WTI $96.0

Brent $104.8

US offshore wind spreads south

www.offshorewind.biz

www.offshorewind.biz

Chinese solar bigs up

www.pv-magazine.com

www.pv-magazine.com

Prefab carport solar shading

www.pv-magazine.com

www.pv-magazine.com

UK-Germany 1.4GW gridlink

www.pv-magazine.com

www.pv-magazine.com

Panels get bigger

www.pv-magazine.com

www.pv-magazine.com

Dark tankers are a thing

gcaptain.com

gcaptain.com

Complicated sanctions

/cloudfront-us-east-2.images.arcpublishing.com/reuters/N5VXSN3OKNNU5EFCY73A2GXE6U.jpg)

www.reuters.com

www.reuters.com

Big ticket items

www.offshorewind.biz

www.offshorewind.biz

Political risk rising

www.theguardian.com

www.theguardian.com

Brent $104.8

US offshore wind spreads south

US Expanding Offshore Wind to Gulf of Mexico and Southern Atlantic

US President Joe Biden has announced that the Department of the Interior is advancing the development of offshore wind areas in the Gulf of Mexico and the Southern Atlantic.

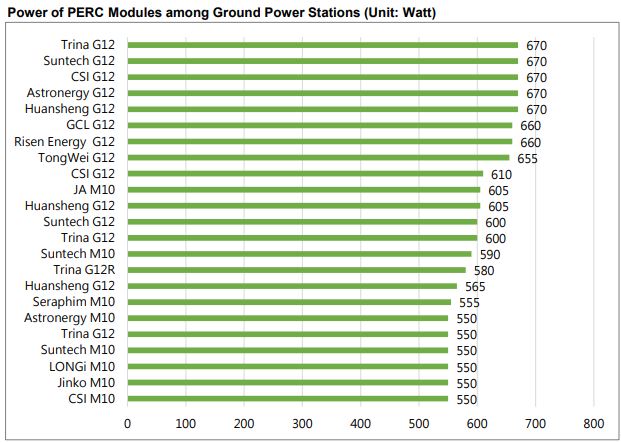

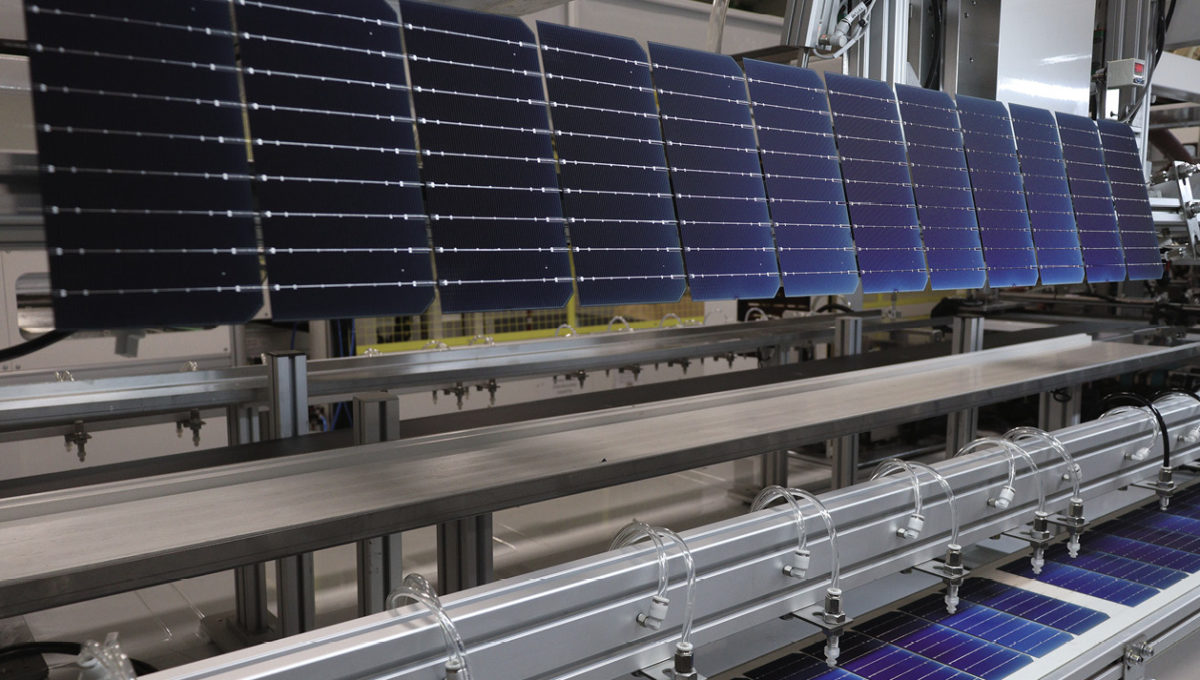

Chinese solar bigs up

Chinese PV Industry Brief: China may install up to 100 GW of solar this year

The country added more than 30 GW of new PV capacity in the first half of 2022 and its cumulative installed solar power reached 340 GW at the end of June.

Prefab carport solar shading

Australian startup unveils scalable shade solution for commercial applications

Canyon Solar has unveiled a prefabricated solar PV shade structure for commercial carport applications that it claims can be installed at least three times faster than traditional systems and outcompetes rooftop solar PV on a dollar-per-watt basis.

