2virgule5

Member

Yep, including my second reservation (configured 2 weeks ago), 13xxx as well. Time to trade in the Bolt.Several VIN assignments being reported around 13,xxx.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Yep, including my second reservation (configured 2 weeks ago), 13xxx as well. Time to trade in the Bolt.Several VIN assignments being reported around 13,xxx.

One thing is clear.....the ramp is on. It's obvious now that they were able to slug out approximately 1,000 3's per week for much of Q1, while occasionally shutting down the line to add equipment. But over the past week and a half, we've seen a step change in production.

The words I've liked have been (to paraphrase) 'as we go through 300 per day', and 'comfortably above 2,000 per week'. Neither of those phrases sound like burst rate, window-dressing type BS we got at the end of Q4. They sound more to me like the ramp will continue. Add to that the confidence of Musk that there's practically no chance of bankwuptcy.

Most pundits are being overly harsh on the 2,500 per week estimate by end of March. Missed by a week or two....sheesh, tough crowd.

So, we're closer than ever to Porsche-like production numbers, yet the stock is in the crapper.

Not as dumb as those who took it seriously.Call me crazy, but that joke was just dumb.

$389.61 to $244.59...sitting at the lows...a day before a major milestone announcement that has a 100% chance of being spun negatively, regardless of what is said or released.

I believe we have confirmation that, as of this moment, all Tesla shareholders are "f*ckrupt". We have run out of f*cks to give.

Today, I slammed my toe into a table leg. I felt nothing.

You got that back-to-front. They're doing the Aramco IPO to get the trillion to invest in ElonCo.The Saudis would be better off investing a trillion dollars in Elon then in Aramco.

HELLO....

We have just made our first additions to TSLA since (read on) -

Bought in at $247.77 net, picking up a fair chunk in that we added to our positions by 16%.

The last time we added any Tesla was Sept 16, 2016, when we increased holdings by about 30% with that once-in-a-lifetime "free" arbitrage: buying SCTY at under $17 to give us TSLA at $155 - at a time the stock was about $250.

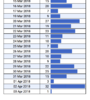

I took the eye of the ball and Apr 2nd turned out into a monster day. Please understand there is delay in input of info, so I expect Apr 2nd to reach at least 40, maybe 50, even 60...Well, Friday March 30th turned into a great day, but not an epic day:

View attachment 291081

I can't see consistency in any time period that would allow Tesla to claim high production rate for extended period, a week or more. At least not at 2000+ cars per week, so we will be probably getting some extrapolated data again.

However, there are other ways to look at the issue at hand:

View attachment 291082

Production in the last four weeks has been WAYYYYY higher than any period before, though that's still probably only around 1000-1500 cars per week. That is for the whole week, there's been one day bursts that have been probably quite a bit higher.

And finally, this may be the most meaningful way to look at the data:

View attachment 291085

Basically Tesla has made 25% more cars in March than previous 8 months combined. Or, in March it made 60% more cars than Jan+Feb combined. You get the picture - there are positive ways to present this information and Tesla typically does that.

I just hope that overall production has approached 2500 cars a week, extrapolated from daily. My best bet is that there were 9000 +/- 1000 M3s produced in Q1. BTW, for the context, I lean towards being cautious most of the time, though Tesla made me look like an unbridled optimist number of time...

Are you kidding. The SP is awesome. 3x sales. 10x book. InfiniteX profit. Google or Apple would kill for numbers like that.One thing is clear.....the ramp is on. It's obvious now that they were able to slug out approximately 1,000 3's per week for much of Q1, while occasionally shutting down the line to add equipment. But over the past week and a half, we've seen a step change in production.

The words I've liked have been (to paraphrase) 'as we go through 300 per day', and 'comfortably above 2,000 per week'. Neither of those phrases sound like burst rate, window-dressing type BS we got at the end of Q4. They sound more to me like the ramp will continue. Add to that the confidence of Musk that there's practically no chance of bankwuptcy.

Most pundits are being overly harsh on the 2,500 per week estimate by end of March. Missed by a week or two....sheesh, tough crowd.

So, we're closer than ever to Porsche-like production numbers, yet the stock is in the crapper.

Kimball could be the older brother that was only on the pilot, but didn’t poll well.Ok.. Franz is the Fonz because he brings the cool factor to Tesla. Elon is Richie because he is basically a kick-ass director and Apollo 13.. duh. And Kimball is Ron Howard's creepy brother Clint Howard. JB is Chachi. Sorry JB.

If Google buys Tesla, the Fonz is gone because Franz ain't putting all that crap lidar and on his beautiful designs. Richie aka Elon is off to direct the Apollo sequel,. Apollo 2021 BFR FTW. Kimball, aka Ron Howard's creepy brother will still be creepy and JB will start his own new EV company (Joanie loves Chachi spin off) which is basically what every one does when they leave Tesla.

This is about as likely a scenario as had been discussed here.

The Saudi prince is is on a business trip to the US and will be meeting with Elon Musk while he’s here. Many are suspecting that he may invest in alternative energy to divest from oil. This might turn into a big deal.

Saudi Arabia's powerful crown prince is taking a landmark US tour, meeting with with stars from Elon Musk and Bill Gates to Oprah

2020 Model 3s in the final 7 days. Meh. Market seems to not hate it. 29000 total deliveries.

More color:

8k Q1 production totaled 34,494 vehicles, a 40% increase from Q4 and by far the most productive quarter in Tesla history. 24,728 were Model S and Model X, and 9,766 were Model 3. The Model 3 output increased exponentially, representing a fourfold increase over last qtr