#7 Tesla’s Competitive Advantage part 2b: Understanding the Tech Adoption Curve

(This is post #7 in a series explaining my long-term TSLA investment philosophy. For previous posts, see

Articles/megaposts by DaveT)

In

my last post I gave the background behind disruption and the enabling technology of improving batteries. In this follow-up post I’ll introduce the Tech Adoption Curve and explain why it gives Tesla a major competitive advantage.

Usually when new technologies are introduced people think adoption will happen faster than it usually does. There are many reasons for this. For one, the technology looks so promising and the new feature/product looks so appealing that people think that everyone is going to buy it. But the problem is the new technology is expensive thus making the new product/feature very pricey and that limits that market size to the super early adopters. Even as the product gets a little cheaper, often people think the product is going to take off, only to be disappointed with weak sales and little interest. Eventually, people adjust their expectations and no longer expect a huge take-off of demand. Rather, the expectations adjust into what people think will be a slow and gradual adoption of the technology.

However, at some point when the technology becomes cheap enough, adoption passes a tipping point and adoption of the new product/feature takes off beyond almost what anyone expects. The curve looks like a hockey stick and people are taken off-guard.

While the mistake in the earliest stages of the new tech is to overestimate demand, the biggest mistake in these later stages is to underestimate the demand. Since once companies underestimate the demand, they are forced into a reactive position of catching up and this opens the field to new market entrants as well.

Let’s apply this to electric vehicles.

In recent years we’ve seen a lot of auto manufacturers release electric vehicles with high expectations of demand, only to be disappointed later (ie., LEAF, Volt, etc). When they first introduced their EVs, they thought that tons of people would flock to buy the cars because of the advantages of an EV, but they soon learned that people weren’t willing to pay much more for an EV than a ICE car. (

http://wheels.blogs.nytimes.com/201...0000-electric-cars-a-year-by-2013-says-chief/)

What Nissan, Chevy and others have learned is that there wasn't as much demand for their EVs as they initially projected so they’ve had to adjust their expectations.

They might have initially expected the future demand for their EVs to look like this:

But after initial bleak sales, they’ve had to adjust their expectations to look more like this:

However, in Tesla’s case they approached the whole EV adoption/demand issue in a totally different way. They understood that initial demand for EVs would be limited due to price. Thus, they started with a compelling, pricey car (ie., Roadster) and a modest goal of selling a few thousand of them. And they knew even with their second major product that demand would still be limited, so they didn’t even try to shoot for a mass market car. They created the Model X to compete in the premium luxury car market and expected 20k annual sales and the Model X with 15k annual sales. They knew that the price of the batteries needed to come down before they could create a compelling, affordable mass market car and that’s why Tesla has waited all these years before even attempting to build an affordable car.

Other manufacturers optimistically imagine that people will buy their EVs even when their EVs are priced higher than comparable ICE cars. But the reality is that the market is very limited when people can get a comparable ICE for less.

In Tesla’s case, they realize that the market is limited for an EV that’s priced higher than a comparable ICE and they’ve refused to release such products. Rather, they’ve chosen to release products that are better than comparably priced ICE cars (ie., Model S). And this is the same motto they will use to release their 3rd generation vehicle. They don’t naively imagine there’s going to be a huge market for Gen3 EV if it’s priced higher than comparable ICE cars. Tesla understands that Gen3 (and any other car they make) needs to be priced comparably with other ICE cars in its market segment and it needs to provide better performance.

So in effect what Tesla has done is manage their early expectations of the adoption of electric vehicles. While other auto makers have entered the market with lofty expectations, only to be disappointed, Tesla entered the market with realistic expectations.

Now, here’s where things get juicy. At a certain point, the cost of batteries gets to a point where an electric vehicle can be made that is truly affordable and has high performance. Once this tipping point is reached, the adoption curve spikes up like a hockey stick. Those companies that had adjusted their expectations downward, now are at a disadvantage since they have to re-adjust their expectations (but they will likely be hesitant to do that since they were burned before).

The advantage Tesla has is that they are expecting what is known as the Tech Adoption Curve. Elon and JB have mentioned this in the past regarding tech adoption, that the biggest mistake early on is to overestimate demand and the biggest mistake later is to underestimate demand. In other words, Tesla has been disciplined in the early stages to not over-estimate demand, but in the later stages (ie., Gen3) they will be disciplined to not under-estimate demand. Herein lies a major competitive advantage of Tesla.

If you survey and research other auto makers, it becomes fairly obvious that no other auto maker is expecting the massive disruption of electric vehicles like the management at Tesla. At best, most auto company CEOs view the ICE car as here to stay, only it will become more efficient (ie., hybrid, etc). They view electric cars as a growing field but just one of the many powertrain options of the future - ICE, hybrid, plug-in hybrid, diesel, natural gas, electric, fuel cell, etc.

This is why when the tipping point occurs with electric vehicles, it is likely that most auto makers will miss out. They will look at the mass demand for Gen3 as some kind of fluke or mania, and not realize that a massive tipping point has just occurred. Rather than calling an emergency meeting with their management, most auto makers will continue to march on with their existing plans to build and invest in more ICE, hybrid, diesel, natural gas, etc. as well as electric cars. They might boost their investment in electric vehicles but it will likely be inadequate. All the while, Tesla is marching ahead with the goal of not underestimating the massive adoption curve. Tesla will likely be building multiple Gigafactories and car factories and will be looking to build millions of cars going into the 2020s. The other auto makers will be in a position of reacting, while Tesla will be proactively making bold moves.

