Explanation : I was recently asked by a school to write a suitable set of practice interview questions regarding energy for a 18-year old in Germany wanting to study a first degree in engineering at a good university. (I used to do these sort of interviews for various things). Below is what I put together for the school to use in their practices. Hopefully it may be of interest to others.

-------------------------------------------------------------------

Interview question

Comment – this is structured so as to ensure that specific understandings are in place for each successive question with any information in the suggested answer brought out in conversation. However the aim should be to allow a conversation to flow albeit in a managed manner. It is deliberate that some calculations are required as sometimes interviewers for these courses will want candidates to demonstrate their ability to perform estimates, understand units, etc – pencil and paper should be allowed (or even a calculator). It is expected that the interviewer will want to relate the questions to the candidate’s home-country of Germany.

Q1. Germany is progressively phasing out its nuclear and coal-fuelled electricity generation and has stated that it intends to move towards only using renewable energy in the future, i.e. for the time being these are political decisions that have been determined/settled. Assuming that hydro power potential in Germany has mostly been already developed, what two other renewable energy sources might make up the majority of the required electricity in the future.

A. Wind and solar (photovoltaic) energy are likely to be dominant. Other options exist but are much smaller in scale (e.g. biogas, biomass, geothermal, ocean wave/currents, solar thermal, etc).

