Well...well...well....i was wondering when one of you was gonna give in. Way to take the high road @Krugerrand !Fine. I will beg Mom’s forgiveness so we might have the SP and timeline information.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Shorty piling-in at key resistance... if you look carefully you'll notice the volume were low, this wasn't shareholders panic selling, this was bears trying to reverse the rallyNo, I meant macros--in particular tech stocks, which are almost all red today (the big ones at least). Dow, Nasdaq, and S&P all near even today. But yes, I think this is all about options and next week shows better promise for more movement.

TBH I think it was a pretty poor effort, SPY even finished green and QQQ was heading that way. Tomorrow will be interesting.

StarFoxisDown!

Well-Known Member

Trust me, I get the paranoia and fear there, but the reality is, that's not how Wall St works. There's always a relation of metrics to the company's actual growth/finances. Now sometimes there's ranges or stretches of those, but by far most of the time those are on bullish side. As in, a company gets a higher P/E than it realistically deserves thanks to some unrealistic future earnings growth expectations.There is a third possibility though:

Tesla's valuation will stay disconnected like it is today.

There isn't any law stating a valuation needs to conform to a standard or be like it's peers. A stock valuation is determined by the investors, and sadly MM's are investors too, and as long as they manipulate the stock TSLA could stay very disconnected from where it "should" be trading.

This disconnect might last quite a while yet.

It's incredibly rare, in fact I don't think I can even find an example, where a company's Forward P/E is substantially lower than it's actual earnings growth. The obvious examples would be companies where it's known by everyone that their future earnings are going a lot lower due to fundamental issues within the company or the space that the company is in. And I'm not talking speculative. I'm talking Blockbuster example. Where everyone knew their entire business model was doomed in the short term and long term.

I think TSLA is already stretched to the limits in terms of the disconnect between it's growth and it's valuation. For Tesla to have a Forward P/E of 60 after posting Q3 earnings growth of around 100% YoY would really be the tipping point. Which again, Tesla has to execute. Then you get into Q4 earnings, if the stock hasn’t moved from today, where Forward P/E would be around 40..........with Tesla posting 100%+ earnings growth in the quarter.

You kinda see where I'm going and why I find it rather impossible for TSLA valuation to not move higher a big way after Q4's earnings at the latest. The disconnect simply becomes too unrealistic. So I effectively think the ball's in Tesla's court. If Tesla executes in Q3/Q4 and going forward, the stock will be forced higher, steadily, quarter after quarter.

Now I do think Tesla won't exactly get the P/E multiple it deserves, because Wall St simply won't believe that TSLA can keep growing revenues/earnings the way they are. And that's where there's some debate. Tesla should easily have a Forward P/E of 150-200+ based on my numbers for growth between now and 2025. But what number will Wall St settle on. Is it a forward P/E of 100? 75? 50? But once that baseline or threshold is reached where Wall St simply says the Forward P/E of TSLA is too cheap to ignore, then you're going to see that dynamic where the stock steadily moves higher, quarter after quarter, based on how well the company executes its growth.

Just to remind everyone, and I don't mean to put ya on the spot @The Accountant , but he's projecting 5.6 billion in GAAP net income for Q4 off of 455k deliveries which would be well over 100% earnings growth YoY. Very doable numbers for Tesla. If TSLA were only 900/share after those earnings, TSLA's Forward P/E would be 42.

Last edited:

Great analysis....so to sum it up....HODLTrust me, I get the paranoia and fear there, but the reality is, that's not how Wall St works. There's always a relation of metrics to the company's actual growth/finances. Now sometimes there's ranges or stretches of those, but by far most of the time those are on bullish side. As in, a company gets a higher P/E than it realistically deserves thanks to some unrealistic future earnings growth expectations.

It's incredibly rare, in fact I don't think I can even find an example, where a company's Forward P/E is substantially lower than it's actual earnings growth. The obvious examples would be companies where it's known by everyone that their future earnings are going a lot lower due to fundamental issues within the company or the space that the company is in. And I'm not talking speculative. I'm talking Blockbuster example. Where everyone knew their entire business model was doomed in the short term and near term.

I think TSLA is already stretched to the limits in terms of the disconnect between it's growth and it's valuation. For Tesla to have a Forward P/E of 60 after posting Q3 earnings growth of around 100% YoY would really be the tipping point. Which again, Tesla has to execute. Then you get into Q4 earnings, if the stock has moved from today, where Forward P/E would be around 40..........with Tesla posting 100%+ earnings growth in the quarter.

You kinda see where I'm going and why I find it rather impossible for TSLA valuation to not move higher a big way after Q4's earnings at the latest. The disconnect simply becomes too unrealistic. So I effectively think the ball's in Tesla's court. If Tesla executes in Q3/Q4 and going forward, the stock will be forced higher, steadily, quarter after quarter.

Now I do think Tesla won't exactly get the P/E multiple it deserves, because Wall St simply won't believe that TSLA can keep growing revenues/earnings the way they are. But once that baseline or threshold is reached where Wall St simply says the Forward P/E of TSLA is too cheap to ignore, then you're going to see that dynamic where the stock steadily moves higher, quarter after quarter, based on how well the company executes its growth.

Wow, looks like Giga Berlin will be in fact using a structural pack built by

According to info obtained by teslamag.de Giga Berlin will be in fact using a structural battery packs supplied by BYD! That is a big surprise. Tesla using cells from other manufacturers is one thing but buying a structural pack after just developing one themselves is interesting IMHO. Does make sense to get as much supply as possible on the one hand but supports slower than expected 4680 ramp thesis. But good they are securing an alternative supply early on until things work out.

teslamag-de.translate.goog

teslamag-de.translate.goog

Looks like according to finance.sina.ch Giga Berlin will soon be using BYD blade batteries end of Aug/beginning of Sep:

Another article on this:

BYD supplying Blade batteries to Tesla's Giga Berlin

Last month we reported on speculation that BYD would supply batteries for the Tesla Model Y early next year. However, things have moved pretty fast, and the Chinese auto company has now made actual deliveries […]driveteslacanada.ca

Once again not clear usage of the word "battery". Wonder if they are delivering cells which are integrated into battery packs in Berlin or whole packs. I think the latter is unlikely because the pack needs to fit into the rest of the car and Tesla would have to give the plans to BYD.

On the other hand, AFAIK Tesla has never used blade cells in their packs at all and Berlin has not even built packs from cells so far, just got complete packs built from 2170 cells at Giga Shanghai.

According to info obtained by teslamag.de Giga Berlin will be in fact using a structural battery packs supplied by BYD! That is a big surprise. Tesla using cells from other manufacturers is one thing but buying a structural pack after just developing one themselves is interesting IMHO. Does make sense to get as much supply as possible on the one hand but supports slower than expected 4680 ramp thesis. But good they are securing an alternative supply early on until things work out.

Exklusiv: Tesla hat schon EU-Genehmigung für neues Model Y mit strukturellem Akku von BYD

Tesla hat eine neue Standard-Variante des Model Y in der EU angemeldet – überraschend mit strukturellem Akku-Paket von BYD.

StealthP3D

Well-Known Member

I believe calling it "embarrassing" might turn out to be the understatement of the decade! At least if the unlikely happens, and FSD is banned.On the other hand, IF lobbying pushes US Gov / States to bar FSD, Tesla is within its rights to get FSD regulated elsewhere (Canada?) which would only make the US case look increasingly embarrassing.

Imagine the Tesla fleet fatality statistics in the US and Canada are roughly equal. I have no idea whether that's true but the relevant thing here is the death rate of the Tesla fleet in the US relative to Canada (or any other place that did not ban FSD). If the death rates diverged after the US banned FSD, in the direction we assume they would, then it would essentially make those who banned FSD guilty of negligent homicide, probably on a massive scale. The severity of the crime would be dependent upon whether they had the relevant safety data available before they banned it and how much the death rate changed. And we know that Tesla will use statistics to prevent the banning of FSD so we can assume they had the data that showed it increased, not decreased safety. And the number of additional deaths caused by the banning of FSD could be easily calculated from the data.

Nobody wants to be found criminally negligent, so I think the banning of FSD is unlikely.

TN Mtn Man

Member

Dang, I didn't realize it was that much anywhere! .089 +~.024 "adjustment here so ~$0.115. Can't imagine what AC costs must be in the summer. I can see why home solar is so popular.In LA area, my peak price is $0.52/kWh. I'm on the "cheaper plan", the other choice is $0.65/kWh. Link. Better adjust your post to 8x during peak...

You can't make this stuff up, and I can't move out of this state fast enough!

UkNorthampton

TSLA - 12+ startups in 1

Tesla are agile, every decent cell can be used. Tesla can outbid others, or simply be a more dependable customer. Suppliers can see Tesla are and will be winning, don't mess them around.Wow, looks like Giga Berlin will be in fact using a structural pack built by

According to info obtained by teslamag.de Giga Berlin will be in fact using a structural battery packs supplied by BYD! That is a big surprise. Tesla using cells from other manufacturers is one thing but buying a structural pack after just developing one themselves is interesting IMHO. Does make sense to get as much supply as possible on the one hand but supports slower than expected 4680 ramp thesis. But good they are securing an alternative supply early on until things work out.

Exklusiv: Tesla hat schon EU-Genehmigung für neues Model Y mit strukturellem Akku von BYD

Tesla hat eine neue Standard-Variante des Model Y in der EU angemeldet – überraschend mit strukturellem Akku-Paket von BYD.teslamag-de.translate.goog

Additionally BYD may want some of the Tesla magic/renown to rub off on them. Also helps ramp volume for their own cars & buses. More volume, the merrier.

Anyone familiar with Elon’s 1999/2000 x.com goals won’t think this is any kind of a wild card. Most of the original x.com plans, the Confnity merger and subsequent Musk plans won’t think this is even a modest goal. That earlier history is partly public, but pretty obscure. I was part of the creation of a partner company in that early development. The fundamental Musk plan was never secret at a very high level. He wanted to incorporate features from the US and other country deregulation the permitted true universal banking. He wanted to combine consumer and commercial banking plus insurance, investment banking and worldwide payments. After his deposing PayPal became only the parsonal/small business payments part. Over the subsequent years they’ve used partners and agents to make that more widespread. They have ignited the larger functions.The whole x.com thing is a complete wild card. Elon’s plan might be as simple as modifications to and transparency of Twitter’s algos (along with bot eradication) or as complex as establishing a social media/banking/online sales ecosystem. If the latter, I’d sell my left walnut to get in on it early.

