms)

2) If Model Y starts ramping in Q1 and ramps slowly like Model 3 in 2017 with negative margin.

This effect is highly unlikely at this point.

The large negative margins of the Model 3 ramp-up were due to several factors:

- A large Model 3 specific workforce sitting idle or doing ineffective work,

- GF1 inefficiencies,

- low parts volumes, which reduced economies of scales with suppliers.

- high fixed costs and high depreciation costs due to inefficient capex use.

- Since 76% of the components are shared with the Model Y, they can use Model 3 assembly crews during the initial phase of the Model Y ramp-up, before hiring new line workers at scale,

- GF1 efficiencies will further increase due to the extra battery packs used by the Model Y,

- parts volumes and economies of scale will further increase as well, as most parts are shared.

- I presume the Model Y line is based on the GF3 Model 3 line, which is a third of the capex rate of the original Model 3 lines. Depreciation costs and fixed costs should be much lower.

Last edited:

dha

Member

About 6% over if one ignores the day of difference in the comparison.

Or you can say that he probably missed a small contraction in the short interest.

He was not 6% off, he was more than 600% off. He estimated a delta of 190k shares while the actual number was 1.3mm shares.

Any idiot could look at the official short interest tables and figure out that SI will be within a few % of whatever it was during the last reporting period. The supposed value of his information is insight into what shorts are currently doing. Is a rally due to shorts covering or longs buying? Are shorts capitulating or redoubling their efforts? In this instance Ihor's estimates would have led you to the wrong conclusions about TSLA price action. Worse than useless!

"Horrifically"? Is there someone out there doing a better job?

His estimates are his best...estimates, so assign an error band to his numbers or ignore them.

See my response to @SageBrush above. Yes, his estimates were horrifically off. In this instance he couldn't even get the direction of SI change correct! All this while he gives estimates down to the single share, implying a degree of precision that is clearly unwarranted.

Last edited:

ByeByeJohnny

Active Member

I think Tesla/Elon need to re-think the pricing, because they can sell personal FSD and Tesla network FSD separately. FSD does not need to be $10,000 (or more) when FSD fully works. It can be sold for $5000, but it won't do any commercial work. Then the Tesla network can be sold for $10,000 or more, or on a model that Tesla gets much more of the revenue until it is paid off.

Absolutely, that's what I meant with my third paragraph.

"Even when robotaxi fleets exist I believe Tesla would sell/subscribe you FSD for private use for something similar to the current price. If you want to have it join the fleet the price will be much higher."

Fact Checking

Well-Known Member

He was not 6% off, he was more than 600% off. He estimated a delta of 190k shares while the actual number was 1.3mm shares.

So had he estimated a delta of 19k shares he'd have been 6,000% off? It doesn't work that way.

The benchmark Ihor's estimates should be measured up against is the average variance between the 2 week NASDAQ reports, which was around ~1 million shares in recent months.

In that sense his estimates being off by 1.1m shares is a big miss, but not by 600%, it's around -100% instead.

He also got the direction wrong: he predicted a (small) increase in short interest, while in reality short interest decreased significantly.

BTW., in the next NASDAQ report I'd expect a small rebound in short interest, as I believe many shorts re-entered near the recent top of around $595.

Artful Dodger

"Neko no me"

