Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Interesting - it's the grid that's slowing down adoption.

More + Source: 2023 Integrated Energy Policy Report with Errata - https://efiling.energy.ca.gov/GetDocument.aspx?tn=254463

cliff harris

Member

Downgrades from big banks are comical. They have never shown any expertise in understanding Tesla. I'm more interested in what anyone in my twitter feed, (which is full of retail investors that do serious analysis of the company) thinks about the company than someone at a big bank. If I wanted to trust those banks to look after my savings, I'd hire them as financial advisors and let them pick my stocks (ha... nope).

Banks set price targets in order to move the stock to their own advantage. Their free advice is seldom cheap.

Good to see gigaberlin back, and Elon visiting and confirming future expansion. Totally unsurprised to see fisker go bankrupt. Lucid next. Rivian likely. Ford and GM and VW and Toyota will be bailed out by taxpayers.

Banks set price targets in order to move the stock to their own advantage. Their free advice is seldom cheap.

Good to see gigaberlin back, and Elon visiting and confirming future expansion. Totally unsurprised to see fisker go bankrupt. Lucid next. Rivian likely. Ford and GM and VW and Toyota will be bailed out by taxpayers.

TesLeif

Member

Claims "high-volume" production by end of 2024... no chance!this report says end of 2024

⚡️ELECTROMAN⚡️

Village Idiot

This is ****ing depressing. I feel like I should sell everything and wait for a couple of years.

Again?OT Fisker is down 46% AH today from news that it's seeking bankruptcy.

https://www.investing.com/news/stoc...in-face-of-potential-bankruptcy-432SI-3336817

growler23

Member

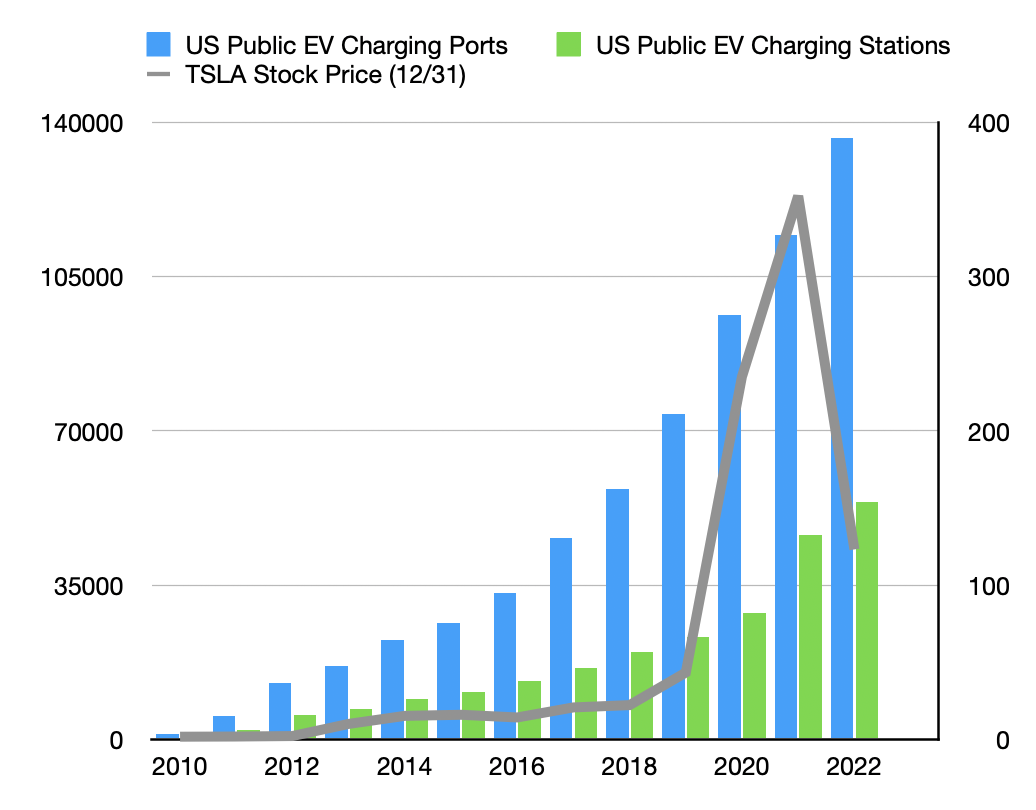

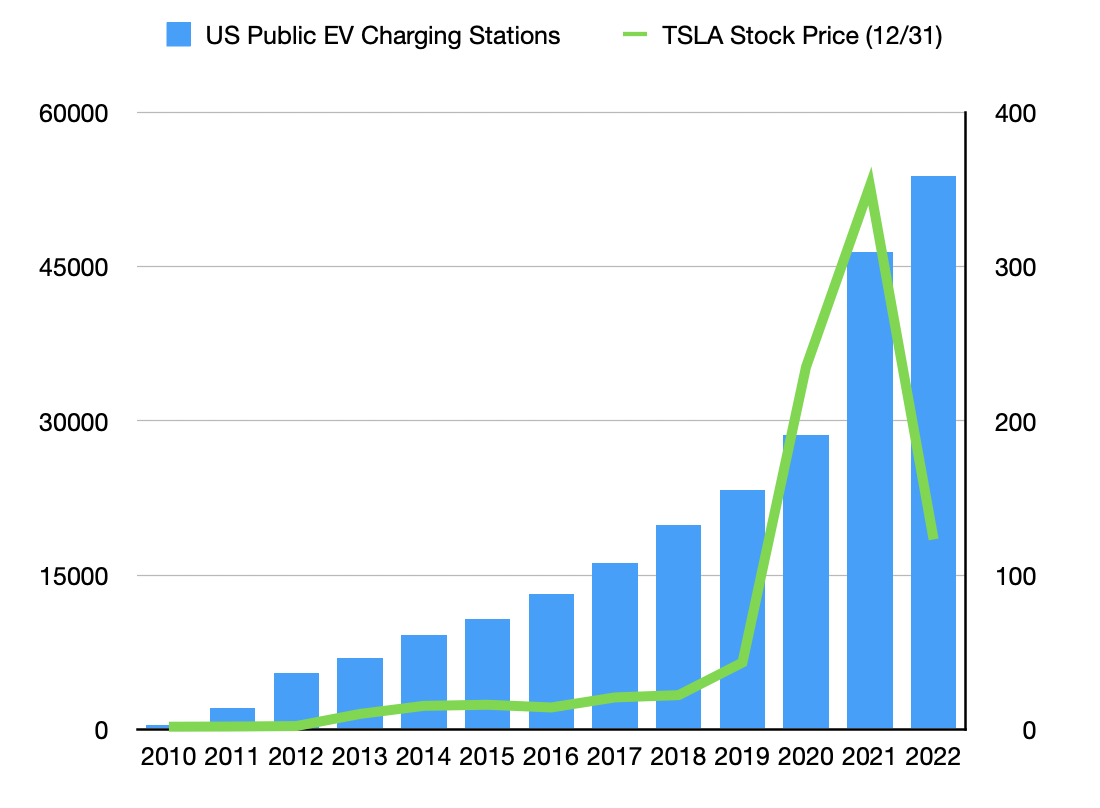

I have seen this elsewhere as well. We need some grid upgrades as well asView attachment 1027681

View attachment 1027683

Interesting - it's the grid that's slowing down adoption.

More + Source: 2023 Integrated Energy Policy Report with Errata - https://efiling.energy.ca.gov/GetDocument.aspx?tn=254463

new chargers in the US, but we are huge and our skilled electrical workforce is not.

We need a veritable army of electricians and electrical workers, and a lot more inspectors/administrators to get the grid moving at the rate Tesla (and earth) needs.

I think the recent emphasis on 2 year trade schools is a help, but not sure our numbers are headed up fast enough.

Words of HABIT

Active Member

What a bunch of idiots. And I'm not talking about Fisker, which was simply over ambitious, trying to run before they could walk, and fell hard.OT Fisker is down 46% AH today from news that it's seeking bankruptcy.

https://www.investing.com/news/stoc...in-face-of-potential-bankruptcy-432SI-3336817

Look at the news release from the fools at Investing.com. Really?! I really don't think the Market knows a strawberry from a banana.

