WTI $76 /bbl

Brent $83 /bbl

NL TTF gas €49 /MWh (EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

Lest we forget

www.power-technology.com

www.power-technology.com

Brent wanted

www.reuters.com

www.reuters.com

Nickel surplus ?

www.reuters.com

www.reuters.com

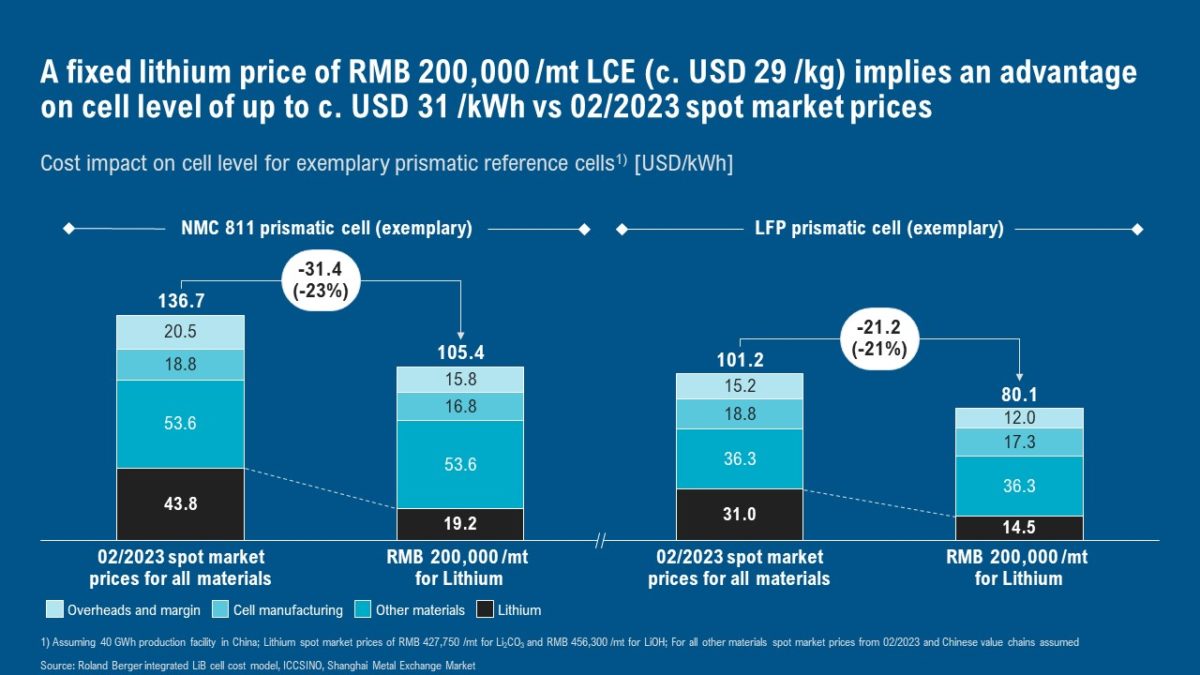

Lithium surplus

www.pv-magazine.com

www.pv-magazine.com

China claims 90%

www.pv-magazine.com

www.pv-magazine.com

Regulatory capture very obviously valuable

www.utilitydive.com

and

www.utilitydive.com

and

www.tdworld.com

www.tdworld.com

Hydrogen hopium, reality

www.woodmac.com

and

www.woodmac.com

and

www.pv-magazine.com

www.pv-magazine.com

100m monopiles ?

www.offshorewind.biz

www.offshorewind.biz

Indian coal failures signal Indian renewables failures, still

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PUAEJWW4VBKAFHHCKVUKEDN75U.jpg)