Elon plans to execute all of that using the Twitter base, if we accept his words. I do. after 22 years he normally does what he intends to do, sooner or later. Admittedly I am not objective.

TN Mtn Man

Member

Thing is, if something like that happens it will be done by government bureaucrats, judges or lawmakers. Meaning NO ONE will be held responsible no matter how many unnecessary deaths there are.I believe calling it "embarrassing" might turn out to be the understatement of the decade! At least if the unlikely happens, and FSD is banned.

Imagine the Tesla fleet fatality statistics in the US and Canada are roughly equal. I have no idea whether that's true but the relevant thing here is the death rate of the Tesla fleet in the US relative to Canada (or any other place that did not ban FSD). If the death rates diverged after the US banned FSD, in the direction we assume they would, then it would essentially make those who banned FSD guilty of negligent homicide, probably on a massive scale. The severity of the crime would be dependent upon whether they had the relevant safety data available before they banned it and how much the death rate changed. And we know that Tesla will use statistics to prevent the banning of FSD so we can assume they had the data that showed it increased, not decreased safety. And the number of additional deaths caused by the banning of FSD could be easily calculated from the data.

Nobody wants to be found criminally negligent, so I think the banning of FSD is unlikely.

Gigapress

Trying to be less wrong

Tesla Semi Financial Model

Hardcore Smackdown on Diesel Trucks

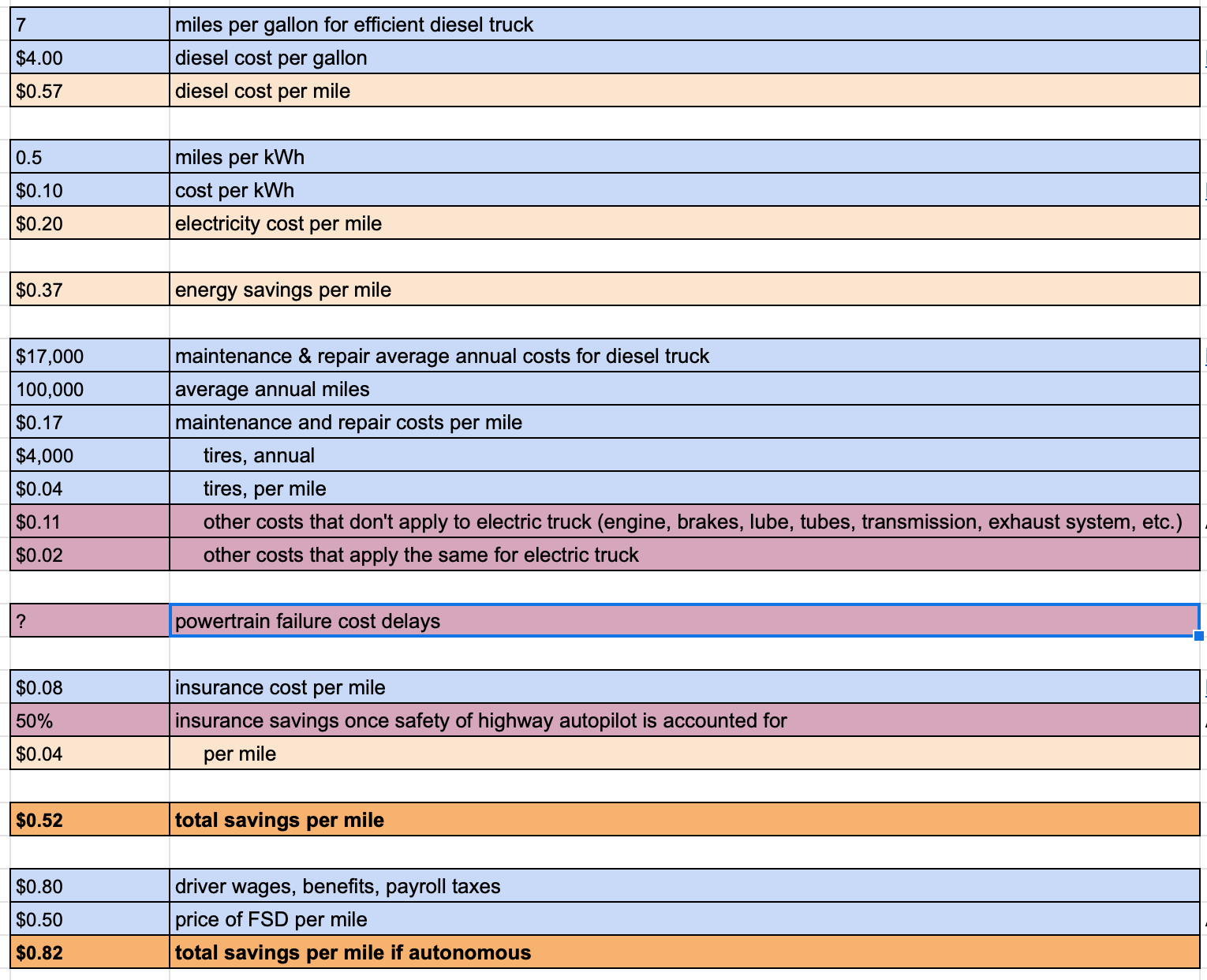

I haven't done a proper analysis on the Tesla Semi until today, and I was surprised how good the business case is. The economics of the Tesla Semi are so strong that it might be economically favorable to retire diesel tractor-trailers early to replace them with the Semi. The market for new Class 8 trucks (80k pound max gross vehicle weight) is likely going to grow as compelling electric trucks arrive on the market, due to lower cost, higher reliability, better environmental performance, and more. Products that are both better and cheaper sell more units in the marketplace, in accordance with the Law of Demand.

