So it isn't even all "index funds" but S&P 500 indexed funds - which should be about ~40% of all passive index funds. (The "total market" funds, the large-cap funds and the tech funds already include TSLA.)

S&P 500 funds are I think about 5% of shares of high tech firms, which on TSLA would be about 7% of the float: a substantial (and temporary) pop of $50-$100 but probably not "technical short squeeze" material.

(BTW., the smartest index fund arbitrageurs are probably already buying, S&P 500 inclusion next year is probable at this point.)

I'm unsure what you find crazy about what I wrote, the 2013 TSLA short squeeze is a simple historic fact:

Shorts often try to argue that 2013 was different in that "days to cover" was higher. What their argument is missing is that today Tesla is a large-cap tech company and about ~80% of the TSLA intraday volume is HFT/algo trading that doesn't offer liquidity to 30 million shares shorts covering. In 2013 was a small-cap/low-mid-cap company with less HFT liquidity skewing the daily volume figures, so 'days to cover' metrics were a lot more representative of true free short-covering liquidity available on the market.

I.e. the true "days to cover" is in reality 5 times larger than listed: instead of the

~3 "days to short cover" listed by NASDAQ, the real number is closer to 15 days - and even that is using up 100% of true liquidity to cover, while in reality any such sustained momentum would attract a lot of momentum traders with which shorts would have to compete.

The real time it will take for shorts to cover at naturally available liquidity is closer to 30-60 days. Anything beyond that rate of flow will bid up the price rather significantly - i.e. a short squeeze.

Also, there are several types of short squeezers:

- A "technical short squeeze" similar to the VW short squeeze of 2008 which was violent and over in 2-3 days is unlikely for TSLA, unless a big investor is really bullish and ties up a significant part of the Tesla float.

- A "fundamentals driven short squeeze" is highly probable after Q3 results: the fundamentals of Tesla just improved immensely (cash generation ability close to Apple's and twice that of Amazon, in a much bigger market with a lot of space to grow), which is unlocking a much broader base of investors. The 2013 Tesla short squeeze was such a fundamentals driven short squeeze.

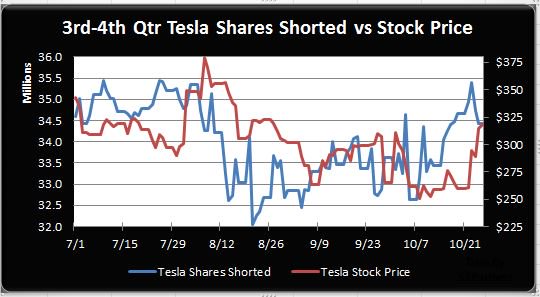

These estimates of mine roughly match what Ihor Dusaniwsky's daily short interest report is showing:

Shorts covered about ~1 million shares since their peak, while the price was bid up by about ~$60. If we naively assume that a third of the price action was shorts covering and extrapolate that to say 30 million short shares covered, that's a price effect of +$600, quite some rocket fuel which would bring the stock to near $1,000 levels if longs didn't change behavior as prices increase - but in reality longs and even long term investors will probably jump in sooner than that to take profits or to swing-trade once they think the short squeeze has been exhausted, or if they think the price levels are irresistible.

Even without a technical short squeeze some nice intraday price action is also possible at around key price levels of short capitulation: I'd not be surprised to see a massive cascade of stop orders once $390 is breached, to well above $400.

There's also some key upcoming events that will unlock even more tiers of investors, such as the Moody's upgrade and the S&P 500 inclusion next year as

@neroden suggested, and of course the upcoming "profitable 18'Q4" event, the "profitable 19'Q1" event, the "profitable 19'Q2" event, etc. The "but will Tesla ever be able to post

five profitable quarters in a row!!" short thesis won't have nearly as many followers.

The time frame of the 2013 re-pricing of TSLA was 6-9 months, with the most violent short squeeze portion taking about 2-3 months to play out.

Anyway, all the data suggests that it's pretty probable at this point that there's a

lot of pain waiting for shorts and the price levels at which they will be allowed out of their positions will be determined by Tesla shareholders, not by anti-shareholders.