www.reuters.com

www.reuters.com

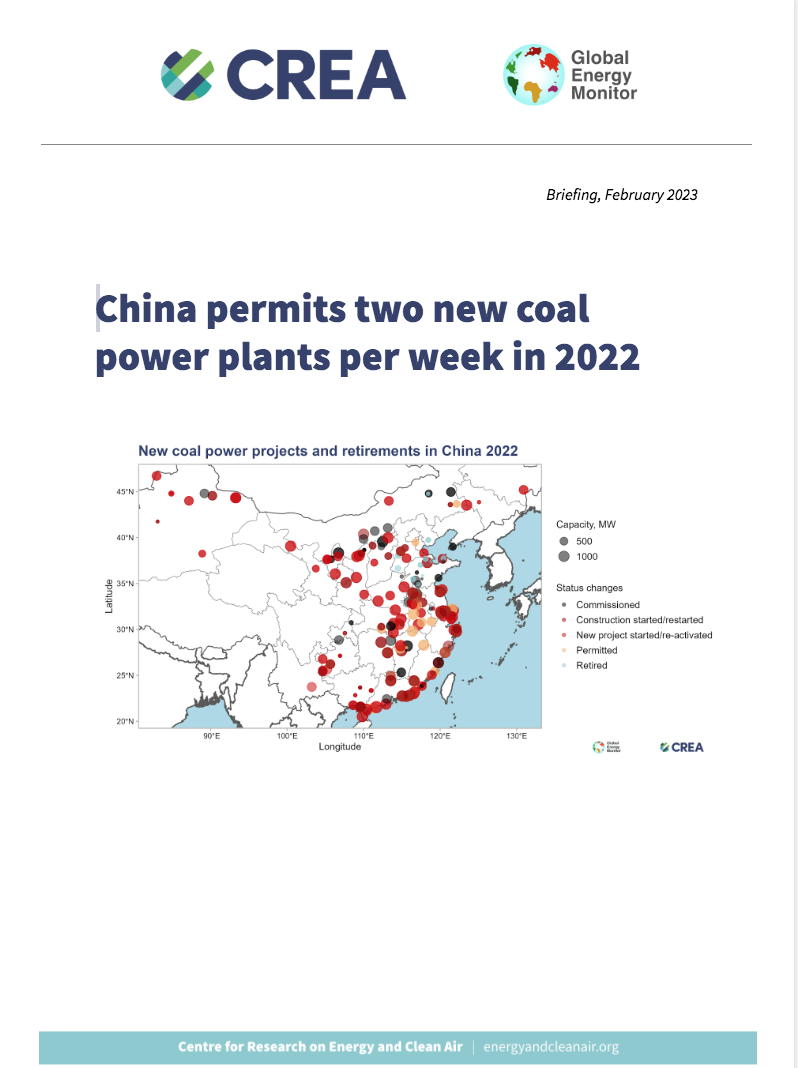

China coal

www.reuters.com

and

www.reuters.com

and

Bulgaria rail

www.railfreight.com

www.railfreight.com

Franco-Spanish third rail (that station in the photo is just bonkers if you ever visit it)

www.railfreight.com

www.railfreight.com

Naughty Belarus

www.railfreight.com

www.railfreight.com

Brexshit consequences never ending

www.theguardian.com

www.theguardian.com

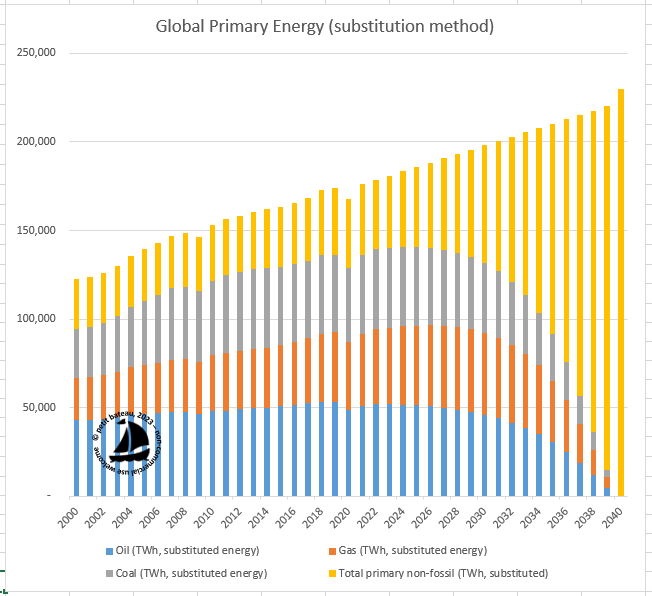

Hope, there is .... (some of my results for current global adoption trends)

Brent $83 /bbl

NL TTF gas €49 /MWh (EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

Lest we forget

One year on: Russian war and renewables - Power Technology

Following a year of isolation from Russian power supplies, governments across the globe have decided to invest in renewables.

www.power-technology.com

www.power-technology.com

Brent wanted

Platts to include U.S. crude oil in Brent benchmark from June

S&P Global Platts will include U.S. WTI Midlands crude in its Brent oil benchmark from June, as previously guided, S&P's Vera Blei said in a benchmark update at the London Energy Forum on Monday.

Nickel surplus ?

Nickel's electric dreams turn into a pricing nightmare

The global nickel market flipped from deficit to surplus over the course of 2022, according to the International Nickel Study Group (INSG).

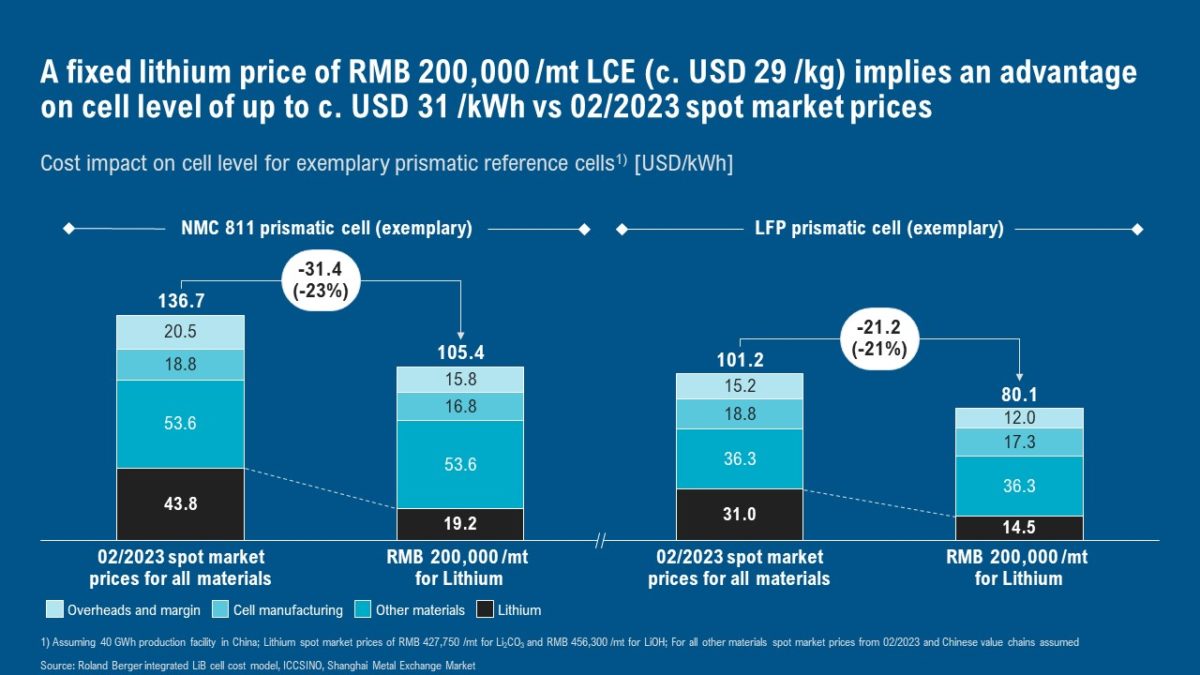

Lithium surplus

CATL offers big battery discounts amid looming lithium surplus

CATL’s new lithium pricing structure gives Chinese original equipment manufacturers (OEM) an effective discount of more than 20%. It is making the move to win more orders amid a slowdown in the electric-vehicle market and the ongoing efforts of cell manufacturers to secure raw materials.

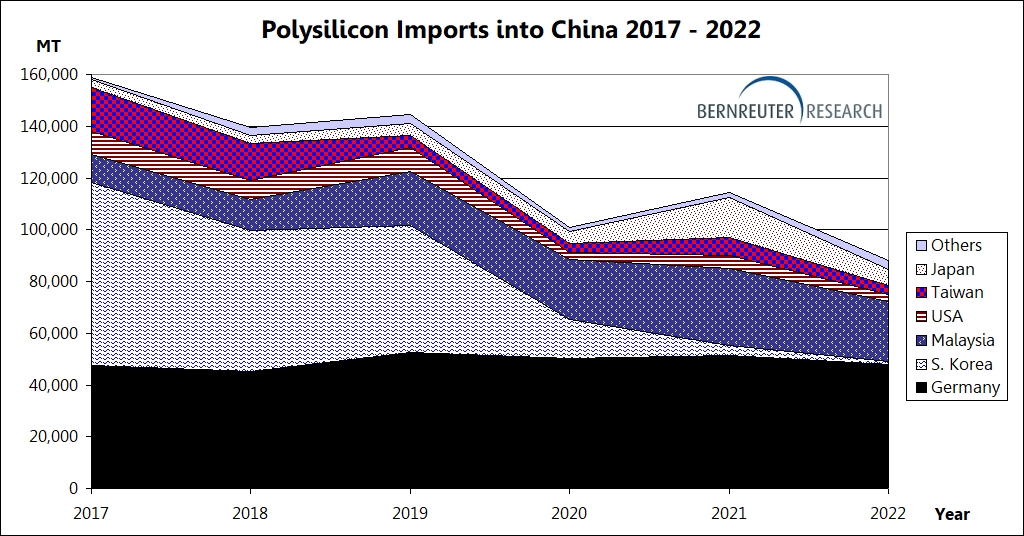

China claims 90%

China’s polysilicon imports fell by 23% in 2022, says Bernreuter Research

After an interim high in 2021, polysilicon imports into China fell again in 2022, but the country’s share in global output still came close to 90%, according to a new report by Bernreuter Research.

Regulatory capture very obviously valuable

AEP moves to ‘de-risk’ with $1.5B sale of unregulated wind and solar assets as it eyes further sales

American Electric Power expects to make a decision before July on whether it will sell AEP Energy, its competitive retail energy business, company officials said Feb. 23.

AEP Strikes $1.5B Deal to Sell Unregulated Renewables

After reporting Q4 results, CFO Ann Kelly says ‘the story is changing’ when it comes to economic and sales growth.

Hydrogen hopium, reality

Decoding the hydrogen rainbow

Do you know your green hydrogen from your blue, grey, black, brown, yellow, turquoise, white and pink, and where they sit on the carbon emissions spectrum?

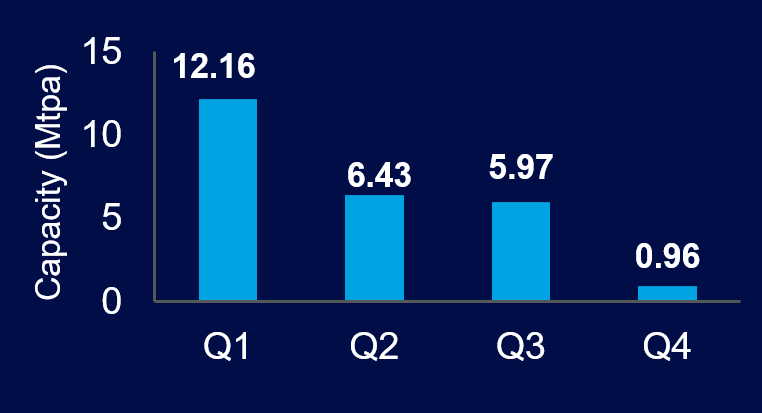

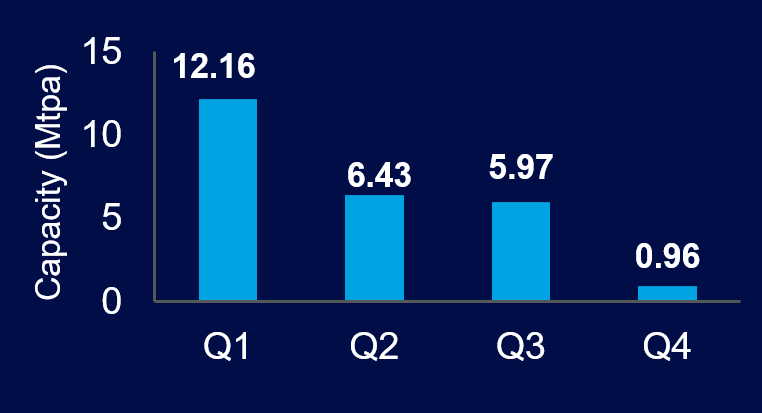

The Hydrogen Stream: Global hydrogen pipeline plummets in Q4 2022

Wood Mackenzie says in a newly published report that new hydrogen capacity announcements fell year on year in 2022, while researchers claim that green hydrogen heating systems will probably not replace gas boilers in European homes.

