WTI $77 /bbl

Brent $84 /bbl

NL TTF gas €53 /MWh (EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

Europe is heading close to the end of the winter season with storage about 69% full, much above the 10-year average of 54% for this time of the year.

Not mankind's first rodeo, (spolier alert : previous ones ended badly)

www.theguardian.com

www.theguardian.com

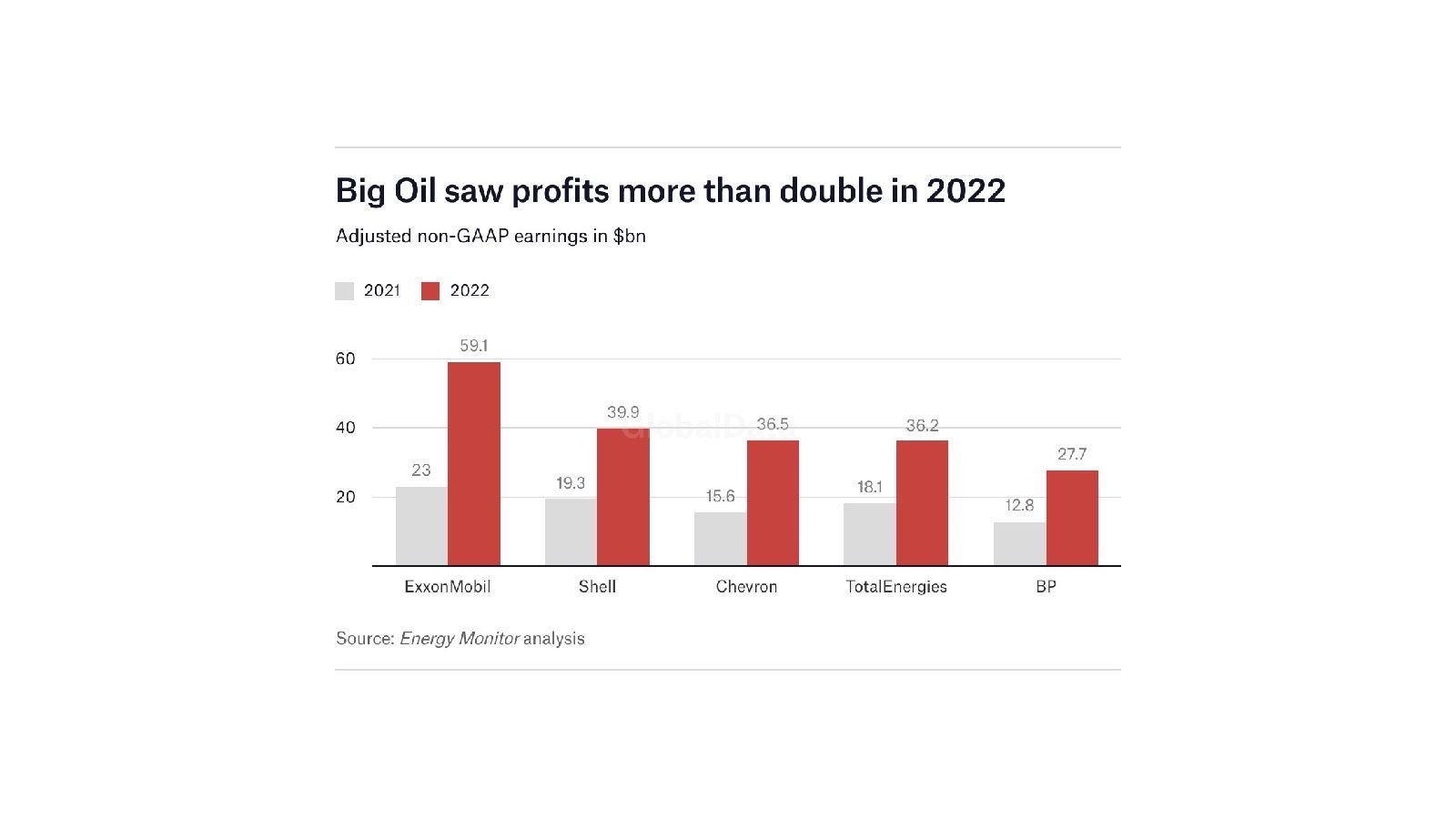

Big oil, big profits

www.energymonitor.ai

www.energymonitor.ai

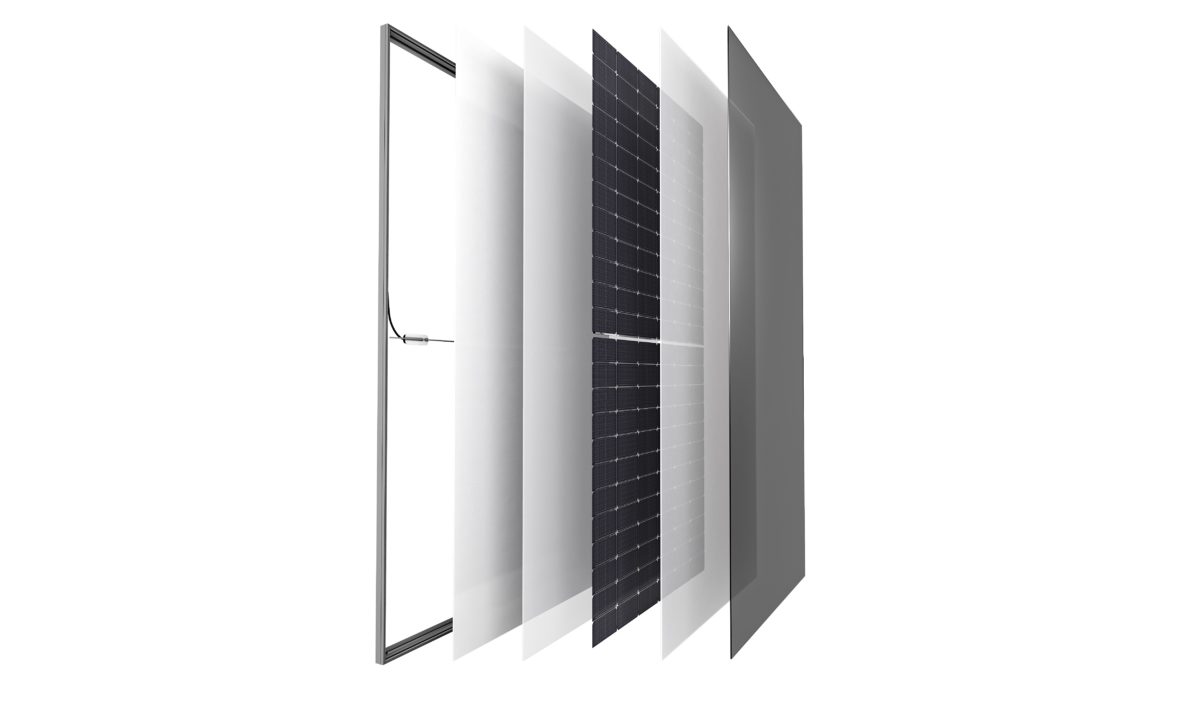

Genuine vehicle packs, not often done, more talked about

www.utilitydive.com

www.utilitydive.com

