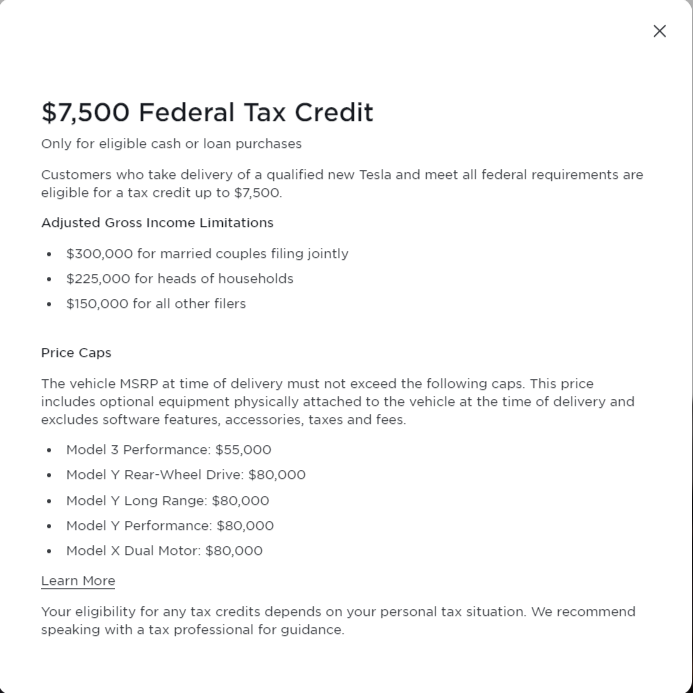

Seeing some content today that indicates the dual motor CT AWD is no longer eligible for the $7500 federal tax credit. Of course, it's early on considering it's only 1/1/2024 - but Tesla has updated their website content and the CT is not listed:

A few news outlets and explicitly stating that the CT AWD is no longer eligible - here's one as an example:

finance.yahoo.com

finance.yahoo.com

Hoping this data is preliminary and subject to correction, but figured I'd post this here to see what others are reading and to track the status of CT IRA tax credit eligibility heading into 2024. The IRS hasn't actually posted an official list of eligible vehicles for 2024 - so I'm still holding out hope this is a work in progress and that the dual motor CT will ultimately qualify for the IRA tax credit. I guess it's a bit surprising to me that it doesn't, given the use of the 4680 battery line that is, AFAIK, 100% assembled in the US, with source materials primarily coming from US trade friendly nations (i.e. not China).

A few news outlets and explicitly stating that the CT AWD is no longer eligible - here's one as an example:

More EVs lose US tax credits including Tesla, Nissan, GM vehicles

WASHINGTON (Reuters) -Many electric vehicles lost eligibility for tax credits of up to $7,500 after new battery sourcing rules took effect on Monday, including the Nissan Leaf, Tesla Cybertruck All-Wheel Drive, some Tesla Model 3s and Chevrolet Blazer EV, the U.S. Treasury said. The Treasury...

Hoping this data is preliminary and subject to correction, but figured I'd post this here to see what others are reading and to track the status of CT IRA tax credit eligibility heading into 2024. The IRS hasn't actually posted an official list of eligible vehicles for 2024 - so I'm still holding out hope this is a work in progress and that the dual motor CT will ultimately qualify for the IRA tax credit. I guess it's a bit surprising to me that it doesn't, given the use of the 4680 battery line that is, AFAIK, 100% assembled in the US, with source materials primarily coming from US trade friendly nations (i.e. not China).

Last edited: