Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tslynk67

Well-Known Member

Seriously. We're at the horribly low levels of....yesterday.

Indeed. This time last week we were trading between 420 and 430. If at that moment you'd ben offered to close today on 470 you'd have bitten the hand off.

And remember, June 3rd, so roughly 7 months back, the daily low was 176.99, the stock is up over 100% since the first week of October.

So as long as it's not a downward trend, it's just noise.

Only thing that worries me is macro black-swans - US/Iran specifically. That's why I deleveraged my options a bit. Not touching any share though, and I still made huge profits.

Robertj

Member

Just listened to four trading guys live on IBD

Three were heavily invested in Tesla , one did not comment re holdings

They suggested a pullback to $460 would not be unreasonable at this point

I have the word for word commentary , but not sure if I am able to paste this here without breaching some

Legal rules ?

message me if you want the transcript or video

humbaba

sleeping until $7000

I can see how an investor can sell if their investment thesis no longer holds (and a better opportunity appears) - or if there is a deadline for when the cash is needed (for e.g. real estate) - but in the latter case TSLA would seem to volatile. Or if in retirement, one could cash out a small percentage every year.

But setting an arbitrary profit and selling when that is reached regardless of the time and other circumstances seems not entirely rational.

I'd agree that that is not an investor: that is a trader. Stock traders do not invest in companies, they trade on the premise of catching climbs.

I'm not saying one is better than the other, but I'm an investor all the way. There are other stocks that make more money than Tesla (even with the current run), but they are not ones I'm interested in investing in and I'm not a stock trader.

Anyway, different strokes and all that.

vigleik

Member

I gave you a disagree because that Investopedia article is not to be trusted: It’s the source of a lot of confusion about the S&P inclusion criteria because it claims, erroneously, that a company must have “Four straight quarters of positive as-reported earnings.” (We’ve been over this many times.)Investopedia: The S&P 500: The Index You Need To Know

Fredneck

Member

Now, I could easily be wrong, and am not an engineer, certainly not in auto manufacture. But I believe I read something along the lines that the new wiring system will also include a change in low voltage systems from ~12V to maybe 48V, for things like headlights, power windows, wipers, sound -- not to forget the whole AP apparatus.

Thus I expect a change into new, shorter wiring to happen in connection to a major change in all models, certainly all built at the same facility.

Exactly when that happens takes a chrystal ball to divine, but I'm pretty sure we will notice it.

Has anyone taken a closer look at MIC M3 headlights, for example? Or other auxiliary suppliers?

48 volts, really? They talked about doing that some 20 years ago in the general auto industry. I read about it in an electronics engineering trade magazine and kinda made a fool of myself by telling friends it was going to happen. Then two or three years later nothing had changed because it was just too much to change every radio, light bulb, electronics module and even the durn car horn.

To change to 48 volts is a big deal, meaning lots of impact. Changing to a hierarchical wiring system is not so much really. I don't know why the major auto makers didn't do that long ago. There are something like 2 dozen MCUs (microcontroller units, not whatever Tesla uses that abbreviation for) in even low end cars already, so what's a few more? Putting one in each door and other locations to eliminate a dozen wires each would easily pay for itself with the reduced number of wires (copper is far from free) and simplified installation. The system voltage change is really just icing on the cake which saves copper on the power wires, not nearly as much benefit once you've reduced the number of wires.

HG Wells

Martian Embassy

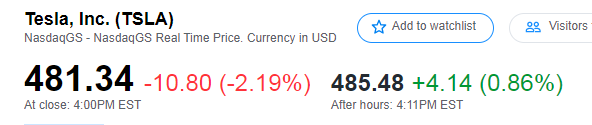

Interesting after hours.

and a moment later.

its -0.59

and a moment later.

its -0.59

Krugerrand

Meow

Forward Observer reporting ~ hey you, this is meI apologize if someone beat me to the punch on this article.

5 things Tesla bears keep getting wrong about this stock

I love this article, if for no other reason than the picture of an X (not my X) propped up nose over a stuffed bear. Yeah, today is a correction ~ frankly I expected it yesterday based on trumpeting news.

I have hunkered down on this stock because I could see through the crap; and was willing to take all the T-bones; no matter how badly they hurt. No, I do not need yet another merit badge, and no I do not need another MSM (army medal). I have taken subliminal heat from my financial conservative in-law-family view. Mathematical wizards, but want their money safe all but under the mattress. If I had not ceased the moment, well who knows who my in-law-family would have been.