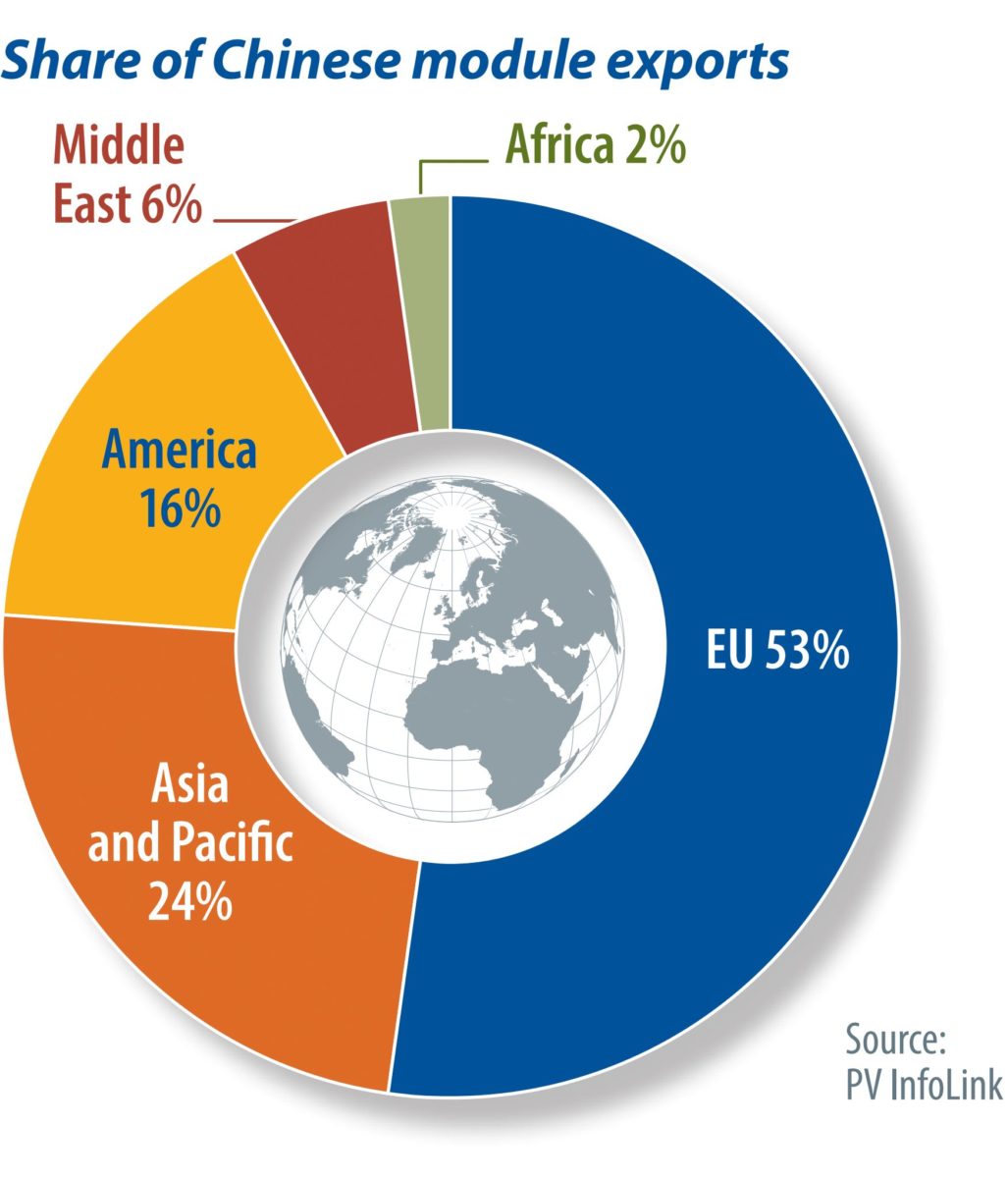

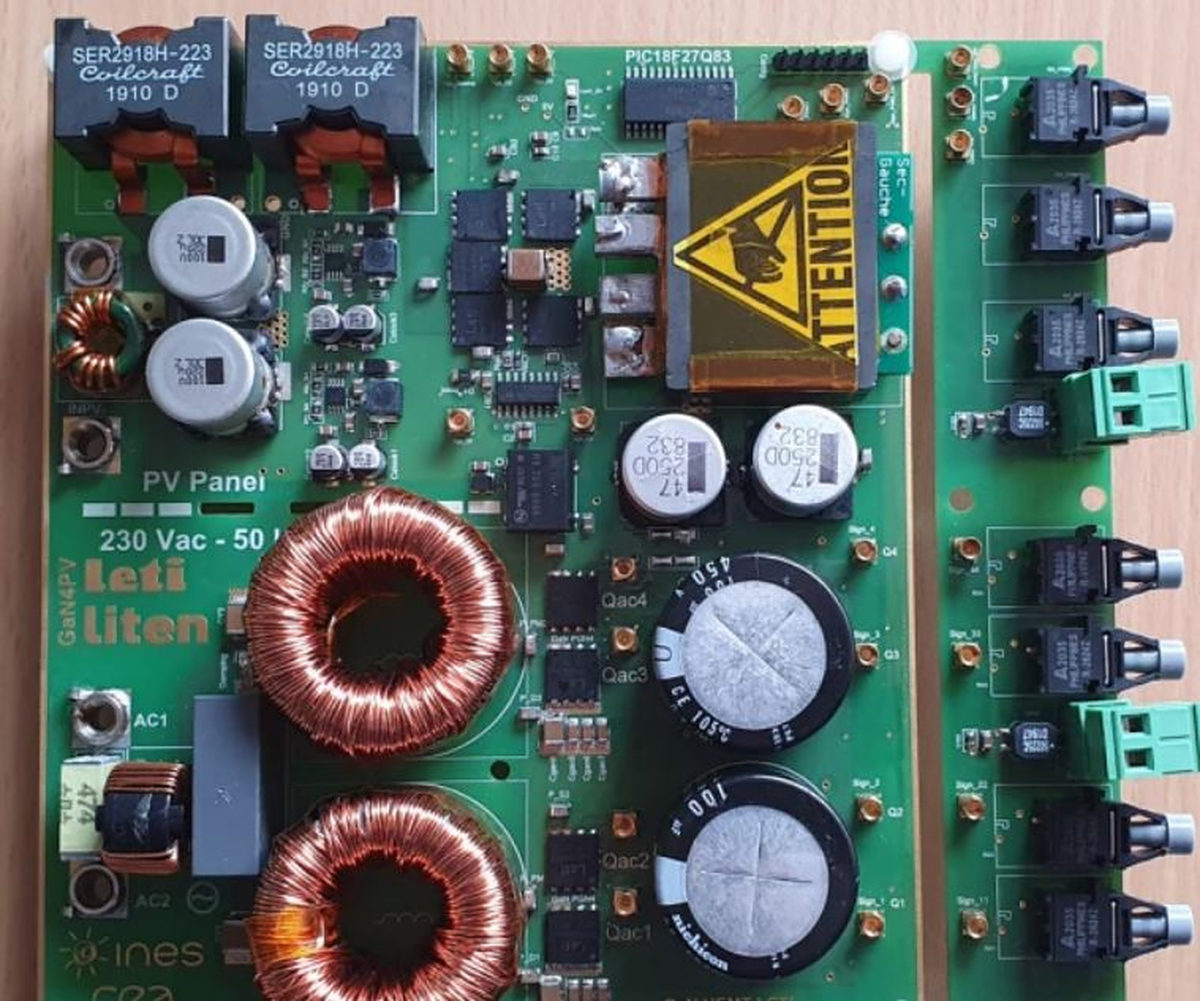

UK-Germany 1.4GW gridlink

Project to build 1.4 GW high-voltage cable linking Germany with the UK moves forward

The European Investment Bank has agreed to provide €400 million ($406.5 million) in funds for the €2.8 billion project. Construction on the infrastructure should begin by the end of this year.

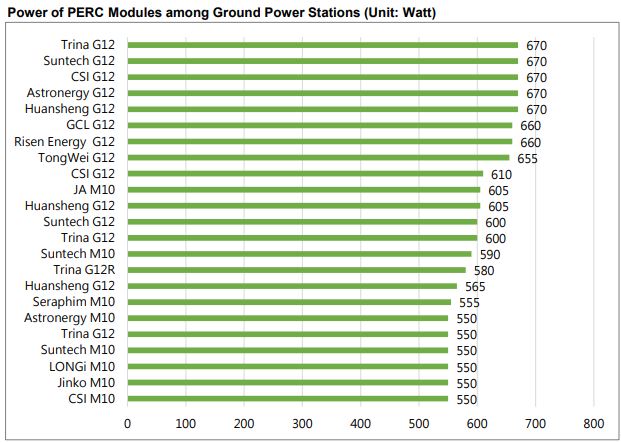

Panels get bigger

Solar panel sizes continue to get larger and improve LCOE, says TrendForce report

A new report from the Taiwanese market research company shows growth in the production of modules over 600 W and increased format size. Cells and wafers are getting larger as well.

