#3 The Three Stages - Understanding 2013 (The Case for TSLA at $2000-3000 by 2030)

(This is post #3 in a series explaining my long-term investment thesis on TSLA.)

In my last 2 posts (

Post #1,

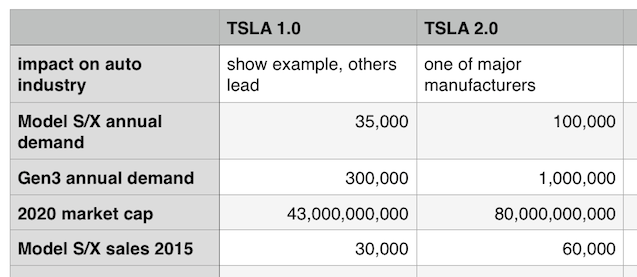

Post #2) I introduced the concept of a TSLA 1.0 company (as outlined by the Elon Musk CEO incentive plan to reach $43 billion market cap by 2020-2022) and the TSLA 2.0 company (kind of like a TSLA 1.0 but on steroids with double the demand and double the growth trajectory as TSLA 1.0).

In this post I'd like to take a few minutes to share how I view what happened in 2012 and 2013. This will hopefully shed light into the present and future.

2012: The battle between TSLA 0.0 vs TSLA 1.0

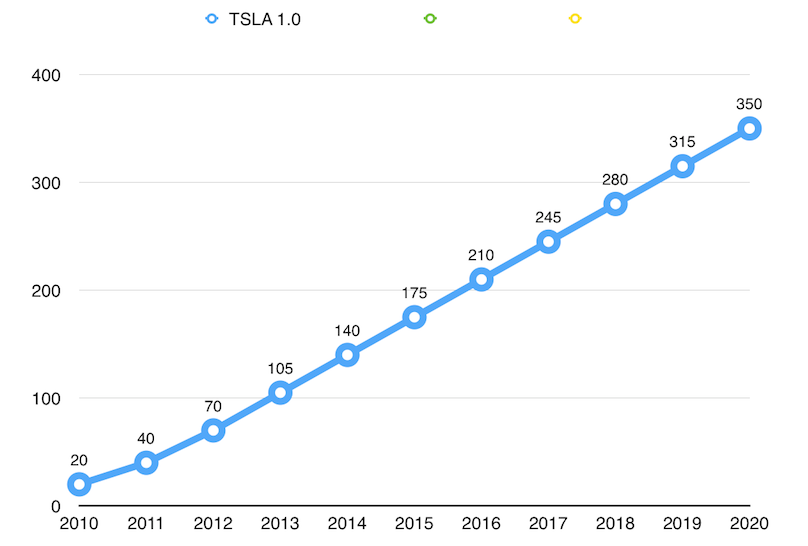

In 2012, the big battle was between the shorts who thought TSLA would go bankrupt and become TSLA 0.0, and the longs who believed that TSLA would become TSLA 1.0 and a $43 billion company within 8-10 years. However, if you follow TSLA's trajectory for a TSLA 1.0 growth, you can see by 2012 TSLA's stock price should have been higher than the $30/share that it was. But TSLA had some missteps in the eyes of analysts (ie., not delivering on 2012 numbers) and there was a lot of fear about Tesla's viability as a company.

In May of 2013, Tesla reported a profitable quarter and basically killed the hopes of TSLA 0.0 that the shorts were banking on. What should have happened is a bounce back to normal TSLA 1.0 levels (as shown in the chart above). Instead, TSLA kept going up and up well beyond the TSLA 1.0 trajectory. I shared in my last post that one of the main reasons was because not only did Tesla confirm strong demand but they confirmed demand that was much higher than initial expectations by the company and others. In the

Q1 2013 shareholder letter, Tesla shares "U.S. demand expected to exceed 15,000/year; global demand likely above 30,000/year". This introduced a whole new company, I'm calling TSLA 2.0.

TSLA 2.0 is not just TSLA as a more mature company. Rather, what I mean by TSLA 2.0 is that TSLA became really a different company. It's growth trajectory was steeper, demand greater, and it's aspirations higher. (I shared earlier how TSLA 2.0 was brewing ever since Tesla released the Model S and how early owners and test-drivers could have seen it coming. The car was better than expected and the stellar product would drive demand that was far greater than Tesla's initial 20k units/year projections.)

2013: The battle between TSLA 1.0 and TSLA 2.0

2013 was a super volatile year for TSLA. And while there were many reasons for it (ie., high short interest, etc), there was an underlying battle of perception that was swaying the stock. People were confused as to how to value TSLA, and I think the main reason was because people were still trying to decide whether Tesla was TSLA 1.0 or TSLA 2.0.