I see now, shortly before posting this, that @LYTRIDR posted Semi numbers (link) while I was working on this. It looks like we have similar estimates. The biggest difference is in fuel saving estimation, where LYTRIDR's model uses $5/gallon for diesel, which is today's cost, and 6 miles per gallon which is probably more accurate, while I use $4/gal to reflect the average over the last 15 years and 7 mpg to be more generous about today's most efficient diesel trucks. The other major difference is that my model includes a 7% weighted average cost of capital to account for the time-value of money.

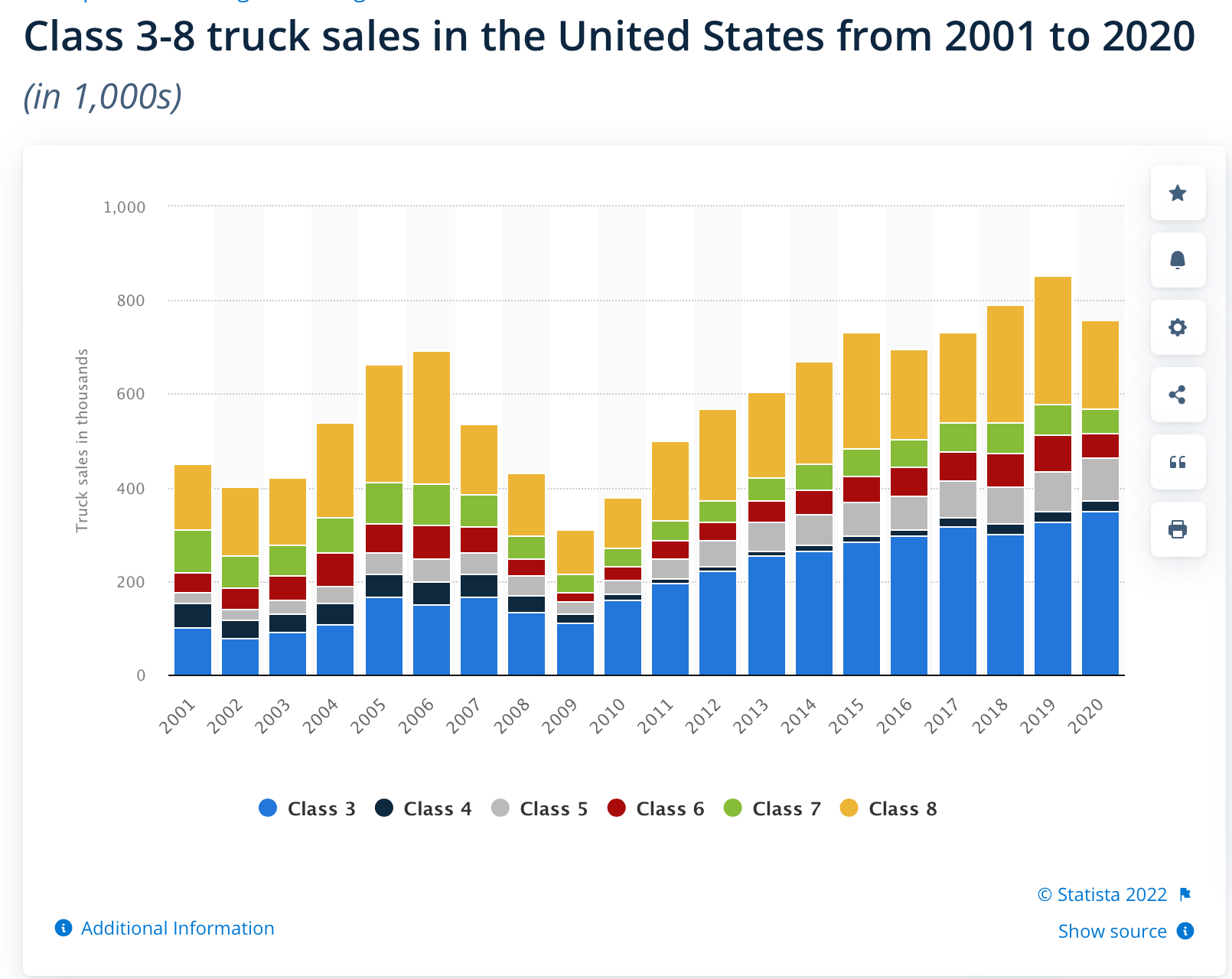

The craziest part is that this only covers full-size Class 8 trucks. Tesla could leverage their technology advantage across all the other classes of smaller trucks as well. In the US, Class 8 trucks only make up a quarter of truck sales volume in the Class 3-8 range of heavy-duty trucks. Note: Classes 1 & 2 are for light-duty trucks like F-150 and F-250; Cybertruck will serve this segment.

