JoostP

Member

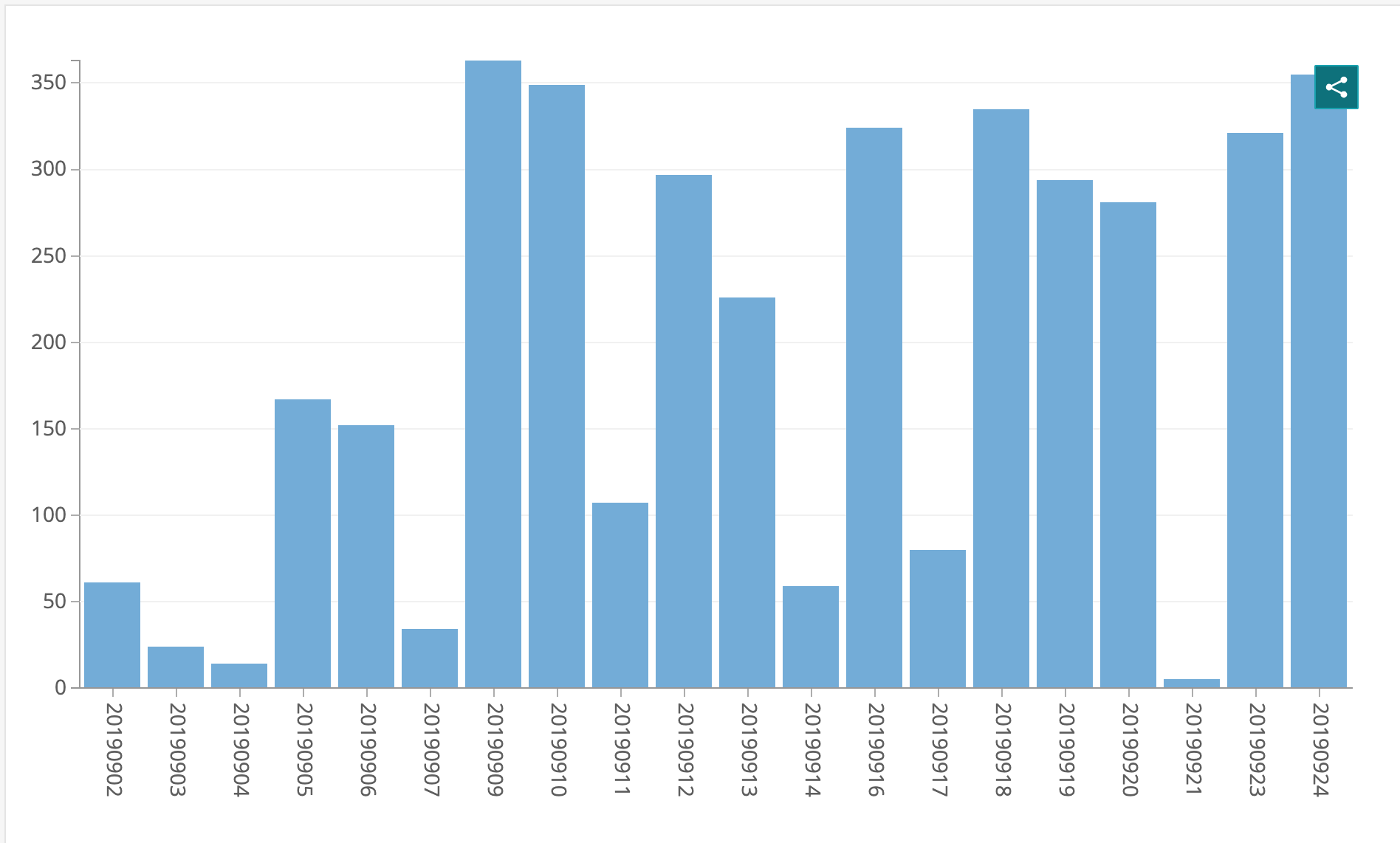

Netherlands doing 300 cars a day, think we deserve that GF

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

If you have a better free site where the court filings in TSLA related litigation can be accessed, please share it.

Tesla guided for 2-3 GWh for energy this year. They should be at a 3 GWh / year rate by this point, so to be conservative, you should account for that.

Hopefully they’re above 28.5 GWh/ year rate

Really tough to go long here

Smart money is aware of the widespread, persistent effort by manipulators to crush the stock. They don't want to get in the way of that. I have no evidence, but I believe TRP dumped their 7M+ shares because they were warned that the move that culminated at sub-$180 was in the offing. The presence of these manipulators continues to deter their reentry, IMO.Tesla shares should definitely and always be for long term holding. I think we can all agree that Tesla trades its on way. How you can usually value stocks, when to buy, and how the relationship of stock performance correlates with how the company is doing. That all gets thrown out the window when you're an investor in Tesla.

Buying into Tesla right now, regardless of the length of how long you plan to hold the shares, is acknowledging that the stock action will not correlate to how the company is doing. The stock can and will drop without notice, for reasons that are either non-existent or reasons that a 1st year trader could see through as not important. You're up against a well funded large group that wants to see Tesla's stock collapse. The governing body that is supposed to be a watch dog will not regulate and will in fact hurt your the company you're invested in if given the chance. Shall I keep going?

