It should at least have gone up with CPI, so should now be £51k;Yep that is annoying the threshold doesn’t go up yet the put the actual surcharge up each year, started of at £300 extra now around £390?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

VED Changes

- Thread starter GPDP

- Start date

Mark89052

Member

Yep, That would make far more sense

It's just a tax, whether it is on VED, Income or VAT doesn't really matter. At least the Luxury Car Tax is a little bit progressive and won't effect the cheapest cars while encouraging EV manufacturers to get their prices under £40K.

Sadly our Brexit-smashed economy doesn't mean we can afford any carrots to encourage EV adoption anymore. If the exchequer has money can give back I can think of plenty of more deserving's causes first, public sector workers, NHS, income tax thresholds etc.

Life was so much nicer back when we had a functional economy, 11+ years ago.

Sadly our Brexit-smashed economy doesn't mean we can afford any carrots to encourage EV adoption anymore. If the exchequer has money can give back I can think of plenty of more deserving's causes first, public sector workers, NHS, income tax thresholds etc.

Life was so much nicer back when we had a functional economy, 11+ years ago.

Jason71

Well-Known Member

Gov only cared how easy it was for the DVLA to implement so they could get the revenue in quickly. The impact on the rest of you was not their problem and I WAS working with the DVLA at the timeOh its sillier than that - consider over covid when you had _massive_ waits on new cars. Whether or not the supplement depends on the list price _on registration_. I.E. you could be waiting for 12 + months for your new car then when it arrives get hit with the supplement even if the dealer is honouring the price when you ordered.

Also it wasn't that easy to implement for everyone - I know as I had to help implement it at work (not for the DVLA but for a company that produces software for the leasing industry)

And you mean examples like this:

Car buyer stung with extra £2k to tax VW that turned up 20 months late

This is Money reader Gavin Reeves (inset) ordered his new Tiguan in November 2021 but it has only just arrived this month. However, inflated prices means it will cost him thousands extra to tax.

Jason71

Well-Known Member

They do but they are feeding all of them to company car drivers.Sadly our Brexit-smashed economy doesn't mean we can afford any carrots to encourage EV adoption anymore. If the exchequer has money can give back I can think of plenty of more deserving's causes first, public sector workers, NHS, income tax thresholds etc.

The Bik on the average Tesla for a higher rate taxpayer is £400. On the equivalent ICE its £6000. And that is per year. That's quite a decent carrot. So they took away one off payments of £2500 from private buyers and then gave double that per year to company car drivers.

And then there is the 100% first year capitol allowance that the companies benefit from.

There are also still charge point grants as well but again not for private single residence's.

yeah, its rather strange, but perhaps its futile to look for some great reason why, it's just some random idea that somehow became policy.They do but they are feeding all of them to company car drivers.

The Bik on the average Tesla for a higher rate taxpayer is £400. On the equivalent ICE its £6000. And that is per year. That's quite a decent carrot. So they took away one off payments of £2500 from private buyers and then gave double that per year to company car drivers.

And then there is the 100% first year capitol allowance that the companies benefit from.

There are also still charge point grants as well but again not for private single residence's.

WannabeOwner

Well-Known Member

They do but they are feeding all of them to company car drivers.

I've scratched my head as to why they did it that way, do you have ideas?

I did wonder if it was because company cars tend to get moved on after 3 years, so maybe that would get them into trickle-down 2nd hand market faster than private purchases?

Re: Luxury tax / Annual Vehicle Tax. Whole thing is daft, IMO, because there is an overhead to collecting that (any) tax. And in many cases its a small amount, so collection-cost is disproportionate. Whereas a tax on fuel is progressive etc. etc. And having both means two lots of overhead-cost of collection.

We must be heading for mileage-charge, surely? Why not get on and implement it. Charge a higher rate for a polluter, if you like. Charge less for people / freight travelling at night, if you like (that will be hard if the easiest way of collecting it is "annual declaration" e.g. as part of MOT, car sale, and perhaps a scouts-honour system for cars in 1st 3 years that don't change hands). Something like that ...