(link)

Additionally, if Tesla may have a competitive advantage with respect to managing charging networks and predicting future energy costs in a future grid that's increasingly based on solar and wind, with real-time pricing and with reliance on responsive smart loads (such as BEV charging) that consume power when electricity is most abundant. Any advantage from Tesla's experience with the Supercharger network, Autobidder, Megapacks, etc would also help with the economics of the Semi. Anything that can save even $0.01/mile in trucking is a big competitive advantage. A truck with a 1 MWh battery is basically a Megapack on wheels, and therefore it can participate in the energy storage market as well as the freight market, depending on which is optimal at any given time. This could be especially useful at night when many of the trucks aren't carrying anything.

A typical semi trailer lasts around 800k miles before needed a major rebuild which is 8-10 years of typical usage. I think a Tesla Semi can probably last twice as long, but I have no way to estimate this precisely. I went with 1.5 million miles. The diesel trucks most ripe for early retirement will be the oldest ones with the highest maintenance, repair, and fuel costs and worst reliability.

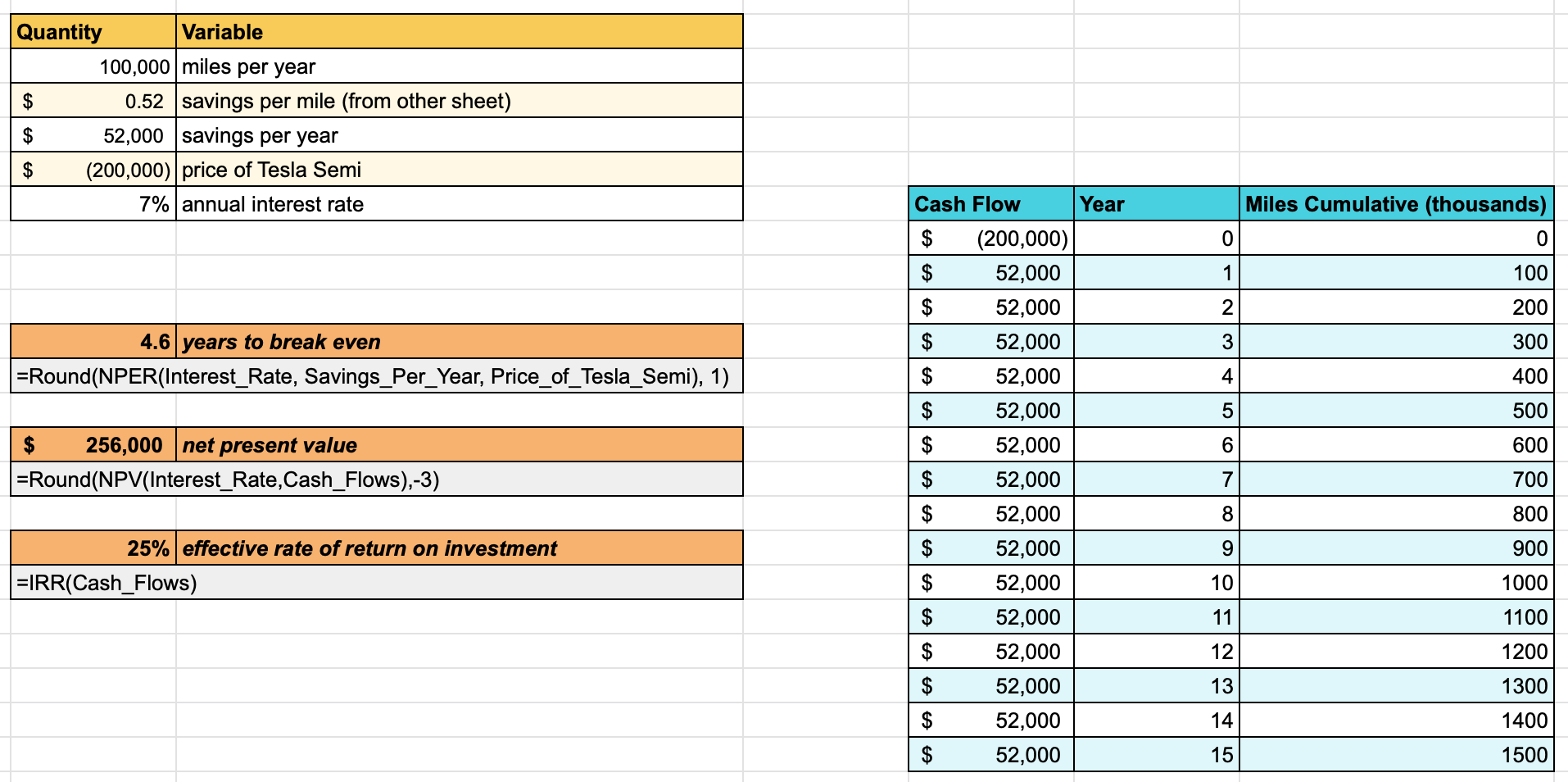

This rough model indicates that a Tesla Semi purchase would break even after less than 5 years of ownership and deliver a 25% equivalent return on investment over a 15-year, 1.5M mile lifespan. This kind of return on investment is ridiculously high for an extremely competitive commodity market like freight trucking.