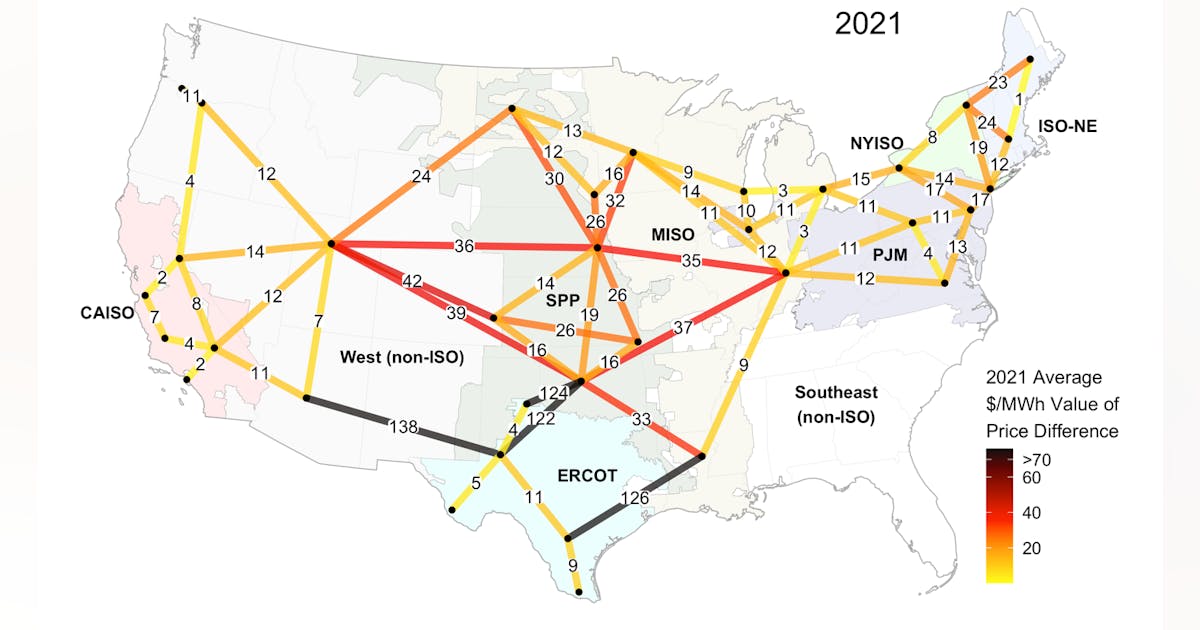

Dark tankers are a thing

Dark Tanker Market Gets Competitive

Data from Vortexa, a platform in the energy industry, shows that Iran, Russia, and Venezuela are all vying to sell oil to Asia. According to the analysis, Russia’s growing exports...

gcaptain.com

gcaptain.com

Complicated sanctions

/cloudfront-us-east-2.images.arcpublishing.com/reuters/N5VXSN3OKNNU5EFCY73A2GXE6U.jpg)

EU sanctions tweak to unblock Russian oil deals with third countries

Russian state-owned companies Rosneft and Gazprom will be able to ship oil to third countries under an adjustment of European Union sanctions agreed by member states this week aimed at limiting the risks to global energy security.