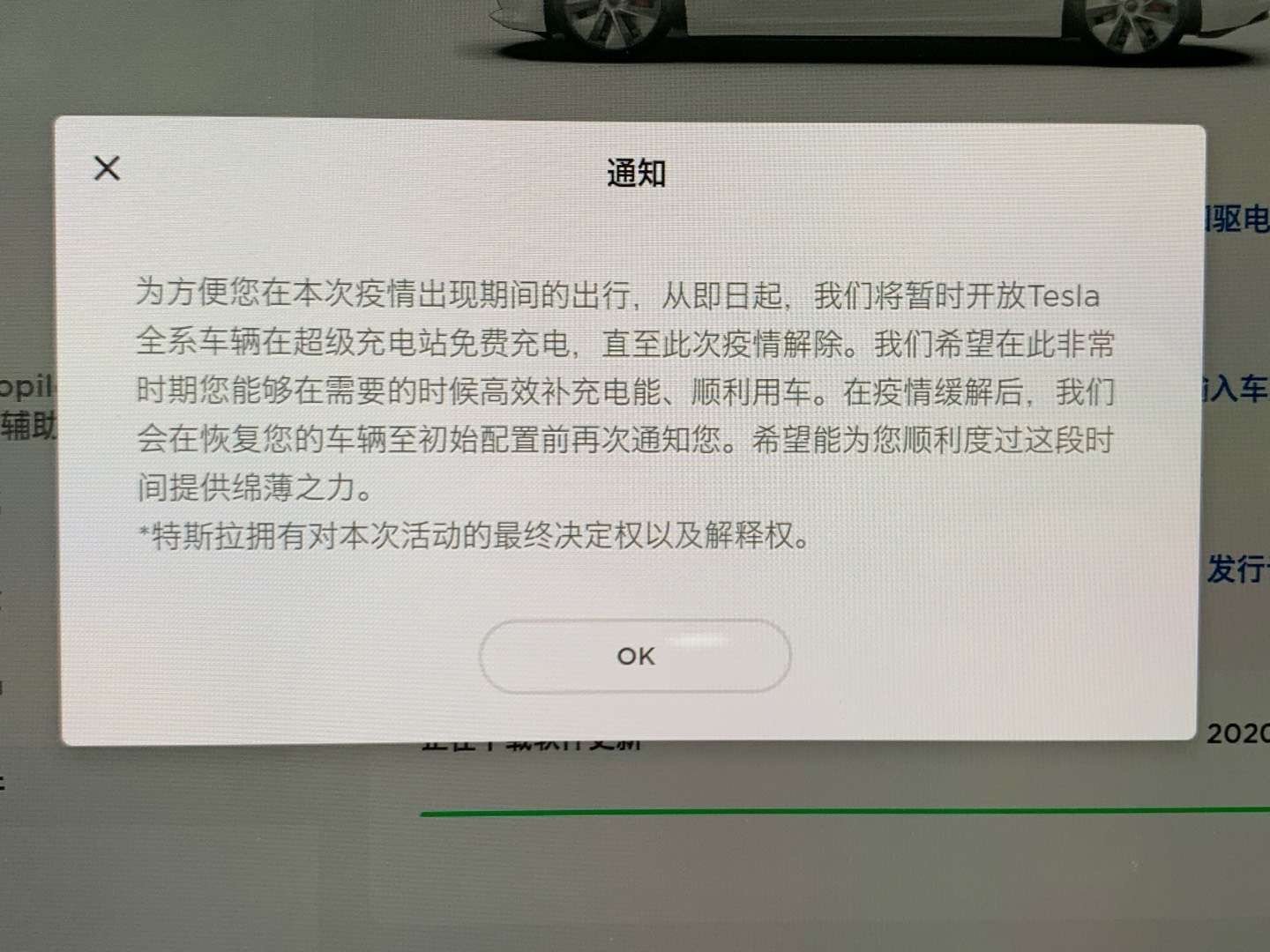

Earlier, somebody mention they thought Elon (Marketing Genius) would find a way to turn the Coronavirus outbreak in China into a positive for Tesla. Well, Exhibit A:

Tesla Owners in China Get Free Supercharging During Coronavirus Outbreak As Gas Stations Shut Down in Locked Cities

Well done sir, well done.

Cheers!

Tesla Owners in China Get Free Supercharging During Coronavirus Outbreak As Gas Stations Shut Down in Locked Cities

"Tesla owners in China have shared that the EV company is currently offering temporary free Supercharging amidst the ongoing coronavirus outbreak in the country. In contrast, gas stations in locked cities within China have shut down temporarily.

"News of Tesla China's temporary free Supercharging offer was shared by owners who received the notification through their all-electric vehicles' infotainment systems. Photos of the announcement can be seen below."