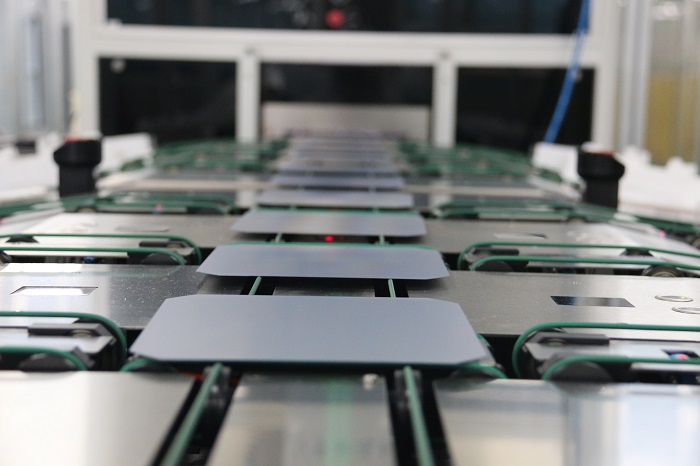

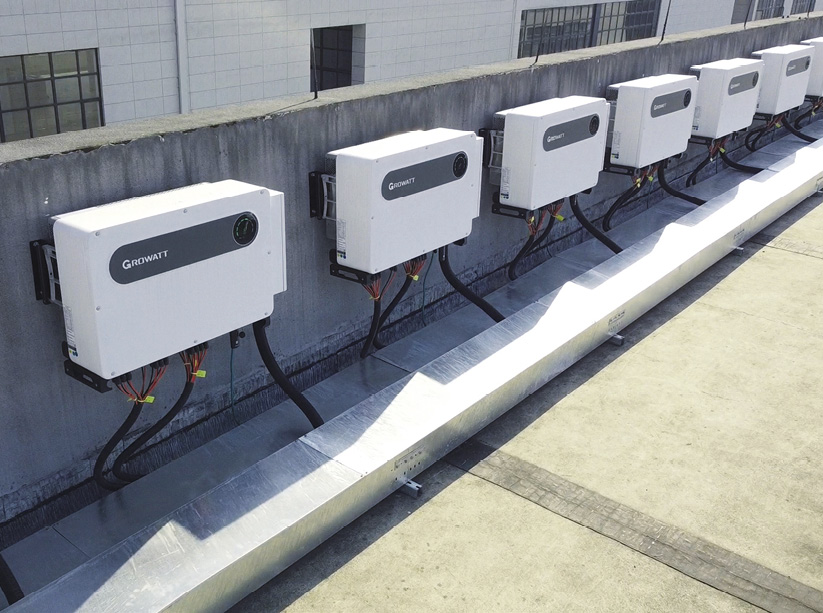

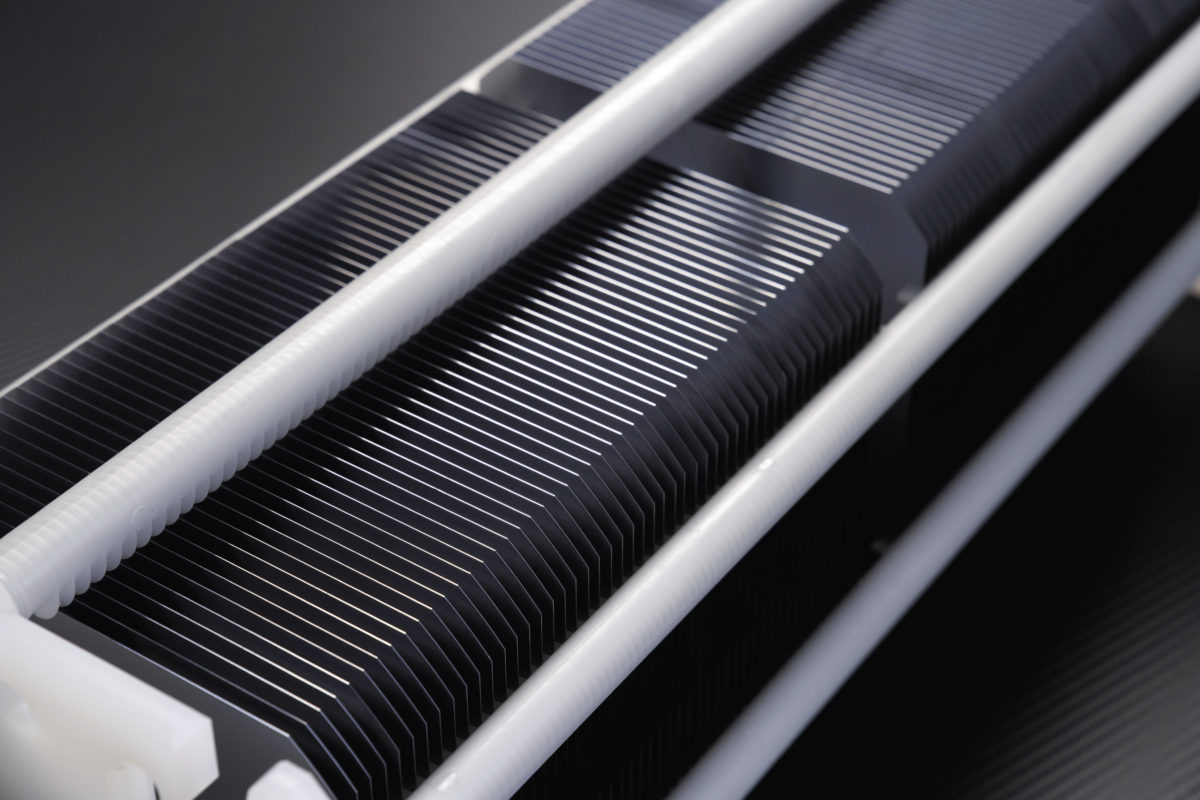

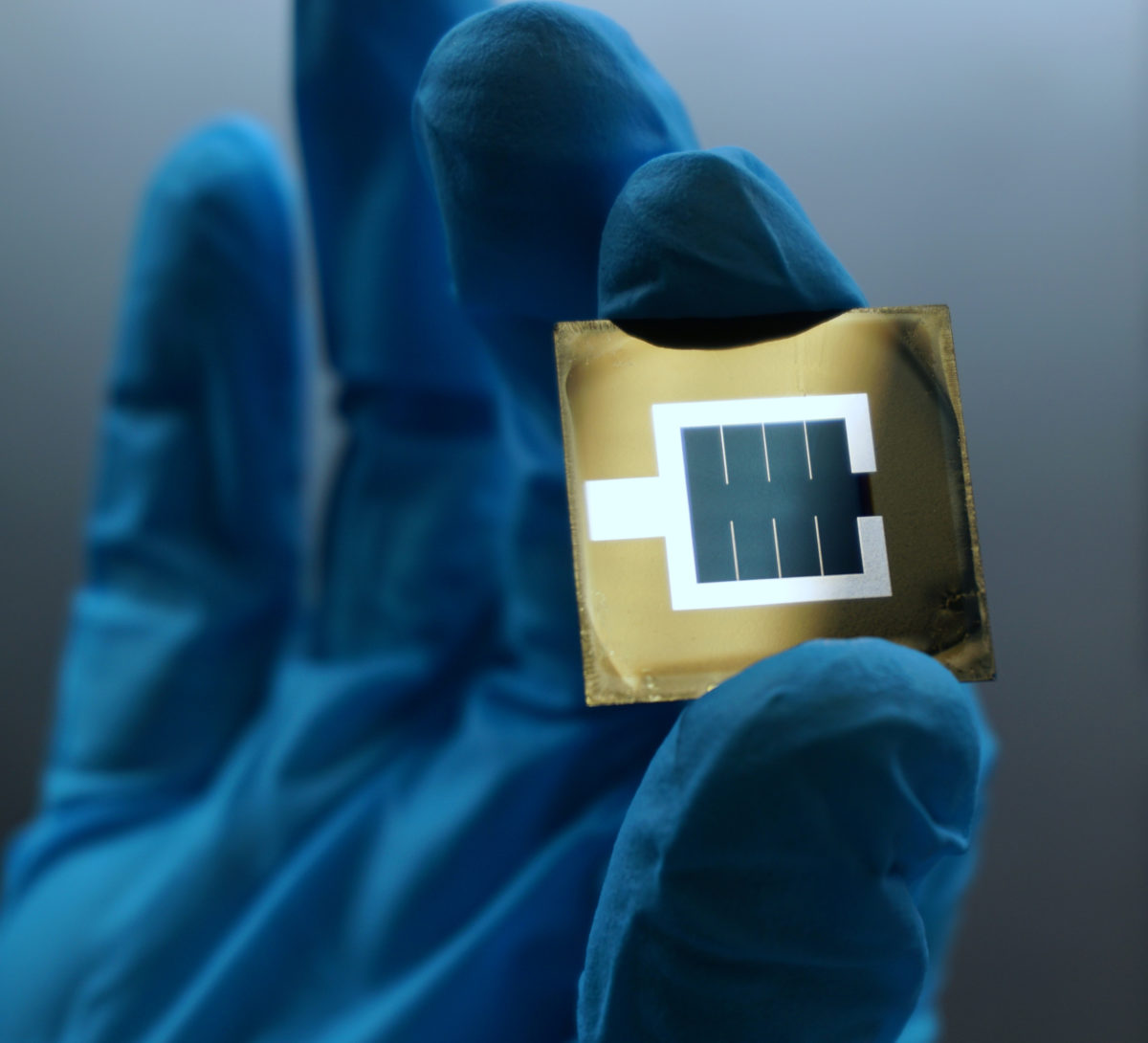

Q2. How do we capture solar PV and wind energy to generate electricity ? What are the main features of wind and solar energy that might concern an engineer studying a country such as Germany’s energy requirements? To what extent are they similar or different ?

