dhanson865

Well-Known Member

Playing with Tax Bracket Calculator 2022-2023 | Calculate Your Income Tax Bracket

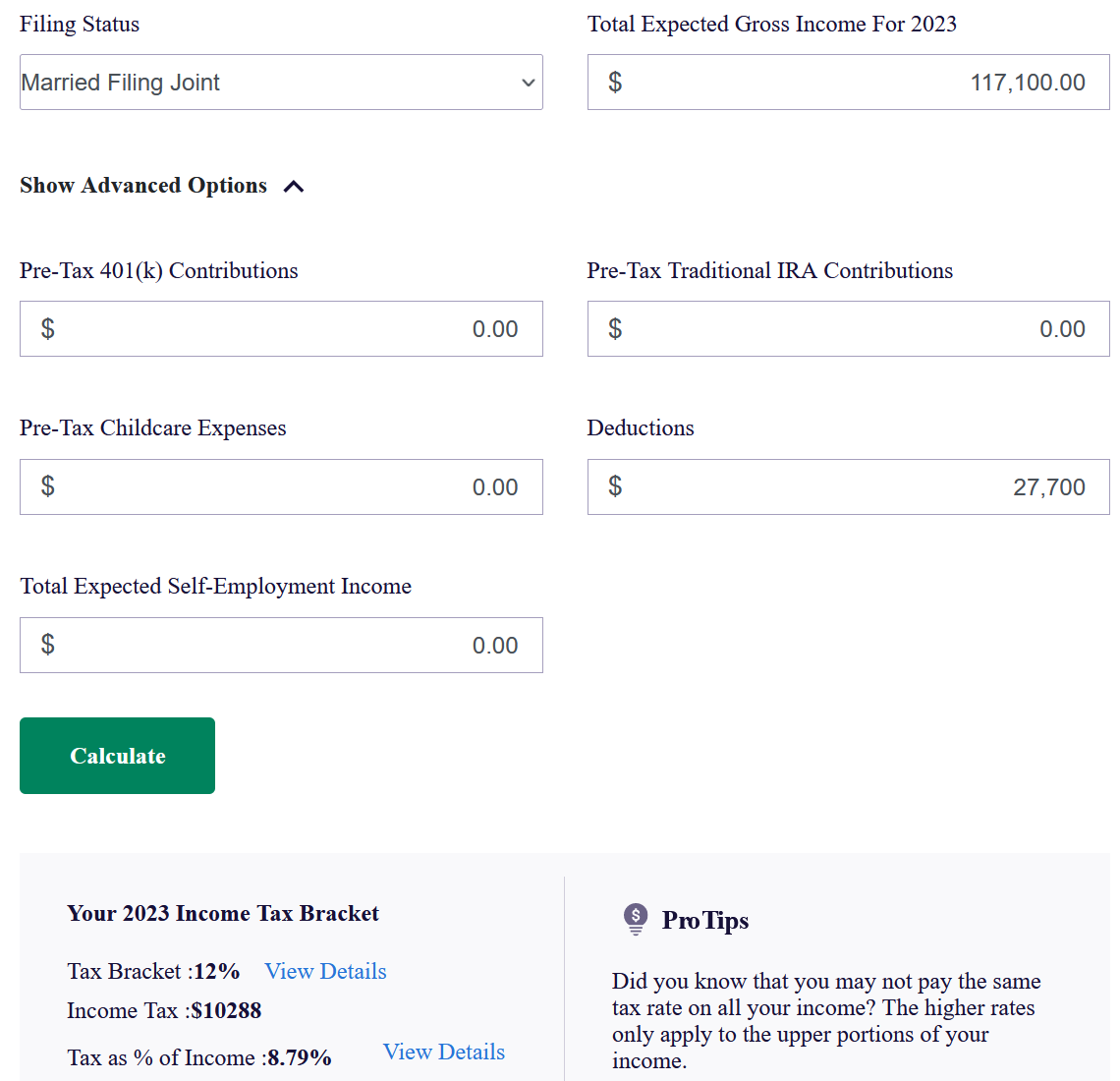

maxing out my current 12% federal tax bracket happens around $117,100 if I'm retired in 2023 and don't put money into a 401k. And round $126,000 if I'm putting money into my 401k like I was in my last paycheck.

Either of those 2 scenarios has an effective tax rate below 9%

In the retirement scenarios where I drop to $55,000 my effective tax rate is around 5%

And since the difference between the 12% and 22% tax brackets is 10% it's similar in thought to the early withdrawal penalty. If I've got excess retirement funds it's not a big issue, but if I want to try and increase my savings riding that 12%/22% border might help.

maxing out my current 12% federal tax bracket happens around $117,100 if I'm retired in 2023 and don't put money into a 401k. And round $126,000 if I'm putting money into my 401k like I was in my last paycheck.

Either of those 2 scenarios has an effective tax rate below 9%

In the retirement scenarios where I drop to $55,000 my effective tax rate is around 5%

And since the difference between the 12% and 22% tax brackets is 10% it's similar in thought to the early withdrawal penalty. If I've got excess retirement funds it's not a big issue, but if I want to try and increase my savings riding that 12%/22% border might help.