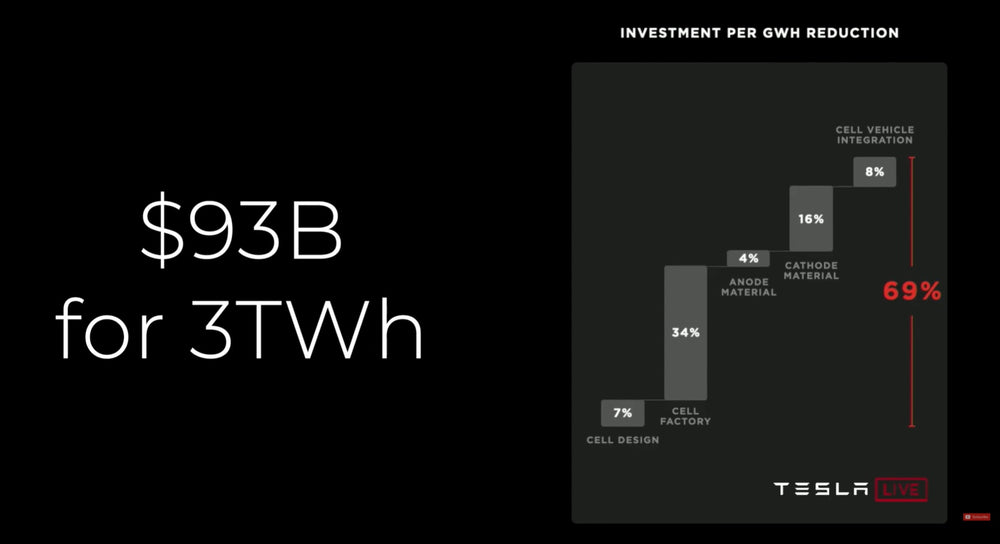

This. I think some of stock drop was 'oh Tesla is relying the success of a really complicated roadmap to 56% reduction in $, it won't happen!'

Each development is mostly independent of the others.

I'm gonna rank these in order of "likely to successfully execute in the near future".

I think they will execute on all 5. But let's sandbag and say 4 & 5 take too long to happen. #1 and #2 and #3 all seem very possible and lead to a 33% reduction in cost even without progress on #4 and #5.

- Vehicle Integration 7% improvement - This one seems the simplest to explain and execute, can't see why this wouldn't happen.

- Cell design (bigger, tabless) 14% improvement - Definitely a leap forward, but the bigger size and lower heat are amazing.

- Various cathodes 12% improvement - Ranking this here because 3 different battery chemistries provide room for failure. If Nickel is short, focus on nickel/magnesium. And the iron battery seems like a no-brainer.

- Cell factory simplification (dry electrode) 18% improvement - Elon admitted to this step being difficult, and could see this being the step that causes 'Elon Time'. But only maybe, 3 years is a lot of time to work on this.

- Silicon anode 5% improvement - Ranking last because very little was said about this step, and it's a bit out of left field. Nobody was expecting some sort of elastic polymer to allow for silicon expansion. In any case, least amount of improvement, least important in the list.

Not only is Tesla likely, in the long run, to exceed several of these projections, they've also given themselves a tremendous opportunity to take their success in small chunks. Any one of these improvements alone should strike fear into ICE manufacturers. Two would have made a great battery day. All 5 is just bananas and almost cruel how far ahead they are of the competition.

The SP doesn't reflect this reality. They assign a risk of this 100% not working, they (analysts) assume a longer timeline, but in reality there's almost no world in which Tesla doesn't realize at least SOME of these improvements immediately.

The problem is that your step #4, DBE, isn't optional. If they can't do it they would require much more factory space and expense to be able to build the solvent based electrode process. So as far as I can see it is in the one required innovation.