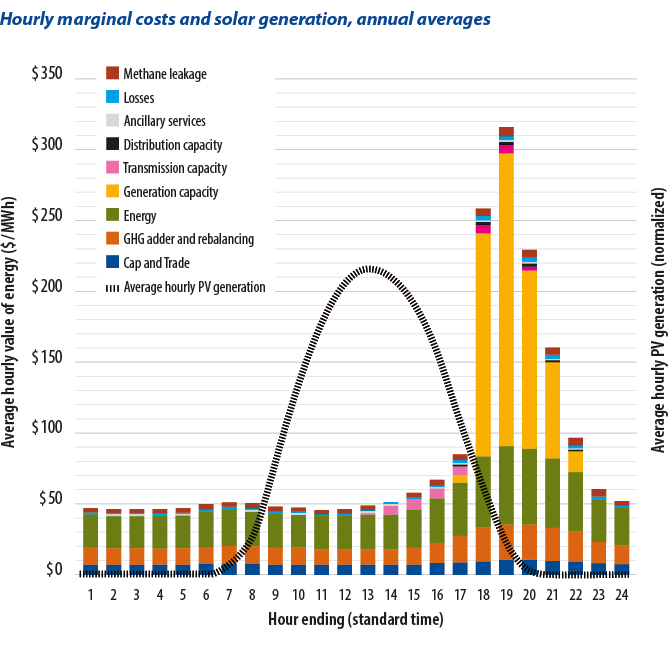

A. Both generate electricity that originates in the sun, one directly via solar radiation exciting silicon semiconductors to set up a voltage and induce electron flow; and the other by solar radiation creating wind circulation patterns that are harvested aerodynamically by rotating wind turbines with mechanically-linked electrical generators. Both are intermittent but forecastable over differing timescales – for example we very accurately know when the sun rises and sets, and how many hours of solar radiation of what average intensity will fall on the earth at what angle, but we don’t necessarily know how much cloud cover will occur until shortly before. Similarly we know that winter tends to be windier than the summer, but we cannot forecast too far in advance what will be the exact amount of wind at a given location. In the case of Germany we can say that generally solar energy is more prevalent in the Summer and that wind energy is more prevalent in the Winter. The cost of these will be a big concern, as will be the ability to design, manufacture, install and operate them.

Q3. Germany had approximately 210 GW (210 x 10^9) of total installed electrical generating capacity including nuclear, hydro, fossil-fuel, wind and solar. In 2021 Germany consumed 512 TWh (512 x 10^12) of electrical energy in total. What therefore was the average annual utilisation of the generating capacity (this is also termed ‘capacity factor’). Does this capacity factor seem high or low to you ? Why might this be ?

A.

Energy = Power x Time

210 GW x 365d x 24h = 210 GW x (8760 h/yr) = 1,839,600 GWh/yr = approx. 1,840 TWh

Capacity factor = 512 / 1840 = 28%

Most students will be surprised that the real-world capacity factor is so low. In fact typical annual average maximum capacity factors for fossil-fuel generation are often ~40%, for solar are ~11%, for onshore wind are ~30% and for offshore wind ~40% and nuclear ~80%. Therefore a blended capacity factor of 28% is not unusual for a country. Good explanations will include that the total system capacity must be great enough to deliver the peak consumption (even allowing for some equipment unreliability or unavailability) and so a lot of the system will be under-utilised almost all of the time. During periods when equipment is not in use it might be in maintenance, or on standby, operating at partial output, or awaiting its intermittent energy source such as wind or solar.

Q4. We note that in the case of Germany we can say that generally solar energy is more prevalent in the Summer and that wind energy is more prevalent in the Winter. Nonetheless if Germany is to transform its electrical supply to renewables there will be periods when the wind is not blowing and the sun is not shining, but it will still be necessary to deliver electrical energy to the population for domestic, commercial, and industrial use. How might periods of intermittency such as this be managed in a fully renewable manner if there is insufficient hydropower to meet the need, and what are some implications of this ?

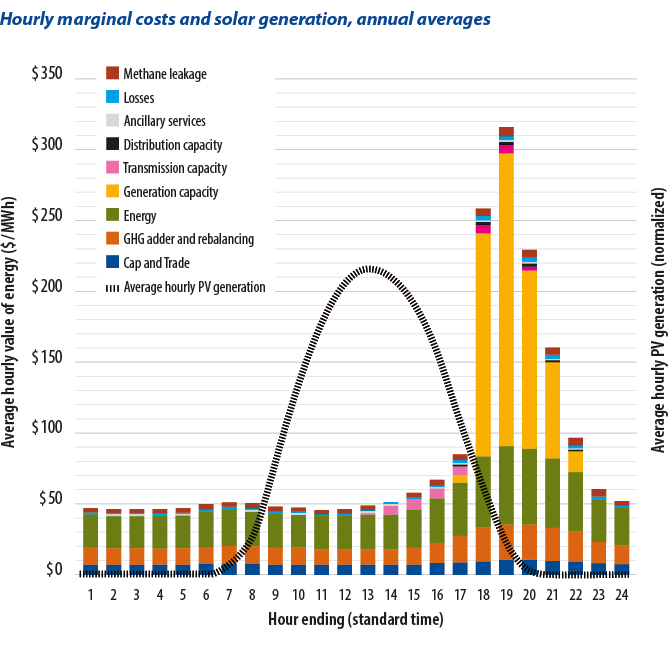

A. A part of the answer is to minimise use during periods of intermittency, either via enforced curtailment (rationing) or market-driven behavioural changes, primarily through the mechanism of dynamic real-time energy pricing. This is one motivation for the development of so-called “smart grids”. It is generally expected that imposition of overly high energy prices on consumers in even a very transparent manner will be politically undesirable, and so whilst demand management may be a part of the solution it is thought to be better to find ways of storing energy for release during periods of intermittency.

