why he has to mention the same fact twice

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Well said (bolding mine)...this is the essence of Tesla’s secret sauce, the generating power and foundation underpinning the strengthening sentiment. It’s what differentiates Tesla from what people have experienced as ephemeral momo stories.A radically superior product is gonna find many more buyers than predicted by past experience with inferior products. <snip> The world has seen nothing like them before, and most people can't imagine them before they experience them.

This recognition will continual to build viral excitement throughout this decade, which is likely to be widely known as the Tesla Twenties as the decade wanes: Cathy Wood at ARK-Invest has articulated the key disruptive innovation platforms, and Tesla is leveraging way more of them than anybody else - AI, robotics, autonomy, energy - in ways that “most people can’t imagine them before they experience them.”

TSLA is up almost 20% in 2 days since it announced their stock splitAAPL is up 20% in 2 weeks since they announced their stock split.

Actually it can....if you go to the champagne room....a 'friend' told me.Normally, I'd say a lower stock price leads to more speculation and higher volatility. However, in case of Tesla, since MM seem to have enjoyed days of low volume and big swings in price that scare the *sugar* out of some retails, I think that more participants in TSLA and smaller swings = good. More people who can afford to buy the dips = good. TSLA is like that $2 downtown strip club; it can't get any shadier no matter how much stuff you throw at it.

Sudre

Active Member

Some of yesterdays $1600 strike Calls held for today. There are now Puts coming in at that level so I expect this to start being forced down or at least an attempt. Calls with a $1700 strike are the candy of the day. If we go up over $1650 the delta hedging will have to start again meaning more rise. I think the $1700 Calls are expected to be easy money for the seller. Can't wait for the after lunch moment when the MM comes back to his desk and goes "F$CK". If there isn't another 10% gain I think Friday will be flat or down.

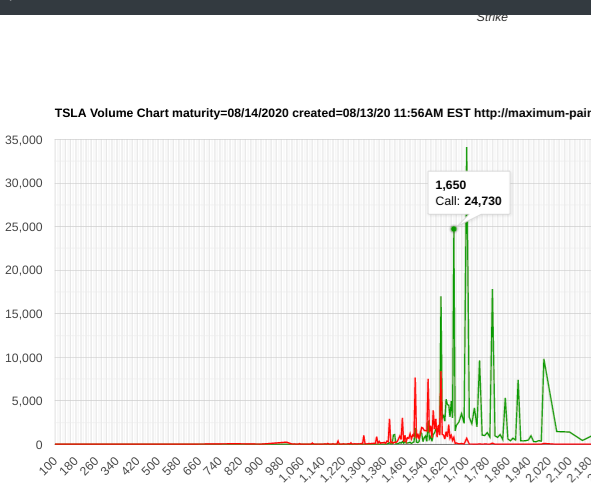

Open Interest this morning. Note Max Pain came up to the upper 1400s.

The volume chart shows activity on the $1600 Calls which could be profit taking and MMs roll up to $1650 - $1700 with a spike in volume there.

I have bought back my PUT spreads for pennies and I sold a few more Call spreads well above current SP. With the profits from the Puts spreads, worst case would be a zero gain week. Best case..... nice.

Open Interest this morning. Note Max Pain came up to the upper 1400s.

The volume chart shows activity on the $1600 Calls which could be profit taking and MMs roll up to $1650 - $1700 with a spike in volume there.

I have bought back my PUT spreads for pennies and I sold a few more Call spreads well above current SP. With the profits from the Puts spreads, worst case would be a zero gain week. Best case..... nice.

woodisgood

Optimustic Pessimist

TSLA is up almost 20% in 2 days since it announced their stock split

Yes, though it can be argued it should have done so straight away after an amazing ER instead of dropping and being pinned like a voodoo doll.

But then it can be argued that rise occurred prior to the actual ER with the short shorts availability.

And then it can be argued that it’s just not worth arguing. *pooped*

It took them two weeks? Slackers.AAPL is up 20% in 2 weeks since they announced their stock split.

StealthP3D

Well-Known Member

What do you mean by TSLA being illogically priced? I see a valuation of 305 billion, which is 4 times VW and 10 times Ford. Should that be 2 trillion right now? Markets are forward looking, but there’s a limit to their horizon.