BissetY

Member

Correct but it’s fixed at what they weren’t paying before…so it won’t all of a sudden kick in…You still pay for it in a lease one way or another….they don’t just forget the VED

Billbrown1982

TM3 LR 2021 | Red | FSD

I've scratched my head as to why they did it that way, do you have ideas?

I did wonder if it was because company cars tend to get moved on after 3 years, so maybe that would get them into trickle-down 2nd hand market faster than private purchases?

Re: Luxury tax / Annual Vehicle Tax. Whole thing is daft, IMO, because there is an overhead to collecting that (any) tax. And in many cases its a small amount, so collection-cost is disproportionate. Whereas a tax on fuel is progressive etc. etc. And having both means two lots of overhead-cost of collection.

We must be heading for mileage-charge, surely? Why not get on and implement it. Charge a higher rate for a polluter, if you like. Charge less for people / freight travelling at night, if you like (that will be hard if the easiest way of collecting it is "annual declaration" e.g. as part of MOT, car sale, and perhaps a scouts-honour system for cars in 1st 3 years that don't change hands). Something like that ...

Yeah but we are dreaming if anyone thinks that will save anyone money. There will be a minimum charge or whatever at around (probably higher) than what it already is and then anyone doing extra mileage will just get charged on top of that.

Honestly I don't think we need that in our lives right now. More people than ever have to commute further to get decent jobs and this will just further penalise them.

When gov offers blanket rebates on a purchase the sellers just seem to price higher. Sellers price on what the market will stand, if the government offered a 10k grant for each car you wouldn’t suddenly find they were 10k cheaper, they’d mysteriously get more expensive (before grant) fairly quickly. You see it today with company cars where the pre tax lease prices are very expensive compared to doing it privately, there are a few differences but they’ve pitched it where post tax they’re a bit cheaper than private.(it’s a generalisation but it does seem the lease companies are gouging). You also see it when grants get removed, list prices magically drop.

As for retrospective application, I thought this was largely only for new registrations around the time? Gov seldom applies retrospective charges to cars already owned although they are at liberty to set future charges on years they've not yet declared.

Edit to add; they announced this in Nov 22 giving all but 3 years notice for existing car owners

As for retrospective application, I thought this was largely only for new registrations around the time? Gov seldom applies retrospective charges to cars already owned although they are at liberty to set future charges on years they've not yet declared.

Edit to add; they announced this in Nov 22 giving all but 3 years notice for existing car owners

Last edited:

they announced this in Nov 22 giving all but 3 years notice for existing car owners

Whilst retrospectively adding it to cars registered nearly 5 years prior which was never done before and that imho is very naughty

Isn’t it more a case they’ve never said what VED would be in these later years, and they now have. I don’t think they’ve ever said “you’ll always have £0 VED”, they may have said “the VED for EVs until 2025 is..” It’s an important distinction.Whilst retrospectively adding it to cars registered nearly 5 years prior which was never done before and that imho is very naughty

Im not disputing and it would be naive to think that this would continue and I knew this from back around 2005 when some cars started paying silly low amounts, however with the same coin this was never done before when reviewing.Isn’t it more a case they’ve never said what VED would be in these later years, and they now have. I don’t think they’ve ever said “you’ll always have £0 VED”, they may have said “the VED for EVs until 2025 is..” It’s an important distinction.

Steviebloke

Member

Re the surcharge: the Expensive Car Supplement seems to apply to the first five years of the car’s life only. So not a concern for those of us with elderly cars.

Jason71

Well-Known Member

EV's have never been VED exempt. You have always had to buy a licence for one it's just that the price has always been zero.Whilst retrospectively adding it to cars registered nearly 5 years prior which was never done before and that imho is very naughty

There was never any promise of how long that would last. Giving as much notice as they have is fairly un-precedented tbh. No one likes to pay for something that used to be free but in the litany of bad or annoying stuff that this govt has done this barely registers for me.