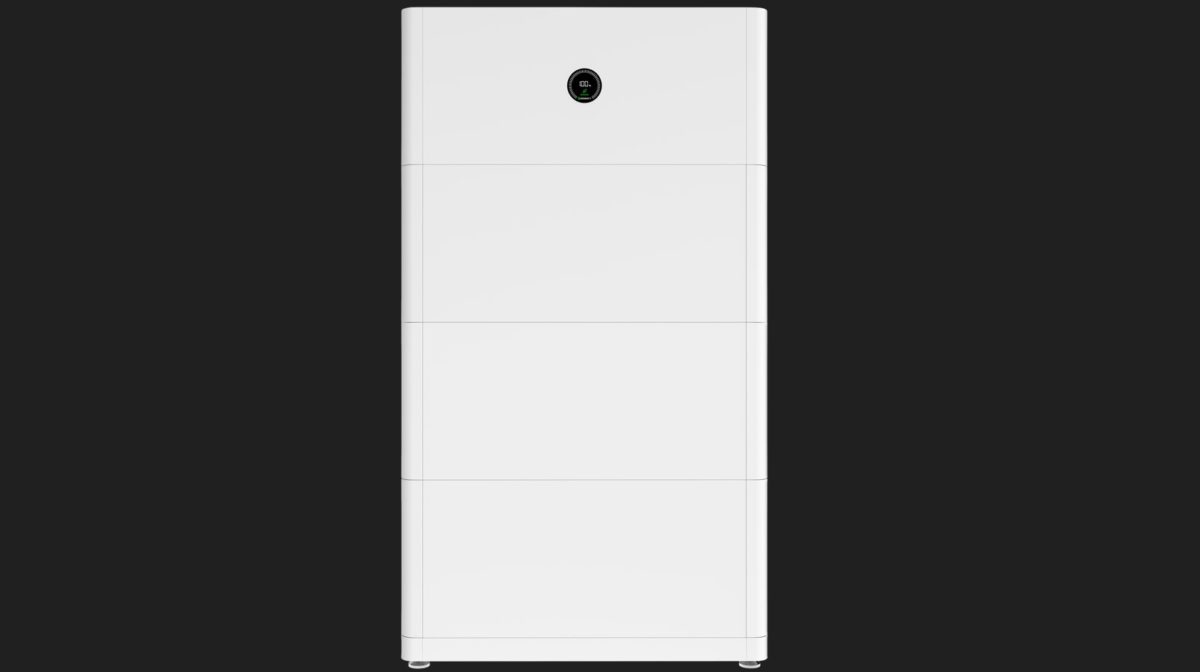

Energy storage proposals include various forms of battery; compressed gases; flywheels; raised masses; and the generation of ‘green’ chemical fuels such as hydrogen that can be converted to electricity through combustion or fuel cell processes. These all seem very expensive and difficult to scale to meet the challenge. That is why this is one of the biggest engineering challenges of our time.

Q5. If there are 83-million people in Germany what is a) the installed generating capacity per person; b) the average annual electricity consumption per person; c) the average generating capacity utilised per person. Does this seem high or low to you ? Approximately how might the consumption be spread amongst sectors such as (say) industry, households, commercial trade & services, and transport ?

A.

a) 210 GW / 83-million = 2.5kW per person installed capacity

b) 512 TWh / 83-million = 6,169 kWh per person per year total consumption

c) 2.5 kW x 28% = 0.7 kW average power utilisation rate during year per person

It often surprises students to relate the very large numbers for a country back to what it means for an individual person. In fact these are very typical numbers for an advanced European economy, i.e. less wasteful than (say) the US usage of power, but much more than in many less developed nations.

As a generalisation European economies electricity use tend to be nearly one third split between industry, household, and commerce with a tiny fraction for transport. In Germany the division is currently approximately 2% transport, 30% commerce, 26% household, and 42% industry.