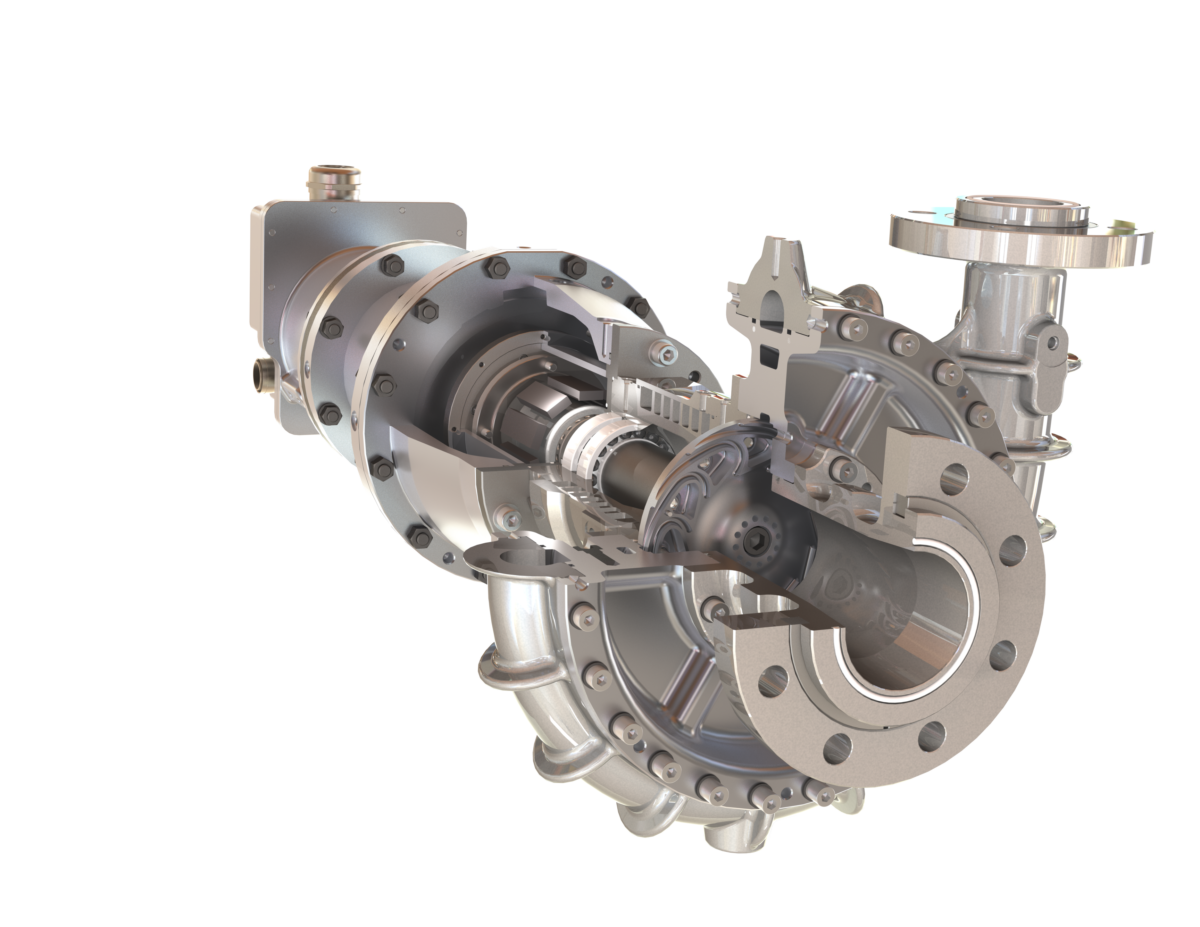

Big ticket items

Siemens Energy Secures Its Largest Grid Connection Order

Amprion Offshore GmbH has now commissioned Siemens Energy to supply the converter platforms for the DolWin4 and BorWin4 offshore grid connection systems.

Political risk rising

Italy’s loss of Mario Draghi is a warning to progressives across Europe – and to the EU | Lorenzo Marsili

The prospect of the far right taking power underlines the failure of technocratic government – and the need for true alternatives, says Italian philosopher Lorenzo Marsili

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CWMOXSNBUFK3NH4S4ZF44WAP6A.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LQXVNZU4QZJ3TGMQM4TSC5DV6Q.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MB3KMQWWF5PDVE5UCGWCPTGVVY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IVVEFNEJCVPOTCHRD2MESE3MF4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WHHNEJL6TNL6HMIPUE42URHKQI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6VWFFLFDZVKDXA5TIFUNTZNPFE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/G62JTGDORVMD5IHBJK4H7Q4XKM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WPDNCZBUIVIARJYIJYP3MPUGYQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QBKEVZMLEFONLG7NAZ2QME3WMA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DFD7HQ3BEJIZJKISRCXNZLOXM4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2Z7HRKZNP5LIRNILHZZ7KJ7STI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MJD542IUZFMXDKC36NFXDGTAKQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DWRPWI5OBZMDHPZXDQ5BH56OJM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GJEEM4NYGFJ7DGQ3T42H4JCNIY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QTFCGK6FGZKWXECCTP5NV33I2M.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5L3X4B7P6ZIOPOBDI3POAA3JLQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QVTKDCTNUBO37KKGOENRQXY2NA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BANGVPRKTRL5XPVUDGQF6576Q4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/A53T37JDVNPLPLSVGYGH75ARFA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IIVFNSGTTVMSTJFSFH6MW6BJGE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JDIZPTD7LBJP7BI22LNIKZVTJI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RAAFMPDEIBJDBJZATZDT56KDZA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4E5AU35MWZLYNKXTRU3PWURDKI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Q7HJJDYEOFNCVDBXRN5CP5ARRY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QHTAG6Y2LFLDTA3NUNPLJWBJHM.jpg)