The bolder and bigger the moves that Tesla makes, the greater the advantage they accrue. They will experience greater economies of scale, greater brand presence, more superchargers, more service stations, more stores, more word-of-mouth, more revenue leading to more investments, etc. In other words, as Tesla focuses on not underestimating demand, they can invest like crazy and the investments snowball into greater advantages.

Other auto makers might find themselves in a position where they are reluctant to push EV sales hard because that might mean the cannibalization of their existing ICE/hybrid car sales. Also, their new EV cars might not have the same margins as their existing ICE cars because their ICE cars will have much larger economies of scale and years of refinement. Thus, it makes more sense to push ICE cars for higher margin. In any case, it’s going to be a challenge for existing auto makers because they’re divided, and probably more loyal to what’s been feeding their cash cow. However, for Tesla there are no existing loyalties to ICE cars. Tesla breathes and lives only one loyalty, and that’s to electric cars. They do not fear cannibalizing sales of their existing cars, and as a result they can go all-in with the electric vehicle revolution.

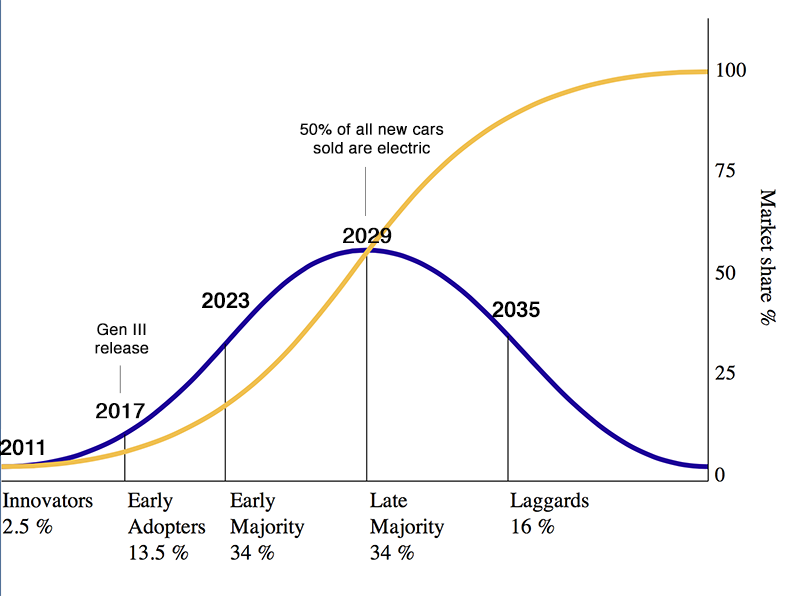

I’ve adapted what’s known as the Tech Adoption Curve to reflect how I see demand for electric cars in the next 20+ years. The disruption, though occurring over decades, will be thorough and complete. The theory of the Tech Adoption Curve is that adoption starts out with innovators at a very slow pace, then expands to early adopters and eventually to the early and late majority. However, the pace of adoption picks up very quickly from early adopter all the way to the start of late majority, where the pace starts to slow.

IMHO this is a roadmap to the future disruption of the auto industry.

Here’s a few more notes about the graph below:

- Innovators are everybody before 2017 (roadster owners might be considered pre-innovators and early innovators. Model S/X owners are innovators and until 2017 they make up only 2.5% of the market, including demand for other electric vehicles).

- Early Adopters start from 2017 to 2023. This stage is marked by the release of Gen3. And this stage EVs take over 13.5% more of the market. This is where the demand curve shoots up like a hockey stick and surprises most people.

- Early Majority starts in 2023 to 2029, and this is where EVs take 34% more of the market (for a total market share of 50% by 2029). 2023 also might mark the release of a Gen4 (even more affordable vehicle than Gen3) by Tesla.

- Late Majority starts in 2029 to 2035 and this stage EVs pick up another 34% (for a total 84% market share). However pace of adoption starts to slow as most of the market has already transitioned to EVs.

- Laggards starts in 2035 and is the last stage where the remaining market share (note: we’re talking about new vehicle sales) switches over to EVs.

In summary, currently Tesla is one of the only auto makers that understand the Tech Adoption Curve and that the key is to not underestimate demand when the Early Adopter stages commences in 2017 with Gen3. This is why I believe Tesla will aggressively pursue expansion of multiple Gigafactories and car factories to execute on this crucial time period of 2017 to 2023. Tesla is in an unique position to take advantage of this disruption as they have no legacy ICE products to support/maintain and no conflicting loyalties. Further, Tesla is alone among major auto makers in this view of the auto industry, where they see a complete transition to electric vehicles. In other words, Tesla is the only major auto maker who really believes in the Tech Adoption Curve for EVs above, and in fact has made it it’s mission to do everything it can to facilitate and promote this massive transition. The reason Tesla's understanding of the Tech Adoption Curve is a major competitive advantage is because it allows Tesla to make massive investments and big bets toward the adoption of EVs in their eventual domination of the auto industry, while other OEMs are biased against the Tech Adoption Curve because of their existing loyalties to their ICE car lineups that are their cash cows and will be reluctant, slow and reactive in their investments towards EVs.

On a final note, it’s interesting that all of Elon Musk’s companies have been involved in disrupting existing industries:

Zip2 - though smaller startup, dealt with disruption in publishing industry

Paypal - disruption via online payments

SpaceX - disruption of aerospace industry

Solarcity - disruption of energy industry

Tesla - disruption of auto industry