Q6. The average German household size is 2 people. Many people are suggesting that households should install a household solar PV system of (say) 4kW size and a battery system of (say) 10kWh to help the electrical grid manage the transformation and assist with intermittency. What can you say about this ?

A.

A typical German person consumes 26% x 6,169 kWh per year in their household, so 1,604 kWh of electricity. Therefore the average 2-person household will consume 3,208 kWh of electricity per year in the home.

Using the previously given capacity factor of 11% the suggested 4kW solar PV system would generate 4 kW x (365 days x 24 hrs/day) x 11% CF = 3,854 kWh/year.

The suggested household solar system would be an approximate match for a typical household’s consumption. It is likely that a domestic house would not achieve the general 11% capacity factor as the siting will be less than the ideal given the constraints of most houses. Many people will not be able to install such a system on their house, either due to physical house limitations or their own financial circumstances.

However the system would tend to produce quite a lot more than the house needs in the Summer when the house’s electrical energy needs are low, and almost nothing in the Winter when the house’s electrical energy needs are highest.

On an average day the household would use 3,208 kWh / 365 days/year = 8.8 kWh per day.

Therefore the proposed 10 kWh battery is an approximate match for the household’s average daily use, allowing the householders to store up solar generation during the sunnier hours of the day and to consume it in the dark hours of the evening or the early morning. So we can see that the suggested battery size is fairly sensible at an average level, however we also know that the sun’s strength and the daylight hours vary through the year. Just as the solar generation is most when least needed, so too would this battery not be able to store sufficient power for more than about one day.

Therefore the battery in this proposal may help the national electricity grid for short-term intermittency but will not help much with longer term intermittencies or for interseasonal storage.