Astroturf inbound

www.utilitydive.com

www.utilitydive.com

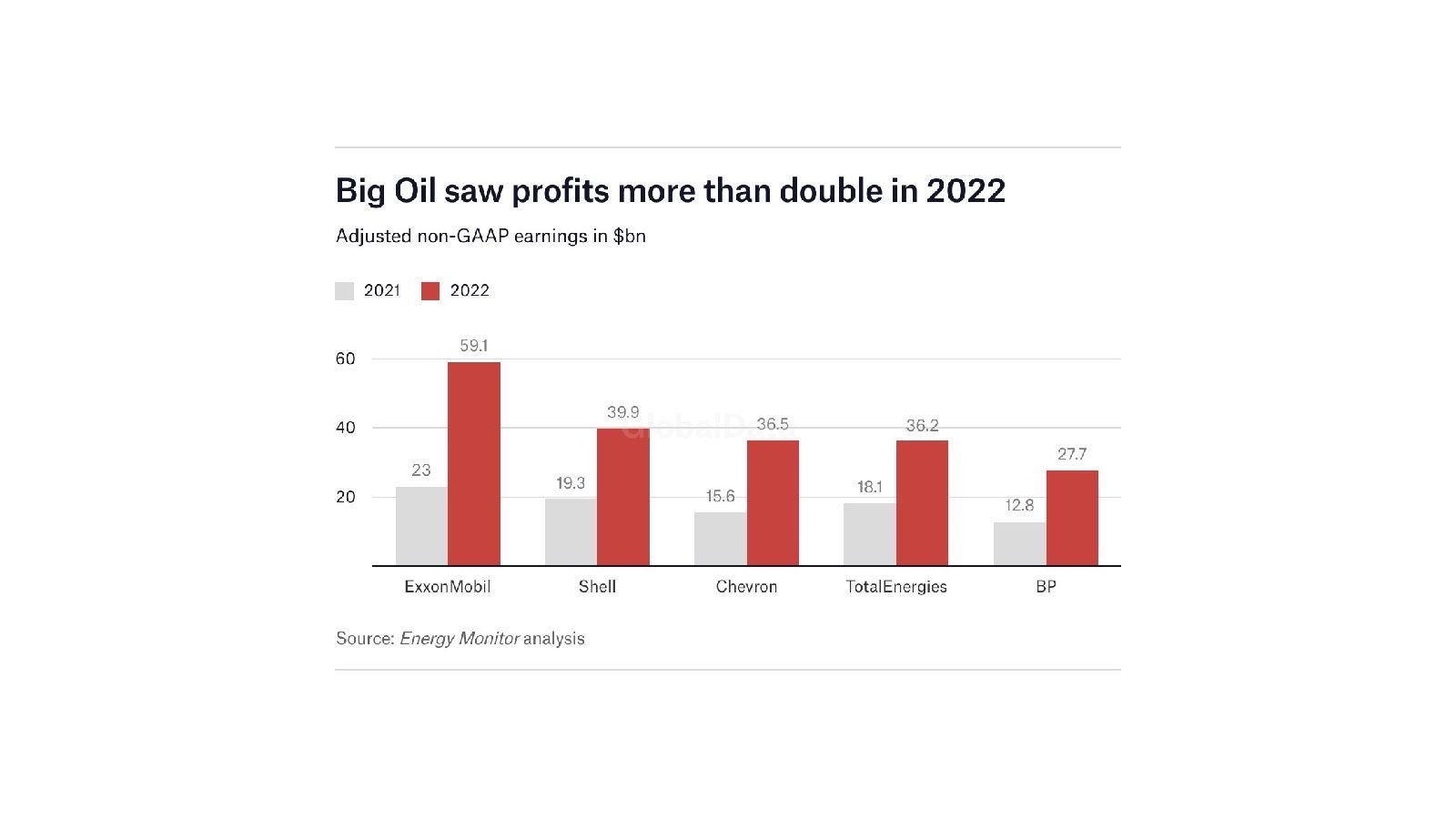

More of that 536 GW of solar per year

www.pv-magazine.com

see also

www.pv-magazine.com

see also

www.pv-magazine.com

www.pv-magazine.com

Circular blades breakthrough (not just applicable to wind)