I don't get the comparison to VW (and especially Ford). How can you compare a business with huge rapid growth potential to businesses that are actually shrinking as far as the eye can see? If you assume Elon is going to continue to innovate to make electric cars constantly cheaper (and therefore the standard), and use VW's own projections for the number of EV's they hope to produce in 5 and 10 years, you will see a massive shift from VW sales to Tesla sales.

Comparing the valuations of two companies with such different probable outcomes simply makes no sense.

ZachF

Active Member

This video is both helpful and informative re recent developments at Giga Texas in Austin:

I want Giga Austin renders Tesla!!!!

What do you mean by TSLA being illogically priced? I see a valuation of 305 billion, which is 4 times VW and 10 times Ford. Should that be 2 trillion right now? Markets are forward looking, but there’s a limit to their horizon.

I mean TSLA going down (mostly) and up (occasionally) without me being able to understand why.

If 305 billion is the correct valuation today - I have no idea.

But TSLA going down on good news - smells funny to me.

Definately amateur hour - but that is where I am.

StealthP3D

Well-Known Member

There has been a line at $1650 today.

I dedicate this song to that line:

Because I can smell it burning shortly!

I dedicate this song to that line:

Because I can smell it burning shortly!

Last edited:

424B2

Apple has more cash than some countries but needs more? Will Tesla follow suit with an offering as well now? (Maybe they already did with the suppressed prices before this price rise)preliminary prospectus supplement is not complete …

SUBJECT TO COMPLETION, DATED AUGUST 13, 2020

You are def 100% correct on all fronts....i look at it as it was an opportunity to add since the drop was unwarranted on all levels. Happy to have been able to add my last 12 at $1388. It was just a matter of time before the rocket ship launched againYes, though it can be argued it should have done so straight away after an amazing ER instead of dropping and being pinned like a voodoo doll.

But then it can be argued that rise occurred prior to the actual ER with the short shorts availability.

And then it can be argued that it’s just not worth arguing. *pooped*

I mean TSLA going down (mostly) and up (occasionally) without me being able to understand why.

If 305 billion is the correct valuation today - I have no idea.

But TSLA going down on good news - smells funny to me.

Definately amateur hour - but that is where I am.

I now understand what you meant. You were referring to the price movements and not to the actual pricing (valuation).

I don't get the comparison to VW (and especially Ford). How can you compare a business with huge rapid growth potential to businesses that are actually shrinking as far as the eye can see? If you assume Elon is going to continue to innovate to make electric cars constantly cheaper (and therefore the standard), and use VW's own projections for the number of EV's they hope to produce in 5 and 10 years, you will see a massive shift from VW sales to Tesla sales.

Comparing the valuations of two companies with such different probable outcomes simply makes no sense.

I completely agree with you on the massive advantage Tesla has compared to VW and F in many areas and its huge growth potential, and the market sees it too, That’s why TSLA is now priced at 305 billion versus 73 billion for VW, even though they sell 20 times as many cars. One can argue whether the difference in valuation should be even higher at this point in time, but I don’t think Tesla’s valuation is ‘illogical’, as @Christine600 wrote (but he/she apparantly meant something else).

TSLA is up almost 20% in 2 days since it announced their stock split

If stock split = 20%+, I wonder what S&P inclusion announcement will be worth?

You know, if I had a PhD in Math, I'd probably go teach, or build rockets, or try to solve the gravitational singularity. Some people, instead, choose to manipulate TSLA for a living.

Last edited:

Some of it 'may or may not' be priced in in this run....but it'll all depend on where the SP is at during announcement. Higher SP = lower % gain..which we are all ok withIf stock split = 20%+, I wonder what S&P inclusion announcement will be worth?

StealthP3D

Well-Known Member

I completely agree with you on the massive advantage Tesla has compared to VW and F in many areas and its huge growth potential, and the market sees it too, That’s why TSLA is now priced at 305 billion versus 73 billion for VW, even though they sell 20 times as many cars. One can argue whether the difference in valuation should be even higher at this point in time, but I don’t think Tesla’s valuation is ‘illogical’, as @Christine600 wrote (but he/she apparantly meant something else).

Valuation is a non-intuitive thing. To understand high valuation companies you only need to understand one thing:

It takes money to make money. Everyone wants to get a piece of a revenue stream that is growing that quickly. It's not a Ponzi scheme or a bubble, it's people fighting for the right to own that revenue stream.

The relative number of cars they produced last year is irrelevant.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K