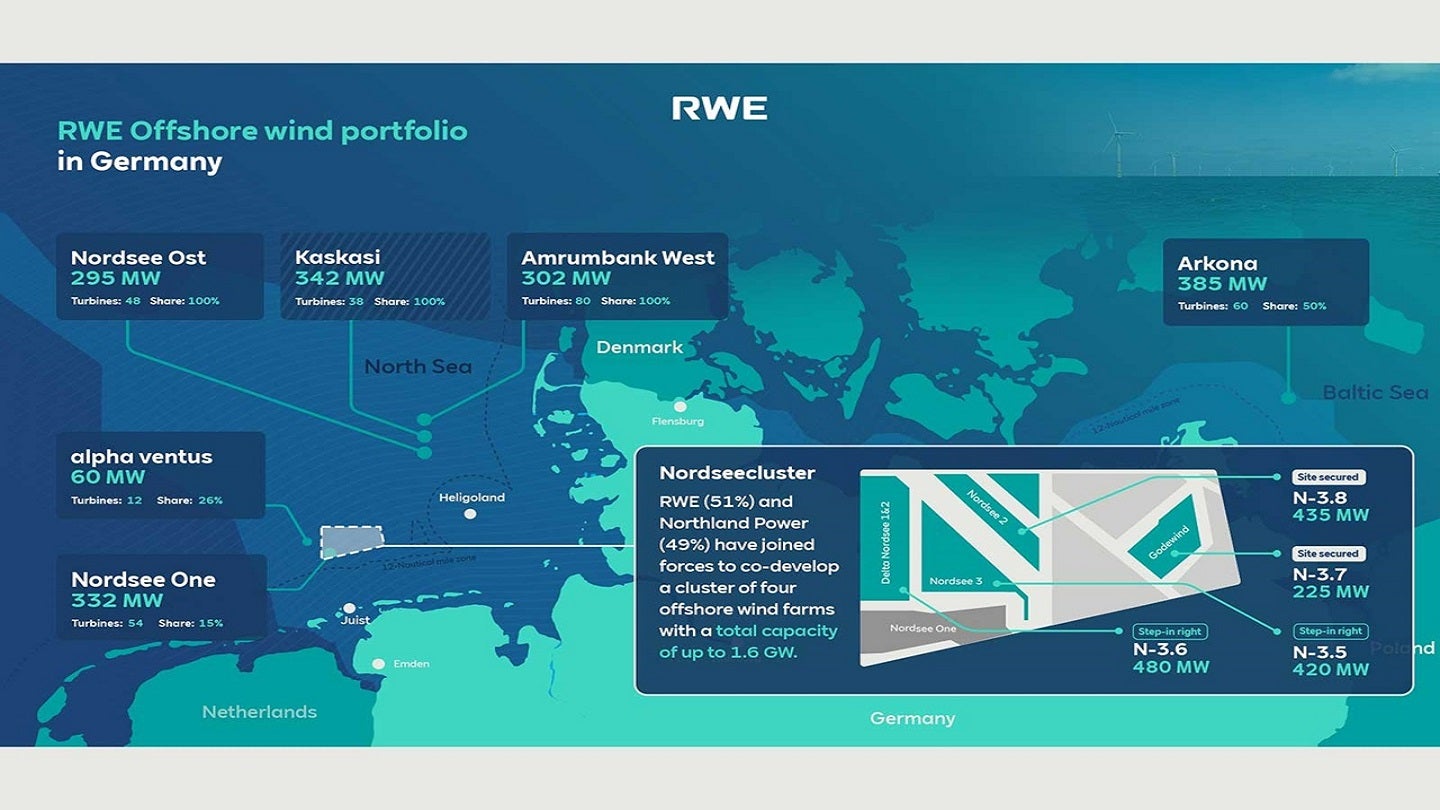

100m monopiles ?

Entrion Wind Wins ScotWind Feasibility Deal for Its 100-Metre Depth Foundation Tech

Entrion Wind has been awarded a project to evaluate the feasibility of its patent-pending fully restrained platform (FRP) offshore wind foundation technology by a Scotwind developer.

Indian coal failures signal Indian renewables failures, still

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PUAEJWW4VBKAFHHCKVUKEDN75U.jpg)

India, China demand boost low-rank thermal coal prices in Asia

Signs of stronger import demand from India have arrested the decline in price of the thermal coal grades most commonly sought by the world's second-biggest importer of the fuel used to generate electricity.

China coal

China's new coal plant approvals surge in 2022, highest since 2015 -research

China approved the construction of another 106 gigawatts of coal-fired power capacity last year, four times higher than a year earlier and the highest since 2015, driven by energy security considerations, research showed on Monday.

Bulgaria rail

A brand-new intermodal terminal just opened in Bulgaria

A new intermodal terminal has just been opened at the Industrial Zone Bozhurishte, a logistics area near Sofia, in Bulgaria. The new facility will be used to handle shipping containers discharged at the port and intended for customers in western Bulgaria. Goods between the terminal and the port...

Franco-Spanish third rail (that station in the photo is just bonkers if you ever visit it)

Is France giving up on this border crossing with Spain?

France might not participate in the financing for the modernisation of the Pau-Canfranc-Zaragoza railway, one of the lines crossing the France-Spain border, closed since 1970. No budget was allocated for this project in a leaked version of the report made by the Infrastructure Orientation...

Naughty Belarus

Lithuanian customs seize tonnes of Belarusian sanctioned cargo and proceed to arrests

The Lithuanian Customs Criminal Service has been conducting an off-the-radar investigation on the possible smuggling of sanctioned fertilisers from Belarus. The authority says that it has seized 3,000 tonnes of urea fertiliser worth 2 million euros during the process. Additionally, after...

Brexshit consequences never ending

Australian startup Recharge finalises deal to take over UK battery maker Britishvolt

Takeover of collapsed company revives hopes for the construction of a £3.8bn ‘gigafactory’ in northern England