Theory: What if the reason why we don't have V12 is because their system isn't capable of keeping up with more users without adding more risk. Maybe they can't utilize any additional video if they're at capacity with their current Beta feedback volume. This would be as opposed to allowing more users but without the capacity to absorb it all fast enough which only increases the risk of accidents early on. They still have their own employees out roaming the countryside, so why not absorb what they can while minimizing risks. (At least that's a reason I could support anyway.)

18 months is the new 2 weeks

Pre v12 FSD minimizes risk by asserting the driver is responsable. It has worked well. Tesla is rapidly growing Dojo, and FSD 12.3 is clearly safer/better than any 11 version. I would argue that FSD 12 is not released for a few unusual reasons (I don't know what they all could be). Coincidently, $TSLA momentum is stalled as well as unit sales growth, as supported by ER call statements. Pretty good reason for the stock to be the worst performer so far this year.

It will take at least 18 months to introduce FSD to EU and China, ramp 4680, CT and Dojo (seperate data centers in China), and possibly introduce 'Model 2' and Optimus. Coincidently it also appears that the Delaware case could be resolved in 18 months. Fate loves irony. Corellation is not Causation.

Simply coincident by timeframe, but based upon the Jan 15th tweet when EM demanded for 25% voting control in order to continue AI and FSD etc, which I think will take a large number of ducks to line up, best done at a low share price. Likely this is why money is drifting to the light of other more timely investments, regardless of the high value, low price of $TSLA

The compensation plans are going to require a lot of well timed decisions, planned actions for the annual shareholder event and vote. I assume this won't happen this year but in the following year, possibly set at an earliest date possible. All of this sounds like someone has to have an absolute mastery of imagination, timing and ability to execute. Which is why I am here.

I looked at public EV charging station locations and ports by year, then plotted with TSLA share price at year-end. The data is from Statistica and TSLA share price at year-end since IPO. Outside of the end of ZIRP in 2022...seems pretty in-line...in fact, if you remove what happened during the pandemic between end of 2019 to end of 2021...

Jim Cramer was around doing the same thing when Apple was struggling. (SHORT AND DISTORT)if only Tesla ran an ad on CNBS .. sp would be in 200s now/s

There is a connection here to X as well.

Cramer is an announcer/guest on CNBC (owned by NBCUniversal) and he owns TheStreet (Cramer has a very large Ford position.)

TheStreet is a subsidiary of ...NBCUniversal, through the acquisition approximately $16.5 million by TheMaven (Chairman is James Heckman) now called the Arena Group which has partnered with Ford to provide content for the X platform.

Ironic.

MC3OZ

Active Member

A year or two ago Petit did a USA/Europe battery plant analysis, more thorough than what I'd done. Battery capacity will be with us to support plenty of needs if minerals are available. The 4680 capacity though seems to be 2026 at best from what I recall. Based on the issues ramping 4680 I'd be careful in modeling, I'd put some very very low expectations on output. On 4680 projections I find it helpful to go back and read about LGs and Panosonics timelines on 4680s. Turns out they were good solid estimates and in both cases I think it was 2026 before large production.

I wonder what has changed since that time.

My thoughts are that nickel based 2170s are closer to a commodity than a rare resource. There are multiple manufacturers. It doesn't make sense to mix suppliers in the same vehicle, but the Semi and Model Y could use different suppliers.

While "between growth waves' it doesn't make sense to leave a factory 71% ramped if that can be avoided.

Working 5/7 days at Austin is a 71% ramped Model Y line.

They have added provisions for additional logistics and staff, 2170 cells and parts seem to be the only things that could hold back 24/7 operation.

I also would not begin to ramp the Semi while Austin Model Y was only 71% ramped. if there is contention for the cells it makes sense to use them in Model Y.

Finally we have heard that the Semi will be produced in Berlin, I expect a European style cab, but the same motors and 2170 cells.

In the long run (perhaps 5-10 years time) Model 3/Y will use 4680s then all 2170s can be used for the Semi.

So we still don't know about cells, my only insight is outbound logistics, hiring intentions, and parking.

Looking at the latest Austin video, the Cybertruck production ramp seems to be going very well. It is also clear that the current preference is to charge Cybertrucks at the 64 new Superchargers on the west side. It could be that the expanded logistics and additional hiring mainly relates to Cybertruck and Model Y might be stuck at 71% for a while.