www.offshorewind.biz

www.offshorewind.biz

Inverter failure rates keep falling

www.pv-magazine.com

www.pv-magazine.com

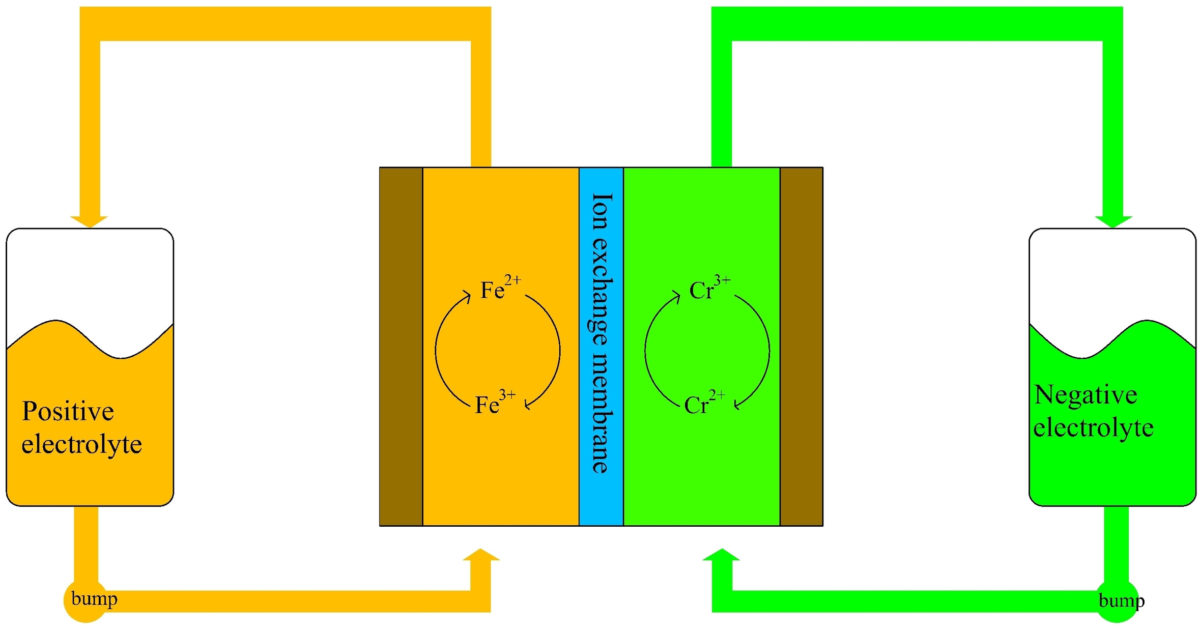

The other big dig

www.railfreight.com

www.railfreight.com

Brent $84 /bbl

NL TTF gas €53 /MWh (EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

Europe is heading close to the end of the winter season with storage about 69% full, much above the 10-year average of 54% for this time of the year.

Not mankind's first rodeo, (spolier alert : previous ones ended badly)

Drought may have doomed ancient Hittite empire, tree study reveals

Examination of trees alive at the time shows three years of severe drought that may have caused crop failures and famine

Big oil, big profits

Big Oil profits soared to nearly $200bn in 2022

The combined profits of some of the world’s biggest oil companies amount to over $199 billion in 2022, hitting records.

Genuine vehicle packs, not often done, more talked about

B2U reaches 25 MWh storage capacity at California facility with 1,300 used Honda and Nissan EV batteries

In addition to deploying the Honda and Nissan batteries at scale, B2U Storage Solutions said it has tested GM Bolt and Tesla Model 3 battery packs, showing that its system can be configured to operate any EV battery.

Astroturf inbound

BP CEO describes Archaea acquisition as a ‘game changer’ for boosting biogas volumes

In their first earnings call since completing the purchase of a leading landfill gas project developer, BP executives outlined plans to ramp up capital spending and pursue new offtake options for the Archaea platform.

More of that 536 GW of solar per year

Tongwei to set up 120,000 MT of additional polysilicon capacity

Tongwei has revealed plans to set up a new polysilicon facility with a production capacity of 120,000 metric tons (MT) in Leshan, in China's Sichuan province.

Global polysilicon capacity could hit 536 GW by end of 2023

Clean Energy Associates said in a new report that it expects polysilicon production capacity to exceed PV installations next year.

Circular blades breakthrough (not just applicable to wind)

Newly Discovered Chemical Process Renders All Existing Wind Turbine Blades Recyclable

A new chemical process discovered as part of a Vestas-led project allows for epoxy-based blades to be broken down into raw material that can be reused in new wind turbine blades.

Inverter failure rates keep falling

Survey shows 34.3% failure rate for residential inverters over 15 years

The Bern University of Applied Sciences in Switzerland has published the initial results of a survey on the durability and performance of residential PV inverters and power optimizers over a 15-year period. They found that more than 65% of the inverters did not present yield-relevant faults by...

The other big dig

9 years until the Brenner Base Tunnel: let’s look at where we are

With a length of 64 kilometres, including the bypass of Innsbruck, the Brenner Base Tunnel will be the longest underground railway connection in the world. With construction works hitting important milestones, this is a good time to look back at those developments and, more in general, at the...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PY6DFLLABVMV3MYBTJYMQBEHDA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UH436OHOC5MDNONGXXLQV4LVGI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/H2XXHU3WIBMTZJBNH2JZY5TLAY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7BAAVXW63NILFNSAOCWY3R4EJE.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/5MSF6VVUOBG5BDEHJHIPJAQHZ4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KE4F3CJKMJIHRF6HGPJYIUEHBY.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/UA3FUO3MXBAEVKQN7NPKT5R3KQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Q3Q72VORKFPZXMKLUS3BUAQ5CU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HO66AA73EBP2JFRAXIZYUYP7QM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/E2MS2VPMZBKPNDLYR6JHJZSCWI.jpg)