I am here because there is nothing else worth believing in ~ period. And, my grandchildren (GrandPups); yes, just two, are what I am protecting.

If you asked me back in 1968 where I would be today; I can guarantee I would not have had a clue and USAA insurance statistically did not have me here either. Just grateful to be here to enjoy the excitement and bask in the sun. I had my 15 seconds of fame long, long ago in a galaxy far, far away.

FYI ~ Tesla still has a long road ahead.

Sony Surprises With Electric Car Prototype - Tesla Motors Club

Sony's story is just beginning; they have a longer road ahead if they are to become competitive.

Ford and GM gave Tesla the middle finger for a long time; now it is time for them to smell the roses.

I have always enjoyed the path right up the center, let others take the credit ~ I just finish the race. Just like my freshman year, one month into my first cross country season. Coach bumped me up to JV after my first meet. The second was an invitational run on CSULB campus where out of 300 runners, I lost miserably ~ okay, very last. At home that night, with my head in my lap, my Dad said, "well at least you finished."

Tesla will finish ~ as promised. Tesla is forcing Ford, GM, BMW, Volvo and so on; to dig themselves out of the mud and into leaning forward in the foxhole.

Zen session open:

Competition should be against yourself not against the others in the race. *That* is why Tesla is winning this race and will continue to win. Tesla challenges themself, compete against themself. It makes, keeps and widens the moat. Everyone else tries to compete against Tesla instead of themselves. That’s the mistake.

Zen session over.

humbaba

sleeping until $7000

ah, trust Claudi Assis to have an article claiming that $TSLA has peaked, noting that shares fell while others gained. But she's slipping. She says that it traded as low as $480.37 -- which is true, but not as negative as the (also true) low of $472.87.

She quotes an analyst who cites GF3 and GF4 as drains to the balance sheet saying its time to sell. Weird to me, maybe that is for the traders, but normally I'd think investing in a growing company would be a positive thing.

Moreover, in a strange world, having room for credit raising is a risk to execution!?!?! I guess the takeaway is supposed to be that Tesla will really start to burn through cash because they could do an equity issuance and dilute the stock? Sell! Sell! Sell!

Naturally, there's a reminder about Elon busting a move and an implication that Tesla is overvalued because it has a market cap greater than GM + F, despite making a small fraction of the cars.

This must have been quite the relief for her after having to pen the previous one where she was only able to work in one snipe.

She quotes an analyst who cites GF3 and GF4 as drains to the balance sheet saying its time to sell. Weird to me, maybe that is for the traders, but normally I'd think investing in a growing company would be a positive thing.

Moreover, in a strange world, having room for credit raising is a risk to execution!?!?! I guess the takeaway is supposed to be that Tesla will really start to burn through cash because they could do an equity issuance and dilute the stock? Sell! Sell! Sell!

Naturally, there's a reminder about Elon busting a move and an implication that Tesla is overvalued because it has a market cap greater than GM + F, despite making a small fraction of the cars.

This must have been quite the relief for her after having to pen the previous one where she was only able to work in one snipe.

Chickenlittle

Banned

Has trip ever been correct?Chowdry's wrong. About everything. Model S is not at end of life. I mean, hello, Elon already publically announced Plaid Model S coming this summer...

If profit taking continues tomorrow

but I am not selling any shares for the foreseeable future...

but I am not selling any shares for the foreseeable future...

Fredneck

Member

I can see how an investor can sell if their investment thesis no longer holds (and a better opportunity appears) - or if there is a deadline for when the cash is needed (for e.g. real estate) - but in the latter case TSLA would seem to volatile. Or if in retirement, one could cash out a small percentage every year.

But setting an arbitrary profit and selling when that is reached regardless of the time and other circumstances seems not entirely rational.

Uh, what exactly is rational about the price of Tesla stock???

If tomorrow's trading exceeds 11M shares, this week's volume will eclipse any single week from last year. If it exceeds just 5M shares it will exceed any single weekly volume from 2018.

There are some big boys involved in this stock right now.

There are some big boys involved in this stock right now.

JRP3

Hyperactive Member

Did they say anything we don't already know?message me if you want the transcript or video

Fredneck

Member

they’re not doing that. This whole “S/X end of life” malarkey is 100% nonsense from an established moron. Ignore it and move on.

Of course it is. While model 3 revenue is the lion's share of the company, I'd be willing to bet currently profits are mostly from the S/X part of the line up. Maybe I should say "income" since they don't have profit on individual products, but I might be wrong then. I'll say for Q4 then and I can be right for another 3 weeks.