My post was in no relation to how Tesla as a company has been doing. They've been doing great this quarter. I'd argue that even Q2 was good(especially like the Q2 earnings call). I don't question my investment in Tesla long term at all. Still though, what happened this week(and Friday last week), is just straight up very disheartening to see. The ease at which the stock could get pushed down was surprising for me at this point considering all of the very positive anecdotal things we've seen leading into the end of Q3. I was expecting much more support from smart money here but it's very evident they're content with waiting on the sidelines.

If you have a better free site where the court filings in TSLA related litigation can be accessed, please share it.

It started last week, charging is a hard problem to solve in Taiwan. Most people live in 30-40 years old apartment with underground garage that can't charge the car. Also most of the apartment HOA don't want to pull cable to do charging facility (has to be approved by the majority)When did it start? Why so much slower than other new markets? Australia for example appears to be targeting 2k this quarter.

But, how would the Germans feel about building cars for an American carmaker? What's their attitude to Opel for example?naah, we need to crack German market, and Germans have car assembly skills in their blood - genetically mutated over time.

From these 3 countries, Spain is actually sort of in line with Q2 numbers, whereas Norway is down 35% compared to Q2. At the same time the Netherlands is up +140% over Q2 due to local tax changes coming up in Q1 2020. Hopefully we are not looking at another Denmark where demand completely died for a while after the tax changes. (Demand was pulled forward).

Cross post from the Netherlands section:

Model 3 - Afleveringen

Bottom line is that in Amsterdam deliveries surge to 400-500 per day towards the end of Q3, similar numbers for Tilburg (also in the Netherlands).

So numbers mounting up to 500-1000 per day for a nation with a population similar to the state of New York.

Just extrapolate...

Q1 is certainly going to be very weak in the Netherlands.

@neroden's "demand pull forward" model estimated that for roughly every 5% of price advantage offered, about 1 month of demand is pulled forward from the pool of 2020 buyers. Does anyone know what the price gradient is before/after costs of the Model 3 are in a Netherlands, for a reasonable time interval a business would consider in their calculation?

In the UK, AFAIK pretty much every new car is built to order, and the variety of paint options is usually pretty big. For a model S...the number of options is notably poor. These are $100k cars in many cases.

A £82k porsche 911 has 17 different paint options right now on their website.

A £38k audi has 11 standard colors and more 'audi exclusive' colors (whatever that means).

A mere £10k VW Up! has 8 color choices.

I don't understand why its so difficult to manage a great variety of colors. Surely in 2019 painting is not rocket science? why is it so hard for (for example) a company to make duplicate spare parts in 20 different colors for those body panels most likely damaged in an accident and keep them in each country? Is it really so expensive if a single location in the UK/Germany/US had 10x10 spare car door panels in a storage room?

Shipping a door panel from somewhere in the US to somewhere else in the US should not take months, or be catastrophically expensive with modern logistics planning.

genuinely curious as to why this is so difficult (both as an investor and someone who makes a video game about this stuff)

On the contrary, it's easier than it's been all week!Really tough to go long here

Q4 in The Netherlands will be even crazier. But it will not be completely over after 1 January 2020, even though that is what the TESLAQ crowd wants us to believe. We will see a big drop in Q1 and Q2, but in Q3 and Q4 it will pick up again, because on 1 January 2021 we have the next tax cliff. And then another one on 1 January 2022.

It's all about the taxation of leased cars people can drive as part of their job compensation package, which covers over half of all new car sales. For ICEs you have to add 22% of the sticker price to your wage and then pay 40 tot 50% of tax on that amount. Every year for five years! So if you drive a €50,000 BMW 3 you will pay €4400 to €5500 in extra taxes per year for five years.

For EVs the current rate is just 4% for the first €50.000 (and 22% for the extra amount). A €50,000 Model 3 will cost you €740 to €920 in taxes per year, for five years.

For cars sold after 1 January 2020 the rate will double to 8% and the maximum for that rate will drop to €45.000, so a €50.000 Model 3 will cost €1920 to €2390 per year in taxes. Still less than half of a comparably priced BMW 3.

In 2021 the rate rises to 12%, in 2022 to 16%, in 2025 to 17% and in 2026 to 22%, just like ICEs. But the government's goal is to get to a 100% EV share of new cars in 2030 and if growth stalls they have the option to adjust the rate. They also have the option of taxing ICEs more. So EV growth will have some ups and downs, but overall it will be pretty linear until 2030.

The problem remains that the site is funded and put forward by shorts and so the record put forth is not a complete one rather, one that selectively drops docs that are solely intended to promote a particular agenda.

Be aware that you are getting a less than complete set of data. Free is not free. Do your best not to come to conclusions or promote conclusions based on partial data.

For EVs the current rate is just 4% for the first €50.000 (and 22% for the extra amount). A €50,000 Model 3 will cost you €740 to €920 in taxes per year, for five years.

For cars sold after 1 January 2020 the rate will double to 8% and the maximum for that rate will drop to €45.000, so a €50.000 Model 3 will cost €1920 to €2390 per year in taxes. Still less than half of a comparably priced BMW 3.

Thanks. I'll pursue those sourcesSure use RECAP to get free copies of official documents from PACER: Docket for In re: Tesla, Inc. Stockholder Litigation, 1:17-cv-00317 - CourtListener.com (OK not the correct case, but you should be able to find it.)

If there is something that hasn't been cached that you want just mention it and someone will surely get it for you. (I think the first $15 worth of documents per quarter are free from PACER.)

Edit: OK maybe that court isn't available free...And The eFiling Experts - File & ServeXpress way over charges.