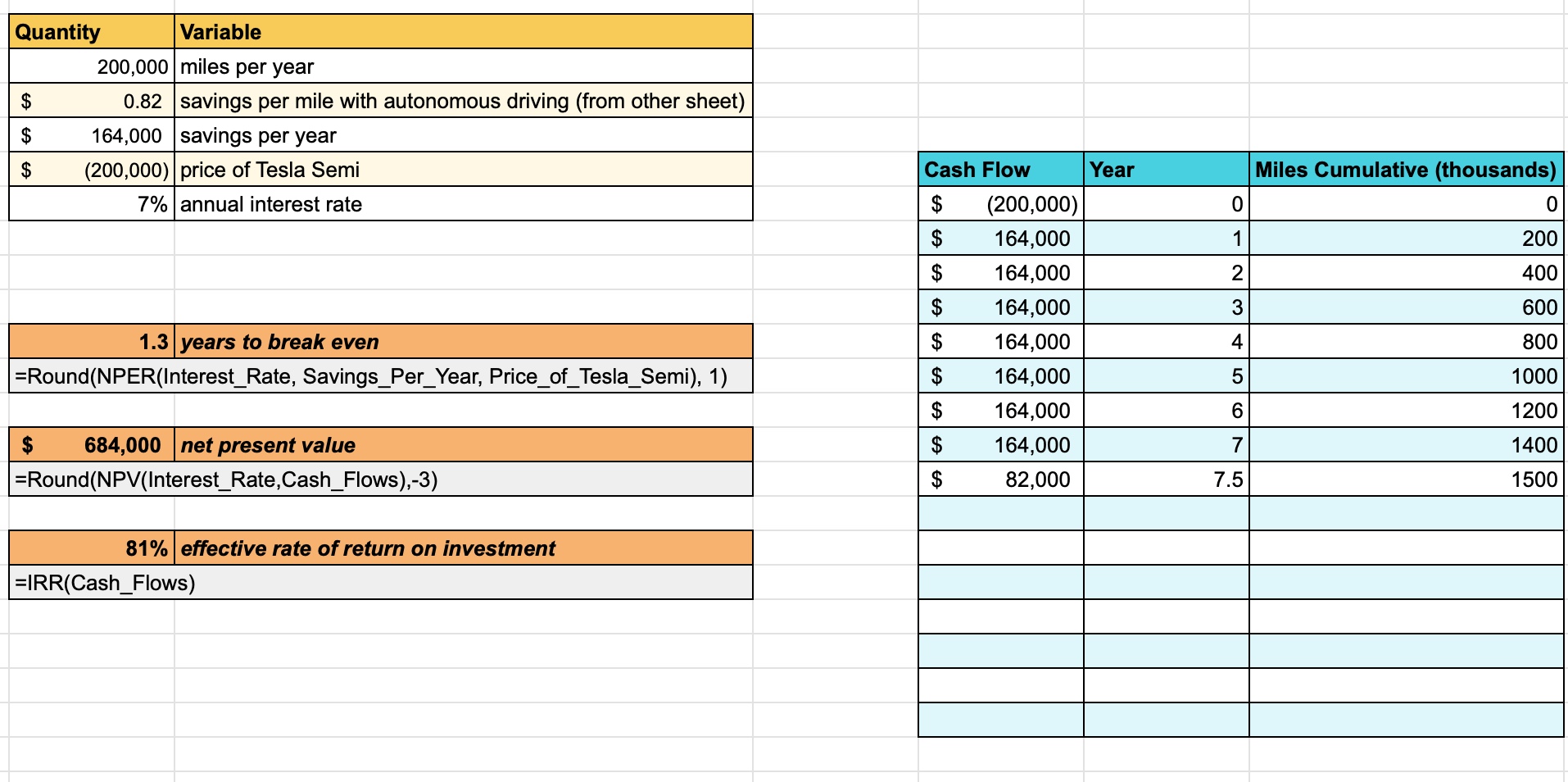

Autonomy will help the return on investment even more if it increases the annual utilization of the truck. Without needing to work around rest for a driver, an autonomous truck could probably double the number of miles driven per year. Because the cost savings are mostly in variable costs, the higher utilization rate means paying off the upfront truck costs sooner and hitting payday after only 1.3 years according to this model! That is a whopping 81% annualized return on investment for the early adopters. Eventually, competition would drive down freight prices until not much profit margin is left, but the early adopters would make a lot of money. Or maybe Tesla would just raise the price of the truck or the FSD license to make the waiting list shorter.

This model does not account for end-of-life disposal because I don't know how to model it. I expect a Tesla Semi has more value for material recycling than a diesel semi and lower costs for disassembly and hazardous waste disposal. This model also doesn't account for the opportunity cost of diesel reliability failures, time spent sitting at chargers, nor faster delivery times on routes with steep grades. However, by far the biggest factors are driver wage savings if autonomous, fuel savings, and maintenance savings.

Any diesel truck in service with a residual value less than the net present value of a Tesla Semi should be scrapped as soon as it can be replaced with the Tesla. By the math above, this will be almost all diesel tractors because $250k is a high hurdle to clear for remaining lifetime value.

Much of this analysis would apply for any battery-powered truck that can be sold for $200k with 2 kWh/mile energy consumption. However, I think Tesla has a serious advantage in meeting the necessary technical specs like range, payload capacity, and charging speed while keeping manufacturing costs low. Tesla also has the best crash avoidance software and can probably win on vehicle longevity, which has a big impact on the overall economics.