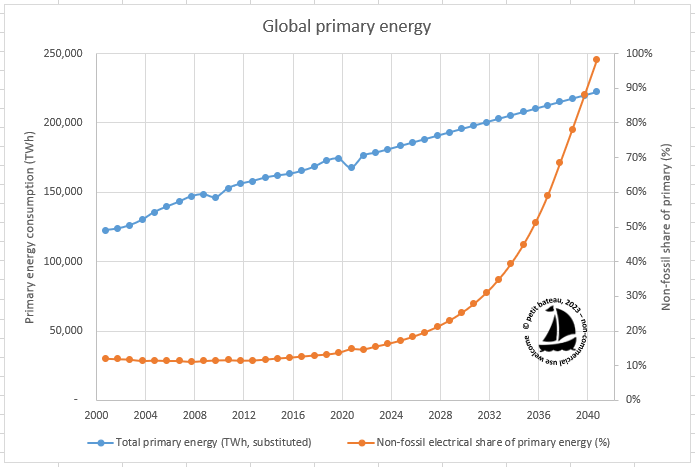

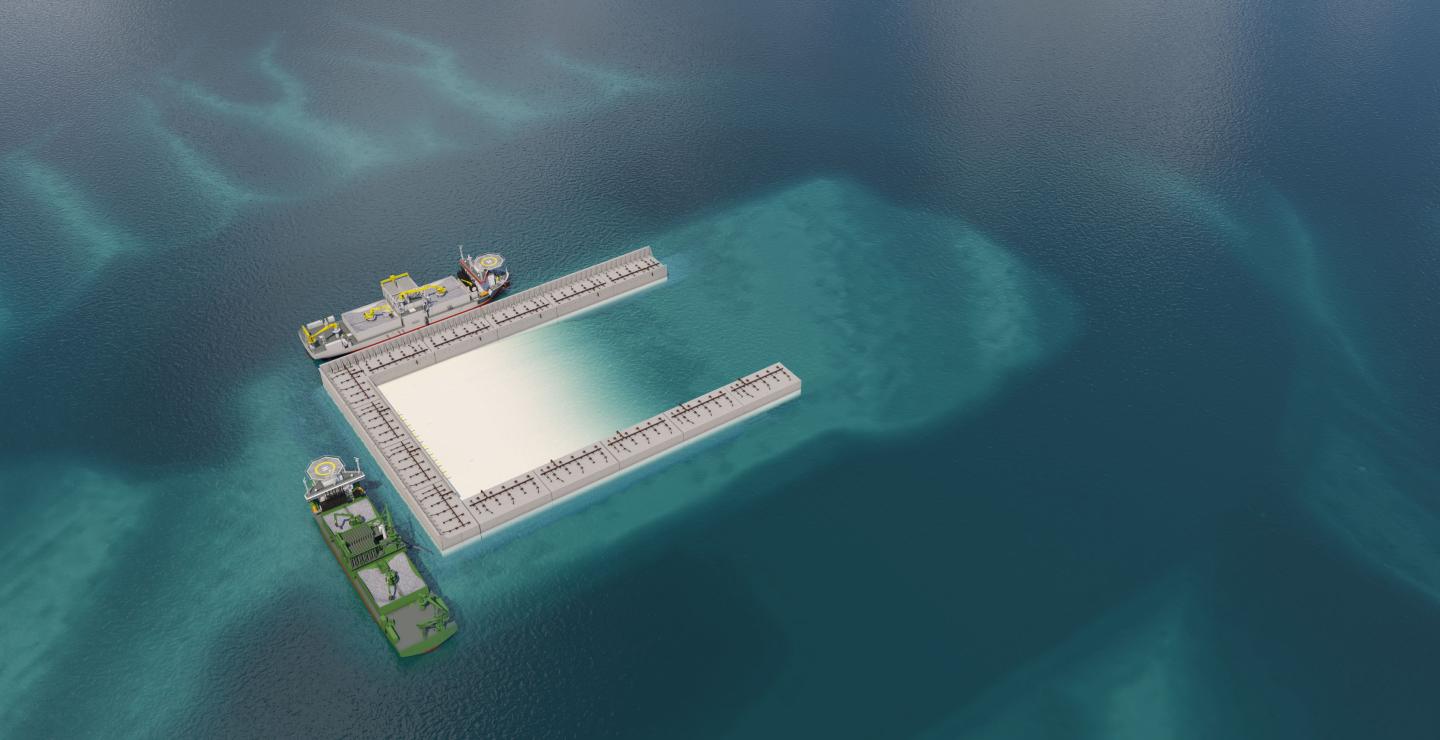

Hope, there is .... (some of my results for current global adoption trends)

Last edited:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NW5RH5XVYVKW3OAA2UENGQKOJY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2PCSD7242JPCPPMAMP6HLRVI3A.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GDJ3OSCMMZMGXCJXKQTVH65BEM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/A2KO7B37BFKF3BHU4L33XMGOGI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RPJU464SDNN5XB325S4OTHPO3Q.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2MMCXNBQURKDVKUPRUTND6XLL4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YYGZ6NVZQZNSJBHMAUHXONXWUI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HIM64ANHVFNIJEFKOVDB6O2FPQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GZYWCVPCOJIBXHNYRNCOWL5NAU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/F72CBNNDLVPIFMELXCFJZ7N64A.jpg)