"News of Tesla China's temporary free Supercharging offer was shared by owners who received the notification through their all-electric vehicles' infotainment systems. Photos of the announcement can be seen below."

Well done sir, well done.

Cheers!

ByeByeJohnny

Active Member

$50/mo is not enough. You get to sleep/work an extra hour every day. You get to send your car to your spouse/kids/parents to take them places when you are at work. You get to start a trip at the end of the day and wake up somewhere 500 miles away. If you are old you get mobility, if you are a drunk you get to keep your car. That is even before you get to RT.

The actual price will be easy enough to figure out. Just try a different price in a few different locations and see what numbers you get.

Also although a higher cost might bring in more even with a lower percentage that higher cost might also dissuade people to from buying the car in the first place if it gets to high.

I might buy a 40k car and subscribe for $50 a month. But I might not buy the same car if the price was then $150/month.

Again, should be easy to find the sweet spot.

ByeByeJohnny

Active Member

Letting people in quarantine charge for free?????

TSLAQ will have a field day:

"Evil Elon is spreading world ending plague by encouraging the infected to reach and infect previously safe areas."

/s

TSLAQ will have a field day:

"Evil Elon is spreading world ending plague by encouraging the infected to reach and infect previously safe areas."

/s

Bet TSLA

Active Member

So the ~$11B short as of the end of the year has become ~$13B short as of 1/15.

Artful Dodger

"Neko no me"

FTFY."Evil Elon isspreadingcontaining world ending plague by encouragingthe infectedTesla Owners to use their hepa-filter in previously infected areas."

/s

Cheers!

Fact Checking

Well-Known Member

Sorry for the delay in responding.

Let's do a comparison for another 50-point spread of about the same cost basis as the 21 Feb $750-$800 spreads ($5,20-$3,50). For 31 Jan, that would be $695-$745 spreads ($3,15-$1,33). Now, we don't have to do 50-point spreads - we could do narrower spreads with more contracts for the same total net reward, but we'll just keep it as an example.

A couple observations:

But really, the short of it is, I just like the look of the 21 Febs more than the 31 Jans.

- For full yield, the stock needs to jump up $187 for Jan and $242 for February. But January has only two trading days post-ER while February has 23 days post-ER. During this time, if it was a good ER, you have analyst upgrades; you'll have given big buyers time to accumulate (or even, first, to decide to accumulate); potential for a Moody's upgrade or S&P rumblings... even some macro stuff going on right now like coronavirus will have time to pass. Two days isn't much; a good ER rarely just causes the stock to jump up big and then flatline.

- If the ER is good but doesn't cause a big enough initial jump, the Jan spreads will quickly become worthless, while the Feb spreads will retain some residual value. The devil is in the details, of course, and both types of spread still definitely fall under the "lotto" category

One could also ask why not even longer in the future, but I'm really not looking to price in even more events beyond that in terms of "lotto tickets". I just wanted enough time for the aftermath of the ER to get fully priced in. And again, these are just some minor lotto tickets; my main options are 15 Jan '21 spreads with relatively unambitious strikes ($620-$800 on the bottom end, $900-1000 on the top), so a year's time on them to achieve some relatively modest growth.

A very quick note to everyone who attempts such lottery tickets: right now there's an about $20 post-Q4-ER price move priced in both calls and puts, in both directions. This means that almost immediately after earnings the "Implied Volatility Crush" will reduce the value of all options with short term expiries. For the above $750-$800 spread to be profitable the realistic break-even price after earnings is $620-ish - i.e. if you aren't as bullish about the price action anymore you'll still need a good move up to be able to exit the position.

If the TSLA price remains around the current $560 or moves lower then the bull spread almost immediately loses about 60%-70% of its value or more, and the break-even price will get progressively worse as expiry draws closer. Even a mild bounce at around $600 would probably only move the bull spread into break-even for very short periods of time.

I.e. this is a true binary lottery ticket for a decisive break above $600, with few of the usual benefits of bull spreads.