Last edited:

Knightshade

Well-Known Member

While "between growth waves' it doesn't make sense to leave a factory 71% ramped if that can be avoided.

Working 5/7 days at Austin is a 71% ramped Model Y line.

They have added provisions for additional logistics and staff, 2170 cells and parts seem to be the only things that could hold back 24/7 operation.

I also would not begin to ramp the Semi while Austin Model Y was only 71% ramped. if there is contention for the cells it makes sense to use them in Model Y.

If they had spare US made 2170s they wouldn't have lost the IRA credits on the Model 3 LR AWD by being forced to switch to 2170s from LG in china. Those extra US cells don't exist though- right now 100% of em are going into Model Ys (some might go into a P Model 3, but there's a decent argument they won't as it'd only make sense if they priced it 55k or less which'd cause a pricing problem with the non-P models).

Semi could use the Chinese 2170s the Model 3 switched to though since it wouldn't qualify for the $7500 consumer credit anyway.

Wingfoiler

Member

Just a friendly reminder that while analysts continually chase stock price movements both up and down with their ‘targets’, and social media frets over predicting the ‘bottom’, thousands of the most capable engineers and factory operators in the world are working their tails off to make great products and scale production to convert the 2 giga-vehicles on earth to EV’s over the coming decades.

I can’t predict with accuracy when FSD will be ready for mass utilization, or when Tesla’s manufacturing scale and ecosystem advantages will lead to ungodly profits, but their data advantage and maniacal focus on manufacturing efficiency give me confidence that these things are a matter of when, not if. Some may be lucky or intelligent enough to time such things and profit from the volatility, but I’m more than happy to just sit, accumulate, and watch the various cycles of anxiety/capitulation/FOMO/euphoria. We know roughly how this script plays out long term.

I can’t predict with accuracy when FSD will be ready for mass utilization, or when Tesla’s manufacturing scale and ecosystem advantages will lead to ungodly profits, but their data advantage and maniacal focus on manufacturing efficiency give me confidence that these things are a matter of when, not if. Some may be lucky or intelligent enough to time such things and profit from the volatility, but I’m more than happy to just sit, accumulate, and watch the various cycles of anxiety/capitulation/FOMO/euphoria. We know roughly how this script plays out long term.

Ah yes, I get ALL my investing advice from a bunch of blankety-blanks who are too blankety-blank lazy to Google an image of an actual Fisker instead of grabbing a 10+ year old photo of a SUCCESSFUL product! /sWhat a bunch of idiots. And I'm not talking about Fisker, which was simply over ambitious, trying to run before they could walk, and fell hard.

Look at the news release from the fools at Investing.com. Really?! I really don't think the Market knows a strawberry from a banana.

Well, to save all you .34 seconds, here is one repleate with a svelte model. . . .That should get you a least a FEW clicks?

Last edited:

Quesder

Member

Now the narratives is about how BYD can manufacture and sell cheaper models in a greater number. And meanwhile, BYD share price has been up since Feb 5, from 167 yen to 215 yen today.Just a friendly reminder that while analysts continually chase stock price movements both up and down with their ‘targets’, and social media frets over predicting the ‘bottom’, thousands of the most capable engineers and factory operators in the world are working their tails off to make great products and scale production to convert the 2 giga-vehicles on earth to EV’s over the coming decades.

I can’t predict with accuracy when FSD will be ready for mass utilization, or when Tesla’s manufacturing scale and ecosystem advantages will lead to ungodly profits, but their data advantage and maniacal focus on manufacturing efficiency give me confidence that these things are a matter of when, not if. Some may be lucky or intelligent enough to time such things and profit from the volatility, but I’m more than happy to just sit, accumulate, and watch the various cycles of anxiety/capitulation/FOMO/euphoria. We know roughly how this script plays out long term.

Here are some Chinese comments in FUTU Tesla forum:

$Tesla (TSLA.US)$當特斯拉和比亞迪 進入較勁比低價時 代表趨勢結局已定 怎麼 還那麼多人 看不透的送錢 為信仰及失去的錢 喊口號壯膽

it says when Tesla started to wage price war with BYD, it means the trend and final outcome has been set.

The one belwo says BYD has some good sales number in Brazil, Malaysia, and Thiland. Tesla cannot compete at all. If Northern American open the market to BYD, Tesla will lose to the extent that it couldn't find which way is North.