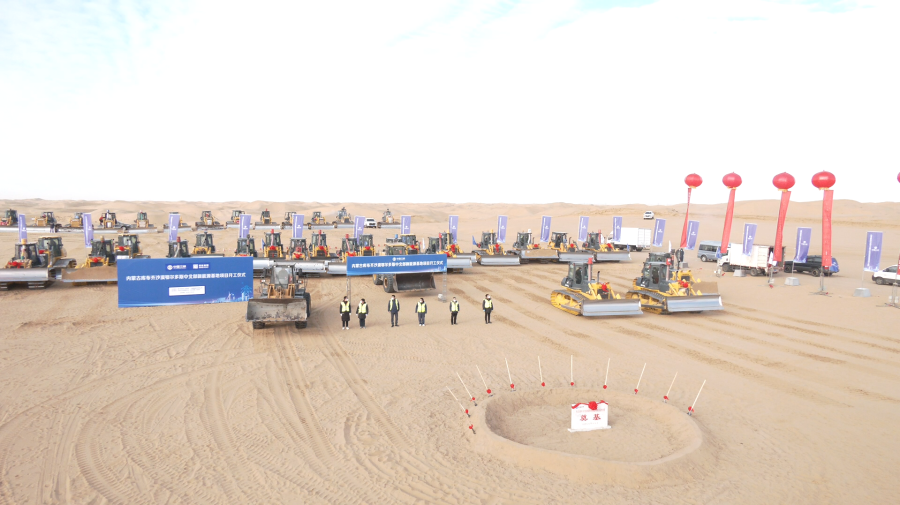

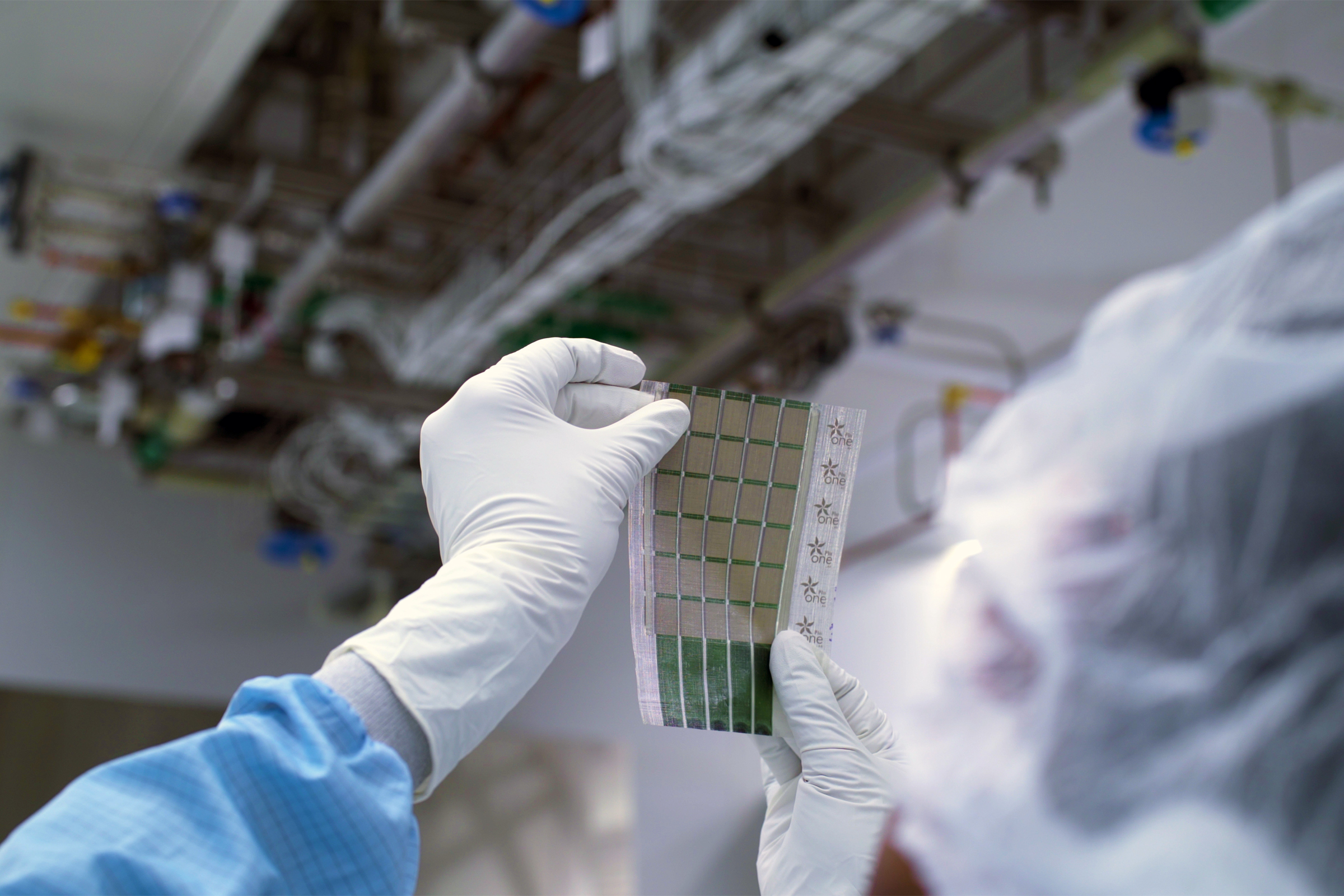

Q7. So far we have been discussing Germany’s electrical energy needs, which were 512 TWh per year. However Germany’s total energy consumption is approximately 3,512 TWh per year, for electricity, transport and heat. In other words approximately 3,000 TWh per year of energy is not converted into electricity but is instead consumed as vehicle fuel, or for heating, cooling and in industrial processes (note : we are slightly simplifying here to make the conversation easier to follow). In energy terms the balance is approximately equally divided between gas, oil, and coal. Overall Germany is now (2021) obtaining 75.6% of its primary energy from fossil fuels, and the remainder from a combination of nuclear and renewable sources. How big a solar PV system would be needed to fully balance an average person’s total share of the German energy need. A 400W solar panel is approximately 2m2. The land area of Germany is 357,588 km2. Does this answer seem a reasonable way to approach the problem, and if not what might be a better way.

A.