Todd Burch

14-Year Member

Has trip ever been correct?

Only thing he's ever been right about is being bullish on Tesla.

tschmidty

Member

48 volts, really? They talked about doing that some 20 years ago in the general auto industry. I read about it in an electronics engineering trade magazine and kinda made a fool of myself by telling friends it was going to happen. Then two or three years later nothing had changed because it was just too much to change every radio, light bulb, electronics module and even the durn car horn.

To change to 48 volts is a big deal, meaning lots of impact. Changing to a hierarchical wiring system is not so much really. I don't know why the major auto makers didn't do that long ago. There are something like 2 dozen MCUs (microcontroller units, not whatever Tesla uses that abbreviation for) in even low end cars already, so what's a few more? Putting one in each door and other locations to eliminate a dozen wires each would easily pay for itself with the reduced number of wires (copper is far from free) and simplified installation. The system voltage change is really just icing on the cake which saves copper on the power wires, not nearly as much benefit once you've reduced the number of wires.

There is talk of 48v motor generator "mild hybrid" systems now. I guess every idea comes around full circle. Ain't gonna happen since it is lipstick on the pig that is an ICE engine. 48v systems for general electrical needs just don't make sense. The difference in wiring needed is minimal in an electric car where you don't even need the high amperage starter motor. Even in an ICE car the differences would be pretty minor.

You microcontroller idea has some merit, but the fact is that running a minimal 3 wire harness isn't much more of a savings labor wise or cost wise than say 12 wires and no mcu. Reliability might be better without X number of mcus and just having a traditional wiring harness (flat or otherwise) with a central "brain". Like I say it is interesting but I think if you sat down and mapped it out it wouldn't necessarily work out. I don't think Teslas have that number of mcus that traditional ICE cars do.

For people who are selling off half their shares, or considering doing so, as a deleveraging mechanism... Let us consider four options:

A) A person who sells half their shares at $490

B) A person who buys $400 Jun protective puts at an SP of $490 ($26x100), paid for by selling stock (5,3 shares per 100 shares covered)

C) #2, except that the puts are paid for by selling an equivalent number of $620 Jun covered calls.

D) No deleveraging

Let's check out your assets at some various SP scenarios at the end of June, for a total original number of shares X.

$0:

* A) $245 * X

* B) $379 * X

* C) $400 * X

* D) $0 * X

$100:

* A) $295 * X

* B) $379 * X

* C) $400 * X

* D) $100 * X

$200:

* A) $345 * X

* B) $379 * X

* C) $400 * X

* D) $200 * X

$300:

* A) $395 * X

* B) $379 * X

* C) $400 * X

* D) $300 * X

$400:

* A) $445 * X

* B) $379 * X

* C) $400 * X

* D) $400 * X

$500:

* A) $495 * X

* B) $474 * X

* C) $500 * X

* D) $500 * X

$600:

* A) $545 * X

* B) $568 * X

* C) $600 * X

* D) $600 * X

$700:

* A) $595 * X

* B) $663 * X

* C) $620 * X

* D) $700 * X

$800:

* A) $645 * X

* B) $758 * X

* C) $620 * X

* D) $800 * X

$900:

* A) $695 * X

* B) $852 * X

* C) $620 * X

* D) $900 * X

$1000:

* A) $745 * X

* B) $947 * X

* C) $620 * X

* D) $1000 * X

It of course gets more complicated when you're talking about scenarios where you'd buy back before expiry, but this complexity affects all choices. The real question, for people considering selling off shares as a means of deleveraging... do the expected returns for this strategy at different SPs really reflect your assumed probabilities for various events?

Remember that if your concerns are only about short-term events, protective puts get a lot cheaper.

ED: Minor error in the above... I forgot to account for the fact that in B), you have fewer shares that you need to protect due to selling some to pay for the puts, so the returns for (B) are slightly higher than listed above.

You forgot Option E: More realistic.

Take Option A where you sell Half your Tesla shares (e.g. you’re retired and 100% invested in TSLA (maybe because you found this forum and got carried away

Rewind back to Dec. 2018, when the stock, after rallying for a while, was at $380 / share, before dipping to $180 and back up to $480 now. This strategy would have handily beaten options A-D., right? Of course this does not provide black swan Tesla protection as one would be buying more TSLA all the way down. So for that most unlikely event, some long term out of the money puts could be a good insurance.

edit I’m doing something similar, but more like down from 125% TSLA to 80%.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K