先不看$Tesla(TSLA.US)$ 股市的具体表现。来,上数据,

巴西:$BYD Company ADR(BYDDY.US)$ 海豚上市4天,销量突破7600辆;

马来西亚:BYD海豹上市4天,销量突破1300辆,更有车评人说海豹在同级别没有对手;

泰国:最近没关注,但作为东南亚车市风向标,前一段时间的车展预定量,中国新能源车包揽前10中的8席,特斯拉连前15都进不了;

……

我说了句,“如果北美向中国新能源车开放市场,特斯拉会被打的找不到北。”特斯拉信仰者一分钟内跑来杠。这它喵的有什么好杠的。

MC3OZ

Active Member

WSJ has a report out saying BYD is having some issue in Europe:-Now the narratives is about how BYD can manufacture and sell cheaper models in a greater number. And meanwhile, BYD share price has been up since Feb 5, from 167 yen to 215 yen today.

Here are some Chinese comments in FUTU Tesla forum:

$Tesla (TSLA.US)$當特斯拉和比亞迪 進入較勁比低價時 代表趨勢結局已定 怎麼 還那麼多人 看不透的送錢 為信仰及失去的錢 喊口號壯膽

it says when Tesla started to wage price war with BYD, it means the trend and final outcome has been set.

The one belwo says BYD has some good sales number in Brazil, Malaysia, and Thiland. Tesla cannot compete at all. If Northern American open the market to BYD, Tesla will lose to the extent that it couldn't find which way is North.

先不看$Tesla(TSLA.US)$ 股市的具体表现。来,上数据,

巴西:$BYD Company ADR(BYDDY.US)$ 海豚上市4天,销量突破7600辆;

马来西亚:BYD海豹上市4天,销量突破1300辆,更有车评人说海豹在同级别没有对手;

泰国:最近没关注,但作为东南亚车市风向标,前一段时间的车展预定量,中国新能源车包揽前10中的8席,特斯拉连前15都进不了;

……

我说了句,“如果北美向中国新能源车开放市场,特斯拉会被打的找不到北。”特斯拉信仰者一分钟内跑来杠。这它喵的有什么好杠的。

Tesla and BYD are the most successful companies, and hence are the biggest targets.

There is plenty of future market share available for both at present.

Krugerrand

Meow

Good to know Chinese media sources aren’t any more accurate than North American.Now the narratives is about how BYD can manufacture and sell cheaper models in a greater number. And meanwhile, BYD share price has been up since Feb 5, from 167 yen to 215 yen today.

Here are some Chinese comments in FUTU Tesla forum:

$Tesla (TSLA.US)$當特斯拉和比亞迪 進入較勁比低價時 代表趨勢結局已定 怎麼 還那麼多人 看不透的送錢 為信仰及失去的錢 喊口號壯膽

it says when Tesla started to wage price war with BYD, it means the trend and final outcome has been set.

The one belwo says BYD has some good sales number in Brazil, Malaysia, and Thiland. Tesla cannot compete at all. If Northern American open the market to BYD, Tesla will lose to the extent that it couldn't find which way is North.

先不看$Tesla(TSLA.US)$ 股市的具体表现。来,上数据,

巴西:$BYD Company ADR(BYDDY.US)$ 海豚上市4天,销量突破7600辆;

马来西亚:BYD海豹上市4天,销量突破1300辆,更有车评人说海豹在同级别没有对手;

泰国:最近没关注,但作为东南亚车市风向标,前一段时间的车展预定量,中国新能源车包揽前10中的8席,特斯拉连前15都进不了;

……

我说了句,“如果北美向中国新能源车开放市场,特斯拉会被打的找不到北。”特斯拉信仰者一分钟内跑来杠。这它喵的有什么好杠的。

Fred42

Active Member

Polestar has cut the US price of the 3 by $10,500 to $74,800 including destination. Imported from China, will later be built in South Carolina. Deliveries to start 2Q24 per Polestar. No tax credit, of course.

I recall their CEO saying they wouldn't follow Tesla's lead with price cuts.

Volvo recently bailed out of Polestar.

I recall their CEO saying they wouldn't follow Tesla's lead with price cuts.

Volvo recently bailed out of Polestar.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K