My daughter pays £150 on her Fiesta. if it was about 5g of C02 lower she would be paying £35. If it was newer than 2017 she would pay £180 irrespective of how much C02 it produced

WannabeOwner

Well-Known Member

Honestly I don't think we need that in our lives right now. More people than ever have to commute further to get decent jobs and this will just further penalise them.

Government only have TAX as a source of income. The majority, or so it seems to me, want less tax and better Schools, Roads, NHS, etc.

Possibly worth noting that the luxury £390 element drops off after 5 years on ICE (at least at the moment)

Also woth noting is that Tesla have priced the M3 RWD at £10 below the 40k threshold for luxury tax... call mne cynical and whilst I recognise 39,990 is the automotive equivalent to pricing something at 99p to magically be less than something... but the VED pricing made 40k threshold a target to beat. Maybe if the gov dropped the starting point for new cars being registered to 35k we'd see a real push to get cars below that level.

You can compain for it to go up so we think we pay less (personally I think thyey just find a different way)... or you can campain for it to go down to bring pressure on the auto companies to follow

Also woth noting is that Tesla have priced the M3 RWD at £10 below the 40k threshold for luxury tax... call mne cynical and whilst I recognise 39,990 is the automotive equivalent to pricing something at 99p to magically be less than something... but the VED pricing made 40k threshold a target to beat. Maybe if the gov dropped the starting point for new cars being registered to 35k we'd see a real push to get cars below that level.

You can compain for it to go up so we think we pay less (personally I think thyey just find a different way)... or you can campain for it to go down to bring pressure on the auto companies to follow

Jason71

Well-Known Member

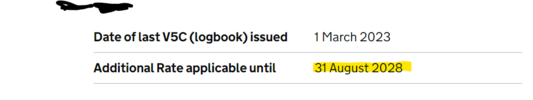

You pay the "expensive vehicle suppliment" for 5 years from the start of the second licence. The first one is still Free or £10 or something. So in most cases it drops off after 6 years but you only actually pay it for 5 years in years 2 to 6.Possibly worth noting that the luxury £390 element drops off after 5 years on ICE (at least at the moment)

Also woth noting is that Tesla have priced the M3 RWD at £10 below the 40k threshold for luxury tax... call mne cynical and whilst I recognise 39,990 is the automotive equivalent to pricing something at 99p to magically be less than something... but the VED pricing made 40k threshold a target to beat. Maybe if the gov dropped the starting point for new cars being registered to 35k we'd see a real push to get cars below that level.

You can compain for it to go up so we think we pay less (personally I think thyey just find a different way)... or you can campain for it to go down to bring pressure on the auto companies to follow

However , ff you buy a nearly new car e.g. preregistered one from a dealer. That is say only two months into its first licence then you would pay it as soon as you bought it which means on that car it would drop off after 5 years and 2 months. So the end date is not actually fixed.

Edit

and in case anyone is thinking ahead and wondering how do I know what the VED rate will be on 5 year old car if the end date of the EVS is variable.

its on the dvlas vehicle checker site:

Attachments

Last edited:

EV's have never been VED exempt. You have always had to buy a licence for one it's just that the price has always been zero.

There was never any promise of how long that would last. Giving as much notice as they have is fairly un-precedented tbh. No one likes to pay for something that used to be free but in the litany of bad or annoying stuff that this govt has done this barely registers for me.

My daughter pays £150 on her Fiesta. if it was about 5g of C02 lower she would be paying £35. If it was newer than 2017 she would pay £180 irrespective of how much C02 it produced

“It’s Easier to Fool People Than It Is to Convince Them That They Have Been Fooled.” – Mark Twain

Similar threads

- Replies

- 18

- Views

- 2K

- Replies

- 13

- Views

- 2K

- Replies

- 25

- Views

- 1K

- Replies

- 18

- Views

- 708

- Replies

- 32

- Views

- 1K