Unit Economics

Total Cost of Ownership Comparison - ROI vs. Diesel

With human driver:

With autonomous driving:

Spreadsheet: link

This was for America only

The US has some of the cheapest diesel in the world. In other major market, Europe especially, the energy cost differential between diesel vs. electricity is even greater.

edit: fixed error which caused underestimate in savings.

Hardcore Smackdown on Diesel Trucks

I haven't done a proper analysis on the Tesla Semi until today, and I was surprised how good the business case is. The economics of the Tesla Semi are so strong that it might be economically favorable to retire diesel tractor-trailers early to replace them with the Semi. The market for new Class 8 trucks (80k pound max gross vehicle weight) is likely going to grow as compelling electric trucks arrive on the market, due to lower cost, higher reliability, better environmental performance, and more. Products that are both better and cheaper sell more units in the marketplace, in accordance with the Law of Demand.

I see now, shortly before posting this, that @LYTRIDR posted Semi numbers (link) while I was working on this. It looks like we have similar estimates. The biggest difference is in fuel saving estimation, where LYTRIDR's model uses $5/gallon for diesel, which is today's cost, and 6 miles per gallon which is probably more accurate, while I use $4/gal to reflect the average over the last 15 years and 7 mpg to be more generous about today's most efficient diesel trucks. The other major difference is that my model includes a 7% weighted average cost of capital to account for the time-value of money.

The craziest part is that this only covers full-size Class 8 trucks. Tesla could leverage their technology advantage across all the other classes of smaller trucks as well. In the US, Class 8 trucks only make up a quarter of truck sales volume in the Class 3-8 range of heavy-duty trucks. Note: Classes 1 & 2 are for light-duty trucks like F-150 and F-250; Cybertruck will serve this segment.

(link)

Additionally, if Tesla may have a competitive advantage with respect to managing charging networks and predicting future energy costs in a future grid that's increasingly based on solar and wind, with real-time pricing and with reliance on responsive smart loads (such as BEV charging) that consume power when electricity is most abundant. Any advantage from Tesla's experience with the Supercharger network, Autobidder, Megapacks, etc would also help with the economics of the Semi. Anything that can save even $0.01/mile in trucking is a big competitive advantage. A truck with a 1 MWh battery is basically a Megapack on wheels, and therefore it can participate in the energy storage market as well as the freight market, depending on which is optimal at any given time. This could be especially useful at night when many of the trucks aren't carrying anything.

A typical semi trailer lasts around 800k miles before needed a major rebuild which is 8-10 years of typical usage. I think a Tesla Semi can probably last twice as long, but I have no way to estimate this precisely. I went with 1.5 million miles. The diesel trucks most ripe for early retirement will be the oldest ones with the highest maintenance, repair, and fuel costs and worst reliability.

This rough model indicates that a Tesla Semi purchase would break even after less than 5 years of ownership and deliver a 25% equivalent return on investment over a 15-year, 1.5M mile lifespan. This kind of return on investment is ridiculously high for an extremely competitive commodity market like freight trucking.

Autonomy will help the return on investment even more if it increases the annual utilization of the truck. Without needing to work around rest for a driver, an autonomous truck could probably double the number of miles driven per year. Because the cost savings are mostly in variable costs, the higher utilization rate means paying off the upfront truck costs sooner and hitting payday after only 1.3 years according to this model! That is a whopping 81% annualized return on investment for the early adopters. Eventually, competition would drive down freight prices until not much profit margin is left, but the early adopters would make a lot of money. Or maybe Tesla would just raise the price of the truck or the FSD license to make the waiting list shorter.

This model does not account for end-of-life disposal because I don't know how to model it. I expect a Tesla Semi has more value for material recycling than a diesel semi and lower costs for disassembly and hazardous waste disposal. This model also doesn't account for the opportunity cost of diesel reliability failures, time spent sitting at chargers, nor faster delivery times on routes with steep grades. However, by far the biggest factors are driver wage savings if autonomous, fuel savings, and maintenance savings.

Any diesel truck in service with a residual value less than the net present value of a Tesla Semi should be scrapped as soon as it can be replaced with the Tesla. By the math above, this will be almost all diesel tractors because $250k is a high hurdle to clear for remaining lifetime value.

Much of this analysis would apply for any battery-powered truck that can be sold for $200k with 2 kWh/mile energy consumption. However, I think Tesla has a serious advantage in meeting the necessary technical specs like range, payload capacity, and charging speed while keeping manufacturing costs low. Tesla also has the best crash avoidance software and can probably win on vehicle longevity, which has a big impact on the overall economics.

Unit Economics

Total Cost of Ownership Comparison - ROI vs. Diesel

With human driver:

With autonomous driving:

Spreadsheet: link

This was for America only

The US has some of the cheapest diesel in the world. In other major market, Europe especially, the energy cost differential between diesel vs. electricity is even greater.

edit: fixed error which caused underestimate in savings.

Attachments

Last edited:

This isn’t really too surprising. Tesla will be using these LFP packs even after the 4680 production is going well. I thought Tesla had made it clear they are going to source as many batteries as possible from whatever source they can get.Wow, looks like Giga Berlin will be in fact using a structural pack built by

According to info obtained by teslamag.de Giga Berlin will be in fact using a structural battery packs supplied by BYD! That is a big surprise. Tesla using cells from other manufacturers is one thing but buying a structural pack after just developing one themselves is interesting IMHO. Does make sense to get as much supply as possible on the one hand but supports slower than expected 4680 ramp thesis. But good they are securing an alternative supply early on until things work out.

