The point I made in my tweet is that its stranded assets because the investment you need to lift to transform an ICE factory into a BEV factory is comparable to building a brand new BEV factory.

In fact, you throw almost all previous invested capital away. it's not like you change a few tools and can start production again. This is not retooling at all but the entire layout needs to change. Everybody who is telling you that knows nothing about automotive production and as a side note, I am a production engineer by education.

Some parts of the old ICE factory can be used again but it's minor compared to what you invest again.

For VW it's a major investment and when they finished it they still have an old factory more costly and with lower productivity. factoring productivity gains in Tesla has with a new factory compared to lower productivity VW has with an old transformed ICE factory they lose money although all the investment.

If you ask why VW does not start on a green field but goes for a blue field investment its the Unions. The VW law allows unions to decide what is produced where and not the VW Management.

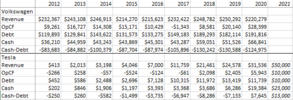

Indeed, not only is there much less overlap between ICE and EV manufacturing, the idea that large incumbent auto manufacturers have unlimited resources to drop at a moment's notice is a stupid. Let's take a look at the numbers and compare VW to Tesla:

The 2021 numbers for Tesla are very rough ballpark guesses.

Now, Capital expenditures are funded by operational cash flow, debt, or equity. Let's compare Teslas and VWs ability to generate this funding:

VW on average generated ~$14b per year in operational cash flow against essentially _zero_ revenue growth. Debt, meanwhile has grown 60%.

Now, Tesla will probably generate about $10b in operational cash flow compared with VW's average $14b.

Interest expense/rolling over the existing debt is going to cost Tesla something under $1b compared to probably around $10 billlion for VW. That drops the OCF less debt refinancing to ~$4b for VW and $9b for Tesla.

Now, let's assume each company wants to keep the debt ratio the same. Since Tesla is growing by 60%, it could theoretically borrow another $6b without increasing the debt to revenue ratio! VW can't do this because of static revenues. Now we are at $15b for Tesla and $4b for VW!

Now, remember, this is the total natural funding roughly available, and VW wont be able to drop it's ICE capital spending to zero even if it wanted to, because the lines will need at least maintenance. Tesla's need to fund obsolete ICE lines is: $0. Ultimately, factor the ICE bare bones upkeep out, and VWs ability to naturally fund EV spending (i.e. without massively increasing the debt ratio) is probably ZERO.

*This* is why VW has had to add $60 billion in debt over the last ~8 years.

Then there are OTHER factors:

-The debt to revenue ratio is *already* much lower for Tesla than VW, so it could theoretically borrow *even more* if it wanted to.

-Tesla has a huge excess cash pile compared to VW

-Tesla's market cap is much higher. With a 1% deval, Tesla could fund $6 billion in capital spending, compared with only ~$1 billion for VW.

-On top of this, since Tesla is now far more experienced in the field of EV manufacturing, it's capital spending is probably going to be much more efficient.

This is what Cathy Wood talks bout when she mentions Tesla's "balance sheet fortress"

People look at Toyota and VW's 10m in sales per year, 20x higher than Tesla, and wrongly assume that roughly correlates with their ability to fund future EV development. The truth is just about the opposite!