3,512 TWh / yr / 83-million = 42,313 kWh per year per person of primary energy

And we know that a 4kW PV system produces 3,854 kWh/yr, so 963 kWh per year per kW

So 42,313 / 963 = 44 kW of PV system

Also,

The mooted individual person’s solar system’s land-take would be:

(1/0.4) x 2m2 = 2.5m2 per kW

44 kW x 2.5m2 = 110 m2

The land area per person in Germany is 357,588 / 18-million = 0.02 km2 = 20,000 m2

So this represents (110/20,000) = 0.55% of the land area per person in Germany

This seems a plausible amount of solar to fully satisfy the energy needs of one German for a year, and certainly seems of a physical scale that could physically be fitted into the country without causing undue hardship. However it does not seem to be the best way to do it, if only because there is no sunlight in the depths of winter. A more likely solution will be some mix of wind power, solar power, and energy storage.

Q8. What information might you need to know to better calculate the best mixture of wind, solar, and energy storage using currently available technology ? How might you perform the calculation ?

A. Assuming for now that “best” means “cheapest” the key pieces of information will be around the actual reasonably expected weather during typical years; the variability of this weather; and the unit costs of the various technologies. One could then construct a computer model for varying amounts of each and try to find the lowest cost solution for Germany. The more information that is known about the weather patterns, at different timescales, the more the computer model could be investigated to understand the robustness of the different mixes to variation in current weather. If the definition of “best” took into account a wider range of factors such as land-take, cash-flow, job opportunities, etc then a range of interesting solutions might be the outcome for further study.

(Note : one can discuss this at great length, but the above would be a realistic answer for a typical viable 18-year old candidate)

Q9. Future developments of new technologies or improvements to existing technology may arise, so perhaps there is value in delaying Germany’s transition to a non-fossil energy system. Equally it is suggested that the effects of climate change may cause future weather systems to be more extreme, so early action to decarbonise is sensible. How might you balance these and similar factors.

A. These are a mixture of philosophical, engineering, economic, political, and earth-sciences questions. As engineers there is a moral obligation to find our best pathway through them, but we can only do so as part of a team effort within our society. One could suggest a formal financial economic model to balance both positive and negative factors in value-of-delay with value-of-acceleration but even then the question would be whether it should be constrained to just Germany or also take into account other factors such as the scale of deployment of technologies around the world (as these greatly determine progress along technology improvement curves). An alternative approach is to just let the market decide, but this is only reasonable if there is a not evidence of market failure, and many people would cite the very slow progress on global climate change as being the evidence that there is market failure. Many studies take the view that quantification of the risks of delay are so large that one cannot reasonably slow down, and that in any case the positive value of transitioning to renewable energy also provides sufficient intrinsic justification to not delay.

(Note : one can discuss this at great length, but the above would be a realistic answer for a typical viable 18-year old candidate)

Q10. How do you as a young engineering student hope to contribute to solving these challenges, and the other great challenges that exist. Do you still want to study engineering?

A. ………………… [!!!!] ……………………….

www.pv-magazine.com

www.pv-magazine.com

www.theguardian.com

www.theguardian.com

www.theguardian.com

www.theguardian.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KLCSTJ6IX5IJZP5PW222HCHZTE.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/U5GG7HLHTBNRFP67FYSGDDQOJU.jpg)

www.reuters.com

www.reuters.com

www.theguardian.com

www.theguardian.com

www.railfreight.com

www.railfreight.com

www.railfreight.com

www.railfreight.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KLCSTJ6IX5IJZP5PW222HCHZTE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/U5GG7HLHTBNRFP67FYSGDDQOJU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/W2ANCE7OH5JGJLTZPQTTZDSXRI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/S4OJZEYJGVLDLBCAMV5IDZT65E.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TLNWW44B5FOYJGB63LQPHTPDMI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VE54RRYBSNLAZJAPZ4ONMGFZEM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HT6IH3BJQBMMNLS6AEXDMJYMWY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LIKZNDZV7FJBFIINANQSI3B6HA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3DJEQ44QYJOXZABISWF67E6TFI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JKS45MUNEBPU5PX4OGQ2CLOLS4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RMF2A4QC45O2LDS2V5B2HOG4HY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FXELTNR5MZLHDFY3BGRISGXTRE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TA74AP2KVVIBVJ4CCP7GQN2TNA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HABZZBQD2VPKFB7TQV76F4DYUQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZI6GUIIJDBPC5IBYDOBFP4FRUM.jpg)