Exklusiv: Tesla hat schon EU-Genehmigung für neues Model Y mit strukturellem Akku von BYD

Tesla hat eine neue Standard-Variante des Model Y in der EU angemeldet – überraschend mit strukturellem Akku-Paket von BYD.teslamag-de.translate.goog

Those 55 kWh LFP cells have to be saving them a lot of money versus 82 kWh nickel packs in the LR.

StealthP3D

Well-Known Member

Thing is, if something like that happens it will be done by government bureaucrats, judges or lawmakers. Meaning NO ONE will be held responsible no matter how many unnecessary deaths there are.

I agree, it would be very unlikely for charges to actually be filed. The point is it wouldn't be a good look. Knowing you were responsible for thousands of deaths would go far beyond embarrassing.

EVDRVN

Active Member

PGE is higher in some cases, wants to tax solar panels, and Berkeley new construction must be all electric with no gas. Off peak has been reversed to favor them and we are also paying for their fire damage while they get protected profits on investments. Criminal. .11 is like free energy here.Dang, I didn't realize it was that much anywhere! .089 +~.024 "adjustment here so ~$0.115. Can't imagine what AC costs must be in the summer. I can see why home solar is so popular.

It does not work like that. If FSD is banned, then every single fatality is the result of the actions of human drivers, therefore there is a specific person (driver at fault) responsible for each and every one of those deaths. No politician or government will be blamed for any of them.I believe calling it "embarrassing" might turn out to be the understatement of the decade! At least if the unlikely happens, and FSD is banned.

Imagine the Tesla fleet fatality statistics in the US and Canada are roughly equal. I have no idea whether that's true but the relevant thing here is the death rate of the Tesla fleet in the US relative to Canada (or any other place that did not ban FSD). If the death rates diverged after the US banned FSD, in the direction we assume they would, then it would essentially make those who banned FSD guilty of negligent homicide, probably on a massive scale. The severity of the crime would be dependent upon whether they had the relevant safety data available before they banned it and how much the death rate changed. And we know that Tesla will use statistics to prevent the banning of FSD so we can assume they had the data that showed it increased, not decreased safety. And the number of additional deaths caused by the banning of FSD could be easily calculated from the data.

Nobody wants to be found criminally negligent, so I think the banning of FSD is unlikely.

StealthP3D

Well-Known Member

It does not work like that. If FSD is banned, then every single fatality is the result of human drivers, therefore there is a specific person (driver at fault) responsible for each and every one of those deaths. No politician or government will be blamed for any of them.

That's not my point. It's that if the relative safety rates of countries with FSD and those without can be compared, both before and after FSD was available or outlawed (as the case may be), then the number of deaths due to not having FSD can be determined. It's a statistical metric, not an assignment of blame in individual accidents.

Good analysis/overview on O´Dowd pedestrian video:

driveteslacanada.ca

driveteslacanada.ca

Raw footage shows Tesla FSD Beta was active during The Dawn Project's tests, but there’s more to the story [Video]

While the video does show FSD Beta was active, it does seem strange that O'Dowd would go to this much effort to only run three tests.

driveteslacanada.ca

driveteslacanada.ca

ZeApelido

Active Member

On Jan 24, 2020 Ralph Nader warned us about Tesla.

Ralph told us that TSLA had a "wildly speculative stock valuation". The stock was at $167 when he made this statement.

View attachment 839756

Yesterday I sent him a tweet reminding him of that stupidity.

Then some rando wanted to tell me he wasn't wrong, so I provided numbers:

Now that rando and the guy I responded to about the short seller interview have blocked me.

Not because I threw out any ad-hominem attacks, but becuase I gave concrete numbers.

These Tesla haters are very, very lame.

damonbrodie

Member

I love it when posters (here or on twitter) post something like this.

If you want to apply actual valuation metrics, that's fine. But post your actual expectations of those metrics, not just some vague/broad lines. If you think TSLA will trade at a Forward P/E of 50, then actually put the work to get yourself to that point. I can look around all of Wall St right now that show me TSLA's valuation is disconnected and either TSLA will rocket higher at any moment or the rest of the stock market needs to tank a good 30-50%.

Otherwise, it's a post with little substance.

The P/E Ratio has slowly been climbing again in Q3 which is encouraging, but the overall slope over the past year has been declining. I expect that a trailing P/E ratio of between 70-90 for the coming few quarters until the next Big Thing.

TN Mtn Man

Member

Don't hate me, but for personal, selfish reasons I hope they hit TSLA hard in the next week or so. I want to buy up more-would have a couple months ago but no dry powder and all my other holdings were gutted horribly. They have made somewhat of a comeback, to the point I can stomach selling and locking in some modest losses to free cash up for more TSLA. If they succeed in pushing SP down, I can't see it holding-too many positive things on the short term horizon.The real question is how low can Wall St push TSLA over these next two months.

1) AI day

2) Record production numbers for July-expect to see even more in AU

3) Q3 production and earnings reports

4) The new EV credit bill, which looks like it will be more positive for Tesla than any other company

5) New FSD release coming

7) Hopefully a prototype Teslabot

8) Semi

9) Investment rating upgrade

I have trouble seeing the FUD-Packers holding it down for any length of time.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K