Vanilla $600-$630 long calls or $650-$700 spreads will have a flatter risk profile in terms of allowing an exit strategy around failed $600 break-throughs, at the price of lower leverage - while still being an almost instant complete loss if the price stays flat at $560 or moves lower.

Another viable strategy to leverage up for earnings, if you have dry powder left and are considering to buy 100-ish shares, is to write a cash-covered put contract in the $500-$550 range and use the premium ($15-$35 per share) to buy multiple leveraged lottery ticket long call contracts in the $650-$750 range with a February 21-ish expiry.

If the price stays mostly flat until earnings then there's basically two main outcomes:

- A drop in the price, in which case your call option goes down to zero and the PUT gets exercised at the strike price you chose. You'll have the 100 shares you wanted to buy before earnings anyway (and you'll be sitting on TSLA paper losses), but you'll receive them sometime in February instead. This is the worst-case in terms of asset value.

- A rise in the price, in which case your lottery tickets might generate more returns than the 100 shares would have. You'll also keep your cash to use in the future.

- (Note that there are a number of middle-of-the-road outcomes as well, such as the price not dropping to exercise your put but not rising fast enough for the calls to generate returns, and there's weird outcomes too such as the price dropping before earnings. There's no free lunch, but at least you'd partly finance your directional bet from the other side's volatility premium.)

The biggest question for me for the Q4 earnings report is how much of the current price levels are bullish sentiment and fair valuation vs. potentially unrealistic expectations for Q4 S&P 500 inclusion or mega-profits.

TL;DR: all of these are very risky option bet lottery tickets and it's not advice.

Last edited:

theschnell

Member

If we ignore the noise then the coronavirus news over the last 24-48 hours has been positive:

So based on current data I'm cautiously optimistic. It will take weeks until the peak in Wuhan is reached, and it's a wait-and-see whether and how fast it spreads within China to other provinces.

- Still all international coronavirus patients are listed as well and stable, several were released as healed, none died. The large majority of international patients showed mild symptoms.

- No trace of pre-incubation infections with international patients. It's up to around 100 people whose travel companions have been extensively examined, who sat on planes and in busy places and the infections so far were all in 'close contact', not through casual contact.

- China has not doubled down on their earlier thesis that the Wuhan virus is infectious during incubation (when patients don't have symptoms)

This effect is highly unlikely at this point.

The large negative margins of the Model 3 ramp-up were due to several factors:

For the Model Y they have all of these factors fixed/improved:

- A large Model 3 specific workforce sitting idle or doing ineffective work,

- GF1 inefficiencies,

- low parts volumes, which reduced economies of scales with suppliers.

- high fixed costs and high depreciation costs due to inefficient capex use.

- Since 76% of the components are shared with the Model Y, they can use Model 3 assembly crews during the initial phase of the Model Y ramp-up, before hiring new line workers at scale,

- GF1 efficiencies will further increase due to the extra battery packs used by the Model Y,

- parts volumes and economies of scale will further increase as well, as most parts are shared.

- I presume the Model Y line is based on the GF3 Model 3 line, which is a third of the capex rate of the original Model 3 lines. Depreciation costs and fixed costs should be much lower.

So if those things are likely non factors, do you think Q1 will be profitable? And related, do you think Tesla will pull in some or all of their deferred tax assets into the P & L for Q4?

Fact Checking

Well-Known Member

So if those things are likely non factors, do you think Q1 will be profitable? And related, do you think Tesla will pull in some or all of their deferred tax assets into the P & L for Q4?

Yes, I think Q1 will be profitable: even with GF3 break-even there's both ZEV income expected from the FCA deal, and FSD deferred revenue recognition, plus there's the deferred tax asset.

Regarding the deferred tax asset: based on the Twitter precedent I'd expect Tesla to not recognize the deferred tax assets in Q4 yet, or at most only a smaller portion. That's what Twitter has done too, they have recognized them in two subsequent quarters.

I could be wrong on both expectations though.

Artful Dodger

"Neko no me"

Coronavirus misinformation | CBC News (Canada)

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K