TSLA 1.0 is a company with smaller ambitions, namely to show an example of how a mass market electric vehicle can be successful and let the other bigger manufacturers take the lead. However, TSLA 2.0 is much more ambitious as it's trajectory places it as one of the major auto manufacturers. The key to distinguish between the two companies is how fast the company is growing and how much demand there is for future products. If TSLA is growing fast (ie., there's demand for 100k Model S/X annually), then this means that Gen3 demand is likely also going to be higher than initial expectations and could be 1 million units/year or more. In that case future projections of revenue/earnings/etc must be adjusted and TSLA is able to command a much higher valuation.

While the May 8, 2013 Q1 earnings kicked off TSLA 2.0 in a very public fashion, TSLA 2.0 gained momentum throughout the year as well. On August 7, 2013 in their

Q2 shareholder letter, they share "If demonstrated demand in North America and Europe is matched by similar demand in Asia, annualized sales for Model S could exceed 40,000 units per year by late 2014." Also, in the

Q2 2013 conference call Elon Musk shared, "long-term demand in North America is greater than 20,000 units a year." Just a few months earlier in May, Elon Musk shared North America demand to be in excess of 15,000 units/year and now he's saying North America demand is 20,000 units/year. Remember, Tesla's initial forecast for worldwide sales for the Model S was 20,000 units/year (this was TSLA 1.0). And now they're saying demand is at least 2x greater at "greater than 20,000 units a year."

People started to realize that this new Tesla Motors was not the same company from 2011-2012. Rather, demand was going to be at least double initial projections and this changed the story. Tesla became a much more sexy company to investors as they had to readjust their expectations and valuations.

Then came the fires.

Through the Fire: Nov/Dec 2013

It was a perfect storm of sorts. TSLA had skyrocketed to an ATH of $194/share. And shortly after, news of a car fire broke. Then TSLA reported Q3 2013 earnings with soft guidance. And right after another car fire story broke. The downtrend was in full force.

One of the forces behind the downtrend (of course there was super high short interest as well) was people started to doubt the TSLA 2.0 story. Maybe demand wasn't going to be as high as Elon had claimed (ie., approaching 50k units/year). Maybe the Model S wasn't as good of a car as every owner says it is. Maybe the Model S is inherently less safe than an ICE. Questions abounded. And people started to think that it would take a long time for the stock price to recover. But there were still many believers of TSLA 2.0 who thought that the fires were a passing event that Tesla could overcome and solve. And while TSLA remained in a funk (ie., in the 120s) investors (maybe more institutions, funds, wealthy investors) bought up the stock and it formed a bottom.

Tesla was eventually able to come out of this funk by announcing stellar Q4 earnings and also they eventually released an underbody armor reinforcement retrofit that seemed to make the car

impressively even more safe than it already was.

As Tesla firmed up its TSLA 2.0 story what should have happened is a return to a TSLA 2.0 stock price trajectory (see chart above). TSLA did break through the ATHs of $194 before Q4 2013 earnings on Feb 19, 2014. At the earnings, Elon Musk briefly shared about the Gigafactory and a week later Tesla released more

Gigafactory details and decided to raise money.

Morgan Stanley came out with a super bullish report and the stock went bezerk, eventually hitting an ATH of $265.

But when I studied and pondered the Gigafactory plans, I realized that the underlining ambition behind the plans were far greater than even TSLA 2.0.

The Gigafactory was laying the foundation for many more Gigafactories to come. In other words, the path was being paved for Tesla to selling many millions of cars by 2030 (far more than TSLA 1.0 or 2.0 had forecasted/expected).

Currently, I think we're still mainly at a place where most TSLA investors have grasped TSLA 2.0. They no longer see Tesla's potential as a niche auto-maker (ie., TSLA 1.0). But rather they see Tesla's potential as become a major auto manufacturer, but not the leading auto manufacturer. What the Gigafactory does is bring up the idea that Tesla and Elon Musk have far greater plans than TSLA 2.0. In my later posts, I'll go more into detail on what I think TSLA 3.0 will look like.

And one point of clarification. I think these three concepts (TSLA 1.0, 2.0, 3.0) will likely battle each other for the next couple years. The TSLA 1.0 concept will gain strength if there are execution blunders (ie., major recall), if demand for the Model S/X softens, or if we hit a major recession. If TSLA 1.0 gains strength, the stock price will suffer (from where it's at now). TSLA 2.0 will likely gain the most strength in the next couple years as Tesla keeps executing and delivering on growing Model S/X demand. However, as Gen3 gets released (ie., prototype sometime in 2015?) this might trigger more people to think about TSLA 3.0 and how the most revolutionary car in our generation could propel Tesla to the top of the auto industry.

(edit: fixed typo in 1.0 vs 2.0 chart)